Content navigation

Executive summary

What drives persistent inflation and what is the impact for consumers? Rising energy costs are often seen as the driver of inflation. But the lagged impact of rising energy costs on food production, often means inflation lingers. We have seen this in the wake of Russian invasion of Ukraine, and this isn’t a new phenomenon. UK economic data shows this happening prominently in the 1950s and 70s.

So, what does this mean for investors? In our view, perceptions of inflation will not fall until food prices do, and that means we may need to wait a bit longer before central banks start to loosen monetary policies. We also have a high employment economy, and labour is able to recoup losses in real wages. This will spur companies to replace hard to find, expensive labour with software and systems, not to mention skilled immigrant workers.

If corporate profits hold and labour remains scarce, this could mean significant opportunities in consumer stocks, housebuilders, software and business to business (B2B) technology – and within this space the UK has a number of smaller innovative companies.

Persistent inflation – what impacts consumers?

The persistence of inflation debate continues. And the fear in central bankers’ minds is that if long term inflationary expectations are raised, then inflation becomes embedded in the system. Combatting inflation becomes an impossible task, and the size of the recession they need to provoke gets deeper over time.

Catherine Mann of the Bank of England (BoE) Monetary Policy Committee (MPC) made exactly this point in a recent speech warning that self-sustaining inflation pressure would be harder to fight than an economic downturn.

‘In my view, holding rates constant at the current level risks enabling further inflation persistence… I worry that there is an increasing inflation risk premium being priced into the UK's macroeconomic prospects’.

The answer for the embedding of inflation in our lives, or rather the misunderstanding of inflation persistence must surely lie in what the consumer sees. What is going up? What really impacts people? It's food, heating, lighting and petrol. These are the lightning rods on which an inflationary fear is built. These are the items you see change quickly and regularly. Then comes the mortgage or rent that rises with interest rates, which the Central Banks themselves have raised.

So, if that is correct, we need to examine what history teaches us about the ‘in your face’ costs.

-

What is going up? What really impacts people? Its food, heating, lighting and petrol. These are the lightning rods on which an inflationary fear is built.

