Content navigation

In this month’s market insights, we explore the current interest rate cycle in more detail.

After a hawkish pause in June, it remains unclear whether the US Federal Reserve’s (Fed) 25bps interest rate rise in July is the last rate hike of the current cycle. However, we believe the Fed is highly likely to be getting closer to the end. With the European Central Bank (ECB) also raising rates by 25bps in July, it is relevant to tackle the debate on when interest rates will peak.

In our view, the current interest cycle will have likely peaked by the end of 2023. The market is now anticipating rapid rate cuts from both the Fed and the ECB in H1 2024. This is an outlook we do not share, due to the persistent inflation and the likelihood of avoiding a recession. Either way, we believe that we have seen the last of the summer hikes from both central banks, as far as the current hiking cycle is concerned, and therefore predict a more supportive environment for quality growth stocks, going forward.

The last of the summer rate hikes – getting close to peak interest rate cycle

We wrote in our mid-year outlook update last month that the Fed rates are close to peaking, and predicted at the time 1-2 more hikes for the Fed, and 1-3 for the ECB before year-end. With both central banks raising rates in July by 25bps, we believe that we might now only have one to two more rate hikes coming from the Fed, and zero to two from the ECB before the year-end. All of this will of course be data dependent – specifically inflation data.

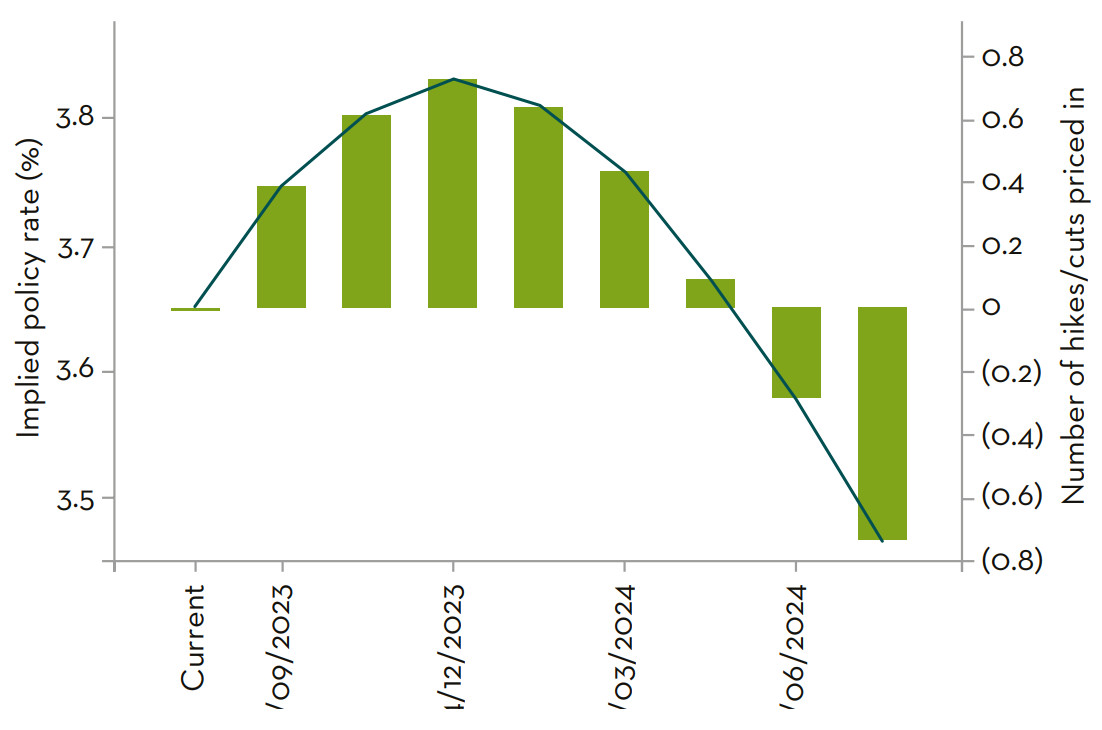

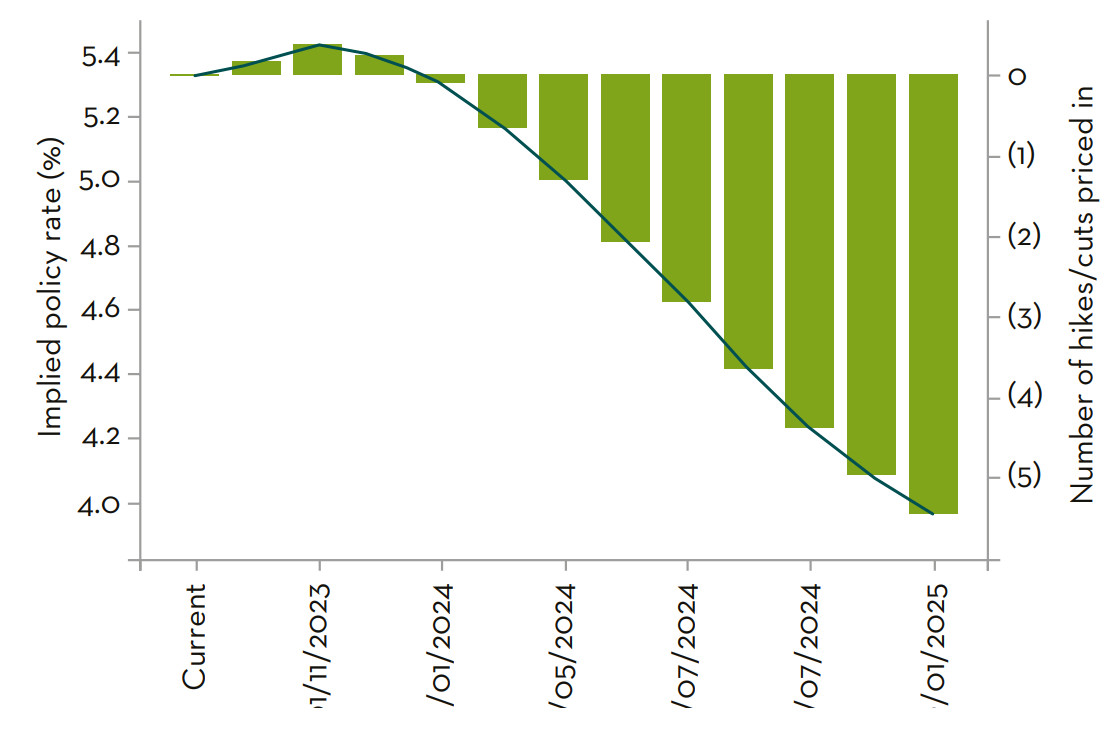

The market is now anticipating one more rate hike by the Fed before year end, followed by rapid rate cuts in H1 2024, with an implied Fed rate of 4.6% expected by July 2024 (from 5.25-5.5% currently), as can be seen in the chart below. For the ECB, the market is now anticipating rates to peak at 3.83% by end of 2023, from a current rate of 3.75%, i.e. implying less than one more 25bps hike, before a reversal in rate direction from the summer of 2024 onwards.

Central bank policy rates versus rate hikes/cuts

European Central Bank

US Federal Reserve

