Content navigation

Warren Buffett once said that “risk comes from not knowing what you are doing”1.

That is the risk that we eliminate by having detailed fundamental assessments of our portfolio exposures. It permits us to know more accurately how our portfolios are positioned, gives us visibility of specific fundamental risk exposures, and enables us to achieve more efficient diversification.

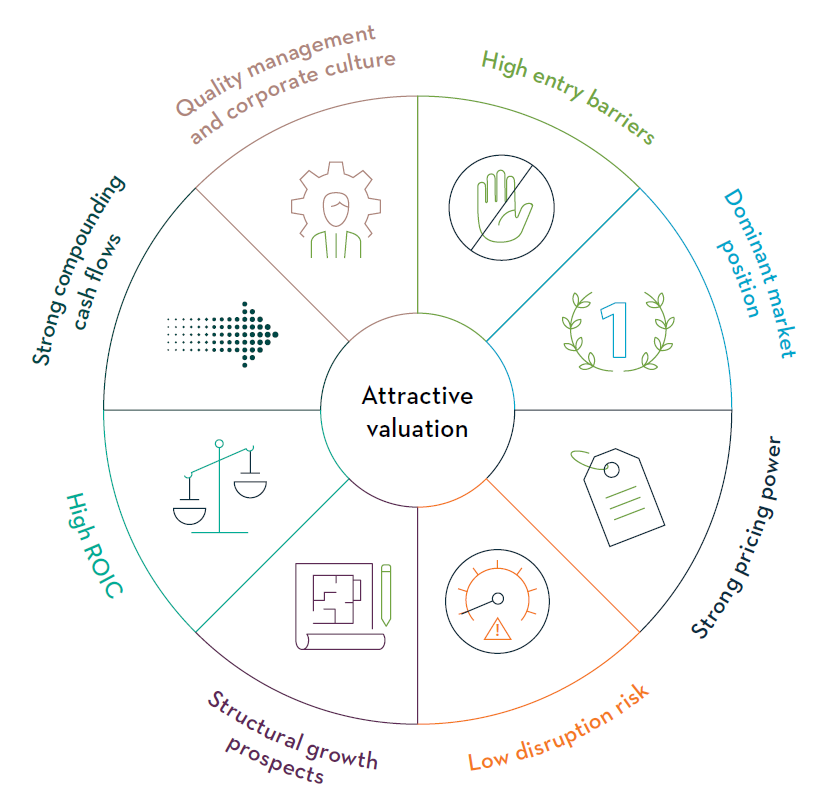

Our innovative risk analytics combine various layers of assessments, through five lenses: thematics analytics, geographic exposures, end-user market exposures, industry life-cycle, and company classification assessment.

This approach complements traditional risk tools and portfolio assessments. We believe this benefits asset allocators, investors and investment officers by pushing the boundaries of our analytics towards more accurate risk representations.

-

These are mega-trends that will be present in economies on a multi-decades basis, and that capture all parts of the economy.

