Examining permanent and long-term net arrivals is an excellent monthly proxy for Australia’s net migration trends – it’s now painting a far rosier picture in comparison to our Covid-19 lows.

What’s more, visa statistics clearly demonstrate that it’s a student driven resurgence, underpinning the sustainability of this impressive turnaround. And importantly, as population growth is a key part of a growing demand profile for listed Real Assets, the return of migration is a major driver in accelerating their growth outlook in this post-Covid world.

Arrivals are a strong leading indicator for long-term population growth

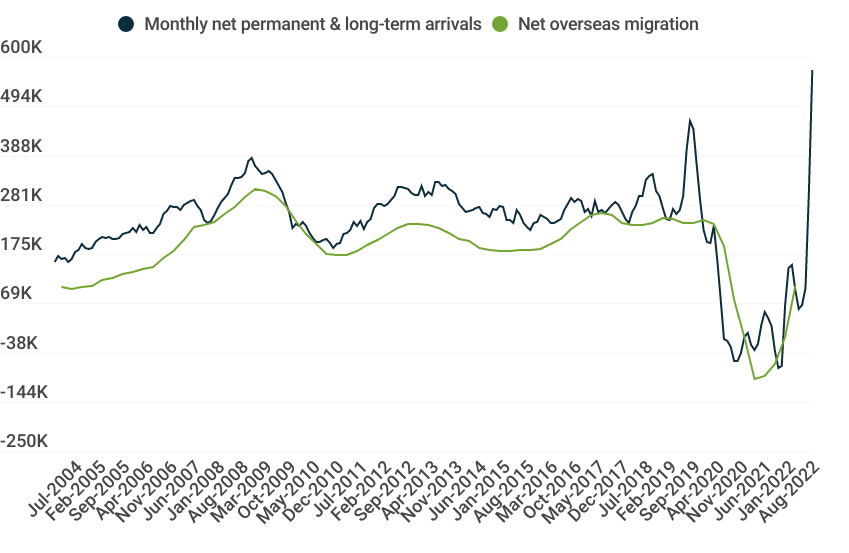

The significant turnaround in net arrivals paints a rosy picture for Australia’s net migration and long-term prosperity from strong population growth. As can be seen in the following chart, the August 2022 release of permanent and long-term net arrival metrics have surpassed previous highs by an order of magnitude.

Permanent and long-term net arrivals (rolling 12 months, in thousands)

Source: Australian Bureau of Statistics (ABS); as of 30 August 2022.

ABS: 3401.0 Overseas Arrivals and Departures, Australia, Table 1: Total Movement, Arrivals - Category of Movement and Table 2: Total Movement, Departures - Category of Movement; data through August 2022, release 11 October 2022

Net overseas migration (4-quarter sum) and Monthly net permanent & long-term arrivals (annualised 3-month sum). Seasonally adjusted data used. Available here.

Australia’s secret source… is the virtuous circle of population growth.

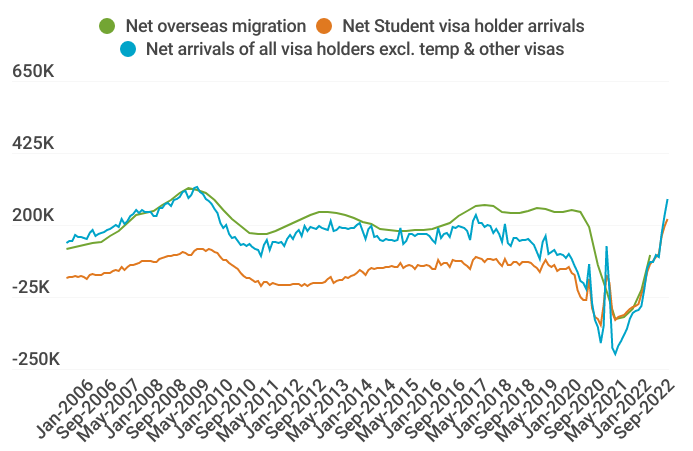

Permanent and long-term net arrivals by source (rolling 12 months, in thousands)

Student visas are leading the revival

Students have always been a sizeable part of Australia’s long-term visa mix. The latest visa data continues to suggest that most of the increase in Australia’s net overseas migration has been in net international student arrivals.

Source: Australian Bureau of Statistics (ABS); as of 30 August 2022.

