Below, we go into the details of why we have not held any banks in our Long-Term Unconstrained strategies, and why we find the Banks sector to be unappealing for us, in terms of potential for value creation for our clients.

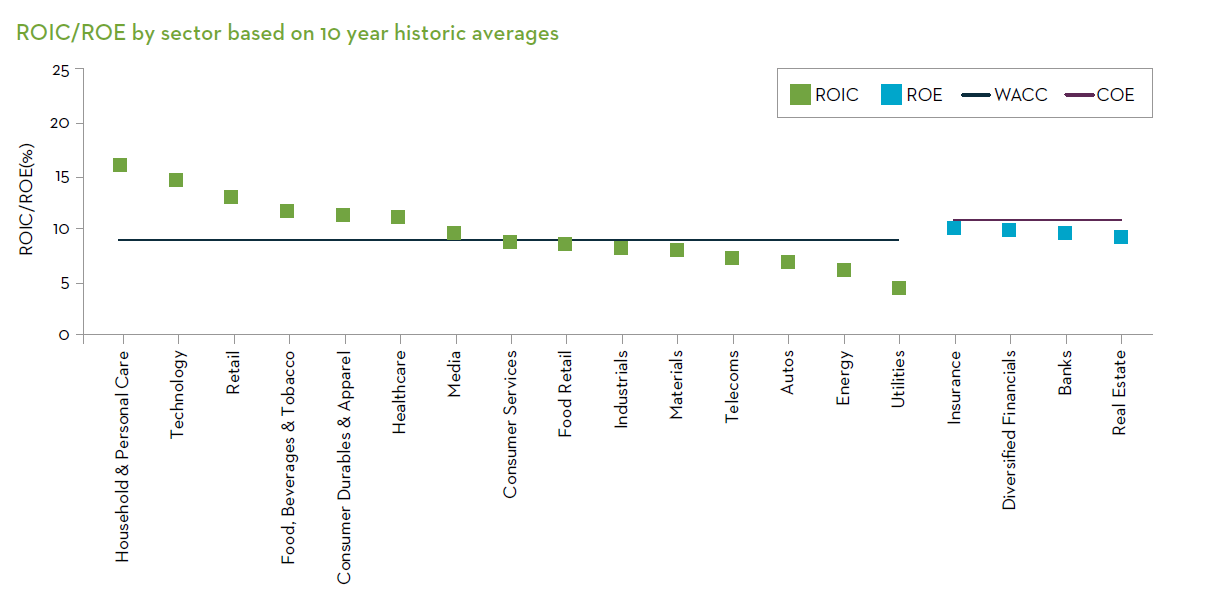

On the returns front, we focus on companies that generate returns (we use return on invested capital, or ROIC, for this) that are superior to their cost of capital on a consistent basis (we use a 9% CoC assumption) – the essence of value creation for a company. If a company cannot generate a positive spread between its returns on invested capital and its cost of capital, it will, by definition, not be generating a positive return for shareholders, and therefore will not be creating value for its shareholders. In fact, if the spread is negative, it will be destroying value for its shareholders.

For companies in the financial sectors, the measure we use is the Return on Equity (RoE), which we compare to the Cost of Equity. The CoE threshold that we use is 11%. As we assess the financial sector, we struggle to find companies in this sector that will, in our view, be able to sustainably generate a positive spread between the Return on Equity that they generate, and the 11% Cost of Equity that we assume.

The below chart plots, at the industry level, the average ROIC for non-financials, and average RoE for financials, achieved at the global level, using MSCI World as the index. As can be seen, there are sectors in the non-financials (in green) that struggle to cover their cost of capital, and therefore in our view struggle to create value for shareholders. Similarly for financials (in blue), there are many industries that struggle to cover their cost of equity, and therefore struggle to create value for shareholders. Banks in particular struggle to cover their cost of equity, which is one of the reasons for us to not be holding banks.

Past performance is not a guide to future returns. Source: Martin Currie and FactSet as at 31 March 2023. Data shown for the MSCI ACWI. Return On Equity (ROE) is used for financial sub sectors and Return on Invested Capital (ROIC) for non-financials. Weighted Average Cost of Capital (WACC) and Cost of Equity (COE) are the thresholds used by the Global Long-Term Unconstrained team.

As we assess the financial sector, we struggle to find companies in this sector that will, in our view, be able to sustainably generate a positive spread between the Return on Equity that they generate, and the 11% Cost of Equity that we assume.

