Introduction

In our last article we focused on the need for “Net Zero” and the importance of the 26th UN Climate Change Conference of the Parties (COP26) in driving this agenda. COP26 will be important not just in terms of providing high level sign-up to net zero pledges but will also be a natural point for politicians, regulators, businesses, and consumers to think deeply about what is needed to achieve these goals. As Bill Gates noted when discussing getting to net zero in his recent book ‘How to avoid a climate disaster’, this will be hard. “We need to accomplish something gigantic we have never done before, much faster than we have ever done anything similar. To do it we need lots of breakthroughs in science and engineering. We need to build a consensus that doesn’t exist and create public policies to push a transition that would not happen otherwise.”1

Even after high-level commitments to net zero have been given, we see challenges falling into four key pillars.

- Moving from high-level, long-term commitments to tangible targets

- Effective definitions and measurement of progress

- Creating an effective transmission mechanism and amplifying policy and technology initiatives through private enterprise

- Protecting against the wider impacts of any economic displacement and ensuring a just transition

We need to accomplish something gigantic we have never done before, much faster than we have ever done anything similar.

Bill Gates

It is imperative that all stakeholders such as corporates, consumers and investors all recognise the need for supporting and facilitating progress.

Moving from policies to targets

We agree with the Royal Academy of Engineering that “Decarbonisation is a unique policy goal, because of the scale of ambition, perceived long timescales, breadth of policy areas, and the number of stakeholders that must work towards a shared and yet uncertain goal.

Acknowledging the complexity and uncertainty offers entirely new ways of tackling the challenge”.2 To deal with this complexity the implementation of policies needs to be broken down into more bite-sized and short-dated targets. This creates a bias to action and a focus on the trajectory, and not a long-dated end point.

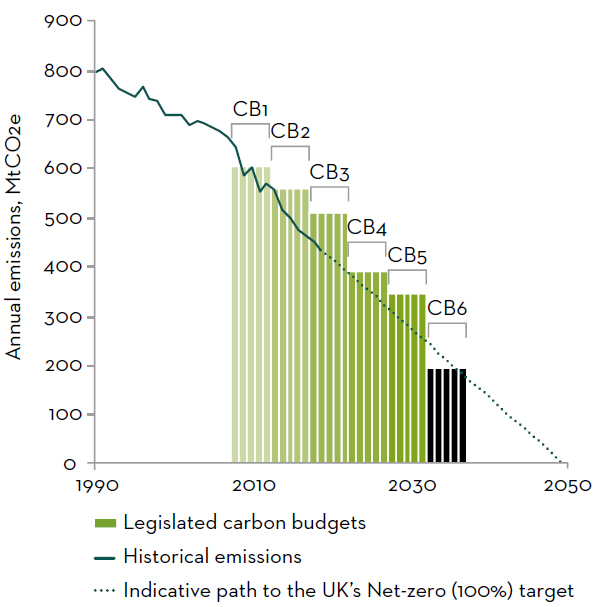

There is a great importance in having interim measures of success. For example, the UK is currently on its 6th Carbon Budget and to meet this, the Climate Change Commission “requires a 78% reduction in UK territorial emissions between 1990 and 2035. In effect, bringing forward the UK’s previous 80% target by nearly 15 years.”3 It is also useful to understand that analysis shows that the UK was behind plan on its 4th and 5th budgets and that more specific policies need to be implemented to reach this goal. Without this tracking and review process there is a risk of leaving action too late with greater environmental and economic consequences.

Importantly, the Committee on Climate Change report builds on the Prime Minister’s 10 point plan4 which laid out the policy agenda in a higher-level fashion and created a more sophisticated framework for measuring progress. In their analysis, The Sixth Carbon Budget can be met through four key steps:

- Take up of low-carbon solutions.

Focused on electric and low-carbon vehicles, home heating moving to be increasingly electric and accelerating the shift of industry to renewable energy or hydrogen. It also involves investigation of sub-sea carbon capture. - Expansion of low-carbon energy supplies.

UK electricity production is zero carbon by 2035. Offshore wind becomes the backbone of the whole UK energy system. By 2050, low-carbon hydrogen has scaled-up to be almost as large as current electricity production. - Reducing demand for carbon-intensive activities.

