Banks have bounced back from concerns

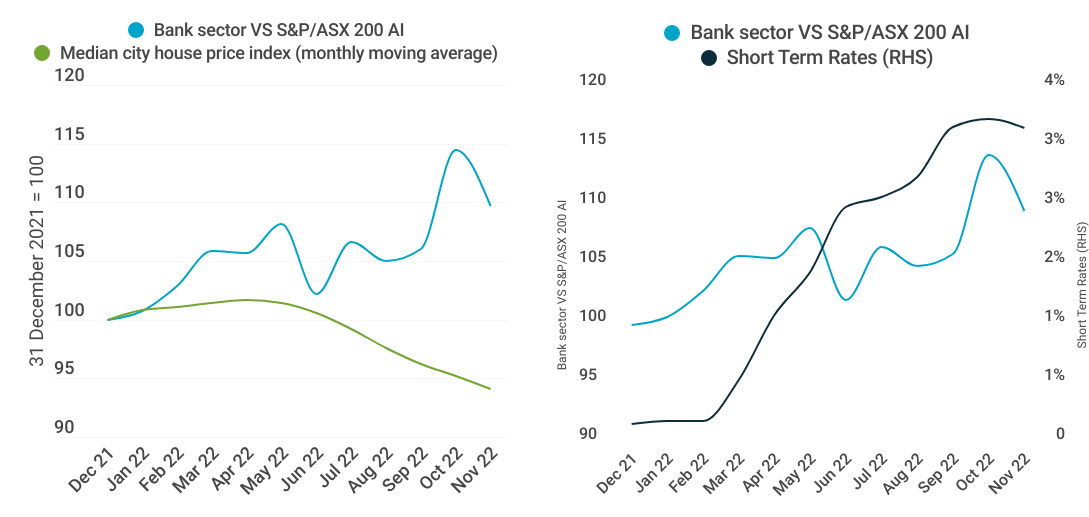

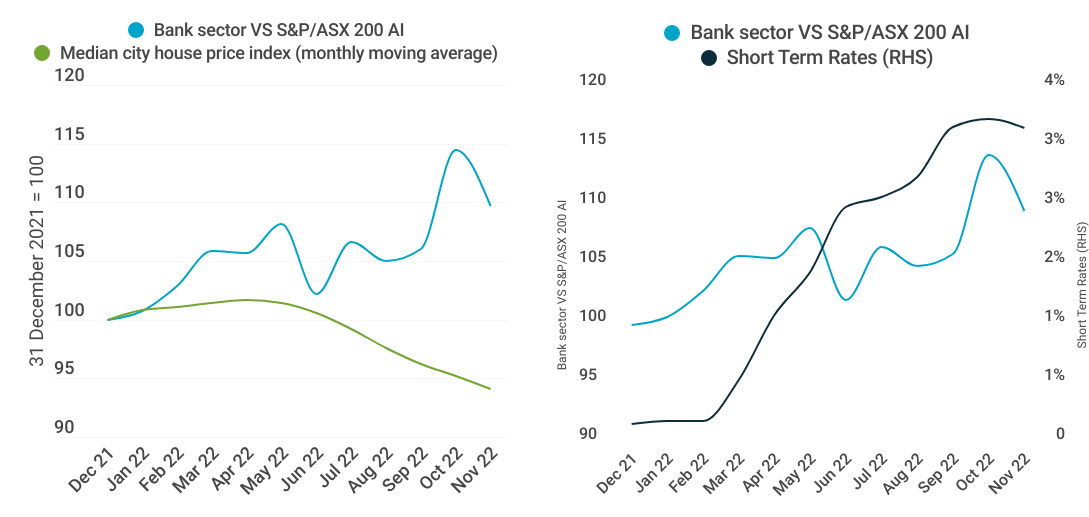

Australian banks spent much of the first half of 2022 facing concerns about the fallout from steeply rising rates on consumers, house prices, and credit risk. Since then, the material tailwind of higher rates for net interest margins (NIMs) has been recognised in share prices, with a reversal in sentiment between NIMs and housing risk.