There are other reasons why we do not like Banks as a business model, all based on our fundamental assessments as investors.

There are other reasons why we do not like Banks as a business model, all based on our fundamental assessments as investors.

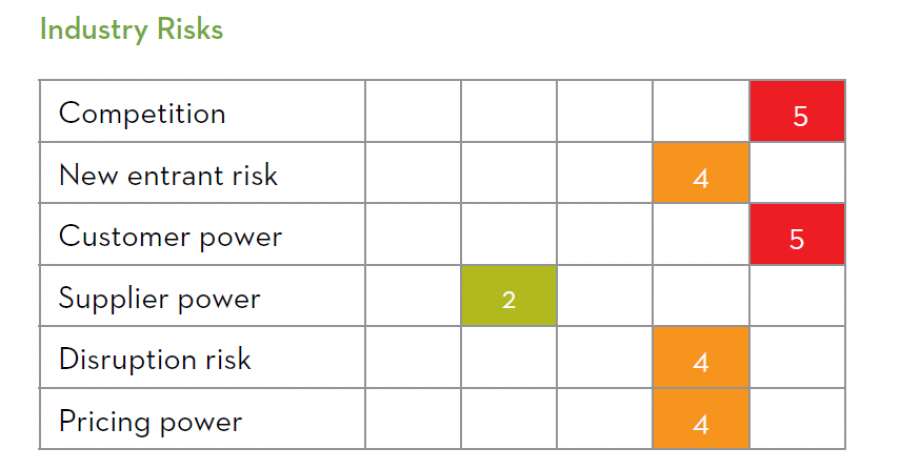

Firstly, looking at the industry dynamics, we have a structured approach to assessing industry risks, in order to focus on finding quality growth companies that operate in industries that have favourable dynamics for value creation. That approach is using Porter’s five forces industry analysis, enhanced for a few additional fields. The table to the right highlights the various fields that we assess, and how the Banks sector fares in terms of each field (with 1 being a low risk, and 5 being a high risk).

For the banks sector, we estimate that competition risk is elevated, given the many banks operating in each market, all vying for market share. We rate that risk as extremely high, at 5.

