Content navigation

Hung parliament likely, leading to slow political decision making and probable limited deviation from current policies.

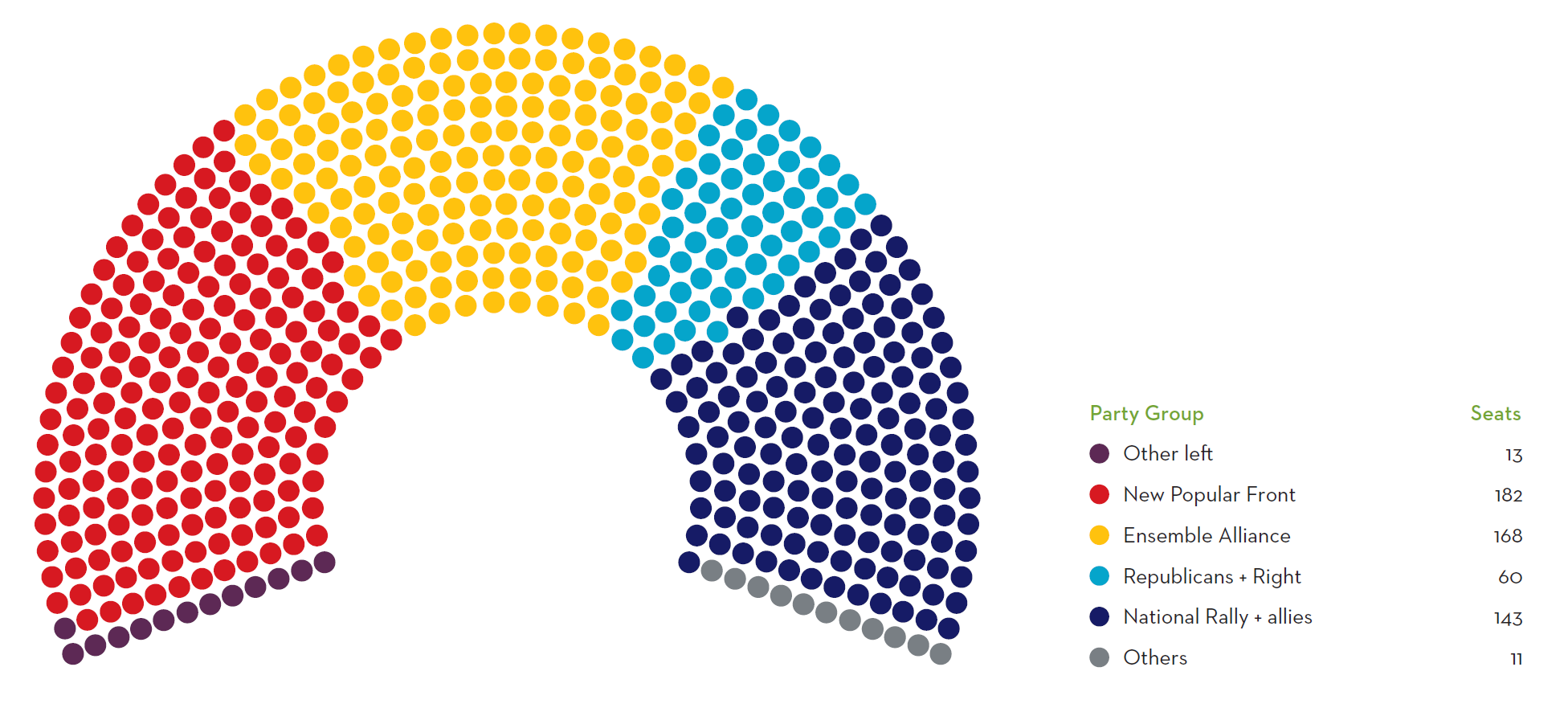

The French second round election has brought a surprise loss in position for the far-right Rassemblement National (RN) party, who came in third with 143 seats despite leading the polls ahead of the elections. It was the far-left party The New Popular Front (NFP) who came first with 182 seats, with President Emmanuel Macron’s centrist coalition Ensemble in second, winning 168 seats.

Centre-right party Les Républicains (LR) got 45 seats, whilst right party La Droite (LD) got 15 seats. Leftist party La Gauche (LG) got 13 seats, whilst centre party Le Centre got 6 seats. Regional and fringe parties got the remaining 5 seats of the 577 seats in the Assembly.

French National Assembly elections 2024 – breakdown of seats

Source: French Ministry of the Interior, as at 8 July 2024.

Hung parliament likely, leading to slow political decision making and probable limited deviation from current policies.