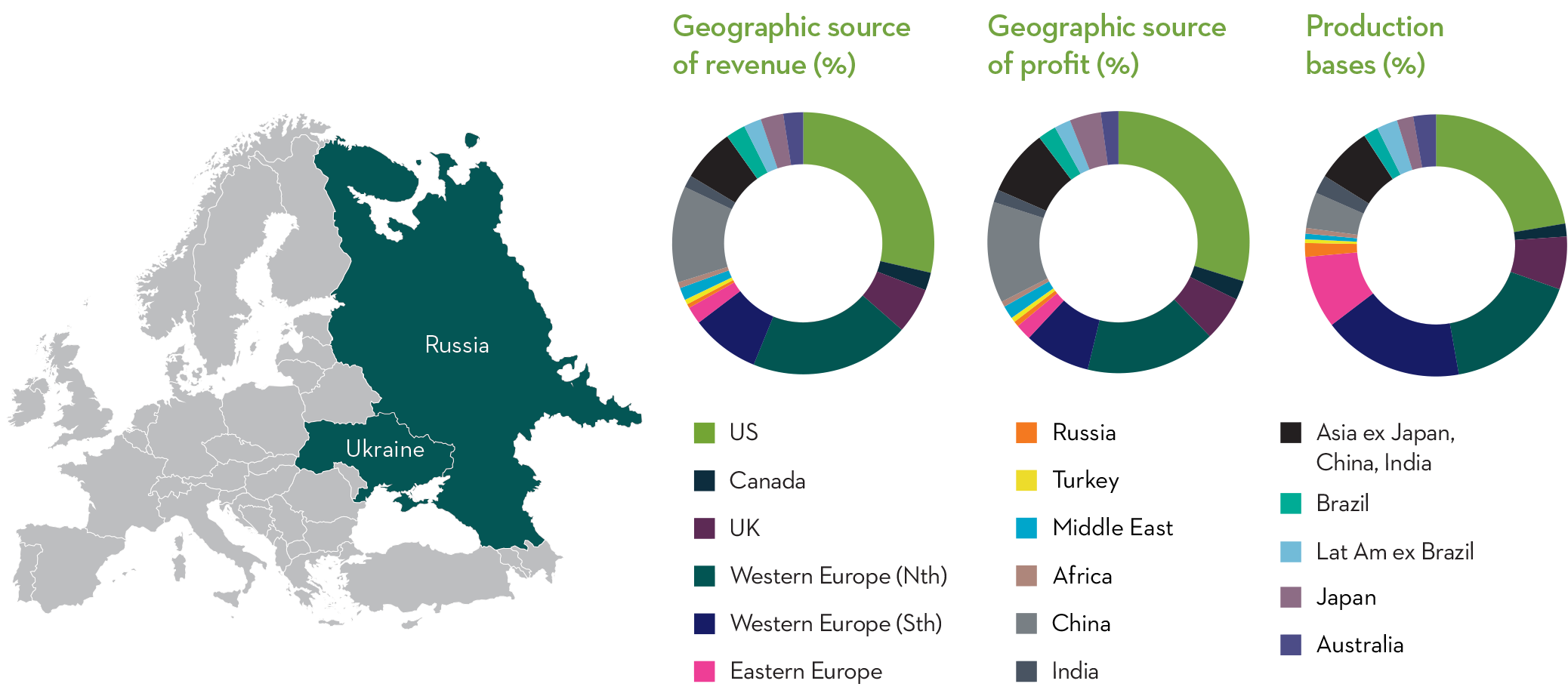

Geographic fundamental exposures provide an accurate account of country risks

As part of our fundamental analysis, we assess a company’s exposure to various geographies in terms of revenues, profits and production bases.

This delivers a complete picture of the fundamental geographic exposure of a company. It also permits us to carry out various assessments of regions where we are underweight or overweight. In turn this allows us to manage risk exposures more efficiently, and to achieve diversification more effectively.

Traditional risk tools, when analysing country risk, assess portfolios by the country of listing for each stock that is held in the portfolios. This unfortunately in our view, does not give a full rendition of country risks.

Ukraine and Russia conflict exposure

When the tragic invasion of Ukraine by Russia began, our traditional risk tools were concluding that we had no country risk exposure to either nation, given that we didn’t hold any stocks listed in these countries. However, we had exposure to Russia and Eastern Europe indirectly, through companies that had presence in these markets.

Source: Martin Currie as at 31 December 2023. Representative Martin Currie Global Long-Term Unconstrained account shown.

The exposure to Russia was c.1% on revenues and on profits, as well as on production bases. We knew what stocks gave us that exposure and which stocks gave us outsized position, so we were able to attend to these names and assess whether share prices had already adjusted for the eventuality of that revenue and profit going to zero, or whether we needed to attend to these holdings.

For Eastern Europe, our exposure was closer to c.2% on sales and profits, but was significantly higher on production bases at c.8-12% depending on the portfolio. For example, our European portfolio had higher exposure than our global portfolio.

For Eastern Europe, our database has more granular country data which we don’t show on the pie chart. Our 8-12% exposure to Eastern Europe in terms of production base was mostly comprised of Poland, Hungary and Romania for the Global, International and European strategies. This illustration highlights the superior approach to portfolio risk analytics using fundamental geographic exposures assessment.