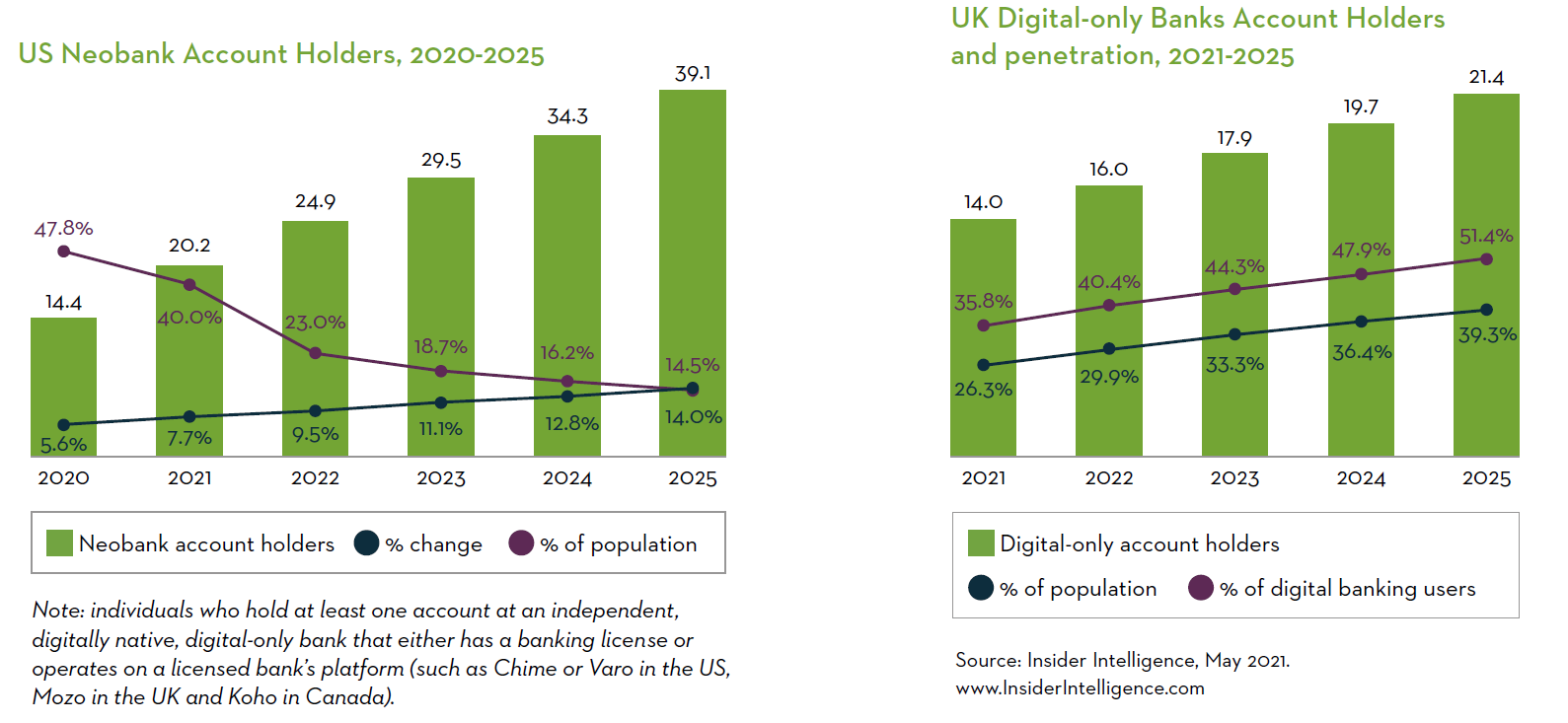

We also estimate that new entrant risk is elevated, notably from neo-banks, that are more agile, more innovative, and are not encumbered by the legacy IT systems that incumbent banks have. Their systems are at times complicated by the various mergers and acquisitions they have gone through, without proper integration or rationalisation of their IT systems. We rate the new entrant risk in the Banks sector as very high, at 4.

Customer power risk in the Banks industry is high - given the competitive intensity in the sector, customers have a good list of banks to go to, which gives them choice, and therefore gives them customer power. This means that the customer power risk faced by banks is elevated in our view - we rate that risk as a 5.

Supplier power risk is low for banks, given they have strong buying power with their customers, notably as a result of the sheer size of their businesses typically, and the fragmented nature of the suppliers. We rate that risk low, at 2.

Pricing power risk is elevated for Banks, and effectively influenced by a combination of competition risk, new entrant risk, and customer power risk that we mentioned above. In essence, Banks have low pricing power due to the high competition risk, high new entrant risk, and high customer power risk, and therefore we rate the pricing power risk as high, at 4.

Disruption risk is also elevated; here we assess how much disruption risk an industry is facing. The banks sector is facing significant disruption from new entrants, who are more agile, are digital natives, and therefore have a superior use of technology. This means that new entrants in the Banking sector can give customers a better user experience, whilst at the same being able to harness the data intelligence that comes with superior technological platforms, to permit them to deliver more customised and tailored services and solutions to customers, through the use of Artificial Intelligence. Traditional and incumbent banks are also encumbered by legacy IT systems that might not be adequate any longer, with some banks, at times running with multiple systems, due to the lack of proper integration of banks they have acquired, or with whom they have merged. This makes them less agile and less able to respond to the disruption threats that they are facing.

There is also a trend towards more disintermediation in the banking sector, as a result of more efficient digital and seamless handling of transactions and customer data, which adds to the disruption risk faced by banks. We therefore rate disruption risk in the Banks sector as very high, at 4.

The chart below shows the trend of market share win of neo-banks compared to incumbent banks, highlighting the speed at which neo-banks are disrupting the industry, for the US and UK markets.

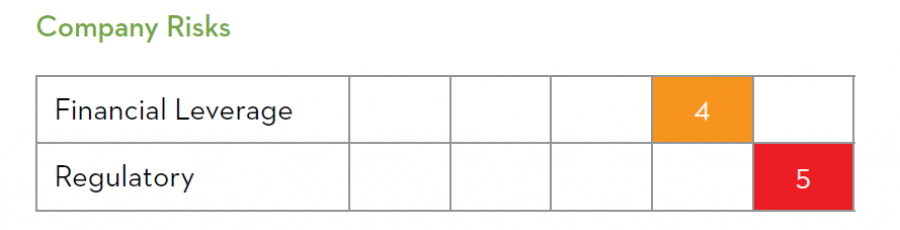

Furthermore, when we assess company fundamentals, we also assess risks faced by companies across a range of fields, including Regulatory Risk and Financial Leverage risk, which are particularly relevant to focus on for the Banking sector.

