Content navigation

William F. Hasley, an American Navy Admiral during WWII once said “All problems become smaller when you confront them instead of dodging them…”

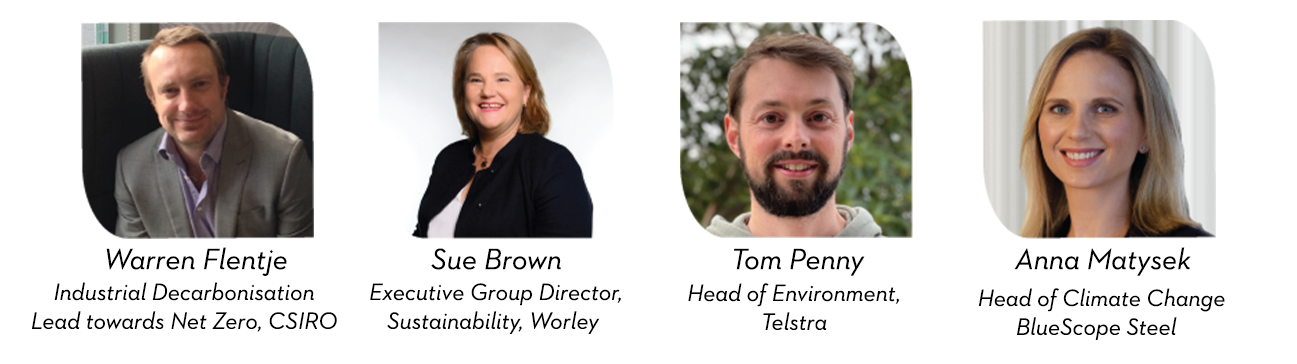

At our second annual Pathway to 2030 Forum in October 2023, I was honoured to moderate a panel of investors, sustainability experts and leading listed companies to discuss how we can all work together to tackle the enormous issue of Net Zero.

We specifically brought together representatives from Telstra, BlueScope Steel and Worley, with CSIRO (Commonwealth Scientific and Industrial Research Organisation) to garner insight from organisations at different stages in their energy transition and emissions reduction pathway. While these are all Australian entities, their insight and experience are global in nature.

The panel discussed how we are all not short of ambition, skill or technology, but in order to improve the pace of energy transition pipeline fulfilment, we need to think differently to work together to get the required capital flowing globally. The panel offered thought-provoking perspectives on the critical elements to achieve this, including transition fuels and carbon offsets, collaboration across and within sectors, a shift away from the traditional way of delivering infrastructure projects, opportunities from the Inflation Reduction Act (IRA), and a focus on community and social licence to operate. From an investor perspective, we shared our view on active ownership as integral to success on Net Zero.

We were privileged to have such extremely qualified panellists share their insights. These companies and organisations are at the forefront of tackling these risks and opportunities. We can learn much from respective pathways.

-

“Coming together is the beginning. Staying together is progress, and working together is success.” - Henry Ford

The current state of play

I asked panellist Warren Flentje to set the scene for this dynamic, but exceedingly complex issue globally. He opined that in Australia, at least, the debate has at last moved on from, ‘why’ and ‘at what rate’ should we transition to a low carbon economy, to ‘how’ should we do it.

For a high carbon country, Australia’s progress has been positive, but modelling suggests that in the next couple of years, emissions from industrial sectors will exceed those from the electricity sector. Warren noted “we only have 70 or so months to 2030 and we need every sector playing their part if we are to make it.”

The key challenge from all panellists was the need for more infrastructure, such as transmission lines and long duration storage. Lack of access has already been documented in delaying final investment decision for many of the renewable projects in the pipeline.

Involving the whole supply chain

The scale of the problem truly is one that individual companies cannot solve on their own. It's going to require collaboration, up and down the value chain, including governments, emitting companies, suppliers and investors. Warren discussed that as success will be very reliant on new processes, unproven at scale, all parties will need to embrace this risk.

Telstra is one of Australia’s largest energy users (accounting for nearly 1% of Australia's overall electricity needs), but an early mover in mobilising the value chain.