Banks have bounced back from concerns

Australian banks spent much of the first half of 2022 facing concerns about the fallout from steeply rising rates on consumers, house prices, and credit risk. Since then, the material tailwind of higher rates for net interest margins (NIMs) has been recognised in share prices, with a reversal in sentiment between NIMs and housing risk.

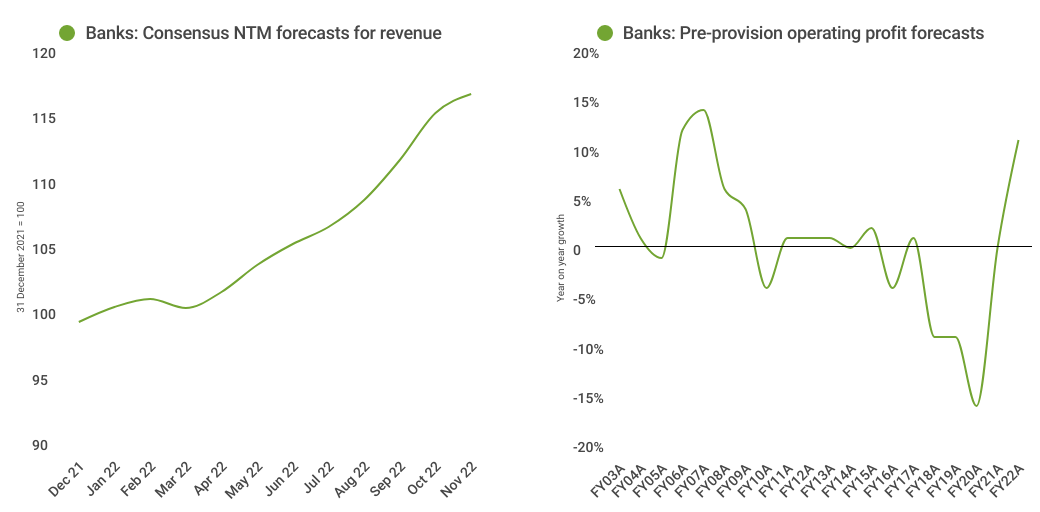

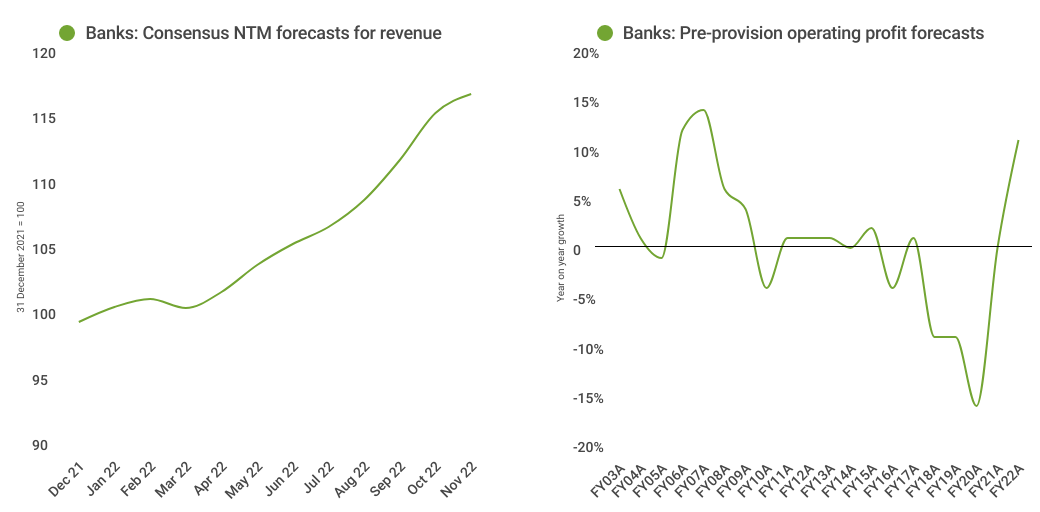

Reporting season reinforced profit growth

Banks were also one of the standout sectors through the August reporting season and November AGM period for upgraded revisions and share price performance. We are now seeing almost unprecedented top-line and pre-provision operating profit (PPOP) growth from the banks, and at least for now, impaired assets remain incredibly low.

