Biodiversity is the variety of life on earth and the ecological complexes that support the natural world and, by extension, many aspects of human activity that depend on it.

Investors have increasingly focused on climate change as a material issue, but the reality is that climate change and biodiversity are inextricably linked and a greater focus on biodiversity itself is warranted.

As such, our fifth edition of STEWARDSHIP MATTERS specifically focusses on the important topic of biodiversity, and why and how investors should be working to protect it.

In this edition we cover:

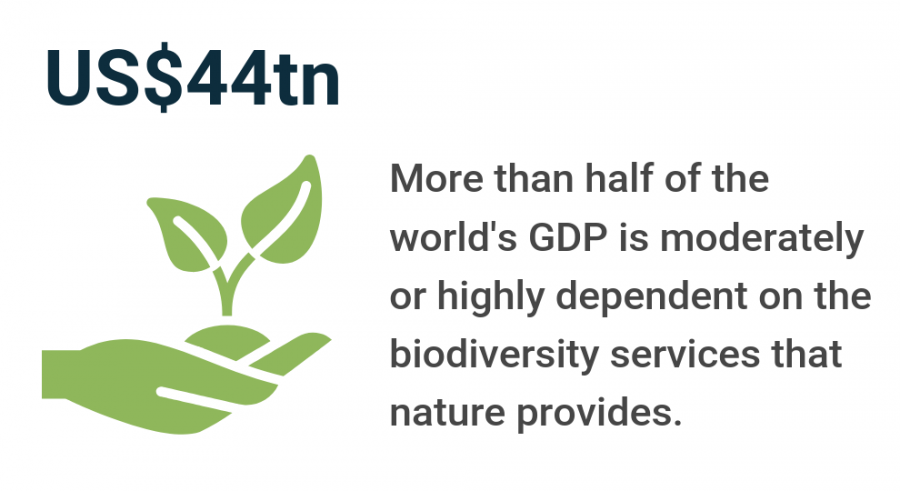

- How biodiversity loss presents a real and tangible risk for business.

- The challenges in measuring the potential impact of biodiversity loss from an investment perspective.

- How companies dealing with biodiversity risk create investment opportunities.

- Examples of the analysis and engagement we have used to build confidence in the investment case for impacted companies.

- An introduction to our biodiversity framework.

- A summary of the extensive engagement and proxy voting activities over calendar year 2021.

Climate change influences the pace at which biodiversity loss occurs, but equally, biodiversity can slow climate change, providing significant capacity to absorb carbon emissions and improve resilience.

1Source: UNEP FI and UNEP-WCMC, June 2021. “Guidance for banks (Version 1: June 2021), Principles for Responsible Banking.” UNEP Finance Initiative: Geneva. Available from https://www.unepfi.org/wordpress/wp-content/uploads/2021/06/PRB-Biodiversity-Guidance.pdf

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.