The ‘Roaring 1920s’ was a decade of economic growth and widespread prosperity. COVID set this century’s ‘20s off to a slow start, but has now set the scene for a resurgence of the Value style.

Value has traditionally outperformed growth

Back in the 1990s, Eugene Fama and Kenneth French’s research highlighted the higher expected returns available over time for stocks with low market value relative to their book value of equity, small market capitalisation and higher beta1. While Value-style investing had been around for many more decades (think Graham, Buffet), Fama and French were the first to systematically test Value and Growth returns across a large set of stocks2.

Their results demonstrated that Value investing can be expected to produce superior long run returns relative to the Growth style.

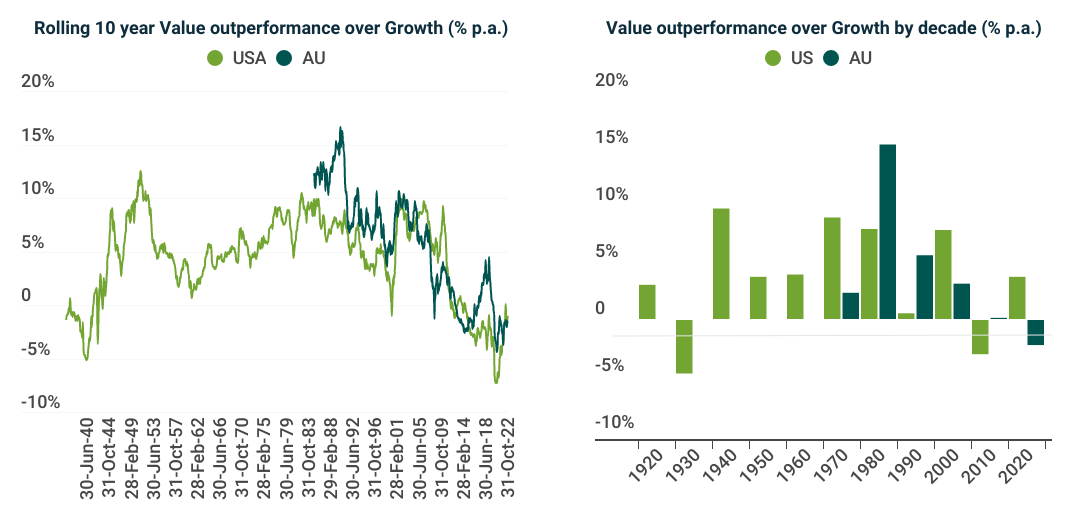

Updated data through October 2022 demonstrates that Value-style stocks have outperformed Growth stocks in eight out of the last 10 decades, and in 82% of rolling 10-year average periods. This observation of superior Value returns has now also been demonstrated in other markets including Australia3.

The ‘Roaring 1920s’ was a decade of economic growth and widespread prosperity. COVID set this century’s ‘20s off to a slow start, but has now set the scene for a resurgence of the Value style.

Value has traditionally outperformed growth

Back in the 1990s, Eugene Fama and Kenneth French’s research highlighted the higher expected returns available over time for stocks with low market value relative to their book value of equity, small market capitalisation and higher beta1. While Value-style investing had been around for many more decades (think Graham, Buffet), Fama and French were the first to systematically test Value and Growth returns across a large set of stocks2.

Their results demonstrated that Value investing can be expected to produce superior long run returns relative to the Growth style.

Updated data through October 2022 demonstrates that Value-style stocks have outperformed Growth stocks in eight out of the last 10 decades, and in 82% of rolling 10-year average periods. This observation of superior Value returns has now also been demonstrated in other markets including Australia3.

Eugene Fama and Kenneth French’s research results demonstrated that Value investing can be expected to produce superior long run returns relative to the Growth style.

Eugene Fama and Kenneth French’s research results demonstrated that Value investing can be expected to produce superior long run returns relative to the Growth style.