Expected next 12 Months (NTM) data is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

Reporting season reinforced profit growth

Banks were also one of the standout sectors through the August reporting season and November AGM period for upgraded revisions and share price performance. We are now seeing almost unprecedented top-line and pre-provision operating profit (PPOP) growth from the banks, and at least for now, impaired assets remain incredibly low.

Expected next 12 Months (NTM) data is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

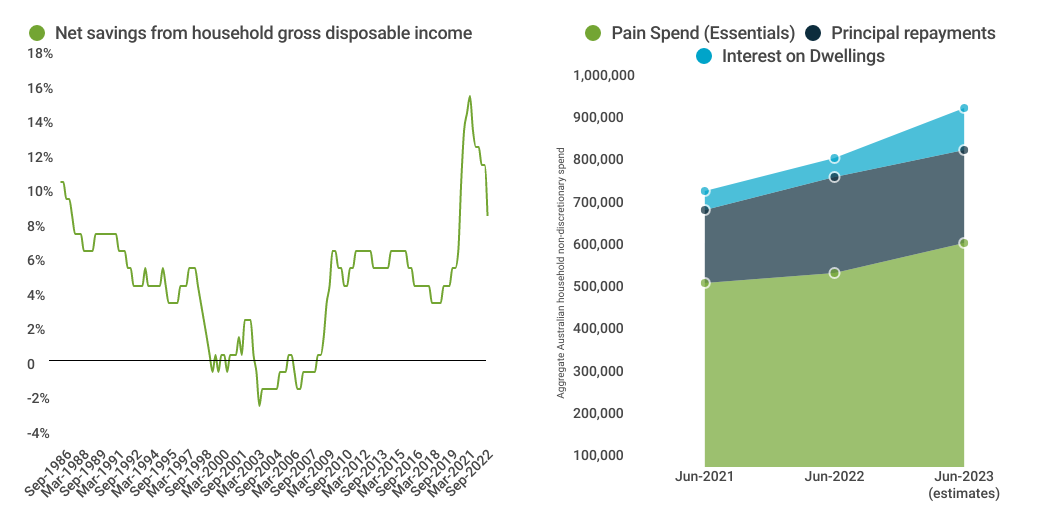

But debate over housing risk is likely to resurface

It seems that despite house prices continuing to fall throughout 2022, bank investors have now shrugged off earlier concerns, now focusing more on the peak in rates and evidence of consumers staying stronger for longer with adequate buffers to handle stress. However, the pressure from rising interest payments and fixed rate mortgage maturities is still largely ahead. We expect the debate for the banks sector earnings will swing back again as greater evidence for consumer pressure emerges.

Source: Martin Currie Australia, Australian Bureau of Statistics (ABS), Reserve Bank of Australia (RBA); as of 16 December 2022.

Sector is resilient for now, and ANZ remains our preferred exposure

Despite looming consumer pressure, we believe that bank earnings will continue to look solid for the near to mid-term, with the NIM tailwinds to be ongoing in 2023. The sheer weight of recent credit creation in the system is also providing support.

For our Value Equity strategy, our active positioning within the banks sector is most focussed on Australia and New Zealand Banking Group (ANZ), Virgin Money, Bendigo and Adelaide Bank. We see that all these banks have ample exposure to rising rates and other factors that will support a positive P/E re-rating.

While we have had a particularly positive outlook for ANZ Bank for some time, the negative market narrative on the bank’s mortgage volumes and the ANZ Plus digital banking move has improved since July when the company announced a more positive NIM outlook, embedded in a press release around their Suncorp Bank acquisition. To us, ANZ Bank remains the preferred major bank through this period of rising rates.

Past performance is not a guide to future returns.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.