Content navigation

Originally written on 3rd February 2025.

The tariffs applied are broad, and there has been a rapid follow through on this policy. Although at time of writing the tariffs on Canada and Mexico have been put on hold for 30 days.

The clean sweep for Donald Trump and Republicans in the US presidential election, in our view, will have the biggest influence on global markets in 2025.

We see this first step of tariff implementation by Trump as a clear negative for the Canadian and Mexican economic growth prospects and igniting an increased level of risk for investors.

Tariffs are likely to weigh on all five risks we highlighted for 2025

Tariffs and trade wars are likely to lead to a higher risk of stickier inflation in the US, as we believe that corporates will typically look to pass the increased tariffs onto their customers. Central banks, and notably the US Federal Reserve (Fed), will in our view find it hard to ignore the potential risk of higher inflationary pressures when setting their monetary policy actions, even if there is an argument that tariffs could be seen as a one-off shock and therefore could be ignored by monetary authorities.

A negative cocktail for inflation

A cocktail of stickier inflation, less dovish central banks, and increased trade friction is a negative for the economic growth outlook, even if each of the tariff implementations are on a case-by-base basis. As such, we see the potential risk of a trade war escalation as a negative for the global GDP growth outlook in 2025, and in turn for corporate earnings growth outlook.

The implication for equity markets is an increase in the equity risk premium

This will be seen as a negative by investors, dialling up the equity risk premium in markets. The risk is that Trump announces additional tariff initiatives against the EU, and further increases the magnitude of tariffs against China.

What to expect next

Investors need to be mindful that headline risk remains high whilst we go through the first weeks of the new US administration and as policy initiatives get announced. Any scenario from here is possible, whether it is escalation of tariffs, no change to announcements, broadening to additional countries/regions, or de-escalation, should some of the countries targeted take the expected right actions from President Trump’s point of view.

We note that some of the tariff announcements on Canada, Mexico and China are related to curbing fentanyl imports into the US, so one could envisage that proactive additional steps by these countries to tackle this specific area of focus could lead to de-escalation, which could appease markets.

-

Investors need to be mindful that headline risk remains high whilst we go through the first weeks of the new US administration and as policy initiatives get announced.

The sectors at risk

As we flagged previously, sectors at risk from tariff implementations will be those that have the largest mis-match between their production bases and the geographic exposures of their revenues. We highlight luxury cars as being at risk, alongside spirits companies, and luxury goods in particular. Industrials goods companies, and healthcare companies tend to have a relatively well matched production footprint to revenue generation. Similarly with technology companies, although we need to assess each company on a case-by-case basis, taking into account any input costs that could be caught in the tariff announcements, leading to a shift in pricing dynamics. Ultimately, pricing power of companies will be critical to assess how well they can navigate the increased uncertain environment brought by the tariffs. Companies with more pricing power will be able to better managed the risk of increased pricing that comes from higher tariffs.

Implications for the Long-Term Unconstrained strategies

We focus on companies with pricing power in general but are taking additional steps to assess any company that could be at outsized risk from tariffs. We do not have any outsized exposures to the Canadian and Mexican economies, and we estimate that our exposure to China on an underlying revenue and profit basis is significantly underweight in our Global and International strategies, and somewhat underweight in our International and European strategies.

The more important implications are likely to be the secondary effects of higher tariffs on the economic growth outlook, and specific impacts on some of the countries/regions. Europe and China could be at risk of weaker economic momentum, from what has already been a lacklustre period of growth. However, we also note that valuations of these regions have adjusted already, to some extent, to the negative risks from Trump policies. On the contrary, whilst the US has been seen as enjoying economic exceptionalism, valuations have become more demanding in US equities.

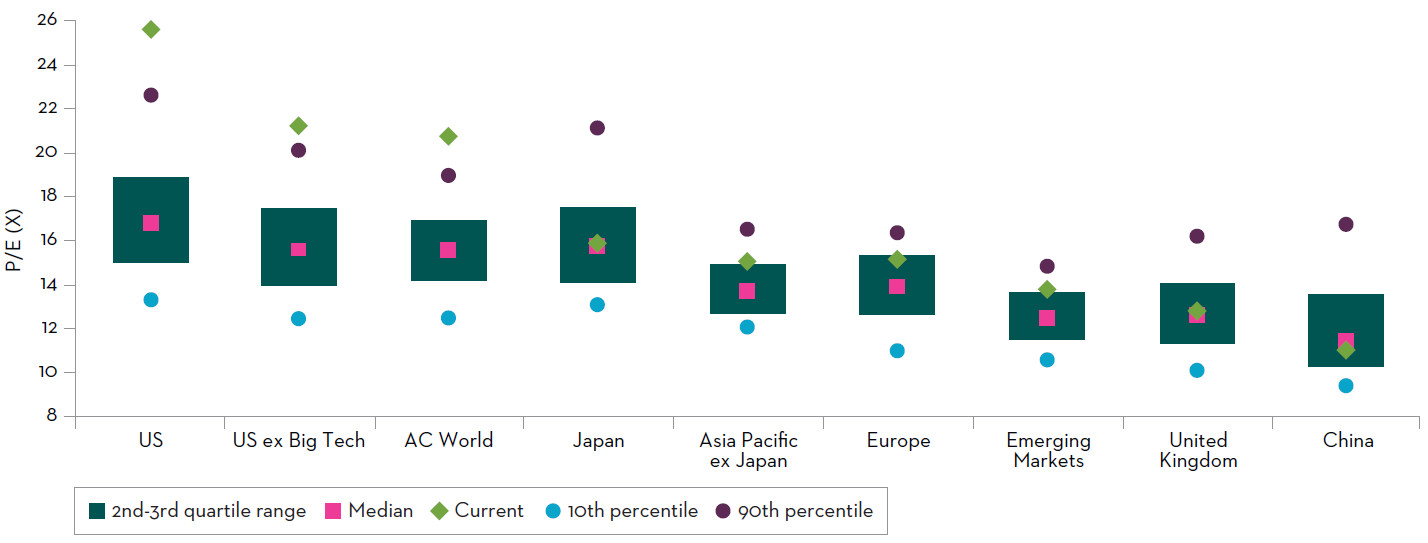

Forward P/E (FY1) across regions over last 20 years

Source: FactSet as at 31 January 2025.

The chart above shows the historic range of P/E ratios for each geography, with the median level, and the current level. It highlights that US equity markets, even when excluding the Magnificent Seven stocks, are currently trading at elevated levels compared to the historic range shown (the historic range is based on past 20 years of data).

The US exceptionalism is arguably reflected in the current valuations of its equity market, so we now need to see a supportive earnings momentum (both in terms of upgrades and broadening of the earnings momentum) to drive the US market meaningfully higher from here in our view.

European, Japanese, Chinese and Emerging Market (EM) equities have generally more supportive valuations when compared to historic ranges. This arguably means that some of the bear cases for these regions have already been discounted to some extent by investors. Despite more valuation support in European and Asian/EM equities, sentiment could still weigh on these regions of course, so once again, as equity investors, we continue to assess what will remain a very fluid situation.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.