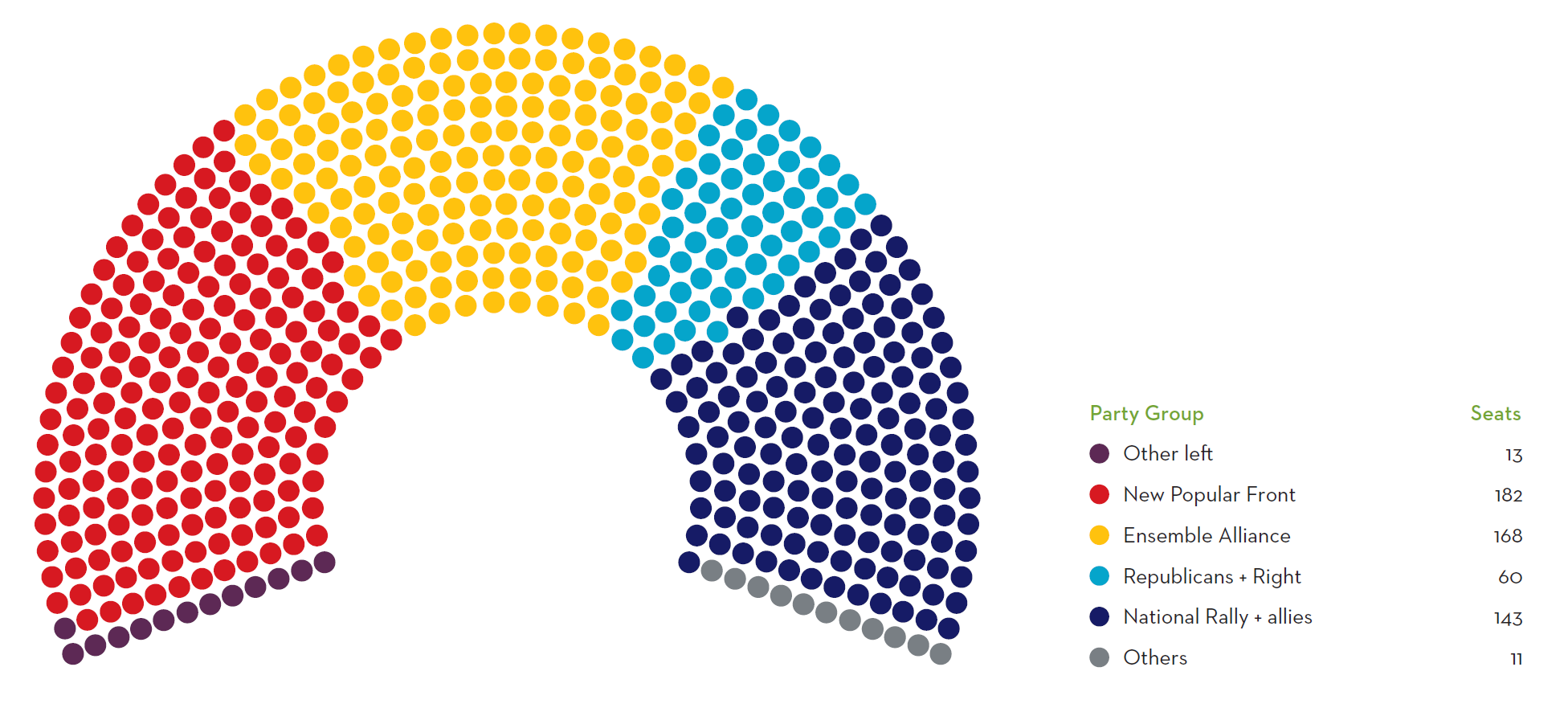

The French second round election has brought a surprise loss in position for the far-right Rassemblement National (RN) party, who came in third with 143 seats despite leading the polls ahead of the elections. It was the far-left party The New Popular Front (NFP) who came first with 182 seats, with President Emmanuel Macron’s centrist coalition Ensemble in second, winning 168 seats.

Centre-right party Les Républicains (LR) got 45 seats, whilst right party La Droite (LD) got 15 seats. Leftist party La Gauche (LG) got 13 seats, whilst centre party Le Centre got 6 seats. Regional and fringe parties got the remaining 5 seats of the 577 seats in the Assembly.

French National Assembly elections 2024 – breakdown of seats

Source: French Ministry of the Interior, as at 8 July 2024.

-

In our view, we are unlikely to see France deviate in any major way from any current policies or get into unorthodox fiscal expansion. Instead, we believe that France will continue to adhere to the fiscal program of deficit reduction governed by the European Union (EU).

-

In our view, we are unlikely to see France deviate in any major way from any current policies or get into unorthodox fiscal expansion. Instead, we believe that France will continue to adhere to the fiscal program of deficit reduction governed by the European Union (EU).

Macron’s move to halt the far-right has paid off

Macron’s Machiavellian move, to call for a surprise snap election, after the strong showing by the RN party at the European parliamentary elections in June, seems to have paid off. We covered this ahead of the elections in a report entitled ‘Machiavellian or Tete Brûlée’ .