Food for thought

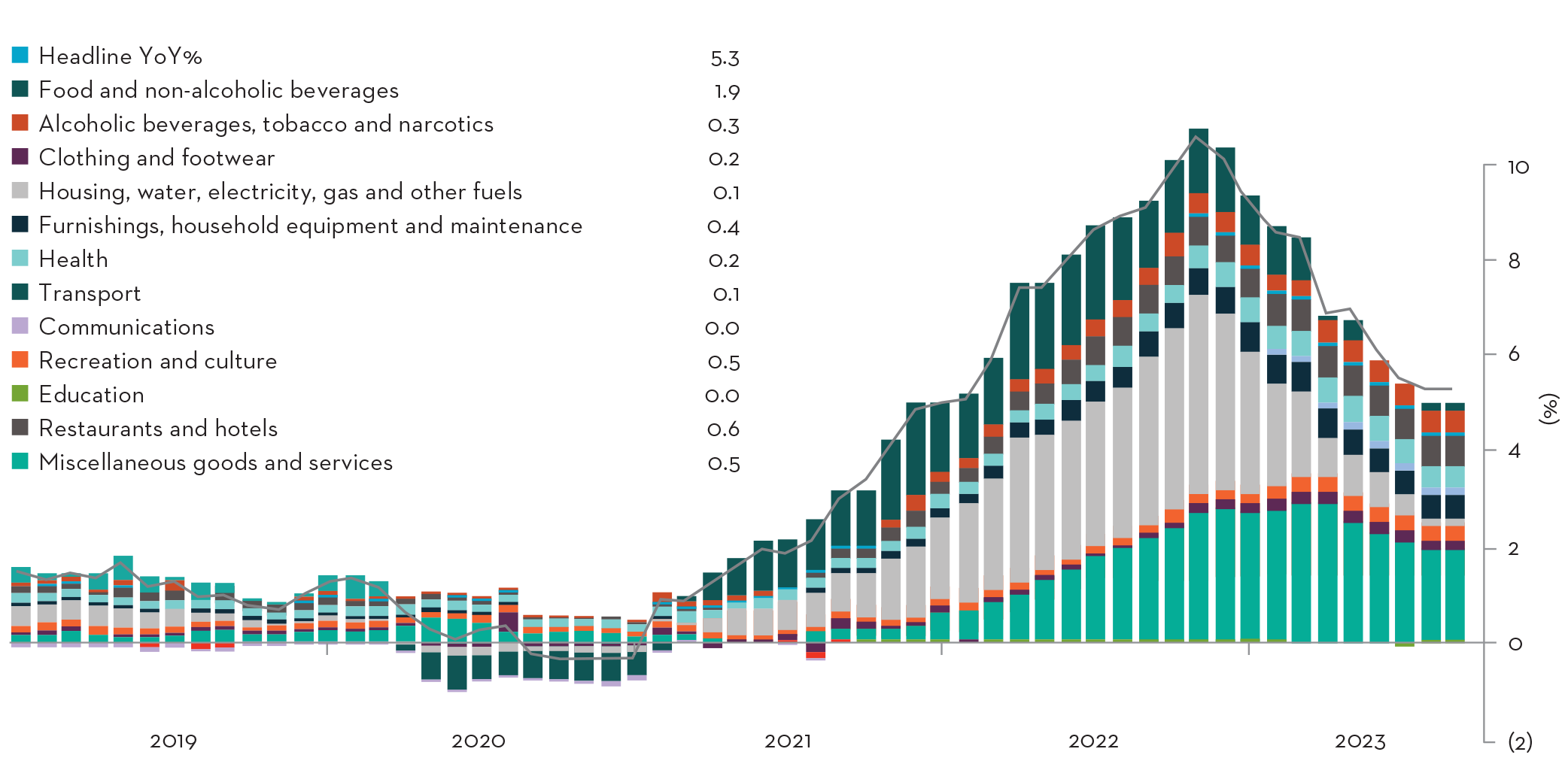

Let’s look at inflation in Europe and its sole cause. The chart below shows the post Covid, disrupted recovery. We see inflation rose due to transport (the dark green bar) and housing, water, electricity, gas plus other fuels (the gray bars). Fuel costs were already rising sharply in 2021 before the Russian invasion of Ukraine, and then in 2022 it comes to dominate our rising costs.

But look what starts to happen to the green bar that underpins the graph. That is food, and as 2021 ends, it starts to spring into life, lagging fuel by between 6 and 9 months. By the end of 2022 it is the dominant force and this has continued to be the case throughout 2023. Inflation persists because of the lagged rise in food prices and this hits the consumer right between the metaphorical eyes.

Figure 1: Eurozone year on year contributors to CPI to August 2023

Source: Bloomberg Financial L.P. Eurozone HCPI Year on Year contributors, monthly. As at 5 September 2023.

