Content navigation

Key takeaways

- Emerging markets (EM) experienced positive returns, driven by China

- Information Technology (IT), Taiwan, and India lagged during the quarter

- The US announced tariffs on imports, which could affect global economic growth and markets

Market overview

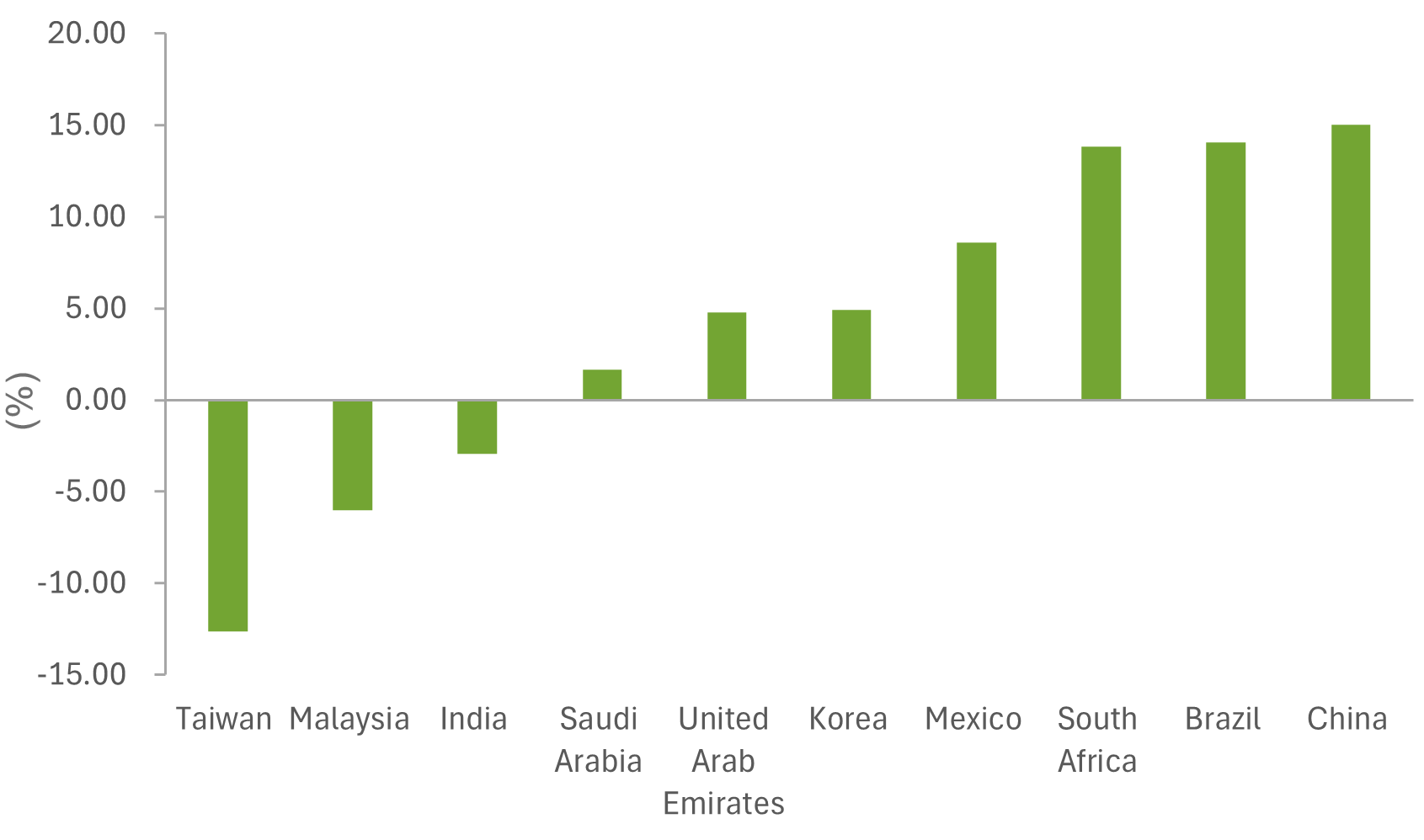

EM equities returned nearly 3% and outpaced the S&P 500 by over 7% in the first quarter. The key driver to the upside was China (+15%), which benefited from advancement in artificial intelligence (AI) innovation and signals of support for the private sector by Beijing. Brazil (+14%) and Mexico (+9%) also contributed positively to performance after selling off last year. In contrast, some of the best performing countries of 2024 underperformed in the first quarter – both Taiwan (-13%) and India (-3%) declined. Taiwan’s decline was driven by the selloff in global technology companies, while India faced a near-term slowdown in its economy.