Source: Bloomberg, August 2023.

Whilst the market might have a healthy bull-bear debate before year end, centered around number of hikes still to come, for us, as long-term investors, the more relevant aspect to focus on is that we are now close to peak rates. And, we might have now seen the last of the summer hikes for both the Fed and the ECB, as far as the current rate hiking cycle is concerned.

Being close to peak interest rates in itself should be supportive to the Quality Growth style within equity markets in our view, as the market starts to anticipate a reversal in the rate cycle towards cuts. It is worth flagging that we do not share the market view of rapid rate cuts in H1 2024. This is based on our view that 1) inflation will remain sticky, and 2) the economy will avoid a recession – both variables together should keep the Fed away from reversing rates for some time in 2024, after reaching peak rates at the back end of 2023.

-

The market is now anticipating rapid rate cuts from both the Fed and the ECB in H1 2024. This is an outlook we do not share.

A pivot in rates remains premature for this year, and is unlikely until sometime in 2024

In addition to the Fed, we continue to believe that a pivot by other western central banks is unlikely to take place until sometime in 2024. This is based on our assumption that inflation will remain stickier - therefore more elevated and longer lasting than what the market is expecting.

That said, we do anticipate an easing in the inflationary pressures in the second half of this year, in large part as a result of the elevated base effect of last year. However, we also believe that deglobalisation trends, ongoing localised bottlenecks in supply chains, and wage inflation could risk keeping the inflationary pressures higher.

We believe that neither the Fed nor the ECB will be successful in hitting their c.2% inflation target by 2024, even though they are likely to have made good progress towards that target by then. As such, with both central banks stating clearly that they will remain data dependent, stickier inflation will likely keep them away from reversing the hiking cycle for the time being.

