China's National Congress was held last month, and we have been following this closely to understand the implications for Australian stocks. It has highlighted the potential for continued uncertainty in steel demand, and, therefore, the iron ore market.

President Xi’s speech focused on the long-term policy direction to achieve socialist modernisation by 2035, with little reference to short-term measures to boost an ailing economy, outside of claiming the zero Covid policy had been successful and saved lives. This did little to boost confidence that stimulus measures of credit availability, and less restrictive property ownership guidelines, would rescue the property sector.

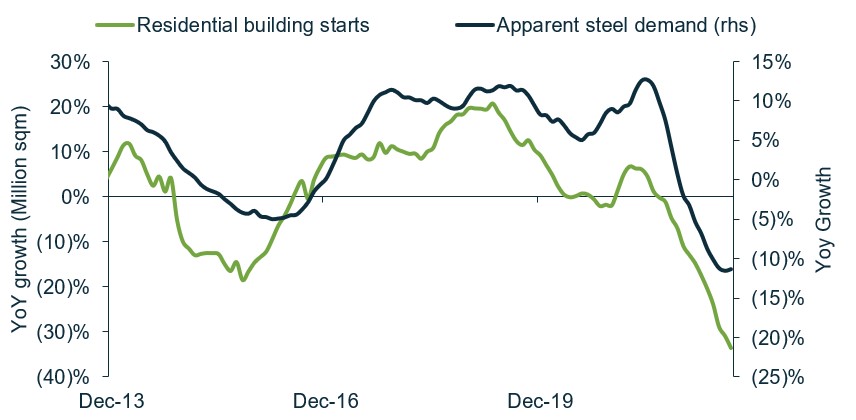

This is what has weighed on steel demand and production. Property demand makes up >25% of steel demand and, with building starts down almost 40% year on year through August 2022, there are no signs of recovery.

Building starts and steel demand

Source: Martin Currie Australia, Bloomberg; as of 31 August 2022.

Furthermore, Xi’s reiteration that “housing is for living, not for speculation”, has been a consistent message of the past few years. This suggests that their growth and modernisation focus is on themes other than property. These include innovation & technology, decarbonisation & green development, national security & social stability, and the aging population challenge.

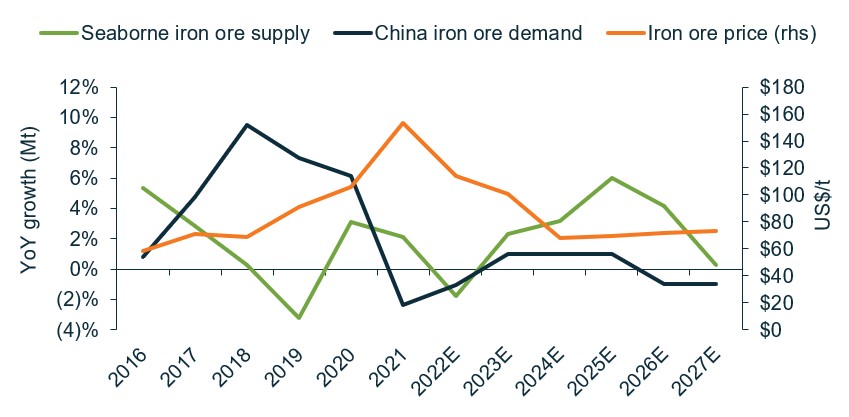

Looking forward, we see growth in iron ore supply, particularly out of Australia, Brazil and Africa, exceeding growth in Chinese demand thereby pushing the iron ore market into surplus and impacting price.

Seaborne iron ore supply and demand vs. the iron ore price

Source: Martin Currie Australia, Bloomberg; as of 31 August 2022.

Therefore, we are continuing to hold an underweight exposure to iron ore in our Value Equity portfolios.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.