The call for a Republican front to rise against extremist parties seems to have come through, with the so-called French tendency for a solidarity vote. The intensive week of political jockeying ahead of the second round, where various candidates from the centre and the left tactically pulled out of the race to reduce the chances of the far-right RN party winning, has borne fruit. Our first round response, 'Melonomics rather than Trussonomics, discussed this.

A lack of clear leadership

Jean-Luc Mélenchon, the leader of the winning far-left NFP party has ruled out a coalition with Macron’s Ensemble. This could allow the leftist party LG, centre-right LR, and right-wing LD to seek alliances and/or enter into a governing coalition with Ensemble, which sits at the centre. This could end up as the best-case scenario for Macron, in what was a pretty precarious situation for his party prior to these elections.

In any case, France is left with a split parliament, and no party with an absolute majority in the Assembly, which means that there will be a need for coalitions to form on any specific policies. Unlike periods of cohabitation, when there was clear leadership in parliament from an opposition party to the French president, this split assembly could lead to political apathy at worst, or certainly slow political decision making.

Market unfriendly polices may struggle for support in the parliament

The market might initially worry that a win by the far-left that has fiscal expansion plans, and policy initiatives that would increase wage costs for corporates, would be negative for the French economy. We would however highlight that the far-left party did not achieve an absolute majority, and therefore does not have control of parliament, and therefore will find it hard to find backing for policies that are overly aggressive. Therefore, in our view, we are unlikely to see France deviate in any major way from any current policies or get into unorthodox fiscal expansion. Instead, we believe that France will continue to adhere to the fiscal program of deficit reduction governed by the European Union (EU).

The 2027 French presidential election represents the key investor risk

As a result, our conclusion remains that the selloff in French equities ahead of the elections could be overdone, especially given that a large proportion of the French index generates revenues and profits from outside France (we estimate >80%1). We would expect French bond spreads to gradually narrow again, as the market gets to understand the situation more clearly, and as a Prime Minister gets nominated. This could take some weeks, until agreement between parties gets reached.

In any case, the spectre of the French presidential elections in 2027 looms nearer and shouts louder. This represents the key risk that investors should focus on, should the French centrist coalition not have a charismatic leader to take over from President Macron’s who will be coming to the end of his second and final term as president.

Macron’s move to halt the far-right has paid off

Macron’s Machiavellian move, to call for a surprise snap election, after the strong showing by the RN party at the European parliamentary elections in June, seems to have paid off. We covered this ahead of the elections in a report entitled ‘Machiavellian or Tete Brûlée’ .

The call for a Republican front to rise against extremist parties seems to have come through, with the so-called French tendency for a solidarity vote. The intensive week of political jockeying ahead of the second round, where various candidates from the centre and the left tactically pulled out of the race to reduce the chances of the far-right RN party winning, has borne fruit. Our first round response, 'Melonomics rather than Trussonomics, discussed this.

A lack of clear leadership

Jean-Luc Mélenchon, the leader of the winning far-left NFP party has ruled out a coalition with Macron’s Ensemble. This could allow the leftist party LG, centre-right LR, and right-wing LD to seek alliances and/or enter into a governing coalition with Ensemble, which sits at the centre. This could end up as the best-case scenario for Macron, in what was a pretty precarious situation for his party prior to these elections.

In any case, France is left with a split parliament, and no party with an absolute majority in the Assembly, which means that there will be a need for coalitions to form on any specific policies. Unlike periods of cohabitation, when there was clear leadership in parliament from an opposition party to the French president, this split assembly could lead to political apathy at worst, or certainly slow political decision making.

Market unfriendly polices may struggle for support in the parliament

The market might initially worry that a win by the far-left that has fiscal expansion plans, and policy initiatives that would increase wage costs for corporates, would be negative for the French economy. We would however highlight that the far-left party did not achieve an absolute majority, and therefore does not have control of parliament, and therefore will find it hard to find backing for policies that are overly aggressive. Therefore, in our view, we are unlikely to see France deviate in any major way from any current policies or get into unorthodox fiscal expansion. Instead, we believe that France will continue to adhere to the fiscal program of deficit reduction governed by the European Union (EU).

The 2027 French presidential election represents the key investor risk

As a result, our conclusion remains that the selloff in French equities ahead of the elections could be overdone, especially given that a large proportion of the French index generates revenues and profits from outside France (we estimate >80%1). We would expect French bond spreads to gradually narrow again, as the market gets to understand the situation more clearly, and as a Prime Minister gets nominated. This could take some weeks, until agreement between parties gets reached.

In any case, the spectre of the French presidential elections in 2027 looms nearer and shouts louder. This represents the key risk that investors should focus on, should the French centrist coalition not have a charismatic leader to take over from President Macron’s who will be coming to the end of his second and final term as president.

Sources

1Source: Martin Currie internal estimates as at 30 June 2024.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this webpage has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The webpage does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.

Sources

1Source: Martin Currie internal estimates as at 30 June 2024.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this webpage has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The webpage does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the named manager as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.