Key takeaways:

- Despite negative headlines surrounding the UK economy, it is showing signs of resilience as consumers continue to draw down on excess savings and the job market remains healthy.

- UK companies appear to be in good health and their stocks offer compelling valuations.

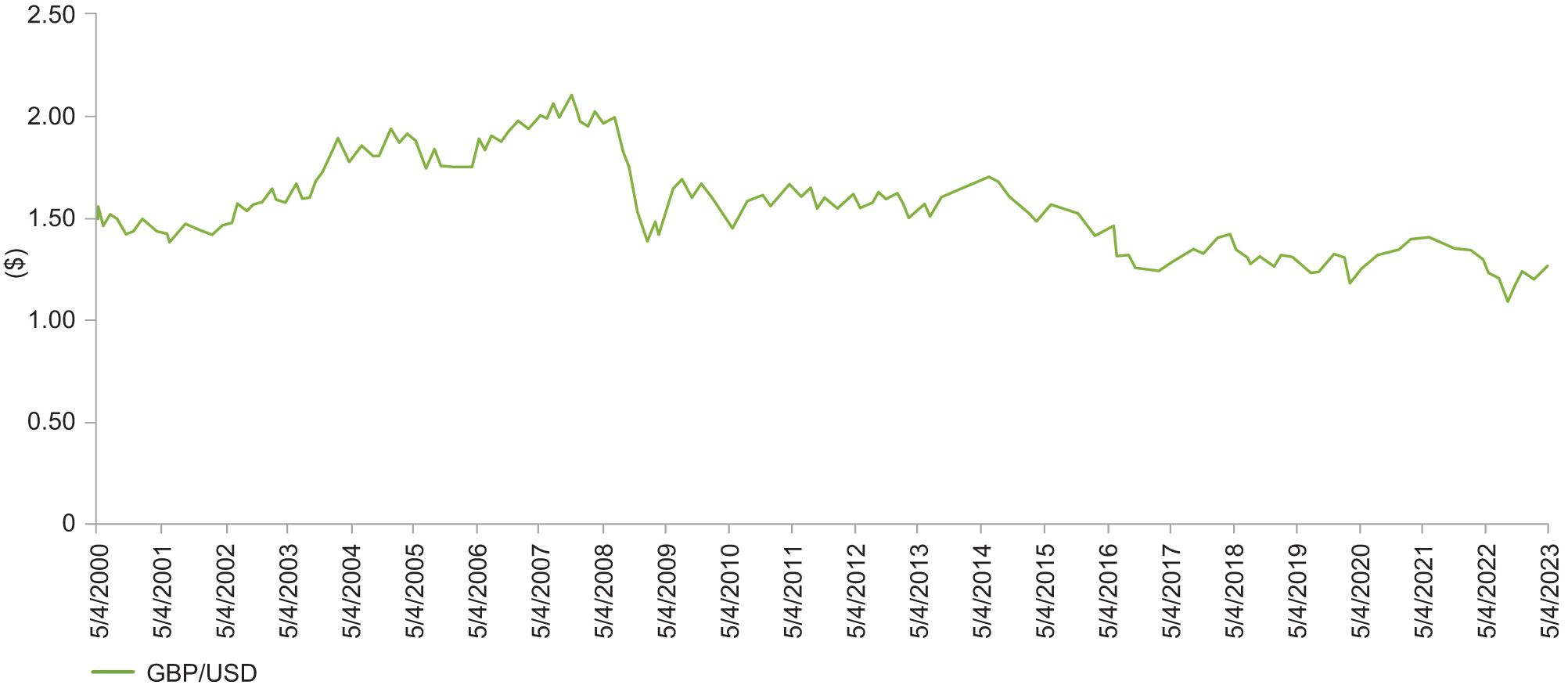

- UK equities are attractive to many international investors as the British pound remains historically low.

- We prefer stocks of high-quality, dividend-paying UK companies that we believe can provide resilient and growing income streams.

UK economy exhibits resilience

Global economies, and indeed equity markets, began to struggle last year as rising inflation and interest rates led to worries about recessions and market volatility. In the United Kingdom, consumer confidence and retail sales fell precipitously in the autumn of 2022.