Wage inflation remains key to watch for signs of further inflationary pressures

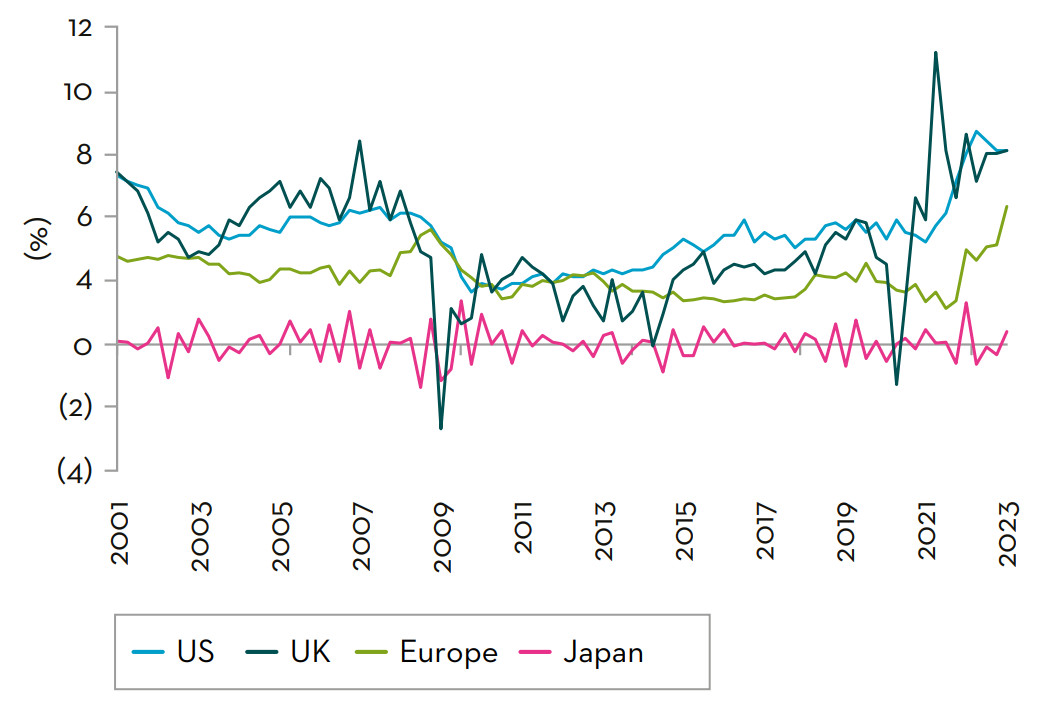

As we wrote in more detail last year (October 2022), all eyes need to remain on wage inflation, for signs of inflationary pressures becoming more persistent. Wage inflation is by far the largest contributor to medium-term inflation, hence its importance.

As can be seen in the chart below, wage inflation has been picking up in the US, EU, and the UK, which might lead to a more elevated and more prolonged inflation in the medium-term. It also carries the risk of turning inflation from being frictional, to becoming more structural. This would certainly keep central banks focused on the inflation side of the inflation/growth balance.