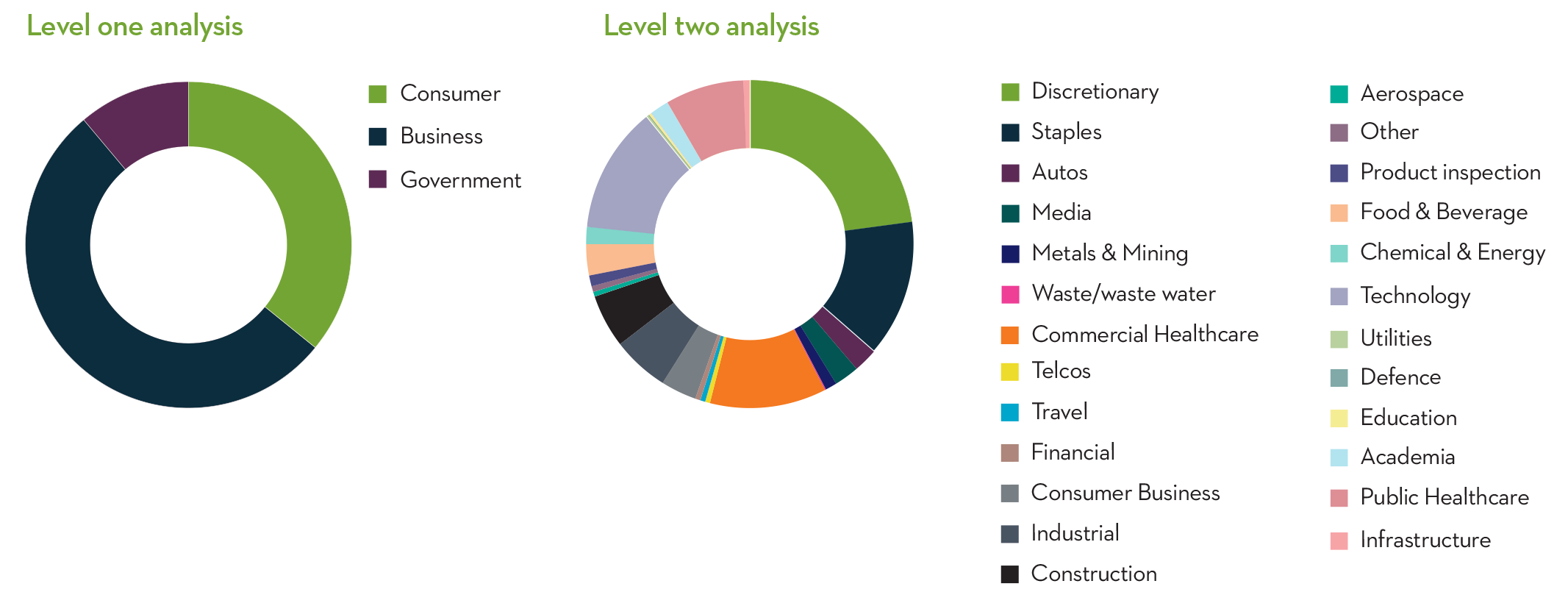

Industry risks addressed through end user market exposures

We also assess companies in terms of their end user market exposures.

While companies can belong to specific sectors or industries, their end-markets can be to a very different sector or industry. We analyse this across the consumer, corporate or government end markets.

In the same way as with geographic exposures analysis, it permits us to both manage diversification more efficiently, and risk exposures more effectively. Having an accurate assessment of end user markets for each company gives us a more accurate picture of portfolio exposures by end-markets.

Source: Martin Currie as at 31 December 2023. Representative Martin Currie Global Long-Term Unconstrained account shown.