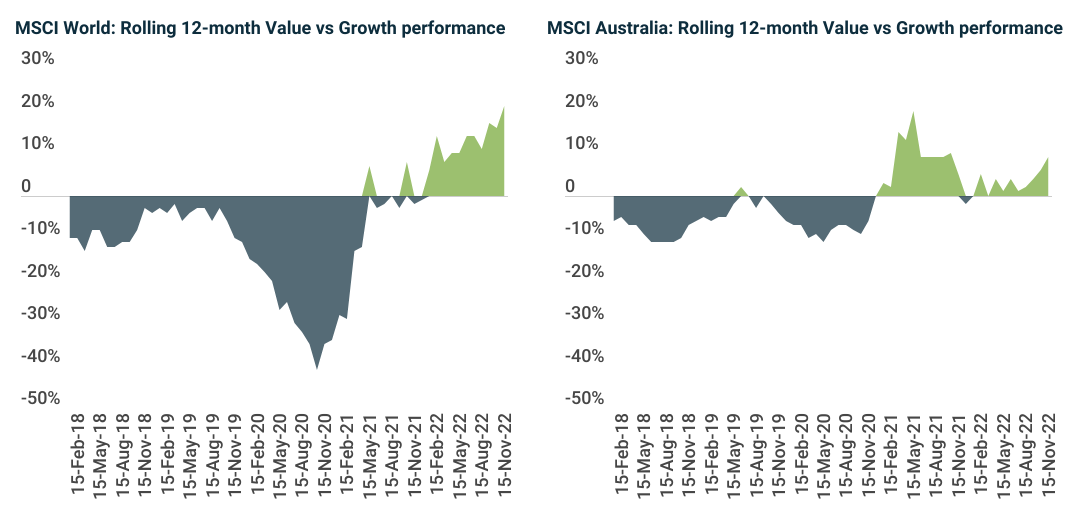

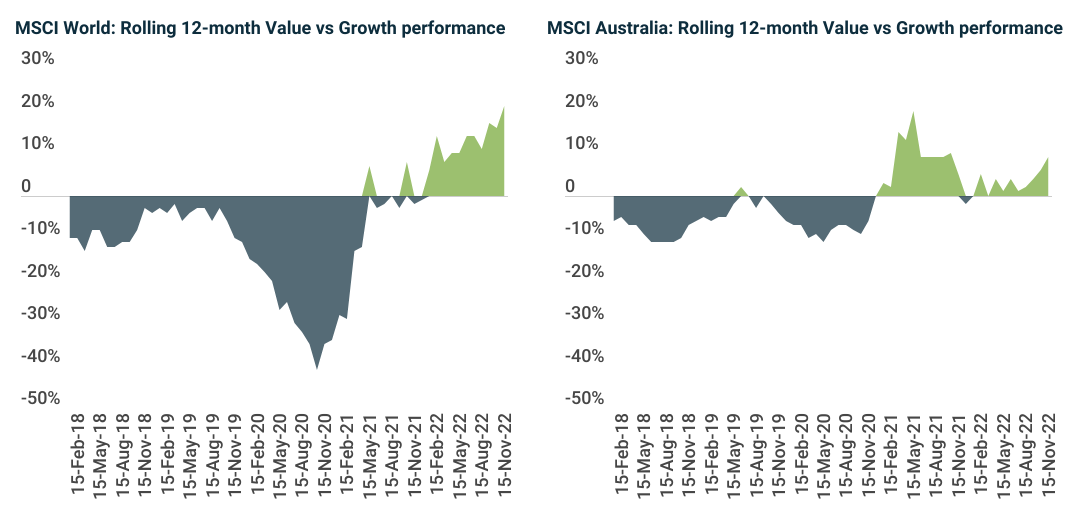

Value's poor last decade was an outlier

However, as we all know, the decade since the global financial crisis (GFC) has proven to be one of the most difficult ever periods for Value investing, recording the worst rolling 10-year results which extended into the start of the 2020s during COVID.

It is hard to determine all the reasons as to why the 2010s were such a tough decade for Value investing, but it is easy to point to one - the extraordinary monetary policies employed over the decade that drove US Bond yields to 100+ year lows. Value stocks have historically shown a strong outperformance correlation with upward movements in bond yields, and yields are finally on their way back up.

The current inflationary conditions now point to a return to the “old normal” for bond yields, and a tailwind for the Value style.

