Key:

EM: Emerging Markets

DM: Developed Markets

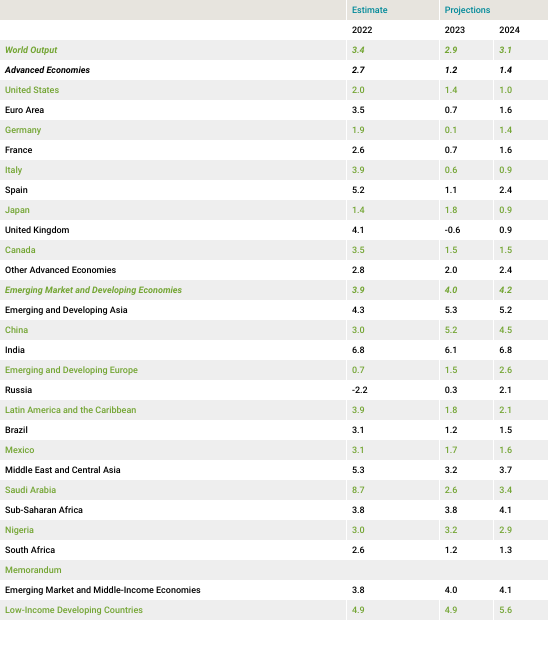

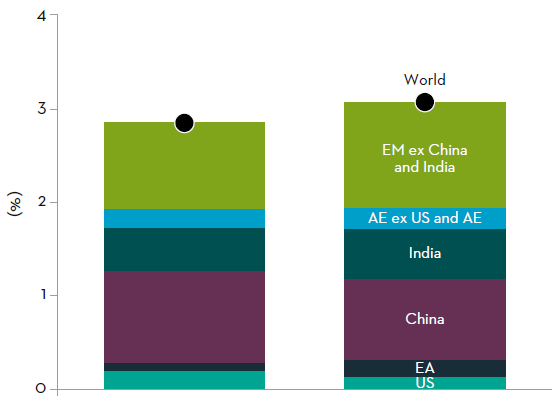

The IMF expects that the emerging markets will outgrow the advanced economies, forecasting 4.0% GDP growth for EM and 1.2% for DM1. The entire global growth estimate is nearly 3.0% for 20231. Within that, China and India are expected to be key drivers of this, contributing close to 50% of that growth projection1.

Figure 1: latest world economic outlook growth projections Real GDP, annual percentage change

Source: IMF, World Economic Outlook Update, January 2023

Note: For India, data and forecasts are presented on a fiscal year basis, with FY 2022/23 (starting in April 2022) shown in the 2022 column. India's growth projections are 5.4 percent in 2023 and 6.8 percent in 2024 based on calendar year.

1Source: IMF, Jan 30, 2023, article entitled Global Economy to Slow Further Amid Signs of Resilience and China Reopening

With growth expectations accelerating for the asset class and the sector we find that the current outlook in 2024 and beyond is to “fade the growth.” This aligns with our team’s view that the sustainable growth path for these names could be more significant.

Figure 2: estimated contribution to world GDP growth

(percent share of world growth)

Source: IMF, Jan 30, 2023, article entitled Global Economy to Slow Further Amid Signs of Resilience and China Reopening.

Given the backdrop of forecasted slowing growth in advanced economies, we are also seeing a wide divergence between company growth dynamics across DM and EM corporates. Specifically in digital economy stocks we are seeing a wide range of expectations for growth in the US vs China.

What we have observed is that the news around Covid related restrictions diminishing has been a net positive for Chinese Internet stocks.

As highlighted below, Chinese online advertising and ecommerce will grow sharply in 2023 vs 2022. The implications are positive for the Chinese information technology sector.

This stands in sharp contrast to digital economy names in the US where the forecast growth rates are decelerating in both online advertising and e-commerce.

Figure 3: online advertising and ecommerce, China vs US, 2019-2024

| 2019 | 2020 | 2021 | 2022 | 2023(E) | 2024(E) | |

|---|---|---|---|---|---|---|

| US Online Advertising | 16% | 12% | 35% | 10% | 6% | 15% |

| US Ecommerce | 15% | 41% | 11% | 7% | 5% | 10% |

| China Online Advertising | 28% | 30% | 26% | 4% | 12% | 12% |

| China E-commerce | 26% | 24% | 27% | 9% | 12% | 12% |

*E= Estimate*

Source: Morgan Stanley, as at 30 January 2023, article 2023 Outlook: Macro, Micro and Key Picks, 2023 China Internet Outlook.

- With growth expectations accelerating for the asset class and the sector we find that the current outlook in 2024 and beyond is to “fade the growth.” This aligns with our team’s view that the sustainable growth path for these names could be more significant.

- Valuations for Chinese internet stocks are still undemanding relative to their long term history.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For institutional investors in Canada:

The content of this website is suitable for Permitted Clients for the purposes of NI 31-103 only. The information on this section of the website is not intended for use by any other person, including members of the public.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For institutional investors in Canada:

The content of this website is suitable for Permitted Clients for the purposes of NI 31-103 only. The information on this section of the website is not intended for use by any other person, including members of the public.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For institutional investors in Canada:

The content of this website is suitable for Permitted Clients for the purposes of NI 31-103 only. The information on this section of the website is not intended for use by any other person, including members of the public.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.