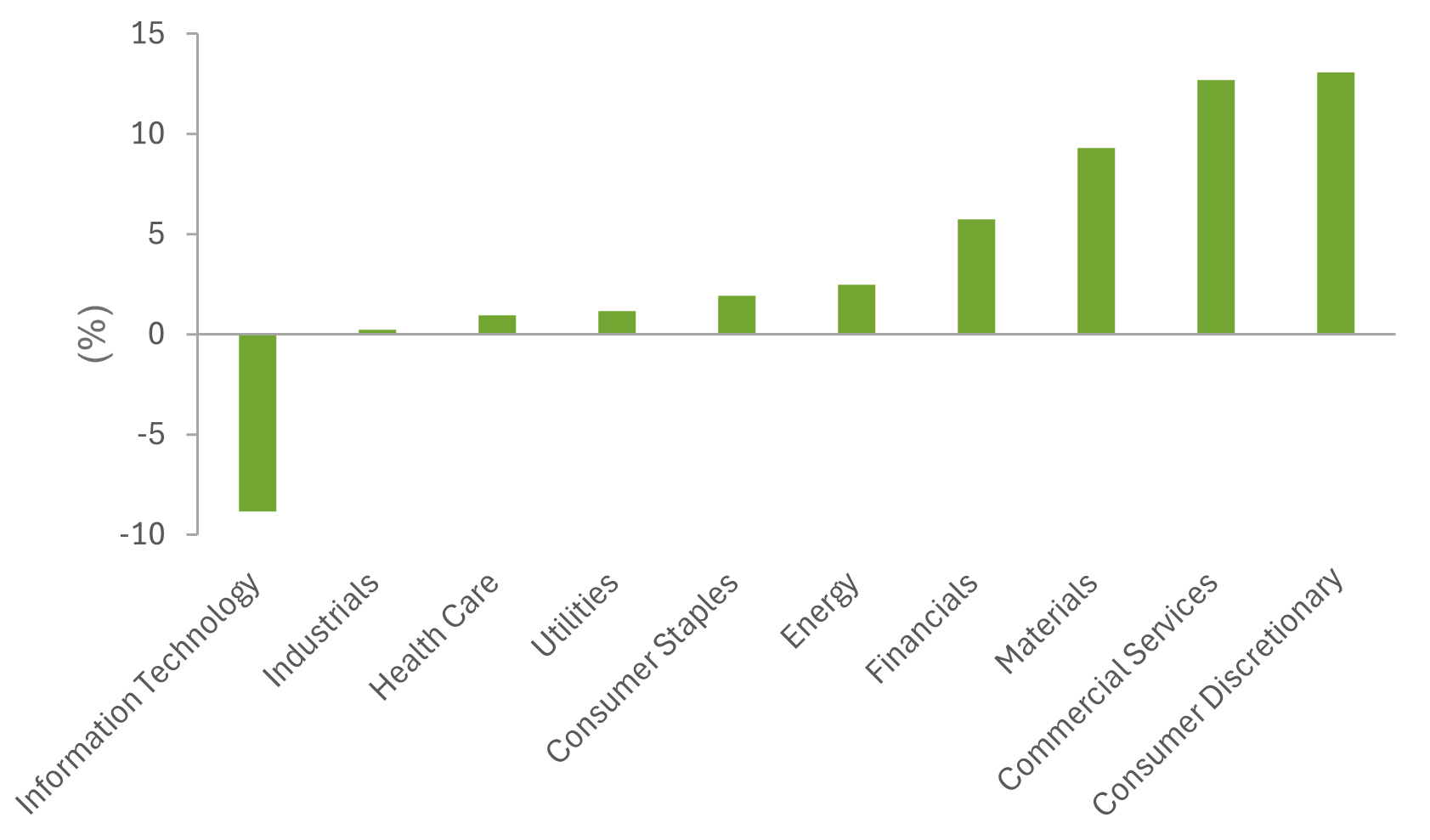

From a sector perspective, Consumer Discretionary and Communication Services (+13% each) led the way, benefiting from the rally in Chinese stocks. IT was the only sector in EM that posted a negative return (-9%) as investors grew wary of a potential slowdown in US technology.

MSCI EM core country and sector performance Q1 2025

Sector Performance

Country Performance

Source: FactSet, as at 31 March 2025. Data in US$. Countries with an index weight over 1% shown.

Top ten holdings by active weight

| Stock | Country | Sector | Active(%) |

|---|---|---|---|

| Tencent | China | Communication Services | 3.4 |

| Samsung Electronics | Korea | Information Technology | 3.3 |

| TSMC | Taiwan | Information Technology | 3.1 |

| HDFC Bank | India | Financials | 3.0 |

| ICICI Bank | India | Financials | 2.7 |

| SK Hynix | Korea | Information Technology | 2.6 |

| China Merchants | China | Financials | 2.2 |

| Titan Company Ltd | India | Consumer Discretionary | 2.0 |

| AIA Group | Hong Kong | Financials | 1.8 |

| Alibaba Group | China | Consumer Discretionary | 1.7 |

Source: Martin Currie as of 31 March 2025. Data shown is for the Martin Currie Global Emerging Markets representative account. Holdings are subject to change.

Portfolio discussion

The Martin Currie Global EM strategy benefited from positive stock selection in two of the largest EM countries – China and India. Within China, the portfolio’s Consumer Discretionary and Communications Services stocks rallied thanks to innovative advancements in AI models and breakthroughs in electric vehicle efficiency. Additionally, while Indian equities declined broadly, our Indian holdings – especially high-quality financials – outperformed during the quarter.

The notable detractor for the quarter was the portfolio’s overweight allocation to and selection within the IT sector. Within the sector, advanced semiconductor manufacturers and IT Services stocks sold off along with US technology.

Portfolio activity

We added two companies to our clients’ portfolios in the first quarter:

Eastroc Beverage: As the domestic leader in the Chinese energy drinks, Eastroc brings exposure to a high-growth, high-return business. Additionally, we expect the domestic nature of the business to mitigate geopolitical risk and diversify our Chinese exposure.

Mahindra: Mahindra is the best positioned to benefit from the long-term growth in the Indian automotive market. Its car division is 100% exposed to SUVs, which continues to see stronger demand than other vehicle types. Mahindra also has exposure to tractors, where demand looks to have entered a new upcycle. Mahindra’s combination of SUVs and tractors should lead to attractive growth from a reasonable valuation starting point.

We exited one company:

Maruti Suzuki: Although the company has shown resilient market share, we believe that the company’s over-reliance on the low-end passenger vehicle market means that the company may underperform Mahindra and middle-class market/SUVs. As such, we sold Maruti to fund our purchase of Mahindra.

Outlook

After a positive first quarter for EM, the Trump Administration’s sweeping tariff announcements in early April led to a spike in volatility for global markets. We are monitoring the developments closely as trade talks evolve in the coming months. Our long-term outlook remains positive for both our portfolio companies and the asset class.

EM are poised to be rewarded for strong fundamentals, especially across the IT sector and within India and China. EM have led the way in advancements in important areas such as AI and electric vehicles, which should continue to lift equity returns. Additionally, EM earnings are expected to grow at a higher rate than the US, while offering relatively attractive valuations. We firmly believe that the long-term investment outlook for EM remains robust, and we maintain strong confidence in our portfolio holdings. The market persistently undervalues high-quality, sustainable growth companies, and we expect that investing in these companies will have the potential to lead to positive results in the long term.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia: This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.