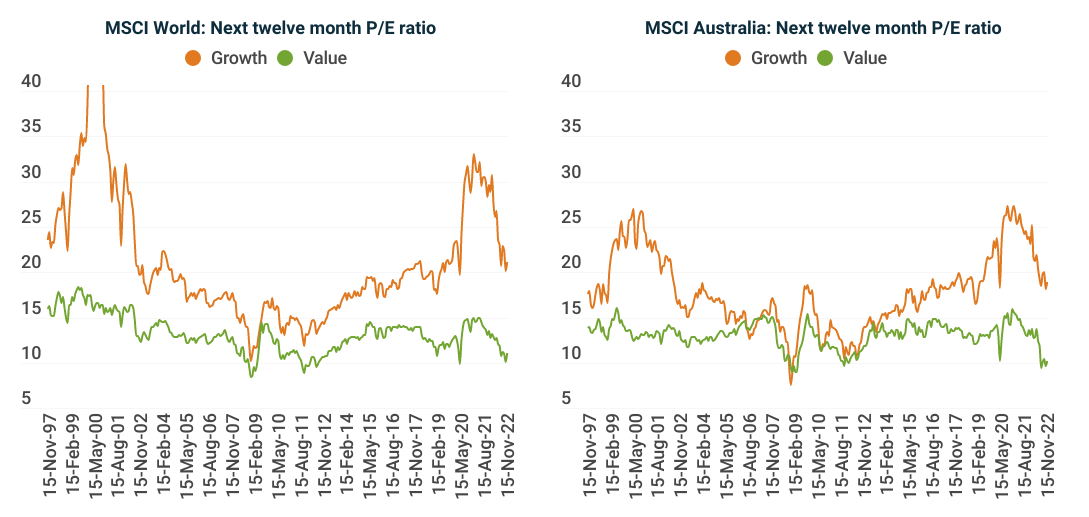

Value stocks are now as cheap as ever

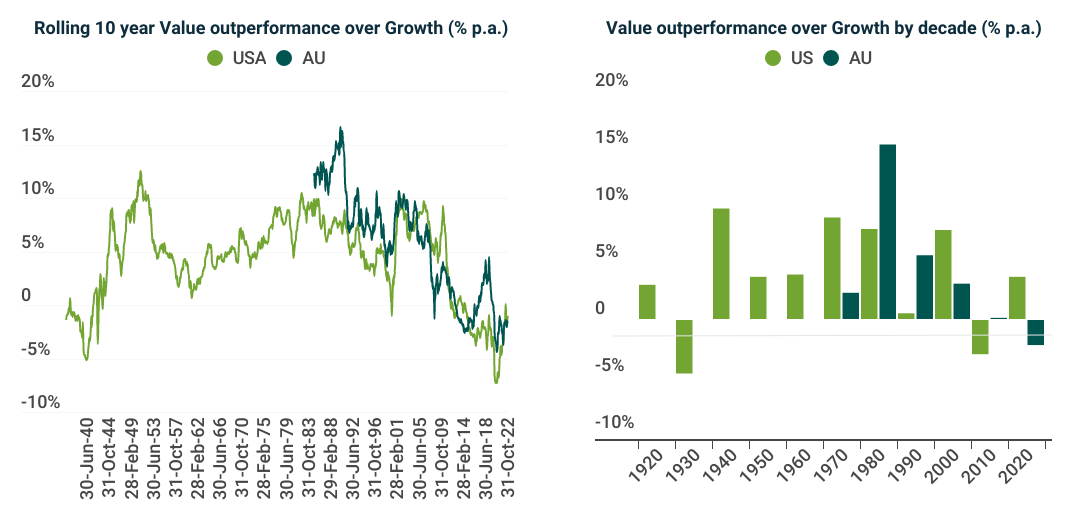

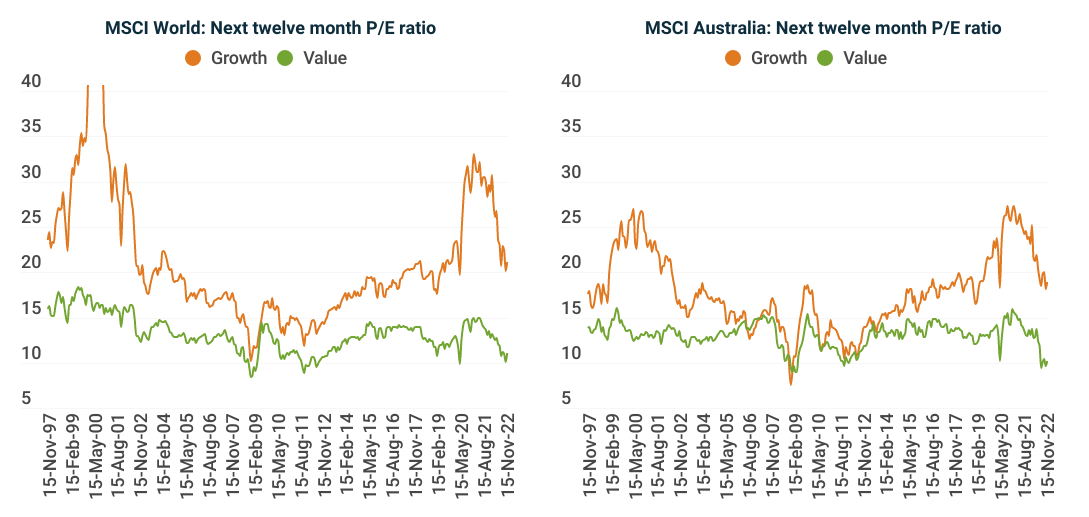

The impacts of the market’s penchant for Growth over the last decade has been stark on stock valuations. Growth stocks are far more expensive and Value stocks are far cheaper today than they have been over most modern periods.

The chart below shows this based on forward Price to Earnings (P/E) ratios4 but a similar observation can be made looking at market to book, dividend yield and our own proprietary Martin Currie Australia valuations.

As these extremes will inevitably unwind, the Valuation starting point for excess returns to Value investing is strong for the next decade.