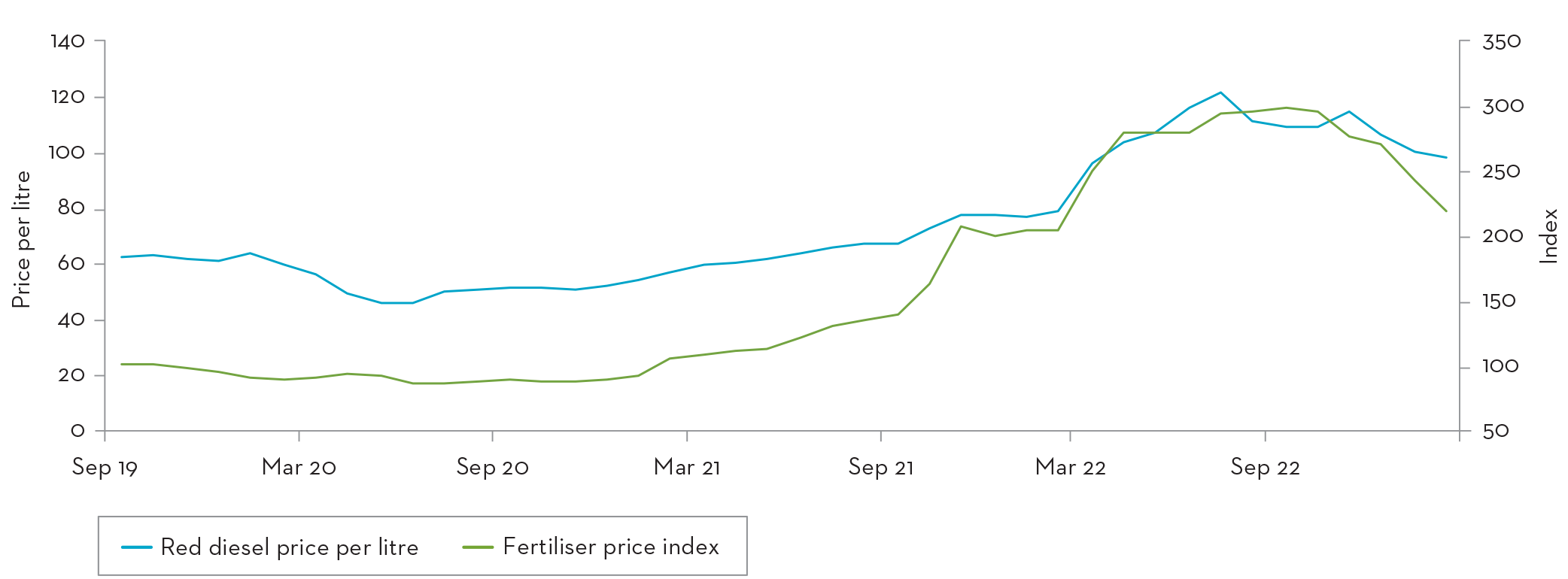

Why the lag? Well look at the life cycle of wheat: a key factor is fertiliser prices, and you can see they are in lockstep with fuel. Fertiliser prices are the key changing cost of each tonne of product. But you do not harvest winter wheat until late summer so the pass through of those costs is delayed.

It’s the same for more energy intensive farming of cattle and other livestock. Not only are food prices a natural lag but they are crucially driven by changing energy costs, lagged by 6 to 12 months.

Figure 2: Fuel versus fertiliser

Source: Defra as at 5 September 2023.

Persistent food inflation has been… persistent.

