To pivot or not to pivot – that is the question.

We believe a pivot from central banks will remain the key talking point for markets throughout 2023, with a risk of weaker economic momentum potentially testing their resolve to focus solely on inflation.

With lacklustre earnings growth – 2023 could be a year of negative growth for markets, such as Europe.

Weaker leading indicators are likely to lead to ongoing downward earnings revisions, with a need to watch out for pricing pressure on corporate margins.

In 2023, we believe that central banks are being faced with a game of chicken: their resolve to fight off elevated inflation could be superseded by their concerns for economic growth, especially if we see a sharp deterioration in economic momentum, and a higher likelihood of recession. This is especially the case for central banks that have dual mandates of inflation and growth, such as the US Federal Reserve (Fed), but could also be the case for other major central banks such as the European Central Bank (ECB).

We could therefore have a scenario in 2023 where central banks tolerate a somewhat higher inflation level of c.3-5%, to prevent pushing economies into recession. Could the Fed return to its average inflation targeting policy, that it briefly took up before inflation escalated to current levels? It will be an interesting aspect to observe.

Whilst we started to see some undershooting of inflation prints in the back end of 2022, more recent prints in 2023 have been mixed to slightly higher depending on the region, and while we believe these inflationary pressures are frictional, related to supply chain disruptions and production bottlenecks, the risk remains that the current elevated (frictional) inflation levels could be longer lasting in 2023.

It remains in our view, that all eyes need to stay on wage inflation. Whilst wage inflation trends are not particularly elevated in Europe, UK, Australia or Japan, wage growth in the US has been stronger and accelerating, which could lead to a risk of frictional inflation turning more structural in the US. The base effect of 2022 should help bring headline inflation rates to lower levels in 2023, so there is a good likelihood that inflation could be in the process of peaking, in the absence of an acceleration in wage inflation.

One sure prediction for 2023 is that the word “pivot” will be used aplenty, and central bank pivots will be an extensive talking point. Timing of monetary policies pivoting, and anticipation of such events will drive market volatility and will generate a healthy bull-bear debate in markets.

From our point of view, we believe that we might not need central banks to pivot from rate hikes to rate cuts to bring support for equity markets; all that the market might need is a stabilisation in interest rate expectations, and an anticipation of the end to the hiking cycle.

This could be supportive in our view, both for equity markets, and Quality Growth style leadership versus Value.

In 2023, we believe that central banks are being faced with a game of chicken: their resolve to fight off elevated inflation could be superseded by their concerns for economic growth.

With lacklustre earnings growth – 2023 could be year of negative growth for markets, such as Europe

Weaker leading indicators are likely to lead to ongoing downward earnings revisions, with a need to watch out for pricing pressure on corporate margins.