ABS: 3401.0 Overseas Arrivals and Departures, Australia, Table 15: Total Arrivals and Total Departures - Visa Group: Original; data through August 2022, release 11 October 2022

Net overseas migration (4-quarter sum), Net arrivals of student visa holders and Net arrivals of all visa holders excluding temporary visitor and "other" visa holders (12-month sum). Seasonally adjusted data used. Available here

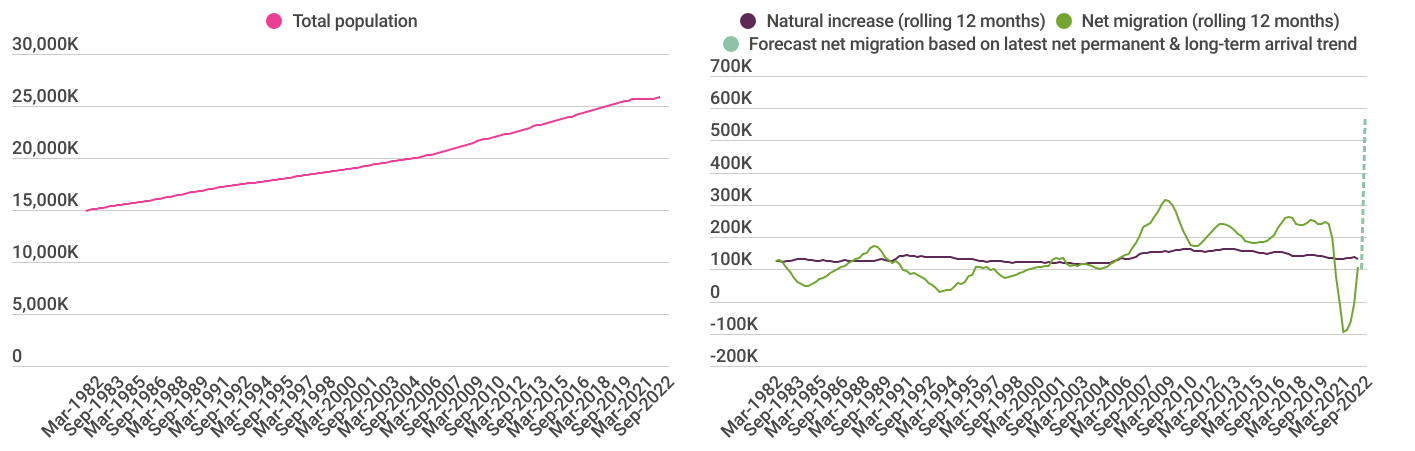

Australia’s natural population growth is supercharged by strong net migration

Improving migration is also a ‘super-charging’ factor in improving Australia’s already high natural rate of increase relative to both the developed and developing world.

Long term population trends (thousand people)

Source: Martin Currie Australia, Australian Bureau of Statistics (ABS); as of 30 September 2022.

ABS: 3101.0 Australian Demographic Statistics, Table 1. Population Change, Summary - Australia ('000); data through March 2022, release 21 September 2022. Available here.

The virtuous circle of population growth for Real Assets

Our key investment thesis for the listed Real Assets we invest in for our Income strategies is that as the population grows, so too will demand for Real Assets to service everyday needs. When the global pandemic put a dent in Australia’s population growth story, one could be forgiven for thinking Real Assets, and Australia’s future, had lost some of its lustre. These recent metrics are both exciting and reassuring news that Australia’s population growth story is back on track. This is good news for the broader economy and our listed Real Asset investments.

In my view, the secret source to Australia’s long-term ‘business model’ is the virtuous circle of population growth. By attracting relatively young, well-educated new citizens with their future economic prosperity ahead of them, Australia maintains an enviable position globally.

One of the ways we do this is through student migration intake; whereby once students have completed their studies, the prospect of remaining in Australia holds strong appeal by accumulating points with a view to becoming a long-term resident and eventually an Australian citizen.

Re-enforcing these strong drivers of population growth, October 2022’s Federal mini-budget saw migration expectations upgraded to 235k net arrivals in FY23 from the prior expectation of 180k; this would see population growth rebound to 1.4% year on year. Based on recent arrivals measures, these government forecasts may prove to be conservative.

While parts of Asia (most notably China) have retained elements of lockdown, I think Australia’s appeal as a global destination has only increased post-Covid. We remain a popular destination given all that our lifestyle offers, the abundant employment opportunities and generally being a wonderful place to raise a family.

This virtuous circle looks set to continue for the long term.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

For wholesale investors in Australia: Any distribution of this material in Australia is by Martin Currie Australia (‘MCA’). Martin Currie Australia is a division of Franklin Templeton Australia Limited (FTAL), (ABN 76 004 835 849). Franklin Templeton Australia Limited is a wholly owned subsidiary of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001.