Action on the built environment through energy efficiency and changing consumer preferences on high-carbon activities such as meat consumption and travel to reduce the overall footprint. - Land and greenhouse gas removals.

There is a transformation in agriculture and the use of farmland while maintaining the same levels of food-perhead produced today.

It also sets targets related to the overall goals which lend credibility and specific impetus to developing solutions.

Comparison of the UK decarbonisation actions with average global pathways5

| UK – Balanced Net Zero Pathway | Global average 1.5°C pathways | Global average 2°C pathways | |

|---|---|---|---|

| Coal % of electricity generation - 2030 | 0% (by 2024) | 8%* | 13%* |

| Low-carbon % of generation - 2030 | 87% | 72%* | 67%* |

| Electric vehicles % of car fleet - 2030 | 43% | 20 - 40%† | 13% |

| Electric vehicles % of car sales - 2030 | 97% | 52%^ | 40%^ |

| Average heat pump installation rate - 2030 (heat pumps/thousand people/yr) | 15.3 | 8.8^ | 7.7^ |

| Low-carbon hydrogen production - 2030 (tCO2/person/yr) | 10.7 | - | 0.9^ |

| CCS per capita - 2030 (tCO2/person/yr) | 0.32 | 0.25* | 0.10* |

| Engineered removals - 2030 (tCO2/person/yr) | 0.07 | 0.04* | 0.01* |

Source: CCC analysis; *Huppmann, D. et al. (2018) A new scenario resource for integrated 1.5°C research. Nature Climate Change, 8 (12), 1027;

†Climate Action Tracker Initiative (2020) Paris Agreement Compatible Sectoral Benchmarks;

^IEA (2020) World Energy Outlook 2020.

Notes: The UK Government has now committed to a full phase-out of petrol and diesel cars by 2030. Electric car fleet figures here include plug-in hybrids. For Europe as a whole, analysis from Climate Action Tracker suggests a benchmark for EV fleets reaching 40-55%. Median figures are used for the IPCCSR 1.5 pathways, with a wide range around these medians across the scenario ensemble. CCS is often used extensively within IPCC-SR 1.5 pathways, to greater extents than in other global pathways (e.g. those from the IEA). Global 1.5°C pathways have ~50% probability of limiting global warming to 1.5°C and ‘well below 2°C’ pathways have at least 66% probability of limiting to 2°C.

A similar approach should be followed within the private sector with long-term aspirations on net zero backed by robust and aligned short and medium-term targets to give confidence that this can be achieved. A key part of our ongoing engagement at Martin Currie with investee companies is to encourage them to adopt a scientific and targets-based approach to their net zero ambitions, with more detailed interim targets to track progress.

Effective definitions and measurement of targets

In looking at countries’ net zero ambitions it becomes clear that implementation and measurement is not a straightforward exercise and not all net zero targets are equivalent. “The focus of the Paris Agreement is the emissions and removals of humans affect, known as anthropogenic emissions and removals. Defining what types of emissions and removals are anthropogenic comes from guidelines produced by the Intergovernmental Panel on Climate Change (IPCC). For example, ocean sinks and unmanaged lands are excluded from measures of anthropogenic removals, although they are still accounted for in global climate models.” 6 What countries choose to currently include in the scope of their own ambitions, however, does vary. While most countries set their ambitions on zero green-house gas (GHG) targets, some such as South Africa and South Korea are explicitly targeting CO2 emissions and New Zealand, for example, is excluding methane emissions from their important agriculture sector.7 Understanding these variances is crucial, as the world focuses on managing emissions it is important to be able to compare progress across countries and to highlight any gaps that may be present.

GHG emissions from land-use, land-use change and forestry (LULUCF) is another area of complexity. Emissions estimates (and those for emission removal) are model-based and include significant uncertainties in measurement. Currently these account for around 7% of global GHG emissions. LULUCF also provide significant potential as carbon sinks which in many cases are going to be necessary to offset residual emissions. Currently anthropogenic emissions (e.g. fossil fuel and deforestation) are far greater than anthropogenic removals (e.g. planting trees). Emission reductions to 2025 and 2030 benchmarks for 1.5°C pathways assume large reductions from all sectors including LULUCF, however, these may be difficult to track effectively with different models being used on a national basis.8

Once definitions are set, there should be a focus on target setting and measurement. From a behavioural perspective the smaller and more short-term a target is, the more likely we are to achieve it. Setting a goal of net zero for a distant date is likely unattainable unless you have a detailed plan including interim targets. If the goal is (like the UK) to achieve net zero by 2050, where do we need to be by this time next year, or by 2025? As previously mentioned, it is helpful to know that we are behind plan on the 4th and 5th UK carbon budgets. This gives the opportunity to re-assess and think how targets can be made more ambitious and what alternative technology and policy levers could be.