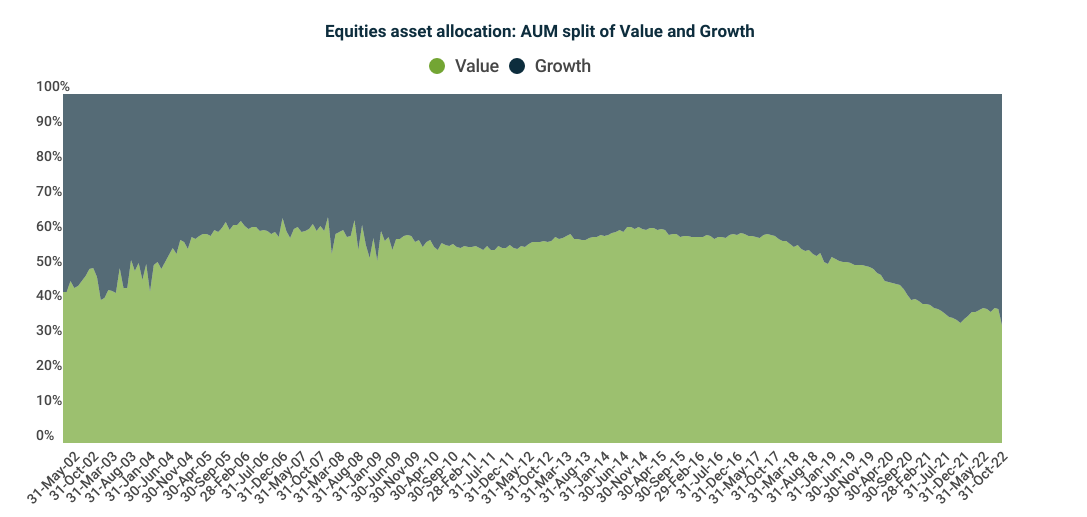

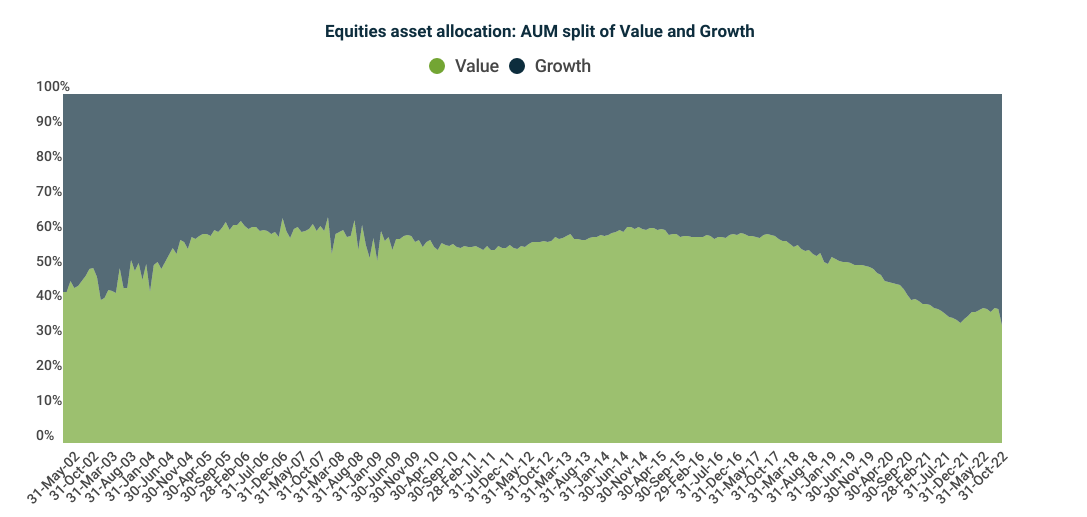

Investors are at risk of being left behind as value reawakens

The other effect of Growth’s outperformance has been on investor positioning. Whilst the asset allocation to typical Growth managers was similar to Value through 2017, the poor performance of Value in the 2010s has resulted in investors culling their weights to Value managers5. In recent times there have been questions of value investing death and distancing from style tags as an explanation of performance.

But Value is far from dead. We are now seeing renewed Value-style performance globally and in Australia, be that from cyclicality or a return to the long-term outperformance patterns shown by the Fama French’s research6.

Recent strong returns for value will pressure those investors who had moved to underweight Value strategies to reassess their asset allocations, redirecting flows back toward Value managers.

Value set to prosper in the new roaring '20s

In summary, the current conditions are strong for Value-style strategies to produce superior long-term returns this decade:

- Value stocks have typically outperformed growth stocks by 5% p.a. over the last 90 years;

- The exceptional monetary conditions and zero rate policies have concluded, and we are now seeing the return of inflation and central bank tightening;

- Growth stocks are expensive and Value stocks are cheap relative to history;

- Investors are under-allocated to Value strategies as they have responded to the unusual returns of the 2010s.

Value's poor last decade was an outlier

However, as we all know, the decade since the global financial crisis (GFC) has proven to be one of the most difficult ever periods for Value investing, recording the worst rolling 10-year results which extended into the start of the 2020s during COVID.

It is hard to determine all the reasons as to why the 2010s were such a tough decade for Value investing, but it is easy to point to one - the extraordinary monetary policies employed over the decade that drove US Bond yields to 100+ year lows. Value stocks have historically shown a strong outperformance correlation with upward movements in bond yields, and yields are finally on their way back up.

The current inflationary conditions now point to a return to the “old normal” for bond yields, and a tailwind for the Value style.

Value stocks are now as cheap as ever

The impacts of the market’s penchant for Growth over the last decade has been stark on stock valuations. Growth stocks are far more expensive and Value stocks are far cheaper today than they have been over most modern periods.

The chart below shows this based on forward Price to Earnings (P/E) ratios4 but a similar observation can be made looking at market to book, dividend yield and our own proprietary Martin Currie Australia valuations.

As these extremes will inevitably unwind, the Valuation starting point for excess returns to Value investing is strong for the next decade.

Investors are at risk of being left behind as value reawakens

The other effect of Growth’s outperformance has been on investor positioning. Whilst the asset allocation to typical Growth managers was similar to Value through 2017, the poor performance of Value in the 2010s has resulted in investors culling their weights to Value managers5. In recent times there have been questions of value investing death and distancing from style tags as an explanation of performance.