This was around the same time that the short-lived Liz Truss administration introduced its disastrous mini-budget that caused chaotic movements in UK asset prices. Although the negative sentiment towards UK assets and its currency reached its nadir in September-October, there continue to be a lot of negative media headlines about the UK economy, stock market and political backdrop. Many international investors remain reluctant to consider UK assets.

In our view, the situation became too bearish in late 2022, and that has provided opportunities. We believe that if investors hold the line and keep positions in UK stocks and sectors that are tied to the domestic economy, consumer confidence and retail spending, then there are value opportunities as conditions improve.

Additionally, even though the outlook for 2023-2024 remains challenging, the outturn for the UK economy is defying the gloomier predictions and is proving more resilient than first feared. As a consequence, UK stock prices have been recovering and the British pound has improved as well. The movement of the UK’s currency is a good gauge of sentiment towards the country.

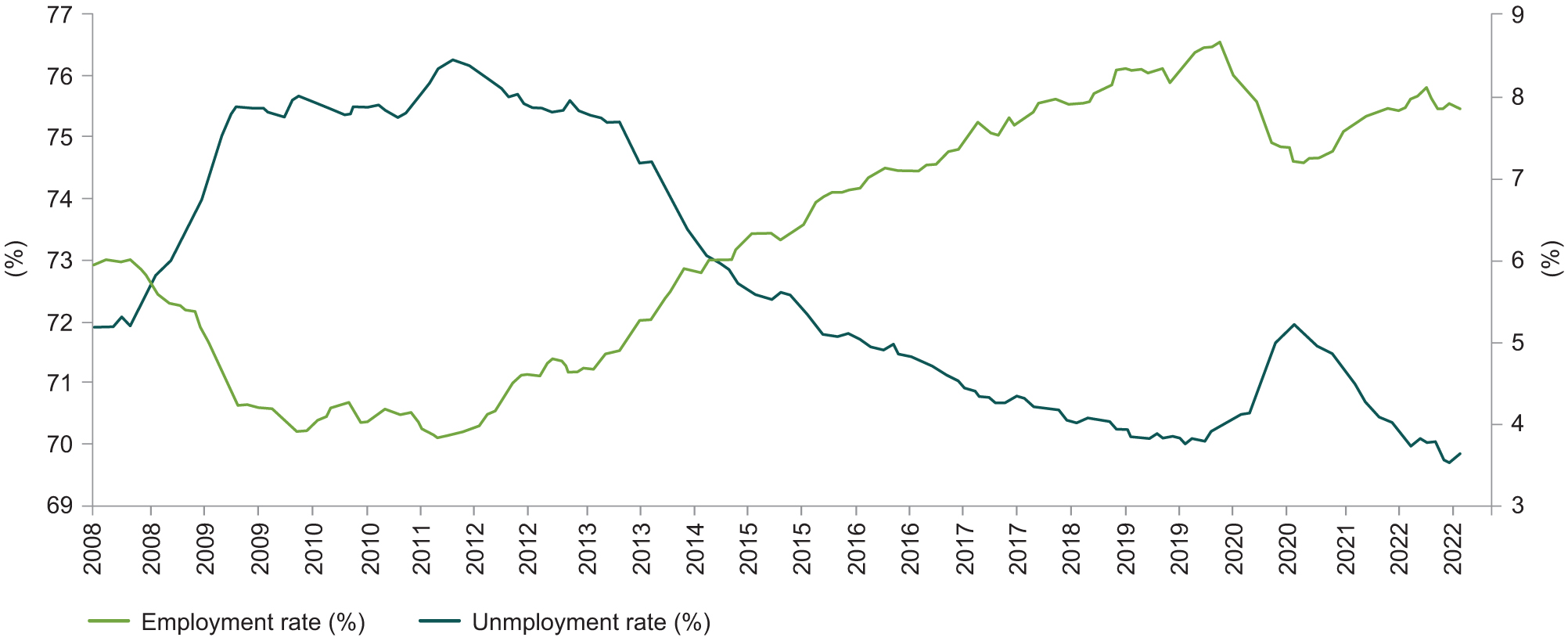

Ongoing Strength of UK Labour Market

The principal reason that the economy is performing better than expectations relates to the ongoing strength of the labour market, with unemployment at historic lows, while at the same time job vacancies remain elevated as employers struggle to fill vacancies.