Tom Penny spoke at the Forum about Telstra’s first power purchase agreement (PPA) using a consortium approach, partnered with several other corporates to get scale. They are also a direct investment in renewable energy generation, investing in solar and wind farms, and more recently battery assets and green hydrogen pilot projects, effectively as a hedging mechanism for their energy bill. Another interesting point was how Telstra are working closely with customers and suppliers to reduce Scope 3 through technology transfer, as they see it as more cost and time effective that trying to go it alone.

Thinking differently about project delivery

Albert Einstein said that “We cannot solve our problems with the same thinking that we used when we created them”.

Einstein’s famous quote still rings true, over a century later.

Given the scale and speed required for infrastructure build, a key discussion at the Forum was around what can we do differently.

Worley provide Net Zero project delivery and asset services to some of the most carbon intensive sectors globally. Sue Brown discussed the work the company has been doing with Princeton University over the last three years on improving the discipline of project delivery, and the challenges they have faced with gaining industry level collaboration on Net Zero. They specifically found that the current ‘stage gating’ process just moves too slowly for success, and that there are different levers that can be pulled to accelerate project delivery and compress delivery schedules by up to 40%.

Sue shared her levers in more detail:

- Broaden the definition of value to include social and environmental value. Communicate that with community stakeholders.

- Better leverage the technology that is already at our disposal.

- Standardise low carbon technologies (such as batteries) to provide certainty to supply chains.

- Keep all technology options open and don’t take ideological positions that cut off options too early.

- Collaborate up, down and across the supply chain, cross pollinate and share learnings within industries, sectors to accelerate progress for all.

Transition fuels to speed up the pathway

Another key issue that we discussed was that when technology needs time to progress, what you do in the interim as a transition solution.

Iron ore mining is an important industry for Australia’s economy and is a necessary enabler of the transition. However, according to the CSIRO, the process of turning iron ore into steel contributes around 7% of global greenhouse gas emissions. 70% of these emissions can be attributed to blast furnaces in China, but as Australia is the largest exporter of iron ore, we have a stake in the industry’s transition.

‘Green Steel’ refers to steel produced with methods to reduce emissions and waste in the production process and renewable energy. I asked Anna Matysek to share her company’s views on the use of transition fuels to help with the technical and economic challenges Green Steel still has.

BlueScope Steel currently use different types of steel making technologies within their global asset base, electric arc furnace (EAF) in the US, iron sands in NZ, and a blast furnace process in Australia. The company has set clear decarbonisation pathways for all their assets, and the ultimate aim to use green hydrogen to produce iron but they are considering transition fuels for some more immediate success.

Anna shared how BlueScope has looked at transitioning the Australian steelworks to hydrogen, but at current capacity and technology this would use 15x their current electricity consumption. This isn’t yet sustainable or economic until more cost-effective renewable capacity and electricity transmission is available. As such, their emissions pathway will start with converting furnaces to natural gas, which cuts emissions by more than half, and also creates latent demand for green hydrogen, as it can be introduced into the process over time as costs come down.

The opportunities and threats from the IRA

In a The Australian newspaper article in 2023, Jennifer Westacott, BCA chief executive declared, “Forget US President Joe Biden’s age. He will become one of the most important US presidents in the past half century because he is defining a new age… This is the clean-energy equivalent of the New Deal of President Franklin Roosevelt.”

I find this an interesting parallel, and the Forum spent time discussing if the IRA, similar to Roosevelt’s 1920’s plan to get America back on track, would end up leaving other regions behind, or present more opportunities.

Anna regards the IRA as a game changer for the steel industry. They are already seeing investments and projects move from EU and Canada into the US because of government funding. Despite this, she believes that Australia will not miss out, and remains a prized location for investment given our stable geopolitics, renewable resources, and higher educated workforce.

As a scientist, Warren finds the IRA highly exciting. He concurs that people think it may lead to a brain drain elsewhere, but to him it is great to see growing investment into research and technology development. He believes that it will increase collaboration between government counterparts around the world.

We also discussed how the IRA is an important opportunity for Australia’s critical minerals industry – e.g., lithium, copper, nickel, cobalt, rare earths. The IRA will provide incentive to work directly with the market and establish a protected supply chain.