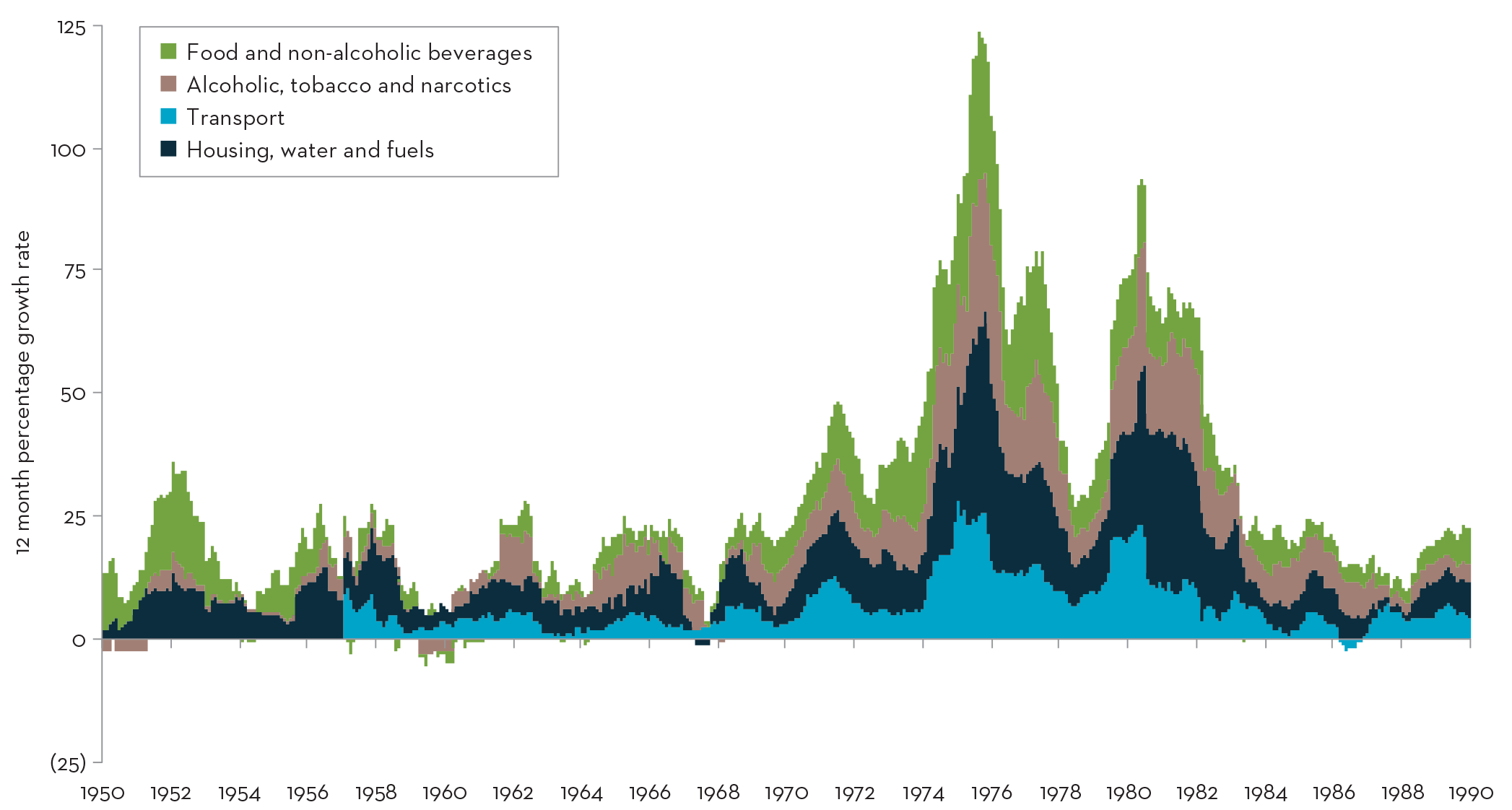

So, if that is the case, surely we must have seen the same effect historically? Rather helpfully the UK Office of National Statistics (ONS) produced research on this in 2019 where they showed that throughout the 1950s food prices were key, and even more so in the 1970s.

Look at the second wave of food price increases in the late 70s after the first peak in 1975, two years after OPEC raised oil prices.

Figure 3: Food and non-alcahloic beverages drove inflation through much of the 1950s and 1970s

Contributions to the 12-month growth rate of CPIH modelled series, UK 1950 – 1989, 12 month, percentage

Source: Office of National Statistics. Modelling a Back Series for the Consumer Price Index, 1950 – 2011, as at 31 July 2014 and Family Food report 2020/2021 as at 25 April 2023.

To underline the importance of food the ONS wrote in their report of April 2023: "In 2020/21 the percentage of spend on food and non-alcoholic drinks for the average UK household was 14.4%, up from 10.8% in 2019/20. The lowest 20% of households, by income, spent 18.3% of their expenditure, up from 14.7% in 2019/20."

So even before the Russian invasion of Ukraine and the spike in oil and then food prices, the consumer had raised the amount they spend on food in the UK. It had become a much larger proportion of our budgets, partly due to our changing behaviour post Covid such as working from home. You can see why we all put on weight!

It is the persistence of food inflation that is obvious, important, and driving both our expectations and perception of reality. So, inflation and the perception of inflation will not alter until food prices fall.