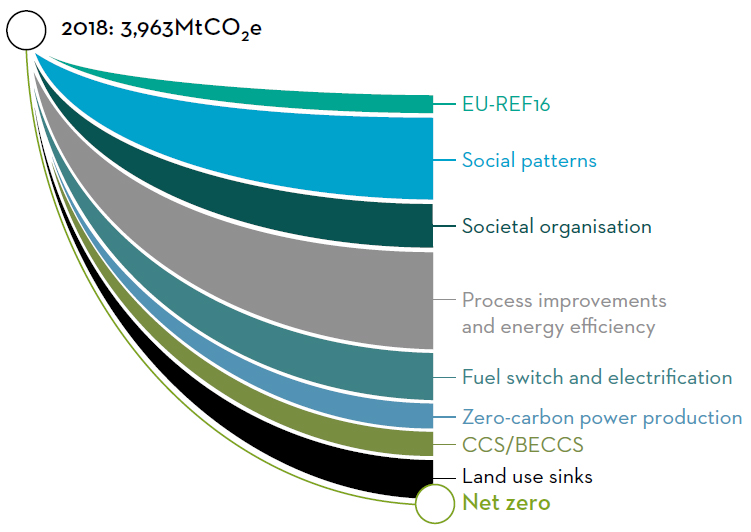

In order to meet net zero it is not just efforts in one or two areas but across an entire system that will determine success. This was highlighted by the European Climate Foundation in their recent analysis on how best to achieve net zero. There are a number of areas across the public and private sector, along with shifting consumer preferences, that need to be effectively measured to see our progress in achieving key policy aims.

The recommended Sixth Carbon Budget9

Social patterns, societal organisation and energy efficiency are key to make it easier to reach net-zero (the contributions of each lever group relate to how ambitious the reference is (EU-REF16))9

Notes: 'CB' = Carbon Budget'. The Sixth Carbon Budget period covers 2033-2037. Greenhouse gas (GHG) emissions are shown on a total (‘actual’) basis, while carbon budgets are assessed against the ‘net carbon account’. Emissions from International Aviation and Shipping (IAS) are not included in this figure, but would either also need to reach zero emissions by 2050 or will have to be fully offset by verifiable removals. Government projections are for total gross UK GHG emissions, not for the 'net carbon account', against which the first five carbon budgets are measured. Outturn GHG emissions are based on the latest BEIS publication and therefore do not account for forthcoming revisions to peatland emissions or global warming potentials.10

As we move to seeing action from both governments and within the private sector, the key takeaway is that by making publicly-stated, measurable goals this creates a feedback mechanism for all stakeholders (consumers, governments and investors) to influence and measure corporate behaviour.

As investors we should play our part by engaging with our investee companies to hold them to account on progress towards targets and the wider impacts on society caused by the transition to a lower carbon economy.

Lowering cost by creating an effective transmission mechanism and amplifying policy and technology through private enterprise

By creating a robust feedback-loop for the private sector we create the optimum conditions for meeting wider goals, by involving a broader set of actors in the pursuit of climate targets.

Specific target setting is a key enabler of this. As we can see from measuring progress to date, it is not just government action that is having an impact. Since 2017, the projected estimated temperature rise has dropped slowly, however, this decline is not due to new or stronger Nationally Determined Contributions (NDC’s) as there have been very few. Real-world emissions’ downward trajectory reflects the rapid cost decline of renewables and implementation of policies. The temperature estimate for governments’ targets and pledges, as of November 2020, is 2.6°C.11

That said, “there remains a substantial gap between what governments have promised to do and the total level of actions they have undertaken to date. Furthermore, both the current policy and pledge trajectories lie well above emissions pathways consistent with the Paris Agreement long-term temperature goal.” 11 This consistent reduction in the climate trajectory, while still short of where it needs to be (and hence why Martin Currie supports a greater push to ambitious NDC’s at COP26 and actionable interim targets), reflects the impact non-state actors are having in driving forward the climate change agenda. It is imperative that all stakeholders such as corporates, consumers and investors all recognise the need for supporting and facilitating progress.

