Net Zero: Managing the wider impact of economic and capital displacement

As our three prior articles in this series have highlighted, a focus on achieving Net Zero by 2050 in line with the targets of the Paris Agreement, is a necessity in terms of dealing with the climate crisis. It is also an area where a greater focus on specific targets would be helpful with capital markets being able to help achieve the goals of Net Zero more effectively than government policy alone. This has rightly attracted political, economic and technology capital in an attempt to finance and provide initiatives that can lead us to achieving Net Zero.

However, by focusing on effective climate action we can’t lose sight of other important sustainable development priorities or the necessity to help manage some of the wider societal changes that come about as a result of a significant reprofiling of the economy. These create a more complex picture for investors and policy makers but one that it is important to tackle holistically to ensure that a transition to a net-zero future happens fairly.

As investors, we can best do this by looking at the wider sustainable development context of our investments and the behaviour of the companies in which we invest. Importantly, we also need to fully incorporate the risks and opportunities associated with the green transition. In this way we can deliver returns for our clients alongside policy and advocacy work that supports a holistic approach to Net Zero. This should include an appreciation of a ‘Just Transition’ - where the benefits of a green economy are shared widely, and those who stand to lose economically are supported through the transition – be they countries, regions, industries, communities, workers or consumers.1

Winner and losers are inevitable

One of the most contentious and controversial aspects of a more aggressive timeline on decarbonisation is the potential for significant dislocation in certain sectors of the economy.