Furthermore, when we assess company fundamentals, we also assess risks faced by companies across a range of fields, including Regulatory Risk and Financial Leverage risk, which are particularly relevant to focus on for the Banking sector.

On the regulatory risk front, the Banking industry is highly regulated, and is at risk of increasing regulatory requirements. Some of the regulatory requirements centre around forcing banks to hold higher levels of capital on their balance sheets, to ensure robust capital adequacy and liquidity ratios, in order to enable them to withstand various operational risks, and to protect depositors. Banks that are considered as global systemically important financial institutions (GSiFis) are even required to hold additional capital, to create an additional buffer (the so-called AT1 capital). These regulatory constraints to hold more capital eats into, and ends up diluting, Banks’ returns on equity; regulatory constraints therefore impact RoEs in the sector negatively.

Past periods of financial crises have also shown that when banking regulators are facing systemic risk, they have tended to impose additional more stringent requirements for capital, notably forcing banks at times to inject fresh capital in order to ensure confidence in the banking system is restored. We do believe that regulators have good reasons to do so in periods of stress, and therefore do not highlight this as a negative at the broader regulatory level, but it does highlight that this further amplifies the regulatory risk that the sector faces.

We rate the regulatory risk in the Banking sector as very high, at 5.

Financial leverage is another risk that Banks face - this is related to the way their business model works, creating what we would deem to be fragility in their balance sheets, as a result of the leverage used. We rate the Financial Leverage risk as high at 4.

There are additional risks that the Banks sector faces, as a result of the interconnectivity within the sector, and within the whole financial system: systemic risk. Whilst systemic risk in the Banking sector would typically have repercussions in the broader economy if it was to flare up, it makes the Banking sector particularly vulnerable to equity value destructions in these instances, which makes the sector unappealing to us.

Furthermore, what we have seen in the most recent bank failures is the added liquidity risk, and duration mismatch risk, that banks might be facing. This is an added set of risks that make the Banking sector business model unappealing in our view.

The final reason why we do not invest in banks is our unconstrained approach to investing. Because we have an unconstrained approach, we can focus on finding the very best stock ideas within our investable universe, without being concerned about not having any exposure to some sectors, such as banks, where we don’t see any opportunities for value-creation. Why have exposure to some banks in the sector, given that the Banking sector has very unfavourable industry dynamics, and unappealing returns profiles. We prefer to put our investors’ capital in businesses that we believe generate better returns, have superior structural growth, and lower risk profiles than the Banking sector does. Food for thoughts.

For comparison to the Banks industry risks that we show above, below are the aggregate industry risks profiles of the various strategies that we manage, i.e. specifically the Global, International, European, and US Long Term Unconstrained strategies. From the below, we highlight the superior industry dynamics that we have exposure to, compared to the industry dynamics that we estimate from the Banks sector as a whole.

Long-Term Unconstrained (LTU) portoflios aggregate industry risk assesments

| LTU Strategies | Competition | New entrant risk | Customer power | Supplier power | Disruption risk | Pricing power | Supply chain dependency |

|---|---|---|---|---|---|---|---|

| Global | 1.8 | 1.9 | 1.8 | 1.7 | 1.8 | 2.0 | 2.1 |

| International | 1.9 | 1.9 | 1.8 | 1.8 | 1.8 | 2.1 | 2.4 |

| Pan European | 1.9 | 1.8 | 1.8 | 1.9 | 2.0 | 2.0 | 2.4 |

| US | 2.0 | 2.1 | 1.9 | 1.6 | 1.9 | 1.8 | 2.0 |

Source: Martin Currie as at 26 March 2023. Aggregate industry risk assessments based on the current portfolio holdings for the representative Global, International, Pan- European and US Long-Term Unconstrained accounts.

To recap the reasons why we don’t invest in banks for our clients in bullet point form:

- Banks generate low Returns on Equity, and struggle to cover their Cost of Equity on a sustainable basis

- We believe Banks struggle to create value for shareholders, as a result of the unappealing spread between their RoE and CoE

- Banks Industry risks are elevated, making for unfavourable industry dynamics

- High competition risk

- High new entrant risk

- High customer power risk

- High pricing power risk

- High disruption risk from new entrants and regulators

- High regulatory risk

- High financial leverage risk

- Facing liquidity risk and systemic risk, which furthur amplifies the regulatory risk

The document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns. The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.

The document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns. The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.