We as investors can use this as our guide to interest rates as well as the economy. It’s just odd that the central banks don’t do so as well.

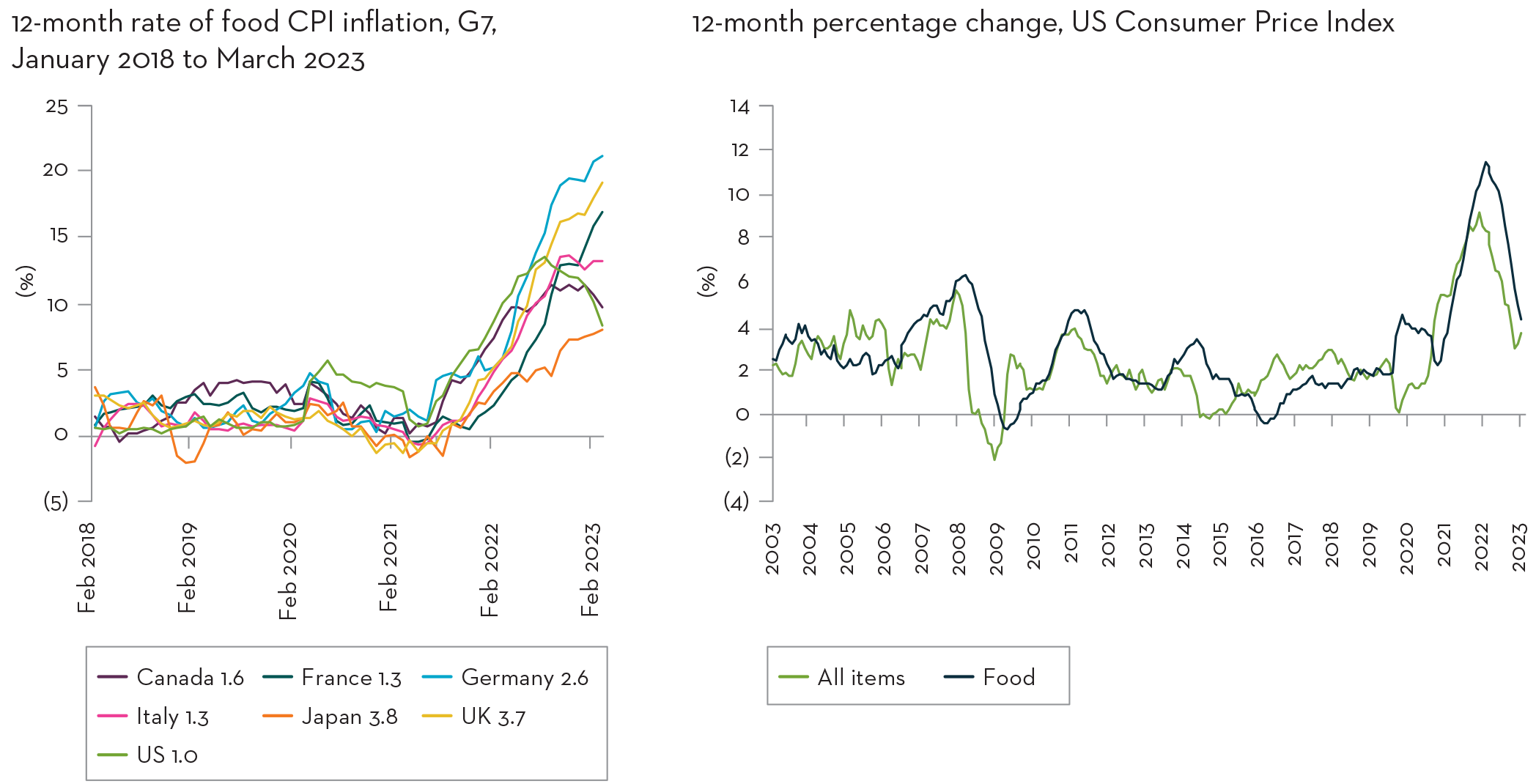

It also helps explain the differential in prices and the speed of fall. You can see below that food explains why the UK and Europe’s experience of inflation is so very different to that of the USA.