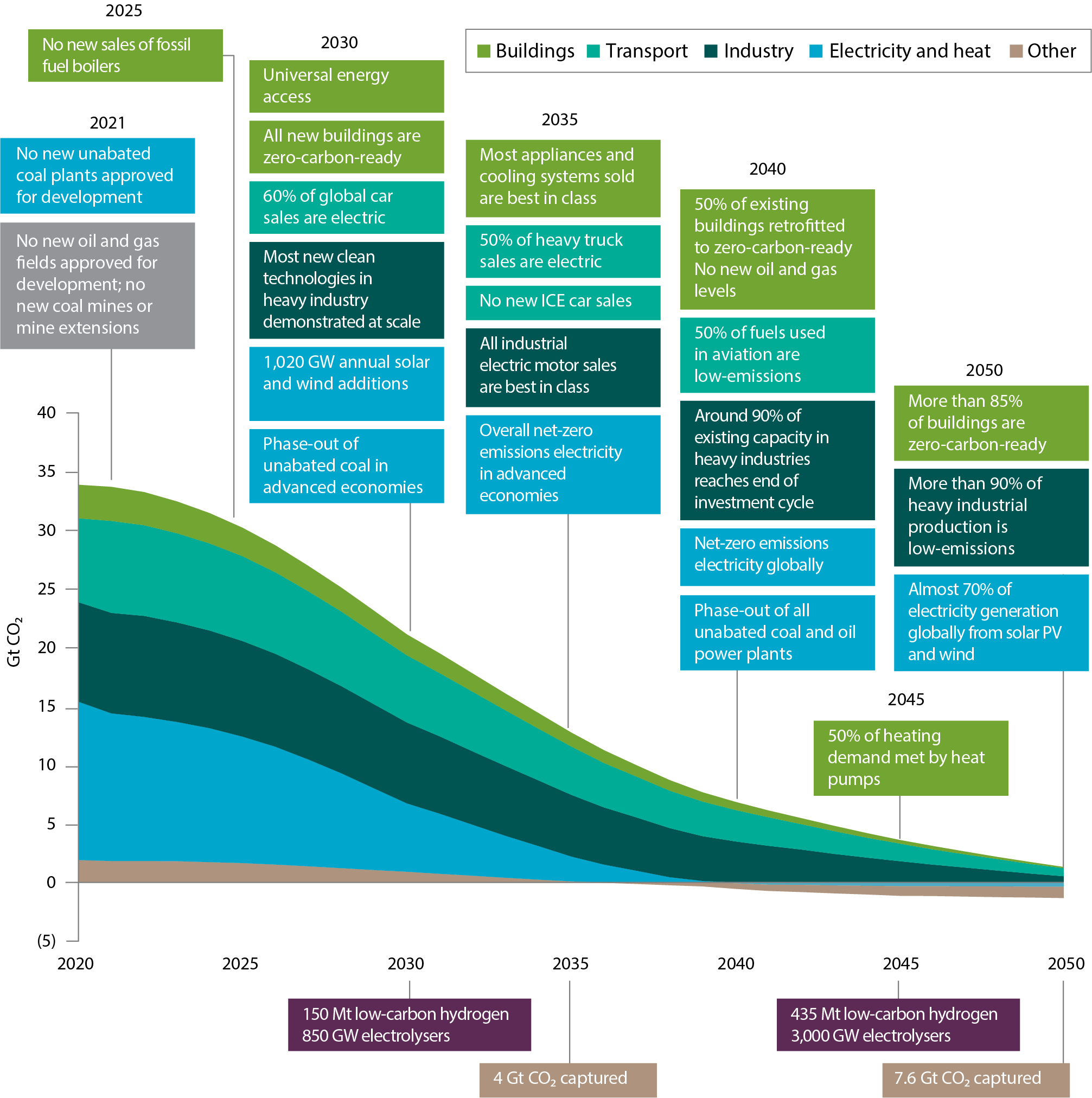

The recently released International Energy Agency (IEA) report ‘Net Zero by 2050’ illustrates a potential roadmap for the global energy sector to reach Net Zero. This analysis shows that in addition to the significant job-creating growth in areas such as wind, solar, carbon capture and electric vehicles, there are equally significant changes in the other direction for traditional fossil fuel producers.

By focusing on effective climate action we can’t lose sight of other important sustainable development priorities.

The IEA scenario has key milestones such as no new oil and gas fields approved for development from 2021 along with no new coal mines from this point forward. As shown in the following chart, a series of steps are required in order to put us on this particular path to Net Zero, with the imperative that they are all met, because ‘if any sector lags, it may prove impossible to make up the difference elsewhere.’2

The reality is that we cannot simply focus on the positive aspects of the energy transition if we are to reach Net Zero. This will inevitably result in regional and sectoral shifts in the economy that may result in job losses, which although possible to mitigate at a macro level still come with significant community consequences.

Key milestones in the pathway to net zero

Source: International Energy Agency, Net Zero by 2050

This nuanced and unequal outcome of shifting policies must be dealt with directly. We have previously argued in this series that for a move away from a carbon-intensive economy to be sustained, it is imperative that the climate transition occur in a fair manner3. This is in order to ensure that the ongoing legitimacy of the Net Zero movement is maintained. For those of us convinced of the necessity of robust climate action, we must make sure that the effects of the transition (be that at an individual, community, country or regional level) are appreciated and mitigated wherever possible. The latest IEA report makes it clear the scope of both the challenges and opportunities associated with the Net Zero transition. For example, the prospect of no new investment in coal, gas & oil would create significant dislocation in these industries and labour pools.

The IEA itself states that although it estimates that this scenario would result in the creation of 14 million new jobs by 2030, this would also result in potentially five million job losses as fossil fuels decline.4 This has been echoed by previous studies by the International Labour Organisation which also estimated significant job creation potential of up to 24 million jobs by tackling climate change.5 However, the likelihood is that although there would be net job creation from tackling climate change, these jobs may well be in different regions, with different skillsets required than in those industries and regions where jobs are lost. Indeed, this is part of what has made the climate debate so overtly political, with the former US president, Donald Trump previously suggesting that 2.7 million jobs would be saved by the US pulling out of the Paris Agreement.6

Just transition as a key enabler of climate action

This type of controversy is not simply a US phenomenon. We have also seen a broader set of events that have highlighted the wider unease that can be felt if communities feel marginalised.

Justice movements, such as the ‘Gilet Jaunes’ which began in France in 2018, highlight the potential for economic dislocation caused by policy shifts and implications on stalling the urgent progress needed on climate action. To maintain popular support behind efforts to combat global warming, it is therefore crucial that politicians, investors and corporates help focus on a Just Transition in terms of economic and policy responses to pursuing Net Zero goals.