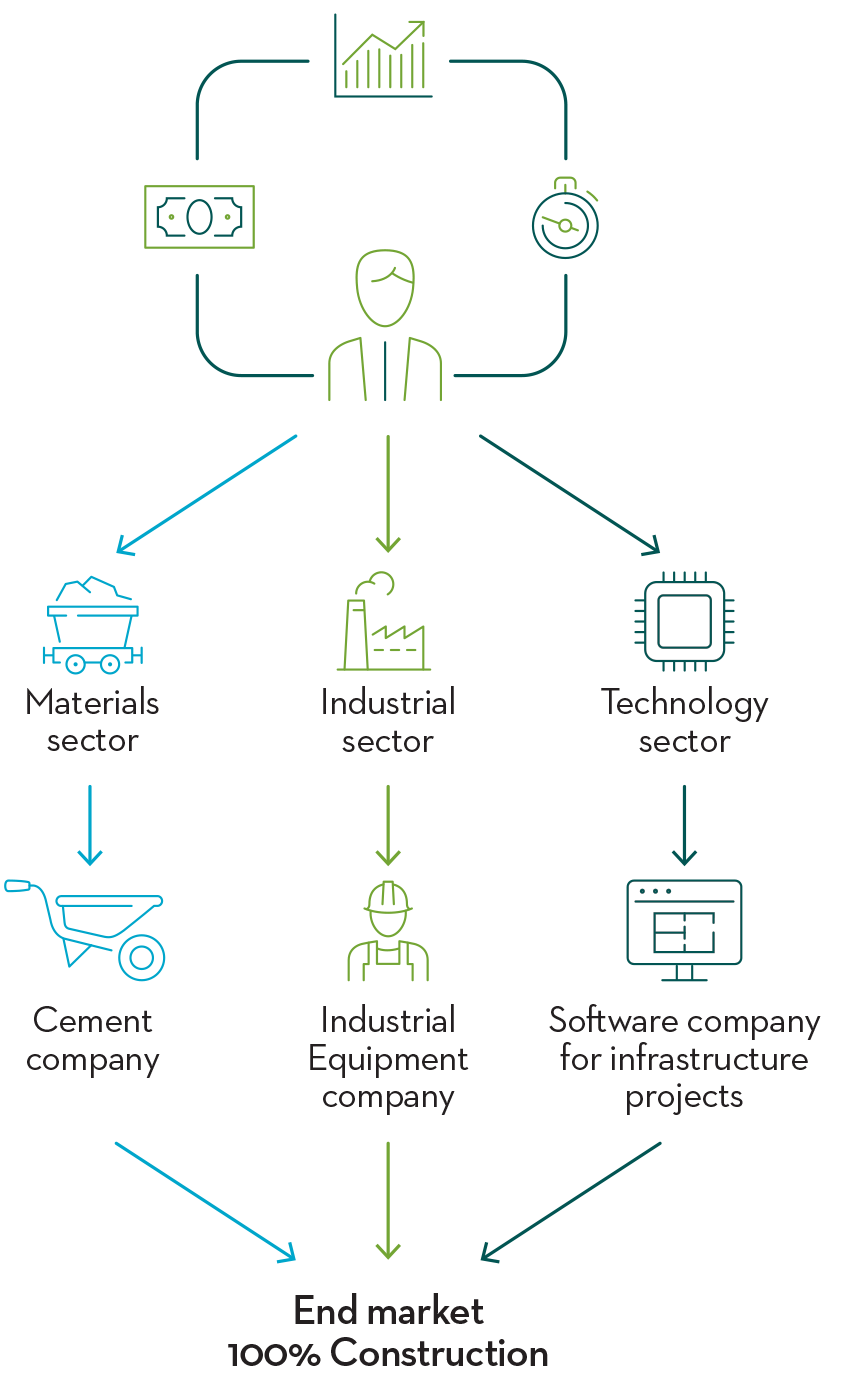

End user markets exposure to construction industry

Equally, take a company like Caterpilar, selling industrial equipment, which typically has its end user market exposure to the construction industry again.

Instead, if we take a company like Autodesk in the US, or Nemetschek in Europe – both companies are classified in the Technology sector given that they are software companies. Yet the bulk of their business is software that is used by the construction industry, as way of project managing more efficiently any construction projects. The end user market of these type of technology companies is therefore construction again.

An investor could have exposure to three stocks in three distinct sectors and appear diversified sectorally, yet these three stocks end up all being exposed to the construction industry in terms of end-user market exposures. This example therefore highlights that there would be 100% exposure to the construction sector.

Thematic exposures highlighted by theme visibility

Accurately estimating thematic exposures running through portfolios is important. Both for better diversification, and for visibility of thematic risk exposures.

