Content navigation

Executive Summary

- Valuation discipline is critical at all stages of the macroeconomic cycle, but even more so at this stage of uncertain monetary policies

- Our valuation tools ensure we aim to put a fair value on companies based on long term assumptions rather than what the market might be willing to pay over the next 12 months

- This long-term valuation approach moves away from the tendency for market short-termism, as seen from the shrinking holding periods over time

- Forecasting long term interest rates is an important difference to using market rates, which is what some valuation experts advocate

- Investors should project corporate cash flows until businesses become mature, reverting to terminal growth assumptions beyond that

- Our disciplined valuation approach makes us confident that we have not overpaid for businesses that we hold in our strategies

Valuation discipline and the importance of anticipating normalising rates

In this month’s market insights, we zoom in on an important aspect of investing, which is core to our investment process: valuation discipline. Valuation discipline is important at any point in time for investors, but we would argue that it is even more critical at this stage in the economic cycle, as uncertainties around monetary policies and their impact on the economy abound.

We have a structured valuation approach, which gives us that discipline. We have price targets on all stocks we invest in and the ones that are on our bench. These targets are constantly updated and calculated based on a combination of valuation tools: Discounted Cash Flow (DCF), which accounts for 50%, Economic Value-Add (EVA) 25%, and target multiples 25%.

On target multiples, we focus on year 5 multiples, rather than 12 months forward, so that we move away from shorter term considerations, and away from what the market might be willing to pay for a business nearer term, instead focusing on the longer term.

On Economic Value Add, we capture the spread companies generate between the Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC). This valuation measure ensures it properly captures companies that create value for shareholders through significant positive spreads – we find that the market has a tendency to undervalue companies’ compounding value-creating characteristics, due to its short-term focus.

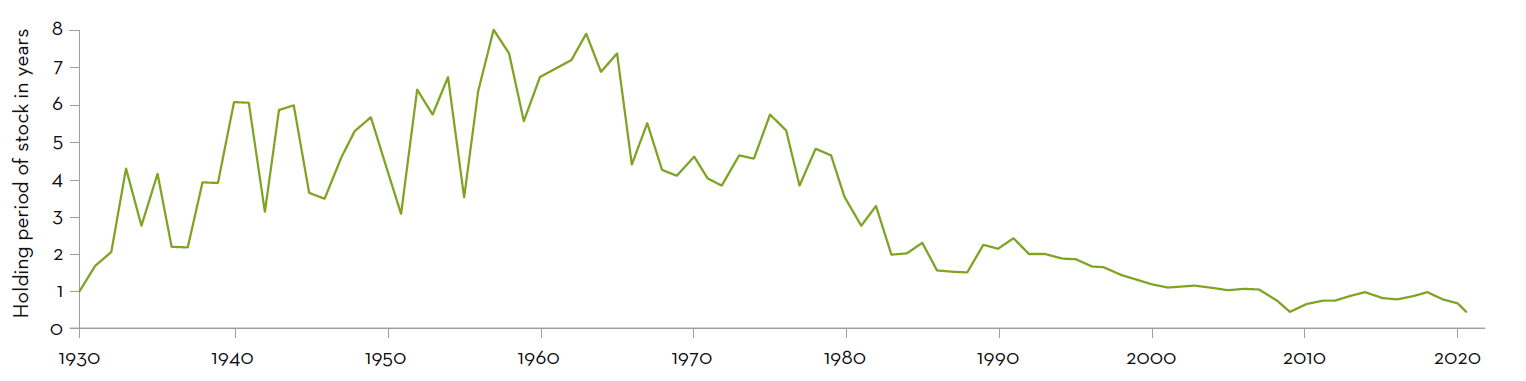

In fact, the market has gradually become more short term over time, as can be seen from the chart below, focusing on the S&P500. It plots the average holding period for mutual funds, which has gone from c.six-eight years back in the 1950’s to 1970’s, to below 10 months in the past five years, and even to closer to 6 months as holding period in the past year.

Average holding period for S&P 500 mutual funds, 1930 - 2020

Source: NYSE, Refinitiv. Note: holding periods measured by value of stocks divided by turnover.

For our DCF analysis, which constitutes 50% of our price target assessment, we want to highlight a few aspects. Firstly, we forecast companies over a period of 20 years. The reason for this is that we want to capture companies through their life cycle, all the way to their maturing stage. We believe that the maturing phase of a company is typically between 10-20 years. Some companies will be able to sustain superior growth and returns for longer than others, so a 20 years forecast period permits us to have flexibility in our assumptions about timeline to maturity.

Our terminal assumptions beyond year 20 are for a growth to perpetuity of 2.5% – this could be deemed as conservative by some, but it is worth emphasising that we are looking here at growth to perpetuity beyond year 20.

