Over the past 12 months investors have been forced to acclimatise to an uncomfortable inflationary environment. Global policymakers responded in unity, unleashing a rapid tightening cycle in an attempt to prevent heated markets from boiling over

Investors continue to monitor macroeconomic data points to determine the efficacy of such attempts. However, we can at least make some initial observations from what some may perceive to be our new ‘base case’ for interest rates.

Income investors will likely be aware of the narrowing equity yield premium over fixed income asset classes, which is now at its lowest in over a decade. Equity income investors seeking to safeguard this premium, in potentially volatile markets, may consider the FTSE 100 as a natural hunting ground for a resilient and growing income stream.

Below, we present three reasons why UK and European dividend investors should consider the UK market as a core component of any income strategy:

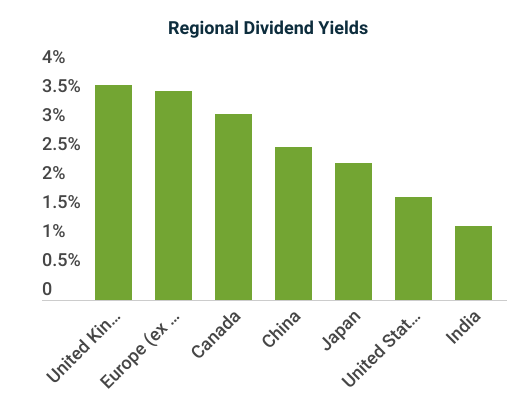

Figure 1. Source: Siblis Research, as at 31 December 2022

The UK offers an attractive yield premium to other regions

For some time, the UK has generated an attractive dividend yield relative to alternative regional markets. As at today, the UK market yields more than nearly all other developed markets and over double the income generated in the US (figure 1).

Even with interest rates rising rapidly over the last year, equity investors still enjoy a healthy yield. In addition, we could then factor in the impact of capital returns, share buybacks, and the erosion of fixed income purchasing power in an inflationary environment.

The propensity of businesses to grow their dividends therefore becomes an important consideration for income investors.

Our active approach also enables us to select companies in the FTSE 250. Here, we are able to seek out dividend payers that are less mature in nature and have a runway ahead for rapid capital and income growth.

The composition of the UK market is attractive to dividend investors

We do not need to reflect for long to assess how certain markets responded to an extreme period of volatility. Across the globe, dividend cuts were inevitable throughout 2020 and enabled many businesses to emerge from the pandemic in a stronger competitive position.

And, a significant proportion of the UK market can be found in dividend paying sectors too, such as, consumer staples and commodities. In fact, each of the UK sectors generating a positive relative total shareholder return (TSR) in 2022 are healthy dividend sectors, reinforcing the importance of income as a component of total return (table 1).

| Sector | 2022 TSR1 | FTSE 100 Exposure | S&P 500 Exposure | MSCI Europe Exposure | MSCI World Exposure |