Another factor to consider relates to the excess savings built up during the pandemic, providing a spending cushion and helping households manage their way through a higher inflation environment.

Employment and Unemployment Rates (%)

2008-2022

Source: ONS as at 31 December 2022.

The principal reason that the economy is performing better than expectations relates to the ongoing strength of the labour market

UK equities remain attractive

In our analysis, there are several reasons why UK stocks are attractive. First, corporate balance sheets largely appear to be in good health, despite the uncertain economic outlook. This has not always been the case during periods of economic weakness.

UK Equities are Relatively Cheap

MSCI UK Price-to-Earnings (P/E) Relative to MSCI World

31 March 1996-29 March 2023

Source: Bloomberg as at 30 March 2023.

Looking across market sectors, aside from financials stocks, corporate debt is at very manageable levels. This means that corporations are in a good position to absorb rising finance costs—as interest rates increase—without upsetting their financial metrics. In our opinion, it would seem there would be little need for distressed rights issues or emergency equity raises, activities that we might have seen in previous economic downturns.

Second is that the UK equity market looks attractive to us on an historical basis with a price-to-earnings (P/E) ratio of around 11x1. In our analysis, the valuation of the UK equity market also looks more attractive versus its international peers, with the MSCI UK Index 12-month forward P/E at the bottom of its historic range relative to that of the MSCI World Index2.

Third, while the British pound has gone a long way from moving towards parity with the US dollar as market commentators talked about last year, it is still at the bottom of its historic range. This situation reinforces the attractiveness of UK assets to international buyers, in addition to the aforementioned attractive valuations.

We have seen ongoing mergers and acquisitions taking place as international trade buyers, private equity and venture capitalists have continued to acquire UK assets. We believe this trend will continue through 2024.

The banking sector has recently been in the spotlight amidst turmoil in the US banking sector tied to the collapse of Silicon Valley Bank, amongst others. However, the UK banking industry is structured very differently from that of the United States—the latter being composed of several thousand regional banks subjected to relatively ‘light-touch’ regulation.

That said, we believe the US banking crisis will likely lead to more regulatory scrutiny and tighter lending standards in both countries, which will likely affect credit creation and ultimately impact economic growth. We are mindful that any regulatory intervention or political pressure to change the banks’ actions could undermine the positive macro factors that have arisen this year.

British Pound (GBP) Weakness Presents Opportunity

GBP vs US Dollar (USD)

4 May 2000-4 May 2023

Source Bloomberg as at 4 May 2023.

In the past 15 years or so, with interest rates near zero, it was difficult for banks to make any meaningful net interest margin between deposit rates and lending rates—the backbone of industry profits. Against such a backdrop, it is unsurprising that banks’ share prices flatlined and were not compelling investment opportunities from our point of view. If, as seems likely, we are at the beginning of a higher interest-rate environment, the prospects for the industry have changed. This has led us to cautiously reconsider the dividend-paying attractions of some of the names in this space.

Focusing on opportunities

Based on all of the abovementioned reasons, we believe that now is a good time to maintain and even add exposure to UK equities. In the current environment, we will continue to take a consistent approach to investing and remain focused on valuation.

We prefer the stocks of high-quality, dividend-paying UK companies that we believe can provide resilient and growing income streams. In our analysis, UK equities offer an attractive yield premium versus other developed markets.

Lastly, we believe UK companies—which derive a large portion of their revenues from overseas—are well-positioned to benefit from an eventual turnaround in the global economy.

1Source: Berenberg, “Signs for Optimism,” 12 July 2022.

2Sources: Datastream, JPMorgan, Bloomberg Finance L.P. as of 5 September 2022. There is no assurance that any estimate, forecast or projection will be realized. Indices are unmanaged and one cannot invest directly in an index. Important data provider notices and terms available at www.franklintempletondatasources.com.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.’

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.