Climate Action Tracker (CAT) warming projections

Global temperature increase by 2100

![]()

Source: Climate Action Tracker: Warming Projections Update, December 2020.

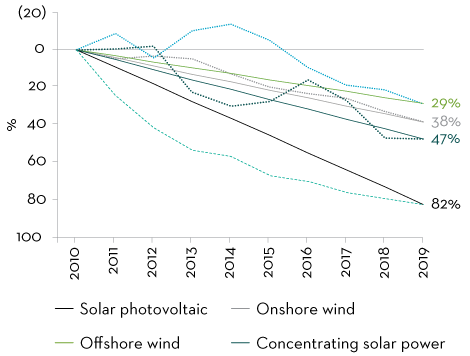

The pace of technological progress is also accelerating. Low-cost de-carbonization technologies (mostly renewable power) continue to improve consistently through scale. Recent research from Goldman Sachs has suggested that the emergence of breakthrough technology such as clean hydrogen could lower the cost of de-carbonizing emissions in more difficult sectors (industry, heating, heavy transport) by 30% and at the same time, increase levels of abatable emissions from 75% to 85% of total emissions.12 In total this has the capacity for shaving US$1 trillion p.a. from the cost of the path towards net zero and creating a broader connected ecosystem for decarbonization that includes renewables, clean hydrogen, batteries and carbon capture.

Percentage drop in renewable energy prices, Global LCOE (2019 USD/KWh)

Source: IRENA, Renewable Power Generation Costs in 2019, June 2019.

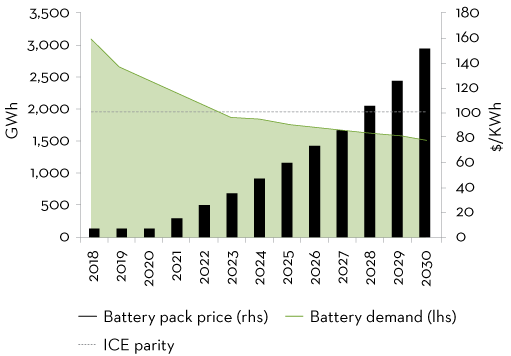

Battery demand and EV battery cost

Source: SNE Research, Think Energy ad Environment, Battery Supply and Demand Forecast and Cost, Price and Profitability.

Further evidence of the falling expense of implementing solutions to a net zero world can be seen in the consistent and ongoing fall in renewables costs over time. Falling costs help stimulate demand and help accelerate the adoption of low carbon alternatives. An example of this can be seen in the acceleration in demand for EV’s as battery costs near and then exceed price parity with internal combustion engines (ICE). Partly as a result of this “the CCC finds that these savings substantially reduce the cost of net zero compared with previous assessments: now down to less than 1% of GDP throughout the next 30 years. This is thanks, not only to the falling cost of offshore wind but also a range of new low cost, low-carbon solutions in every sector.”13 These cost improvements combined with rapid technological development have allowed real-world emissions reductions to go faster than current policy commitments, and to a certain extent, recent intergovernmental commitments to net zero are playing catch-up to non-state actors. Market based incentives for action such as carbon pricing are becoming increasingly important and we will cover this in more detail in our next article, focussing on the role of capital markets in facilitating and accelerating progress towards net zero.

A just transition is necessary to maintain support for policy agenda

For this momentum, in the move away from carbon intensive economy, to be sustained it is imperative that the climate transition occur in a fair manner.

There has long been an awareness of a risk of significant displacement from climate transition that needs managed in terms of its human cost. Justice movements, such as the Gilet Jaunes, highlight the potential for economic dislocation caused by policy shifts and implications on stalling the urgent progress needed on climate action.

The concept of a ‘Just Transition’ is about doing this in a socially just and equitable manner by encompassing a “systemic and whole of economy approach to sustainability. It includes both measures to reduce the impact of job losses and industry phase-out on workers and communities, and measures to produce new, green and decent jobs, sectors and healthy communities.”14 This was acknowledged at the Paris Agreement adopted at COP21 which explicitly recognised the need for a wider sustainable development initiative, to manage the impacts of policy shifts and encourage sustainable development.