Figure 4: UK food price inflation is among the highest of the G7 economies

Source: Office of National Statistics and Food and Agricultural Organisation of the United Nations (FAO). As at 23 May 2023.

Tame food prices, tame inflation

So what next? If food is the issue, why is no one looking at it? Well, they are but through the wrong lens. Governments are looking for someone to blame: In the latest British Social Attitudes report published by the National Centre for Social Research (NatCen), which since 1983 has been conducting an annual survey of what people in Britain think about a wide range of social and political issues.

The results of its 2022 survey revealed that more than two thirds of the public want the Government to intervene to help keep prices down, marking a rapid rise and record number of Britons believing that it is the Government’s responsibility to control prices.

It is no surprise then that Parliament has held an inquiry into the Private Equity buy-outs of Asda and Morrison. These two companies used to account for almost a quarter of UK grocery sales1, and it's claimed they have forced up prices in order to pay the interest on expensive debt. Undoubtedly this has an effect but it's missing the point, as politicians often do.

As we can see from the 1970s oil crisis, you need to tame food prices before you can tame inflation. Recent data has been encouraging, it has fallen from 14% to 12.5% p.a. change2. But it’s hardly changing the perception of the consumer. But for investors armed with this simple fact, we are able to make much better predictions of inflation, interest rates and thus market moves. When will the rate cuts come? Only when food stops pressurising us all through price rises.