The key purpose of focusing on a Just Transition in our eyes is two-fold as highlighted by the work of the Grantham Institute and the European Bank of Reconstruction & Development respectively:

- Broadening the understanding of systemic risks from climate change, by factoring in issues such as social exclusion and increasing inequality.7

- Ensuring that the substantial benefits of a green economy transition are shared widely, while also supporting those who stand to lose economically – be they countries, regions, industries, communities, workers or consumers.8

This type of work has been showcased by the European Just Transition Fund (JTF) where member states will develop plans to support areas facing economic dislocation resulting from changes that are necessary to achieve the EU’s 2030 and 2050 climate targets.9

The JTF has also been supplemented by national schemes with a similar focus. The JTF will support a wide range of activities including investments in micro-enterprises and start-ups, research and innovation, retraining, clean energy, and decarbonisation of transport. An example of this funding going to work is in Germany’s coal-producing regions where there are significant investments taking place to try and offset the impact of the shutdown of coal-fired power plants, the last of which is expected to close in 2038.10 Projects include the establishment of new research institutions to support the development of green hydrogen at an industrial scale and carry out research into low-emission aircraft engines.10

Net Zero, a just transition and the sustainable development goals are all intertwined

A Just Transition seeks to mitigate the impact of shifts in the economy and provide fair access to sustainable development opportunities. In our eyes it sits as a complementary focus to the UN Sustainable Development Goals (SDGs) and the focus on Net Zero.

For example, we can support a Just Transition by making sure that capital markets and the companies in which we invest are fully appraised of the importance of the SDGs as a complement rather than a substitute for action on Net Zero. With such a significant focus on mitigating climate change, and Net Zero in particular, there is a risk that action here crowds out action or takes focus away from interrelated challenges.

There have even been concerns that areas such as the SDGs have been deprioritised as action on Net Zero has accelerated.11 Partly, this may be explained by the SDGs being a set of broader-based and harder-to-define actions with there being an inconsistency as to whether to use the high-level goals or more specific targets as a frame of reference. This is in contrast to Net Zero, which has a clear and specific goal that can be easily summarised as a call to action.

One solution to this could be to show how the SDGs are important in their own right and how they support efforts such as Net Zero. An illustration of this linkage can be seen in the World Benchmarking Alliance (WBA) analysis which highlights the symbiosis between the SDGs and Net Zero.

An assessment of the SDGs and corresponding targets demonstrated that the decarbonisation and energy transformation can have an evident impact on SDG1 (no poverty), SDG3 (good health and wellbeing), SDG7 (affordable and clean energy), SDG9 (industry, innovation and infrastructure), SDG12 (responsible consumption and production), SDG13 (climate action) and SDG17 (partnerships for the goals), among others.12

At Martin Currie we have attempted to solve this at an investment level by focusing on not just the goals of the SDGs but also their 169 underlying targets. We have identified 37 targets where our investments can potentially have the greatest contribution to the SDGs through specific economic activities and the goods and services they produce.

Targets and tracking create focus

In the same way as we have advocated the need for specific targets and measurement in relation to Net Zero,13 more effective measurement and tracking around wider aspects of sustainable development may help focus on areas where action needs to be stepped up more broadly.

