Asia Pacific ex Japan equity markets year-to-date have been characterised by elevated volatility, caused by a combination of global factors driving uncertainty including:

- a rapid acceleration of inflation as economies begin to reopen following prolonged COVID-19 lockdowns;

- growing expectations for monetary policy tightening over the short-medium term;

- heightened geopolitical tensions and supply chain pressures following Russia’s invasion of Ukraine; and

- downward pressure on Chinese stocks due to regulatory fervour on new economy stocks and tensions between the US and China.

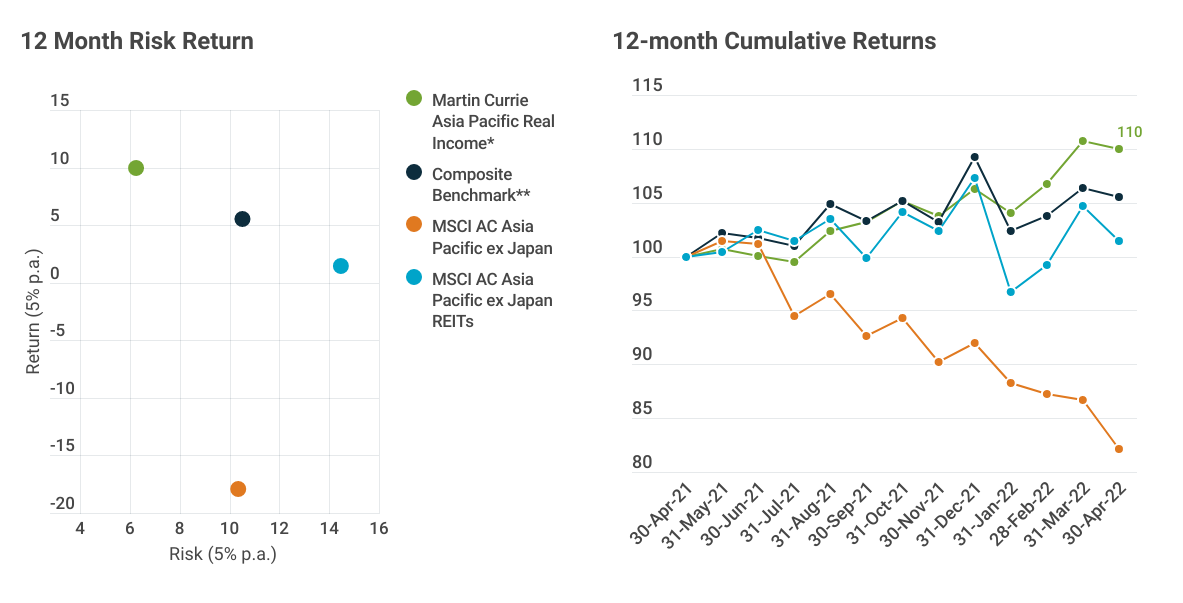

Despite the significant equity market declines during the 12 months April 2022, our Asia Pacific Real Income (APRI) portfolios have continued rising into falling equity markets.

Superior Risk Adjusted Returns

Over this period, the portfolio has not only outperformed the broader market, its real asset composite benchmark and Asia-Pacific ex-Japan Equity Income peers but also standalone real asset sectors such as real estate, all with much lower volatility.

This is in line with our performance objectives, which is to provide investors with a low risk, total return outcome with an attractive and growing yield, and highlights the advantage of the APRI strategy over sector specific solutions or regional income funds.

Past performance is not a guide to future returns. The return may increase or decrease as a result of currency fluctuations.

Source: Martin Currie Australia; as of 30 April 2022

*Data provided for the Martin Currie Asia Pacific Real Income composite in US$ (gross of fees).

**The composite index is comprised of 50% MSCI AC Asia Pacific ex Japan REITS (Net Dividends) Index and 50% MSCI AC Asia Pacific ex Japan Utilities (Net Dividends) Index is used for performance comparison purposes. The portfolio is constructed in a benchmark-unaware manner.

The performance record noted above is clear representation of the strategy's performance over the period shown. Performance information showing five years (or since inception) in complete 12 month periods is available upon request.