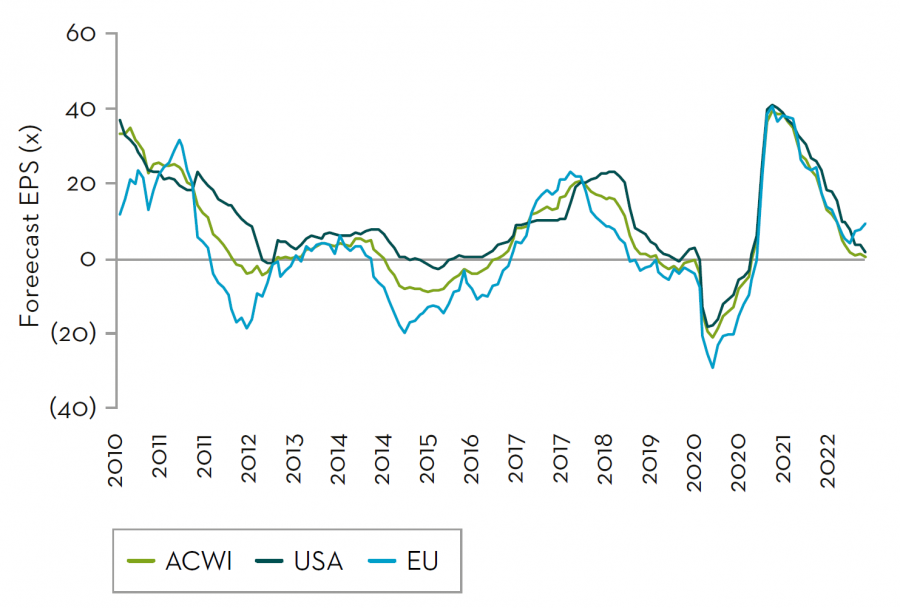

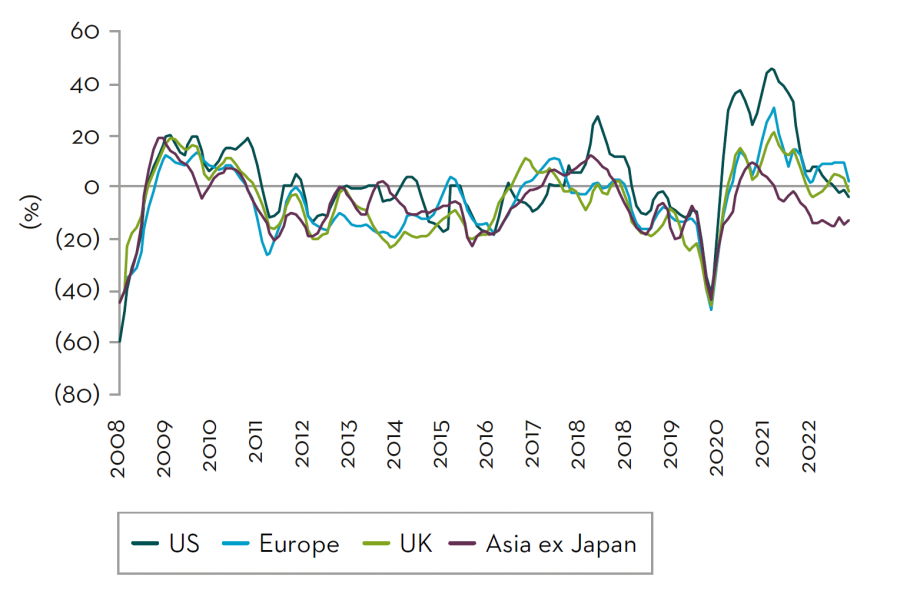

Earnings momentum turned negative from early 2022, with the tragic Russian invasion of Ukraine, and the Chinese regional lockdowns. Economic leading indicators have been deteriorating since then, which in turn have led to a rapid downturn in earnings momentum. Prior to the Q3 reporting season Earnings growth expectations moved from teens growth at the start of the 2022, to low-single-digit growth at European, US and MSCI World level.

Since then, with the support of the outsized growth being achieved in the Energy and Utilities sectors, and US dollar strength, European growth expectations have recently shifted above 2022 estimates, due to the outsized growth being achieved in the Energy and Utilities sectors, and US dollar strength. As expanded on in our February ‘Stock insights’ document, the Q4 reporting season has seen a significant negative earnings surprise for European companies, pointing to margin pressure coming through.

This has been less pronounced in the US, likely a reflection of the impact of higher energy prices weighing on European companies.

Forecast EPS growth NTM of given equity markets

Earnings momentum of given equity markets

Changes in estimates of following year earnings to 30 November 2022

Source: FactSet and MSCI as at 31 January 2023.

With the ongoing weakening in leading indicators however, we believe that earnings revisions are likely to remain negative in 2023. The table below shows consensus forecasts versus our own top-down estimates. There is a high degree of forecast risk in these estimates, given the high level of macro-economic uncertainty.

| Earning Growth | Consensus | Martin Currie estimates |

|---|---|---|

| MSCI World | +1% | -1% |

| MSCI North America | +2% | 0% |

| MSCI Europe | +2% | -5% |

| MSCI Asia | +2% | +2% |

Source: Martin Currie, FactSet and MSCI as at 31 January 2023.

We believe that, given the sharp slowdown in which economies are heading into, we are more likely to see a year 2023 with no-growth in corporate earnings at best, or even negative growth for some geographies. We therefore expect downward revisions in consensus estimates and expect a higher risk of earnings downgrades in the cyclical parts of the market.

In this environment where there is a heightened risk of earnings downgrades, we believe it is critical for us to focus on companies with resilient earnings, and pricing power, that can therefore protect their margins from the ongoing higher inflationary pressures.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested. The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to

its accuracy or completeness. Martin Currie has procured any research or analysis contained within for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice. This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This information is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria.

Martin Currie accepts no responsibility for dissemination of this information to a person who does not fit this criteria. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns. The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested. The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to

its accuracy or completeness. Martin Currie has procured any research or analysis contained within for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice. This information may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This information is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria.

Martin Currie accepts no responsibility for dissemination of this information to a person who does not fit this criteria. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns. The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

For wholesale investors in Australia:

Any distribution of this material in Australia is by Martin

Currie Australia (‘MCA’). Martin Currie Australia is a division of Franklin Templeton Australia Limited (FTAL), (ABN 76 004 835 849). Franklin Templeton Australia Limited is a wholly owned subsidiary of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001.

For institutional investors in the USA:

The information contained within this presentation is for Institutional Investors only who meet the definition of Accredited Investor as defined in Rule 501 of the United States Securities Act of 1933, as amended (‘The 1933 Act’) and the definition of Qualified Purchasers as defined in section 2 (a) (51) (A) of the United States Investment Company Act of 1940, as amended (‘the 1940 Act’). It is not for intended for use by members of the general public.