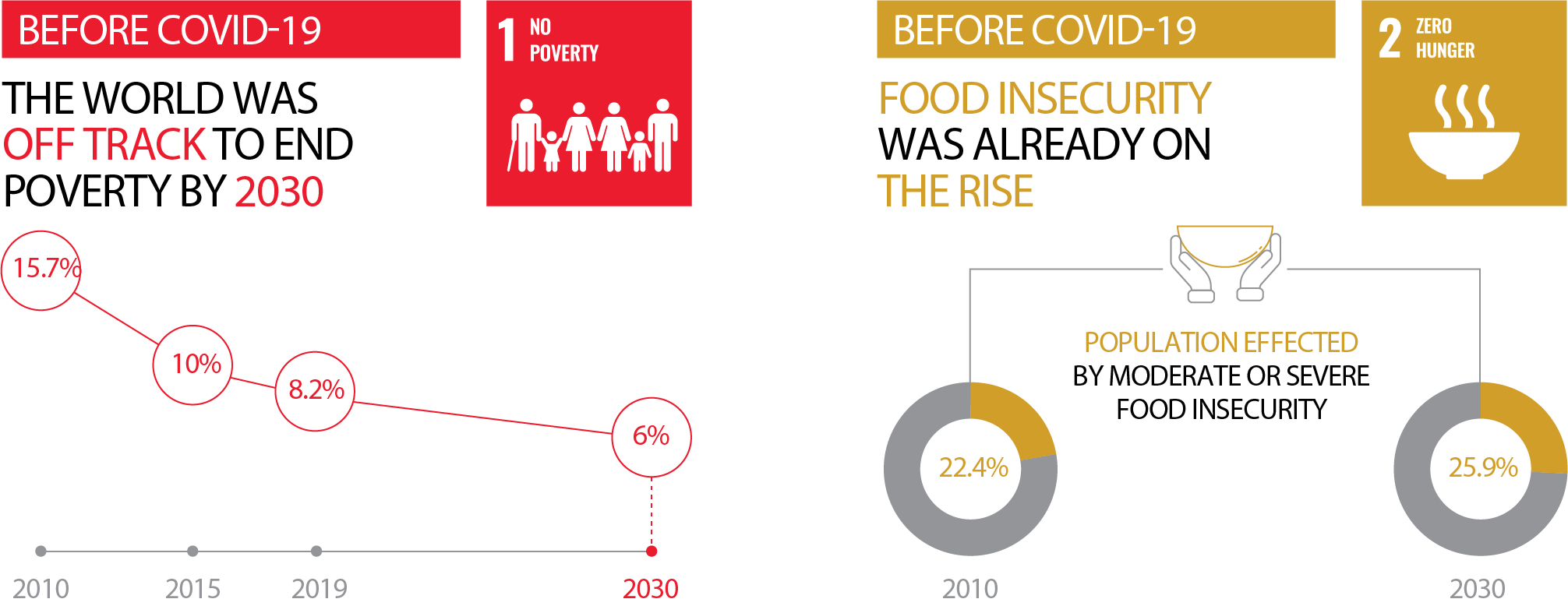

Businesses and policy makers should be able to use tracking tools such as the SDG tracker14 and SDG compass15 to look at how they can effectively contribute to the delivery of the goals. The necessity of this is shown by the UN’s 2020 SDG report which highlighted that progress has been inconsistent, particularly with regards to employment and poverty.

It estimated that 71 million people were expected to have been pushed back into extreme poverty in 2020, the first rise in global poverty since 1998. Lost incomes, limited social protection and rising prices mean even those who were previously secure could find themselves at risk of poverty and hunger.16 Some of this is clearly related to the economic dislocation from COVID-19, but the report serves as a timely reminder that many targets such as progress on poverty (specifically in terms of food insecurity) were not actually showing sufficient progress prior to COVID-19.

The world is behind on key sustainable development targets

Source: United Nations, https://unstats.un.org/sdgs/report/2020/Overview/

This is not to argue to shift attention away from climate-related action, but as a reminder of the need to redouble efforts across multiple areas to ensure that both climate and sustainable development objectives are met. More work clearly still needs to continue on climate-related goals, with the IEA recently delivering a view that the ‘world is not on track to meet the energy-related components of the Sustainable Development Goals (SDGs).’17

It estimated that 71 million people were expected to have been pushed back into extreme poverty in 2020, the first rise in global poverty since 1998.

Better visibility on targets and goals should drive investor action on the just transaction

By encouraging better disclosure on how corporates are contributing and tracking with regards to both Net Zero and SDG targets we can be more effective as investors at driving incremental action.

We want to be in a position where we can use this data to drive our engagement efforts, to be able to use that more significantly in our assessment of risk and reward for investments, and to drive capital towards companies meeting sustainability related challenges.

In this way we can play our part in a wider drive to have the investment community ‘Contributing to societal goals including existing responsibilities to respect international human rights and labour standards as well as new ways of realising the Sustainable Development Goals.’18

By doing this we agree with the Grantham Institute that this can deliver multiple benefits and motivations for investor action as well as contributing to a Just Transition to deliver positive societal impact. Investors can do this by:

- Broadening the understanding of systemic risks from climate change, by factoring in issues such as social exclusion and increasing inequality.

- Reinvigorating fiduciary duty by better capturing the interrelated environmental and social drivers of long-term performance and by taking better account of beneficiary interests in sectors and regions affected by the transition.

- Recognising material value drivers in terms of corporate practices in the workplace and the broader social license to operate: business performance will be increasingly conditioned by the Just Transition.

