Rapid growth in urban-based populations is translating into significant demand for global real assets to service everyday needs.

We believe that our unique blend of listed real assets can provide investors with better income opportunities, fuelled by the multi-decade global megatrend of urban population growth. This is achieved while helping to enrich the lives of the communities that these assets are located in.

Infrastructure

- Toll roads

- Railroads & ports

- Telco towers & fibre networks

- Airports

Utilities

- Gas & electricity grids

- Multi-utilities & pipelines

REITs

- Supermarket-anchored shopping centres

- Office & industrial sheds

- Data centres

- Residential

- Healthcare

Population and urbanisation levels are key drivers for real asset demand

By their nature, listed real estate investment trusts (REITs), utilities and infrastructure assets are the essential ‘building blocks’ of an economy.

As populations grows through factors such as rural to urban internal migration, external migration and natural birth rates, the volume of demand grows for real assets to serve non-discretionary everyday needs. More people leads to greater use of utilities, as well as more pressure on infrastructure and accessing data services.

Making use of online delivery services

Benefits datacentres, airports, rail and distribution sheds

Benefits supermarket-anchored shopping centres

Benefits toll roads

Benefits gas, electricity and water grids

-

Urban population growth is resulting from rural to urban internal migration, external migration, and increased natural birth rates.

Global urban population is growing, but not everywhere

While the trend towards world urbanisation growth is promising, not all countries and cities are growing. Indeed, some are going backwards.

The Martin Currie Australia (MCA) investment team has looked at the demographics across cities in all countries where the real assets in our investment universe operate, and those without urban population growth present less favourable opportunities.

We have focussed on select target countries, regions, and cities with the most attractive demographic growth for population and urbanisation. This investment universe serves as a foundation to create a unique and diversified blend of high-quality listed global REITs, infrastructure and utilities across our Real Asset platform.

Facilitating sustainable growth within cities

The urbanisation megatrend is driven by society’s desire for a better standard of living. However, poorly planned, unsustainable urbanisation can have negative impacts on society.

Real assets have the potential to drive real benefits to society by facilitating more sustainable growth within the cities they service. Two areas in which they can have a real impact are energy transition and enabling connectivity.