-

Valuation discipline is critical at all stages of the macroeconomic cycle, but even more so at this stage.

Discount rates – the importance of anticipating normalising monetary policies

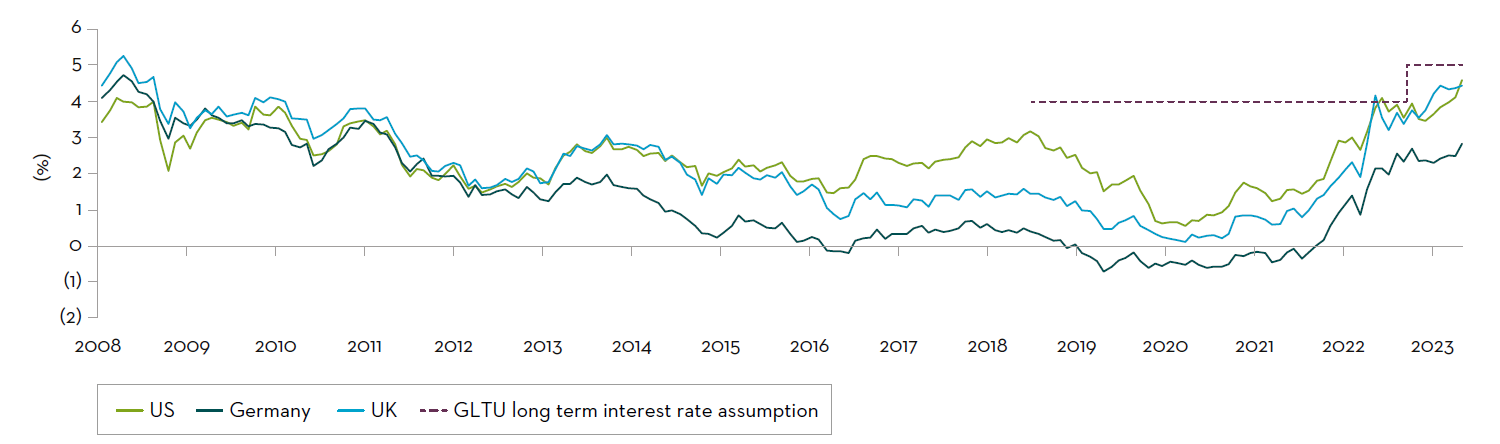

In our view it is important to anticipate normalising interest rates. in determining the discount rate we use in our DCF calculation. In fact we changed our approach in June 2018, instead of using a spot interest rate, we shifted our inputs into a long-term assumption where we thought rates would go. This was critical to do so when sovereign bond rates were at zero or negative, in many regions 18-24 months ago. When we made this structural change in 2018, we took the view that long-term interest rates would normalise at a 4% level. As of September 2022 we further increased our long term interest rate assumption to 5.0%, as we detail in the next section.

Global 10 year bond yields, 2008 - 2023

Source: FactSet, 31 October 2023.

Reasons for shifting our long-term interest rate assumption to 5% in September 2022

Based on the belief that in the long-term inflation would up creep up to 3% (rather than the 2% we previously assumed), we increased our long-term interest rate assumption to 5% in September 2022.

Our view of a stickier and longer lasting inflation is based on four aspects:

![]()

Wage inflation bringing second round inflation pressure: persistent wage inflation could turn inflation from being frictional to being structural (see our inflation report from October 2022 for details)

![]()

Deglobalisation (near-shoring, on-shoring and friendly neighbour-shoring): leading to reflation trends

![]()

Technological fragmentation: leading to diseconomies of scale in key industries, bringing in further inflationary pressures

![]()

Energy transition: the shift towards greener and alternative energy sources is likely to be inflationary, given the magnitude of investments needed

Our approach of using long-term interest assumptions instead of spot long term rates, to anticipate normalising interest rate policies, is different from what valuation experts advocate in their books.

We believe that one of the major drawbacks of using spot interest rate assumptions in valuation tools, as advocated by valuation gurus, is that one ends up valuing companies based on whichever interest rate expectations prevail at the time. When investors value companies when rates are close to zero or negative using spot rates, it risks overestimating fair value assessments. It also means that once the monetary policy regime shifts towards rising rates, the fair value of a company reduces rapidly, as higher updated rates assumptions feed into the valuation models.

Our approach of inputting a long-term rate, based on the assumption of normalising interest rates, means that our fair value estimates are stable, and not prone to major variation as rates fluctuate. We end up with putting a fair value on the businesses that we analyse, using long-term valuation tools and assumptions. This is instead of capturing shorter term market gyrations of long term interest rates expectations.

All in all, the above helps explain the reasons why we shifted to a 5% interest rate assumption in September 2022, and the importance of anticipating normalising interest rates in valuation tools, rather than using spot interest rates.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.