This focus on a just transition is needed because the sectoral and economic transformation being proposed is on a scale and within a time frame faster than any in human history. This presents a real potential for stranded workers and stranded communities as well as stranded assets. This is captured in the Sustainable Development Goals, and in particular Goal 8 which focusses on promoting “sustained and inclusive economic growth, full and productive employment and decent work for all.”15

The importance of delivering a just transition worldwide has recently risen to the top of the global climate policy agenda. In December 2018 at COP24, 53 countries signed the Silesia Declaration, fleshing-out an earlier commitment for governments to take into account “the imperatives of a just transition of the workforce and the creation of decent work and quality jobs.” The logic behind the declaration was clear: “Considering the social aspect of the transition towards a low-carbon economy is crucial for gaining social approval for the changes taking place”.16

More recently, even more ambitious steps have been taken towards achieving these goals with the EU taking decisive action with the launch of the EU Green Deal, a programme which aims to mobilise €1 trillion in sustainable investments over the next decade. As part of the EU Green Deal the Just Transition Mechanism (JTM) is a key tool to ensure that the transition towards a climate-neutral economy happens in a fair way, leaving no one behind. It provides targeted support to help mobilise at least €100 billion over the period 2021-2027 in the most affected regions to alleviate the socioeconomic impact of the transition.17

This recognises that in order to maintain support for climate policies the economic impact should be spread in a fair way and that due consideration is given to the ramifications of shifting industrial patterns on workers and communities. Without this, policy makers and other stakeholders will struggle to build and retain a consensus for robust action to combat global warming.

Conclusion

The challenges of creating consensus around ambitious action, developing and deploying technology, measuring progress and ensuring fairness in addressing a net zero goal are significant but are in the process of being solved. There have been great strides made in creating a policy framework, for example, and the final round of NDC’s at COP26 should form the backbone of policy commitments.

These are gradually being given the force of law which alongside detailed regulatory and industry responses is creating the conditions for tangible near-term action to be taken that puts us on a trajectory to achieve these longer-term goals.

As investors we should play our part by engaging with our investee companies to hold them to account on progress towards targets and the wider impacts on society caused by the transition to a lower carbon economy.

Our next article will focus on the role of the capital markets in accelerating progress on net-zero and what we as Martin Currie are doing to play our part in achieving this aim.

Click to display all sources >>

1 Source: Bill Gates: How to avoid a climate disaster, Chapter 2, Allen Lane, 2021.

2 Source: Royal Academy of Engineering: Net Zero: A systems perspective on the climate challenge, March 2020.

3 Source: Committee on Climate Change©: Sixth Carbon Budget, Key recommendations, December 2020.

4 Source: Prime Minister’s Office: Press release: PM Outlines his Ten Point Plan for a Green Industrial Revolution for 250,000 jobs, 18 November 2020.

5 Source: Committee on Climate Change©: Sixth Carbon Budget, Table 1, p19.

6 Source: World Resource Institute: Long-Term Climate Strategies, Achieving a Balance of Sources and Sinks.

7 Source: Climate Action Tracker: Paris Agreement turning point, December 2020.

9 Source: Committee on Climate Change© analysis based on BEIS (2019) Updated energy and emissions projections 2018, and BEIS (2020) Provisional UK greenhouse gas emissions national statistics 2019.

10 Source: Stylistic representation of Figure 1: Climact, Net Zero by 2050: From Whether to How, September 2018.

11 Climate Action Tracker: Warming Projections Update, December 2020.

12 Goldman Sachs: Carbonomics: Innovation, Deflation and Affordable Decarbonization, October 2020.

13 Source: Committee on Climate Change©, Building back better – Raising the UK’s climate ambitions for 2035 will put Net Zero within reach and change the UK for the better, 9 December 2020.

14 Source: PRI, Inevitable Policy Response: Why a just transition is crucial for effective climate action, September 2019.

15 United Nations: Department of Economic and social Affairs, Sustainable Development, Goal 8.

16 LSE and Grantham Research Institute: Investing in a just transition in the UK: How investors can integrate social impact and place-based financing into climate strategies, February 2019.

17 European Commission: The European Green Deal Investment Plan and Just Transition Mechanism explained, January 2020.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

The views expressed are opinions of the Martin Currie analysts as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or analysts of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.