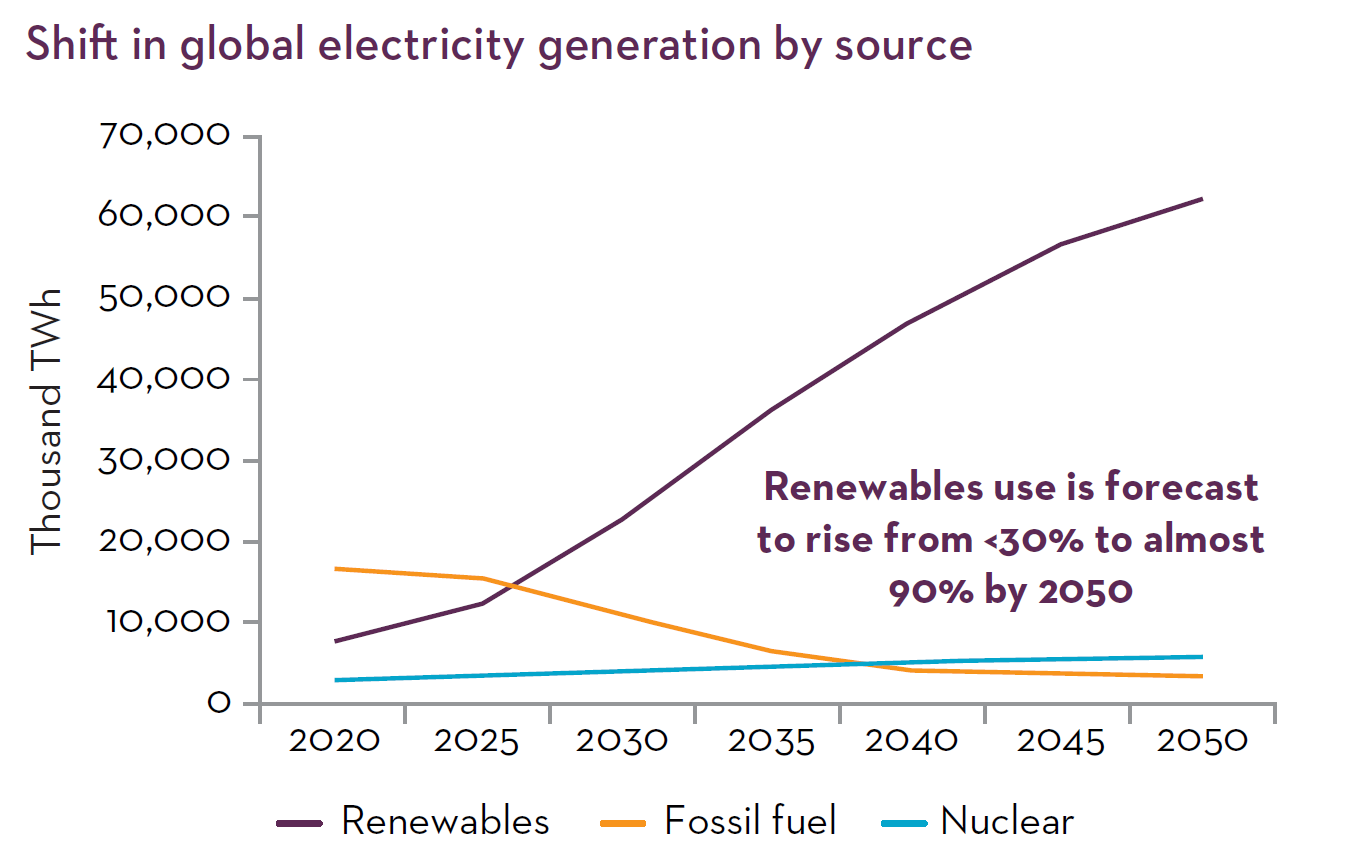

Era-defining global energy transition

As electrification ramps up to help develop a lower carbon economy, we expect significant growth in electricity consumption. This demand will necessitate increased capacity of the whole system provided by utilities and will require significant investment in networks, additional storage, smart grids and energy efficiency solutions.

Alongside growth in renewable electricity generation, when we combine our urban population growth with this net zero opportunity, we believe a once ‘boring’ or stable, listed utilities sector will generate some additional spark in the transition years.

While electrification may be the long-term solution to lower carbon, we still require older generation sources such as coal and gas to continue running in the medium term. While coal and gas currently result in higher carbon emissions, they nevertheless offer opportunities to participate in and sensibly shape the transition.

Aiding connectivity through data

Real Assets are also integral in connecting communities. This might be physically, through rail, ports, toll roads, and airports, or digitally, through communications infrastructure.

Access to data is critical in bridging the digital divide and promoting social inclusion. It reduces the barriers to accessing many essential services, including healthcare, government services, banking, and entertainment, while creating economic opportunities and helping drive innovation.

India’s embrace of mobile technology, for example, has helped more consumers and small businesses to gain access to essential internet-based services. This was once the exclusive domain of the rich – those with a computer and internet connection.

With growing demand for data through technological change and urbanisation growth, the services provided by listed Real Assets – data centre REITs, mobile phone towers, fibre networks – are becoming more important in sustainable cities.

Being active to make a real difference

Embedded into our process is a focus on active ownership and understanding the sustainable economic pathway of every investment we make. We have developed strong relationships with investee companies.

We are ready and willing to challenge them about their progress on reducing carbon emissions, or how they support sustainable growth. By doing this we encourage greater transparency, and gain insight into the company’s management of key governance and sustainability issues.

Ultimately, this process encourages change, more sustainable business practices and the potential for more significant, long-term value in the real assets we invest in.

REAL ASSETS: Investing to Improve Lives

Our unique blend of Real Assets underpinned by urbanisation, and an investment process underpinned by Active Ownership, helps us to uncover investment opportunities that can drive both real benefits to society, and financial outcomes for our clients.

-

Click here to find out more about the Martin Currie Australia Real Assets platform.

-

This article was originally published as part of Stewardship Matters - Edition 10: Making an Impact. Click here to find out more about our Stewardship Matters series.

REAL ASSETS: Investing to Improve Lives

Our unique blend of Real Assets underpinned by urbanisation, and an investment process underpinned by Active Ownership, helps us to uncover investment opportunities that can drive both real benefits to society, and financial outcomes for our clients.

-

Click here to find out more about the Martin Currie Australia Real Assets platform.

-

This article was originally published as part of Stewardship Matters - Edition 10: Making an Impact. Click here to find out more about our Stewardship Matters series.

Graph sources

Past performance is not a guide to future returns.

Source: International Energy Agency (May 2021); Net Zero by 2050, IEA, Paris. Data based on IEA’s Net Zero Emissions by 2050 Scenario (figure 3.10).

Report available from https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c- 10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector CORR.pdf

Fossil fuel includes Unabated coal, Unabated natural gas, Oil, Hydrogen based and Fossil fuels with CCUS. Renewables includes Solar PV, Wind, Hydropower and other renewables.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable. It is not known whether the stocks mentioned will feature in any future portfolio managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.

For institutional investors in Canada:

The content of this website is suitable for Permitted Clients for the purposes of NI 31-103 only. The information on this section of the website is not intended for use by any other person, including members of the public.

For wholesale investors in Australia:

Any distribution of this material in Australia is by Martin Currie Australia (‘MCA’). Martin Currie Australia is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849). Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.