But Value is far from dead. We are now seeing renewed Value-style performance globally and in Australia, be that from cyclicality or a return to the long-term outperformance patterns shown by the Fama French’s research6.

Recent strong returns for value will pressure those investors who had moved to underweight Value strategies to reassess their asset allocations, redirecting flows back toward Value managers.

Value set to prosper in the new roaring '20s

In summary, the current conditions are strong for Value-style strategies to produce superior long-term returns this decade:

- Value stocks have typically outperformed growth stocks by 5% p.a. over the last 90 years;

- The exceptional monetary conditions and zero rate policies have concluded, and we are now seeing the return of inflation and central bank tightening;

- Growth stocks are expensive and Value stocks are cheap relative to history;

- Investors are under-allocated to Value strategies as they have responded to the unusual returns of the 2010s.

Positioned for the Value opportunity

The Martin Currie Australia Value Equity strategy provide investors with a diversified exposure to our highest conviction stock ideas with Valuation potential, while balancing risks through our focus on Quality & Direction analysis. Our stock selection, driven by our proprietary fundamental analysis process, is positioned to benefit from the continuation of the market’s rotation from Growth to Value.

Click to display all sources >>

1 Source: Eugene F. Fama & Kenneth R. French. June 1992: “The Cross-Section of Expected Stock Returns”, available from https://doi.org/10.1111/j.1540-6261.1992.tb04398.x. February 1993: “Common risk factors in the returns on stocks and bonds”, available from https://doi.org/10.1016/0304-405X(93)90023-5.

2 Source: Martin Currie Australia, MSCI, IRESS, Kenneth R. French Data Library; as of 31 October 2022. Returns are based on Fama/French Research Portfolios: Value data is based on the average return on the Fama/French small & big high book-to-market portfolios, and the growth data is based on the average return on the small & big low book-to-market portfolios. Monthly return series from July 1926 through October 2022. Available from http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html#Research.

3 For Australian data, as Kenneth R. French Data Library series ends in December 2021, the MSCI Australia Value/Growth and S&P/ASX All Ordinaries Accumulation indices are used to fill the gap to October 2022.

4 Source: Martin Currie Australia, FactSet; as of 15 December 2022.

5 Source: Martin Currie Australia, Morningstar Direct; as of 31 October 2022. Based on AUM of Morningstar Australia OE Funds & ETFs Australia Fund Equity category. Value: Australia Large Value & Mid/Small Value and World Large Value; and Growth: Australia Large Growth & Mid/Small Growth and World Large Growth.

6 Source: Martin Currie Australia, FactSet; as of 15 December 2022.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

Important information

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

Click to display all sources >>

1 Source: Eugene F. Fama & Kenneth R. French. June 1992: “The Cross-Section of Expected Stock Returns”, available from https://doi.org/10.1111/j.1540-6261.1992.tb04398.x. February 1993: “Common risk factors in the returns on stocks and bonds”, available from https://doi.org/10.1016/0304-405X(93)90023-5.

2 Source: Martin Currie Australia, MSCI, IRESS, Kenneth R. French Data Library; as of 31 October 2022. Returns are based on Fama/French Research Portfolios: Value data is based on the average return on the Fama/French small & big high book-to-market portfolios, and the growth data is based on the average return on the small & big low book-to-market portfolios. Monthly return series from July 1926 through October 2022. Available from http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html#Research.

3 For Australian data, as Kenneth R. French Data Library series ends in December 2021, the MSCI Australia Value/Growth and S&P/ASX All Ordinaries Accumulation indices are used to fill the gap to October 2022.

4 Source: Martin Currie Australia, FactSet; as of 15 December 2022.

5 Source: Martin Currie Australia, Morningstar Direct; as of 31 October 2022. Based on AUM of Morningstar Australia OE Funds & ETFs Australia Fund Equity category. Value: Australia Large Value & Mid/Small Value and World Large Value; and Growth: Australia Large Growth & Mid/Small Growth and World Large Growth.

6 Source: Martin Currie Australia, FactSet; as of 15 December 2022.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

Important information

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.