- Uncovering investment opportunities that combine climate and social goals such as inclusive growth, identified through the lens of the Just Transition.

- Contributing to societal goals including existing responsibilities to respect international human rights and labour standards, as well as new ways of realising the Sustainable Development Goals.18

At Martin Currie we approach this is through our engagement work:

- With regards to SDGs for instance, our emerging market team place an immediate focus on the goals when engaging with any new investee company, highlighting our presence on their share register and introducing Martin Currie’s principles for responsible investing.

We use this introductory correspondence to offer our support through ongoing engagement on ESG performance, which will include engagement on relevant and material SDG targets where we believe the business is, or could be, making a contribution through the goods or services they produce. The response so far has been very encouraging with companies immediately taking up our offer to engage. We intend to adopt this approach with all future purchases in our portfolios. - Another engagement with Indian cement producer Ultratech focused not only on SDG13 in relation to Climate Action but also SDG7 (Affordable and Clean Energy) and SDG11 (Sustainable Cities and Communities) which are key pillars of a Just Transition. In this sense, a holistic view of impact and how to engage with companies can promote a nuanced response to the intertwined challenges of addressing the climate crisis and doing so in a fair manner

Conclusion

We at Martin Currie take our mission of ‘Investing to Improve Lives’ seriously and we believe that a responsible stewardship approach to investing responds to challenges of both decarbonisation and sustainable development.

As we have encouraged our investee companies to be more ambitious and proactive in stepping up their efforts in these areas, we too have been looking at how we can increase our own efforts by increasing our social and environmental efforts around diversity and inclusion, reducing our own carbon footprint and looking at opportunities to join industry-wide initiatives such as the Net Zero Asset Managers initiative. By doing this, we make sure we are committed to the same principles around action on carbon and a Just Transition that we would expect from our investee companies.

Click to display all sources >>

1https://www.ebrd.com/what-we-do/just-transition Agency (IEA) ‘World Energy Investment 2019’ (2019).

2https://iea.blob.core.windows.net/assets/ad0d4830-bd7e-47b6-838c-40d115733c13/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

3https://www.martincurrie.com/uk/insights/net-zero-from-policy-to-action

4https://iea.blob.core.windows.net/assets/ad0d4830-bd7e-47b6-838c-40d115733c13/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

5https://unfccc.int/news/paris-agreement-can-generate-24-million-clean-economy-jobs-ilo

6https://www.washingtonpost.com/news/the-fix/wp/2017/06/01/transcript-president-trumps-remarks-on-leaving-the-paris-climate-deal-annotated/

7https://sustainabledevelopment.un.org/content/documents/22101ijtguidanceforinvestors23november1118_541095.pdf

8https://www.ebrd.com/what-we-do/just-transition

9https://www.consilium.europa.eu/en/press/press-releases/2020/12/16/just-transition-fund-council-endorses-the-political-deal-with-the-parliament/#:~:text=EU%20ambassadors%20 today%20endorsed%20the,to%20tackle%20climate%20change%20together.

10https://www.euractiv.com/section/energy/news/germany-begins-allocating-e40-billion-to-coal-regions-to-start-phase-out/

11https://www.edie.net/library/The-net-zero-bulldozer--Have-the-SDGs-been-forgotten-in-an-era-of-climate-activism-/6972

12https://www.worldbenchmarkingalliance.org/publication/electric-utilities/methodology/

13https://www.martincurrie.com/uk/insights/net-zero-from-policy-to-action

14https://sdg-tracker.org/

155https://sdgcompass.org/business-indicators/

166https://www.un.org/sustainabledevelopment/progress-report/ 17https://www.iea.org/reports/world-energy-model/sustainable-devel

17https://www.iea.org/reports/world-energy-model/sustainable-development-scenario

18https://sustainabledevelopment.un.org/content/documents/22101ijtguidanceforinvestors23november1118_541095.pdf

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally, and any opinions expressed are subject to change without notice. The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The analysis of Environmental, Social and Governance (ESG) factors form an important part of the investment process and helps inform investment decisions. Strategies do not necessarily target particular sustainability outcomes.

The TCFD logo shown on this page is that of the respective owner and is used for descriptive and illustrative purposes only. The company trademark shown is not in any way associated, or to be deemed to be associated with Martin Currie or its group companies.