|---|---|---|---|---|---|

| Energy | 47% | 13% | 5% | 6% | 5% |

| Basic Materials | 20% | 12% | 3% | 8% | 4% |

| Healthcare | 13% | 12% | 15% | 15% | 14% |

| Utilities | 2% | 4% | 3% | 4% | 3% |

| Consumer staples | 1% | 18% | 7% | 12% | 8% |

| Financials | -4% | 18% | 14% | 17% | 16% |

| Industrials | -16% | 8% | 9% | 14% | 11% |

| Consumer | -17% | 7% | 10% | 11% | 10% |

| Technology | -20% | 1% | 24% | 7% | 19% |

| Telecommunications | -21% | 6% | 8% | 4% | 7% |

| Real Estate | -34% | 1% | 3% | 1% | 3% |

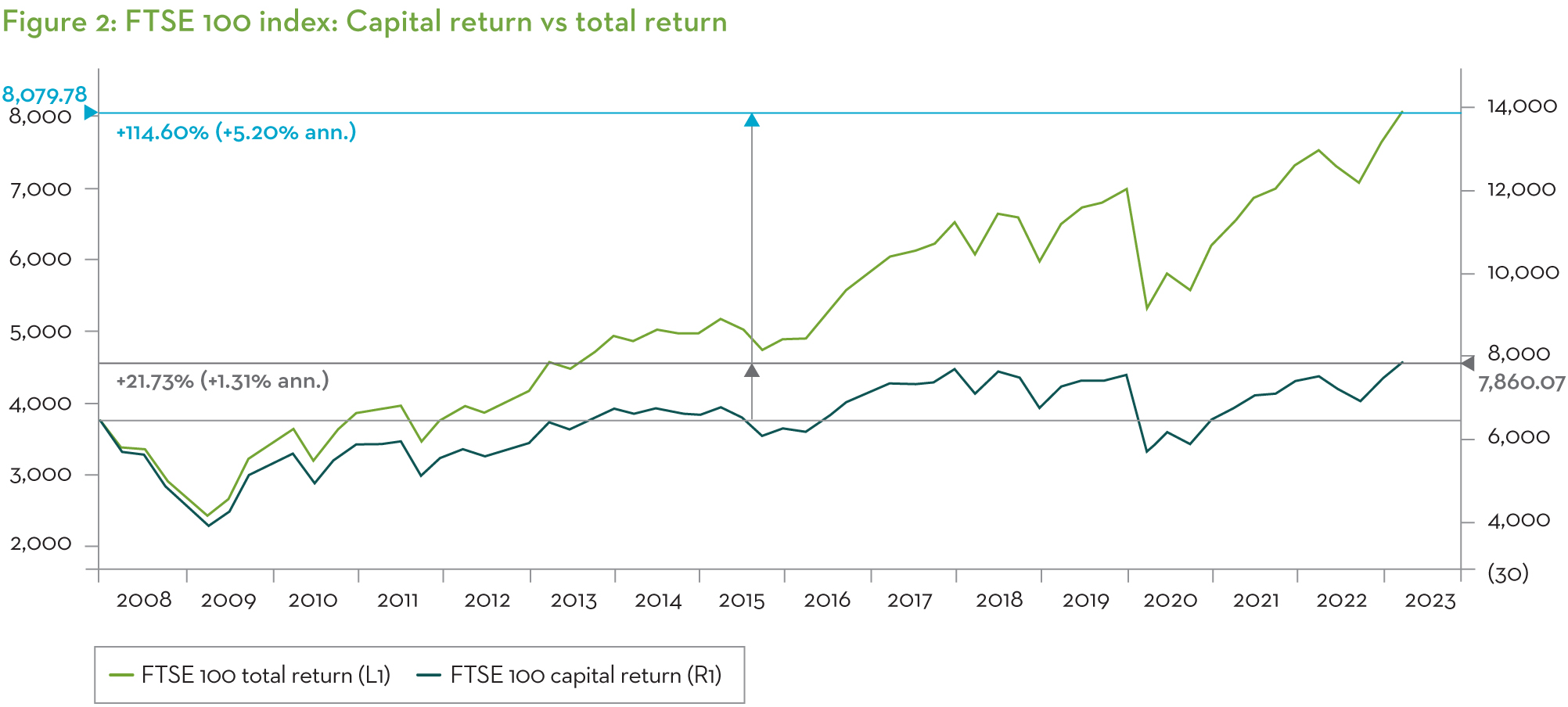

Figure 2 Source: HSBC, as at 31 December 2022

1Source: FTSE 100

The dominance of income in UK returns is unique

For the reasons above, we believe income will continue to be a material component of total return within the UK market. And, this will mainly be driven by the sector exposure of the FTSE 100, which accounts for 80% of the FTSE All Share.

Over the last 15 years, the FTSE 100 has generated returns of around 5.2% per annum, but around 4% of this annualised performance was generated from constituent dividend income (figure 2).

This highlights the prominence of income as a component of total return in the UK. This structural preference for income within the index is unique across the globe and offers a compelling opportunity for investors.

Past performance is not a reliable indicator of future returns.

