Tightening US credit lending conditions could pose a growing risk to US economic growth

With the banking failures in the US regional banks in March and April, we highlighted at the time that credit lending conditions tightening could be a risk to watch out for, given that it would be the transmission mechanism that could lead to higher risk for the US economic activity.

In this month’s insights, we zoom in on the latest credit lending conditions, with the latest datapoint coming through in early May.

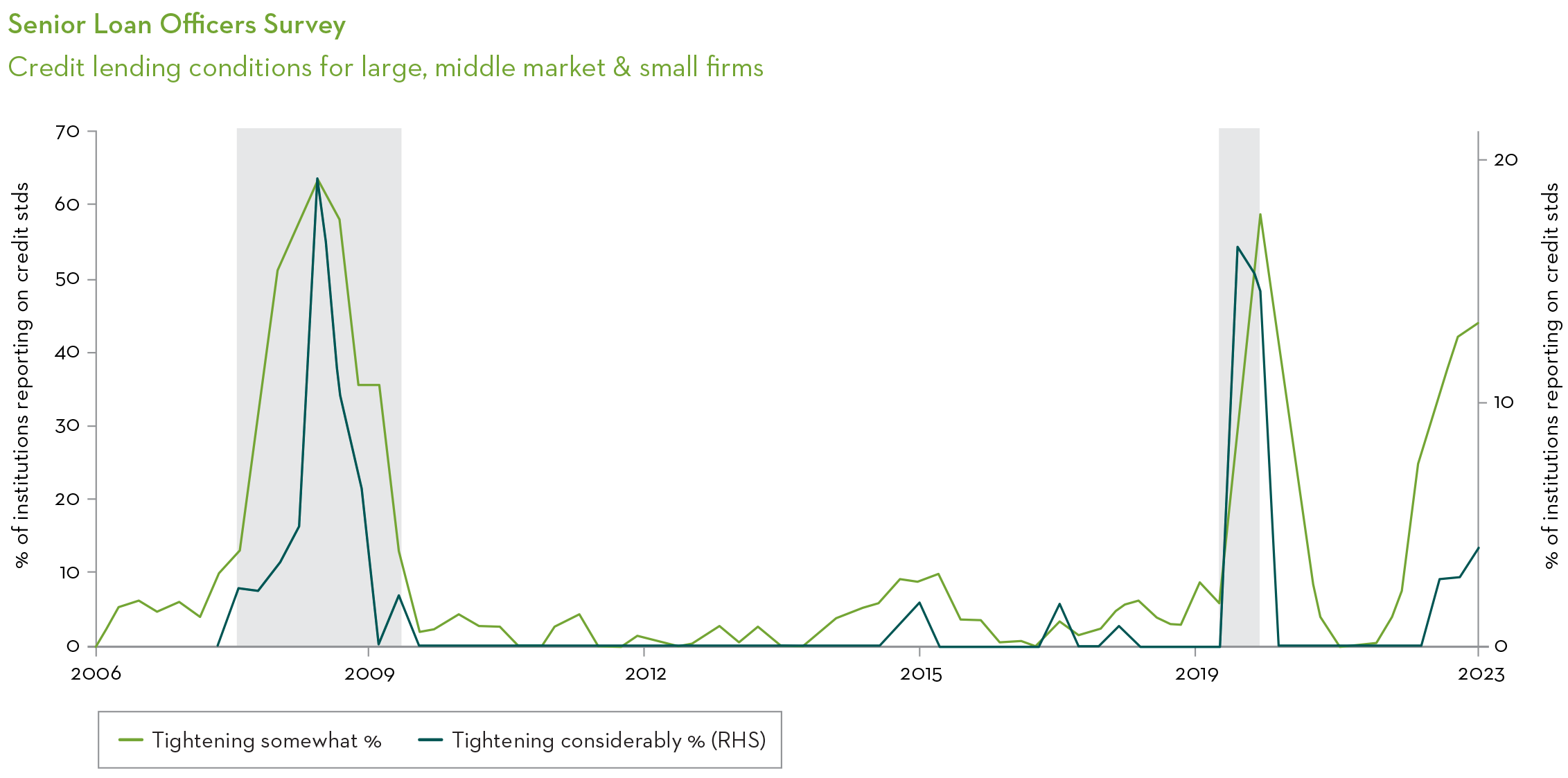

The chart below shows the tightening credit lending standards in the US, through the Senior Loans Officers' Survey.

The market bears will focus on the spiking curve related to the “tightening somewhat” responses, shown in light green. Bringing in the black curve, the “tightening considerably” responses is important to do, as it shows a somewhat more measured picture of credit conditions, as it puts things into perspective, compared to previous significant tightening in lending conditions that have occurred around recessions, both in 2008-09 and in 2020.

Source: State Street Global Markets, Bloomberg.

The conclusion so far is that whilst credit conditions are tightening, the proportion of responses showing significant tightening is nowhere near the levels of previous recent recessions. The trend does however need ongoing careful monitoring, as it could imply that tighter credit conditions will impact economic activity negatively, which could in turn increase the risk of a recession in the US.