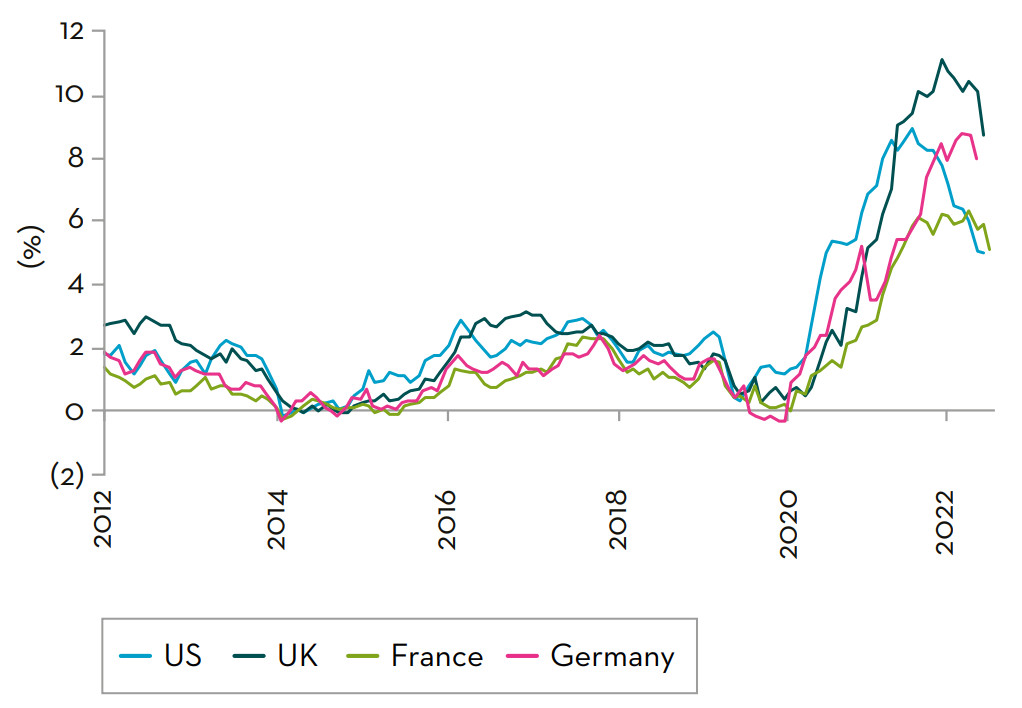

Headline CPI inflation on a monthly basis (%)

Wage inflation nominal (%)

Source: FactSet. For CPI data is shown as at 30 April 2023; for France as at 31 May.

Wage inflation data shown to 31 March 2023. US: Atlanta Fed wage tracker, Europe: Eurozone negotiated wages, Japan; cash earnings, UK: total pay.

-

We reiterate once again that, as long-term investors, we prefer to focus on the fundamentals of companies we invest in.

Continue to focus on Quality Growth companies with pricing power

Interest rates peaking should gradually lead to less downside pressure on long duration stocks, which quality growth stocks typically are. We define quality growth stocks as companies with solid balance sheets, high returns on invested capital, and exposed to structural growth. All of these characteristics are relevant at this point in the economic cycle, given the downside risk to economic growth from higher interest rates. Quality growth stocks, as we have highlighted before, should be able to fare relatively better, should we be heading into a recession (which is not our central scenario).

We continue to favour companies with four important characteristics:

- resilient earnings profiles, given ongoing risk of earnings downgrades;

- pricing power, which helps protect margins, given risk of stickier inflation;

- solid balance sheets, which will provide financial resilience, should we be heading into a recession; and

- structural growth prospects, given the lower growth environment at this stage in the economic cycle.

What sectors and styles work post interest rates peaking

As we approach the peak in interest rates, we take a look at market performance post the last Fed hike over the previous 60 years, for our readers who might be particularly interested in this aspect.

The table below lists the performance of the S&P 500 over one, three, six and 12 months, post the last Fed hike, from 1966 to now. Overall, the market has fared well over three, six and 12 months post the last interest rate hike. As can be seen, with an average performance of +3% over three months, +7% over six months, and +13% over 12 months.

Change in S&P after last rates hikes (blue denotes market falls)

Source: Credit Suisse estimates, Refinitiv Datastream. December 2022. Performance shows S&P 500 index.

The average result however masks the various aspects that can drive share price performances in equity markets, not least starting valuation levels at the time of the last rate hike, but also some of the more fundamental drivers of market sentiment. Notably ISM* data plus other leading indicators, and the expectation of the pace of rate cuts post the last hike, so the reader should be careful about not taking these results too “mechanically”.

Looking at which sectors have typically performed post the last Fed rate hike, focusing on six months performance, there is a mixed array of sector performance, as can be seen in the chart below. We note that some of the sectors with typical quality growth characteristics, such as Consumer Staples, Consumer Discretionary and Healthcare have typically performed well.

Average performance relative market 6 months after last rate hike

Source: Credit Suisse estimates, Refinitiv Datastream. December 2022. Performance shows S&P 500 index.

Whilst some of the Value sectors (Telecoms, Materials, Energy, Basic Resources) have tended to underperform. On aggregate, Technology and Industrial goods have had a broadly neutral performance over that period.

Once again, it is worth emphasising that this average performance masks the nuances listed above that investors need to take into account (valuation levels, economic momentum post Fed rate hike, and interest rate expectations).

Therefore we do not propose that the facts highlighted above are a good guide of future performance. Instead as we get closer to peak rate, these illustrate a few features of historic performance following final Fed hikes, for investors interested in shorter term market and sector moves.

Recession fears might be like waiting for Godot, and might not materialise

In our recent mid-year outlook update, we reiterated our view that a recession could be averted, and we have stuck with our view that a sharp slowdown is our central scenario, both for the US and wider global economies. We reiterate once again that, as long-term investors, we prefer to focus on the fundamentals of companies we invest in. We believe that long term compounding characteristics of these companies should lead to share price appreciation through a longer term economic cycle.

Sources

*Institute for Supply Management. Also known as ISM Manufacturing Purchasing Managers Index (ISM PMI), is a monthly gauge of the level of economic activity in the manufacturing sector in the United States versus the previous month.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.