Within our discussions, an interesting point that Sue shared was how IRA funding will be associated with a ‘social licence to operate’. In a real shift of culture, projects will be rated on their ability to create social and environmental value. This is an important signpost that governments are broadening the value of projects beyond just the financials.

Carbon credits as part of the solution

Investors often have had a cynical view about carbon credits, so I was interested in the hearing about this from a practitioner perspective.

Tom spoke about how Telstra is a significant player in the voluntary carbon credit arena. While these credits don’t count towards their headline commitments, they are getting to a point where to contribute beyond value chain mitigation, they need to remove carbon from the atmosphere rather than just avoid it. They have formalised guidelines on permitted types of credits and have built due diligence requirements for credibility and integrity.

Telstra are also now involved in generating their own credits. Tom shared the details of a pilot carbon farm scheme in regional New Sout Wales (NSW) where they are working with the community to plant more than 150,000 trees and using new technology such as drone planting in hilly areas and Internet of Things (IoT) monitoring to improve growth and viability. They are using this project to work out whether its scalable to accelerate action elsewhere. Harking back to ‘social licence’ discussion earlier, this kind of activity is also a great example of how co-development with local communities can enable more social value.

Anna explained that while BlueScope isn’t using offsets yet, they are seeing demand for them from their customers who are looking to front run access to green steel. BlueScope is exploring the potential to staple quality offsets to products where it meets a customer demand.

This is a trend in the offset space that I think we will likely see in many industries globally, where companies use emissions reductions from within their own supply chain to create low carbon embodied products for their customers.

Importance of carbon capture and storage

Warren also shared how important it is that we don’t just focus on decarbonisation strategies, but also on long-term, high-quality permanent storage solutions. We need progress on both.

Warren spoke of some of the ways that the scientific community are seeing progress in carbon capture. The CSIRO have recently established their CarbonLock Future Science platform, which is looking to dramatically expand the capacity of the biosphere to absorb CO2, not just through traditional vegetation, but also methods like mineral carbonation.

Sue shared Worley’s experience so far with carbon capture projects, and how they are working with Occidental in delivering direct air capture (DAC) technology. DAC effectively sucks air from the atmosphere away from the source of emissions, so good for hard to abate sectors. Occidental’s pilot facility in Texas will be the largest scale DAC in the world and is designed to annually sequester at least half a million tonnes of CO2. These kind of projects should do well from IRA funding.

The real challenge for investors

Investors like Martin Currie Australia (MCA) have a key role to play in the shape and speed of the transition. While returns available from the heavy emitters may be attractive today, as active investors, we must hold our investee companies to account on Net Zero and fund the companies who are moving in the right direction. I am concerned that the rise in passive investing and managers who outsource engagement and proxy voting to third party advisors exacerbates a lack of accountability by the market.

MCA believe that direct Active Ownership is key to our Net Zero contribution. We are using the strong relationships between our investment decision makers and companies to challenge towards real change, better capital allocation decisions, and ultimately, as we believe more sustainable business practices are drivers of risk and return, long-term value for our clients.

Can we meet our 2030 and 2050 targets?

My final question to the panel was if Australia, and other regions can really meet the ambitious greenhouse gas emission reduction targets set at many countries at COP26.

The conclusion was that we are not short on ambition and technical ability, but it is not going to be an easy run to the finish if we don’t change our way of delivering on projects.

There is still an extraordinary amount of carbon that we need to take out every year, and time, funding and access to transmission are the biggest challenges.

What gives me optimism is that public consciousness around Net Zero has improved, and that’s driving transparency and action at both the government and corporate level.

Discover more about Martin Currie Australia

-

This article was originally published as part of Stewardship Matters - Edition 12: The path to Net Zero. Click here to find out more about our Stewardship Matters series.

-

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Discover more about Martin Currie Australia

-

This article was originally published as part of Stewardship Matters - Edition 12: The path to Net Zero. Click here to find out more about our Stewardship Matters series.

-

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Pathway to 2030 Forum: Net Zero in the Real World - A 90 minute recording of the Forum is available to view here.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

For wholesale investors in Australia: Any distribution of this material in Australia is by Martin Currie Australia (‘MCA’). Martin Currie Australia is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849). Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001.