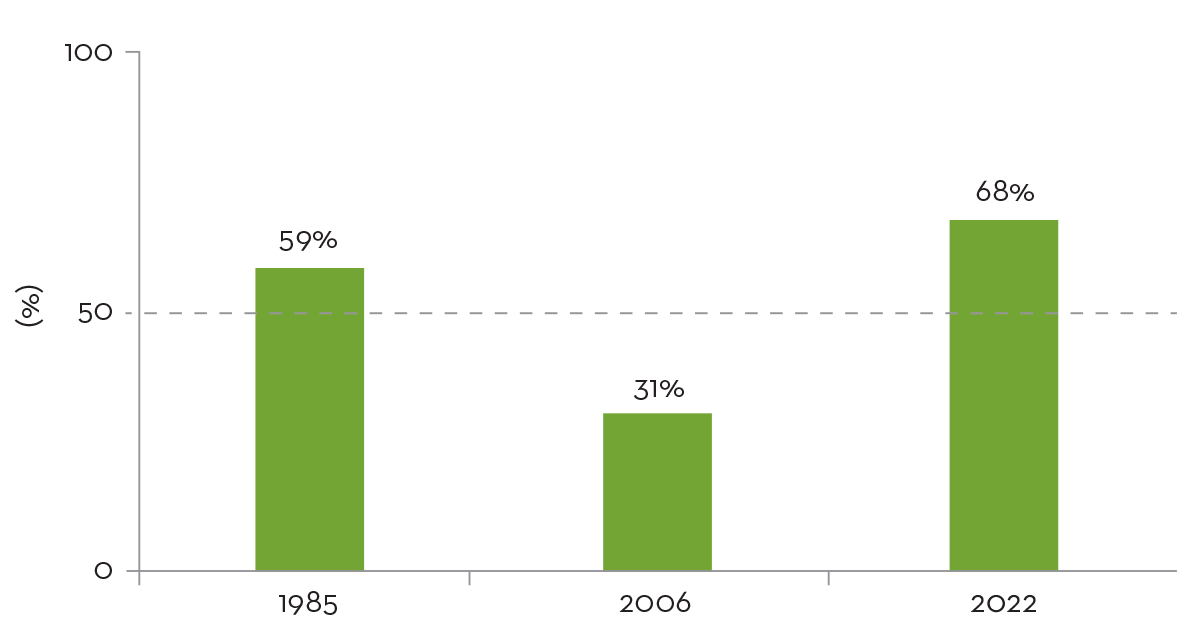

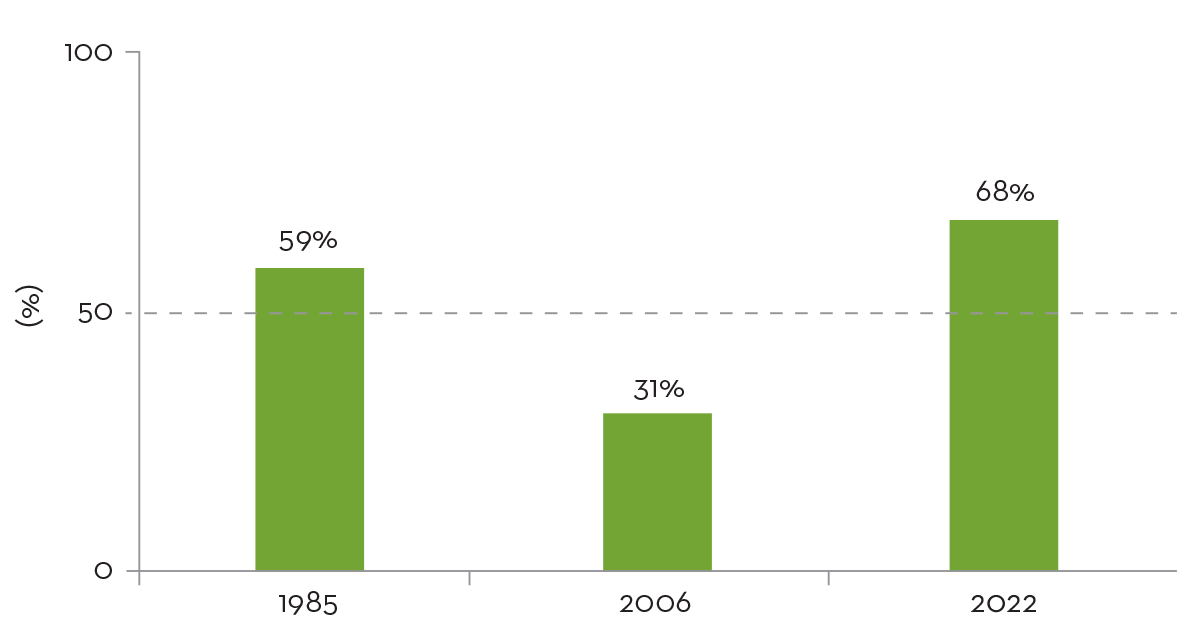

Figure 5: Percentage (%) of UK population wanting Government intervention to keep prices down The results of its 2022 survey revealed that more than two thirds of the public want the Government to intervene to help keep prices down, marking a rapid rise.

The results of its 2022 survey revealed that more than two thirds of the public want the Government to intervene to help keep prices down, marking a rapid rise.

Source: National Centre for Social Research. Roles and responsibilities of government, September 2023.

Opportunities in consumer, housebuilders and software

The other side of the economic coin is that we have a high employment economy today, similar to the 1970s, where labour was able over time to recoup any loss in real wages. Contrast that to just after the Global Financial Crisis (GFC) when real wages fell for four years3

This will spur companies to replace hard to find expensive labour with software and systems. It has already led to a substantial increase in skilled worker immigration.

As long as corporate profits hold and labour remains scarce, there will be significant opportunities in the consumers stocks and housebuilders in 2024 and 2025. Software and business to business (B2B) technology are also likely to lead. The UK has many smaller companies providing such innovative services.

Sources

1 Source: Statista and Kantar Worldpanel. Market share of grocery stores in Great Britain from January 2017 to August 2023. Asda and Morrisons combined market share has declined to c.22 – 23% in 2023.

2 Source: Office of National Statistics, food and non-alcoholic beverages 12 month percentage change. September 2023.

3 Source: Office of National Statistics. Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to May to July 2023. September 2023.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.