Figure 2 Source: Bloomberg, as at 31 December 2022

A hunting ground for active management

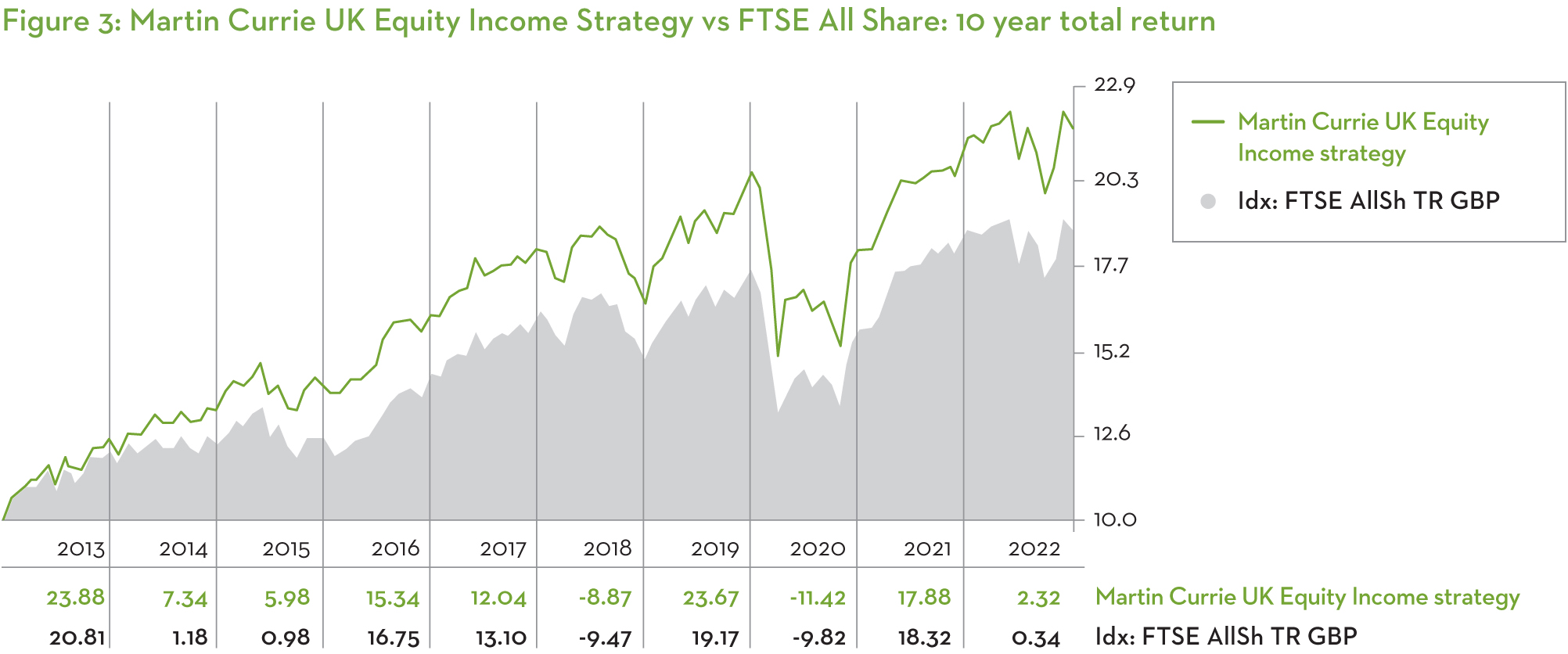

To us, this highlights the importance of active management. By allocating passively to the UK market, investors will enjoy a healthy dividend yield, but our active approach enables us to target a yield of 110% of the UK market.

When income is such an important component of total return, a 10% minimum (often higher) premium begins to compound at a rapid rate – figure 3 demonstrates the cumulative total return of our UK equity income strategy vs the FTSE All Share. On an annualised basis, this has amounted to over 200 basis points of additional annual return over the last ten years.

Past performance is not a reliable indicator of future returns.

Figure 3 Source: Morningstar, as at 31 December 2022

We typically maintain a minimum of 70% exposure to FTSE 100 businesses. However, our active approach also enables us to select companies in the FTSE 250. Here, we are able to seek out dividend payers that are less mature in nature and have a runway ahead for rapid capital and income growth. This flexibility reflects our focus on delivering an attractive total return from this strategy.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in the document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this document, or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.