See end notes for full GIPS disclaimer.

This highlights the advantages of the Martin Currie Asia Pacific Real Income strategy over sector specific solutions or regional income funds.

Portfolio Design Provides Low Volatility Outcomes During Uncertainty

We believe that it is our investment process, which targets a blend of listed Real Assets (Real Estate, Utilities and Infrastructure) and also incorporates a unique “Sustainable Dividend Assessment” (or downside dividend analysis), which has helped the portfolio rise into falling markets in this low-volatility manner.

We see ongoing global geopolitical risks as well as uncertainty around inflation, interest rates and COVID-19. As such, global and regional equity and bond market volatility is likely to persist for some time. Below we outline why we expect the APRI strategy’s focus on income and low volatility total return outcomes will continue to serve investors well relative to broader Asia Pacific equities or real asset sectors.

Ignoring Benchmarks in favour of high-quality income

We don’t think it is appropriate to include any particular security in our portfolio just because it has a large weight in an arbitrary index.

Our focus on high-quality income stocks has kept the APRI portfolio away from speculative names and high multiple / low yielding stocks that have large weights in Asia Pacific equity market indices.

While these index stocks that have come under the most significant selling pressure during the recent market correction, we believe that the performance tilt away from expensive growth style stocks is only just beginning as economies continue to recover from the COVID-19 downturn.

Listed Real Assets have long-term leverage to urbanisation – particularly in the Asia Pacific ex Japan region

To avoid stocks whose growth and returns are driven by the swings of the economic and business cycle, we prefer Real Assets. We see Real Assets as the ‘every day-use’ building blocks of the economy, and that their growth is driven by the structural mega trend of urbanisation. Our key thesis is that as urban population grows, so too will demand for Real Assets to service non-discretionary everyday needs such as electricity, transport and food shopping.

With a growing demand, coupled with the non-discretionary nature of the services provided, Real Assets typically demonstrate strong pricing power, with proven cash flows, with an ability to continually grow distributions to investors no matter the economic and business cycle.

A core focus on Sustainable Dividends

Unlike many ‘high yield’ strategies, our portfolio construction process places great importance on our unique Sustainable Dividend Assessment which considers a stocks ability to maintain payments to shareholders through all different stages of the cash flow cycle, rather than a current or consensus dividend which may be artificially high.

As our assessment of a stock’s long-term Sustainable Dividend takes in a downside scenario for dividends. We are also not forced sellers when a company that is paying a very high dividend, that cannot be sustained, ends up cutting it.

In-built Inflation protection

As economies reopen, the near-to-medium term path for inflation and interest rates is almost certainly up. While this is usually considered a headwind for equities, including listed Real Assets, we see opportunities for growing the income steam for APRI.

With inflation rising, APRI is well positioned due to our focus on owning Real Assets with inflation protection and pass-through mechanisms and strong pricing power. These types of Real Assets should exhibit meaningful cashflow and dividend growth as inflation rises, while companies without pricing power may struggle to raise prices.