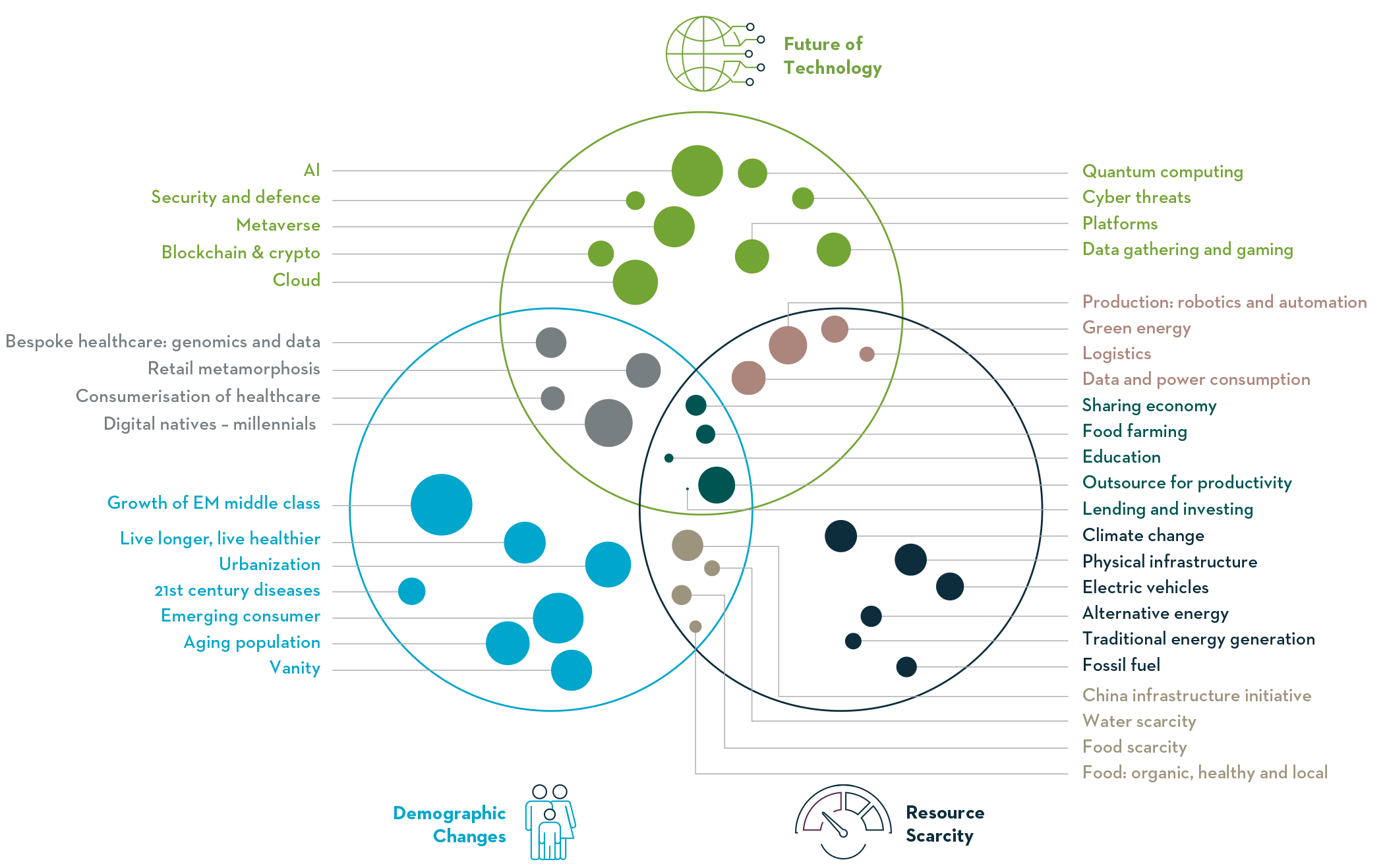

We have developed a thematic framework, centered on three mega-trends, which are Demographic Changes, Future of Technology and Resource Scarcity.

These are mega-trends that will be present in economies on a multi-decades basis, and that capture all parts of the economy. We list various themes, which feature within each of these mega-trends, with some themes overlapping with more than one mega-trend.

We assess each company in terms of themes that the company is facing. By doing this estimation, we are able to aggregate the analysis at the portfolio level. This permits us to have a more accurate assessment of thematic exposures running through the portfolio, ensure a more efficient diversification, and finally gives us better visibility of any theme that we might not have researched, or that we might want to gain more exposure to.

As an aside, valuation discipline is indeed critical when assessing thematic opportunities, as the market has a tendency, at times, to push thematics to levels that get disconnected from the fundamental realities of such themes. In other words, themes can end up being frothy.

Source: Martin Currie as at 31 January 2024. Representative Martin Currie Global Long-Term Unconstrained account shown.

Thematics exposures assessment

In a similar manner to end-user market assessment, one can take a series of stocks that are in different sectors, yet exposed to a similar theme. This negates the diversification effort, which makes it critical to have a good visibility of thematic exposures.

As way of illustration, the theme of ageing population can be captured through:

Healthcare company tackling the ailments associated with an ageing population

Dental company within the Medical Technology sector

Travel & leisure company that can capture the so-called grey-dollar spend

Robotics company within the industrial space to tackle increased autonomous needs

Consumer company related to specific senior population consumption

Life insurance company in the financials space

All in all, this would equate to six companies in six distinct sectors, all exposed to the Ageing Population thematics, i.e. providing no diversification by theme.

Fundamental risk analytics supplement traditional risk analytics

Detailed assessment of portfolio exposures, based on fundamental assessments of geographic exposures, end user market exposures, and qualitative assessment of thematic exposures, permits us to have a more accurate rendition of portfolio exposures.

It allows us to diversify portfolios more efficiently, whilst at the same time permitting us to attend to any are of risk that might need attending, whether it is a geographic risk, an end-user market risk, or a thematic risk.

Sources

1Source: Des Moines Sunday Register as at 8 February 1988. Heralded investor Buffett turns eye toward silver by Reuters News Service.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.