Whilst we keep our probability of a recession in the US in 2023 at 30-35%, there is a risk that such probability could be increasing if credit conditions continue to tighten from here.

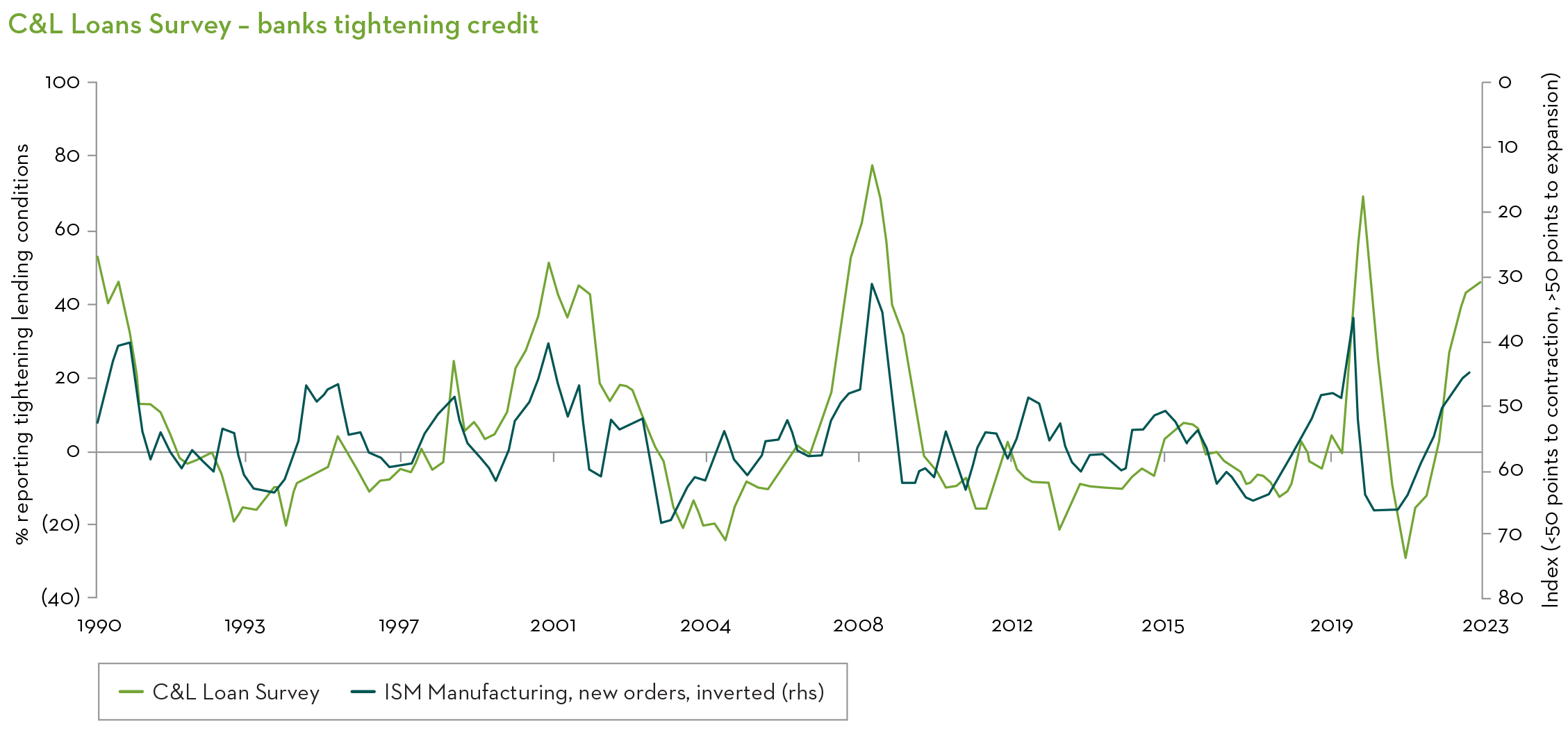

The reason that the market has been particularly focused on credit lending conditions is the close relationship between those, and the ISM Manufacturing* new orders data, as can be seen in the chart below, this is the US purchasing manager index.

There is a strong correlation between tightening credit conditions and deteriorating ISM manufacturing new orders.

This is shown by the increasing number C&L survey respondents reporting tightening lending conditions (light green line).

Whilst we keep our probability of a recession in the US in 2023 at 30-35%, there is a risk that such probability could be increasing if credit conditions continue to tighten from here. Our core scenario remains one of a sharp slowdown, which we continue to assess at 60-65% probability, but we will be reviewing this in light of additional datapoints.

Source: Refinitiv Datastream, Credit Suisse Research as at May 2023.

*Institute for Supply Management. Also known as ISM Manufacturing Purchasing Managers Index (ISM PMI), is a monthly gauge of the level of economic activity in the manufacturing sector in the United States versus the previous month.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.