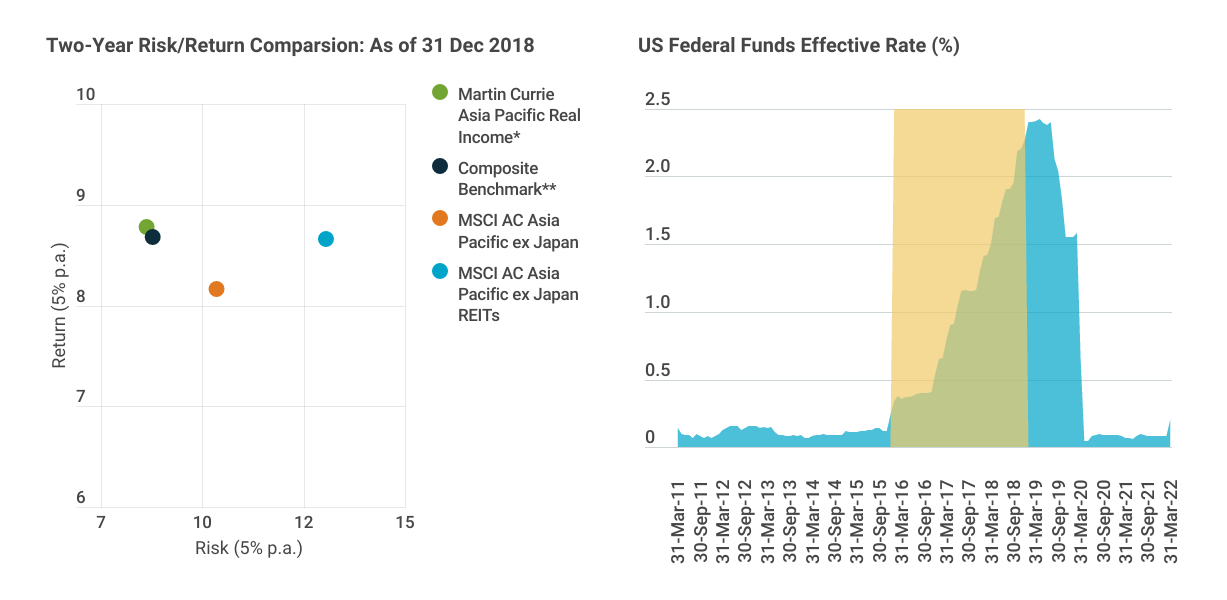

Strong performance historically from higher interest rates

We believe that the market never priced in permanently low interest rates for high quality Asia Pacific Real Assets unlike many other high multiple sectors of the market. Furthermore, the typical longer maturity debt and expensive legacy debt of some of our Real Asset holdings mitigates the impacts of rising interest rates as they maintain their ability to refinance at lower rates than existing loans.

The APRI portfolio also has a strong track record of performing well during rate rise cycles. When we last saw significant and rapid rate rises in the US Fed Funds rate from December 2016 to December 2018, the portfolio outperformed the broader market and its Real Asset composite benchmark – again with lower volatility.

Past performance is not a guide to future returns. The return may increase or decrease as a result of currency fluctuations.

Source: Martin Currie Australia, Federal Reserve Bank of St. Louis; as of 30 April 2022

*Data provided for the Martin Currie Asia Pacific Real Income composite in US$ (gross of fees).

**The composite index is comprised of 50% MSCI AC Asia Pacific ex Japan REITS (Net Dividends) Index and 50% MSCI AC Asia Pacific ex Japan Utilities (Net Dividends) Index is used for performance comparison purposes. The portfolio is constructed in a benchmark-unaware manner.

The performance record noted above is clear representation of the strategy's performance over the period shown. Performance information showing five years (or since inception) in complete 12 month periods is available upon request.

See end notes for full GIPS disclaimer.

With inflation rising, APRI is well position due to the our focus on owning real assets with inflation protection and pass-through mechanisms and strong pricing power.

The Martin Currie Asia Pacific Real Income Strategy

Volatility is likely to continue to be a feature of equity markets for the near- to medium-term as global economies reopen, while grappling with accelerating inflation and the normalisation of extreme monetary policy settings.

A focus on income and low volatility total return outcomes has helped the APRI strategy navigate the falling markets over the last 12 months, but this strength does not diminish the potential for future returns.

We believe that the benefits of Real Assets in this environment are still being undervalued and that income focus of the portfolio will continue to provide resilience in market sell offs.

Key Attributes of the APRI Strategy

- A unique blend of listed Real Assets with income growth driven by long-term demographic themes –Listed REITs, utilities and infrastructure - the essential building blocks of an economy for a growing urban population’s every-day needs

- Proven investment process with Active Ownership – Proprietary multi-lensed investment approach, with fully embedded Stewardship & ESG.

- Income-focused return profile – Unique investment approach aligns stock selection and portfolio construction with the need to reduce income shock and grow income with inflation

- Benchmark unaware portfolio construction – Low security concentrations to provide income diversification so no single stock dominates

- Experienced stock pickers - Deep industry experience generating best Real Asset ideas

End notes

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.