Higher bond yields have the attention of income-focused investors who may be starting to consider government, corporate and high yield bonds as an alternative to dividend paying shares. However, with bonds “back” in vogue, and inflation and rates generally expected to be higher for longer, attention should also be turning to the total return prospects on offer in the listed Real Asset market.

Coupled with a higher growth outlook in a more inflationary environment, the building blocks for an appealing total return scenario are in place.

Real Asset yields reflect higher interest rates

With deep liquidity and transparent pricing, listed Real Assets have quickly priced in the world’s shift to higher rates and bond yields.

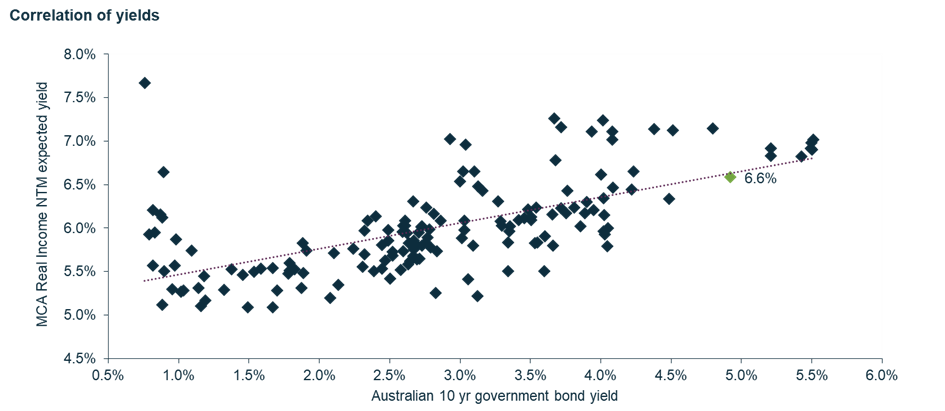

We believe that this is best reflected in our Martin Currie Australia Real Income strategy’s attractive expected next twelve-month (NTM) dividend yield, which is sitting at 6.6% as of 31 October 2023.* This compares favourably to previous lows of 5.1% at the end of 2021, before interest rates started rising.

Real Assets often exhibit a high correlation with interest rates, with their valuations and performance being notably influenced by changes in borrowing costs. In times of rising rates, Real Assets may face increased financing expenses, impacting their dividends. However, it’s crucial to recognise that this relationship is nuanced; while higher interest rates may pose challenges, they can also be indicative of a stronger growth outlook potentially driving increased Real Asset cashflows.

We can further examine the long-term relationship of listed Real Assets yields and the Australian 10-year government bond yield in the following chart. Since December 2010, aside from outliers from the Covid-19 shocks of March and April 2020, this relationship has some degree of explanatory value. The latest data point for Martin Currie Australia Real Income (shown as the green diamond) sits right on trend.

Past performance is not a guide to future returns. Source: Martin Currie Australia, FactSet; as of 31 October 2023.*

Can Real Assets match inflation?

Aside from a compelling yield, the ability for Real Assets to accelerate dividends and offer a degree of inflation protection also appeals in this more inflationary environment.

Real Assets encompass a diverse array of investments such as real estate, infrastructure, and utilities. One of the key attributes that make them attractive in an inflationary environment is their potential for pricing power.

Unlike nominal fixed-cashflow investments whose values may erode with inflation, Real Assets often possess cashflows that are contractually linked to inflation rates. For example, property leases often reference the CPI (Consumer Price Index), regulated monopolies typically include an inflation measure in their allowed returns, while energy utilities can benefit from a rising inflation environment as they often have the ability to pass through higher prices to end users.

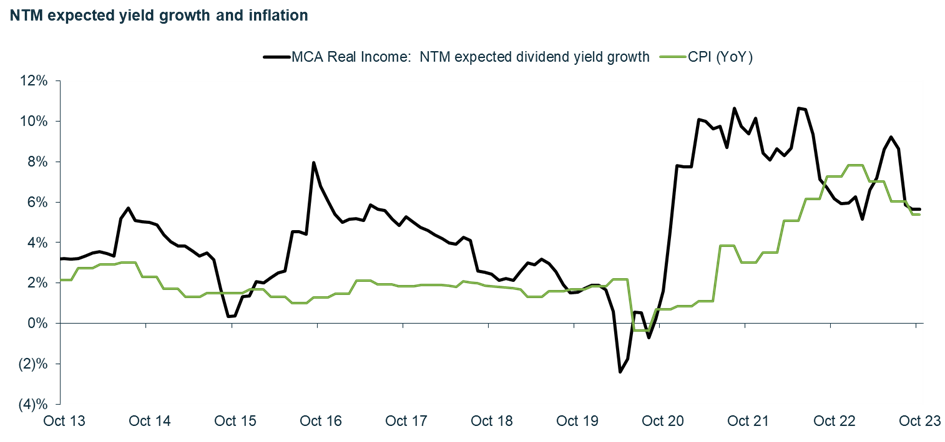

Examining, consensus data for expected NTM dividend yield growth through different inflationary environments over the past decade, we can observe in the following chart that:

- Martin Currie Australia Real Income portfolio’s expected NTM dividend yield growth currently sits at 5.7%, much higher than pre-Covid levels.*

- Following Covid impacts through 2019/20 and then the ensuing re-opening, expected NTM dividend growth has settled at higher levels that match our most recent observed higher rates of inflation.

Past performance is not a guide to future returns. Source: Martin Currie Australia, FactSet; as of 31 October 2023.*

-

Aside from an attractive yield, the ability for Real Assets to accelerate dividends and offer a degree of inflation protection also appeals in this more inflationary environment.

Combining yield plus growth for a Real total return

The capacity of listed Real Assets to boost dividends in a higher inflation environment transforms an already attractive expected yield into an even more compelling total return prospect.

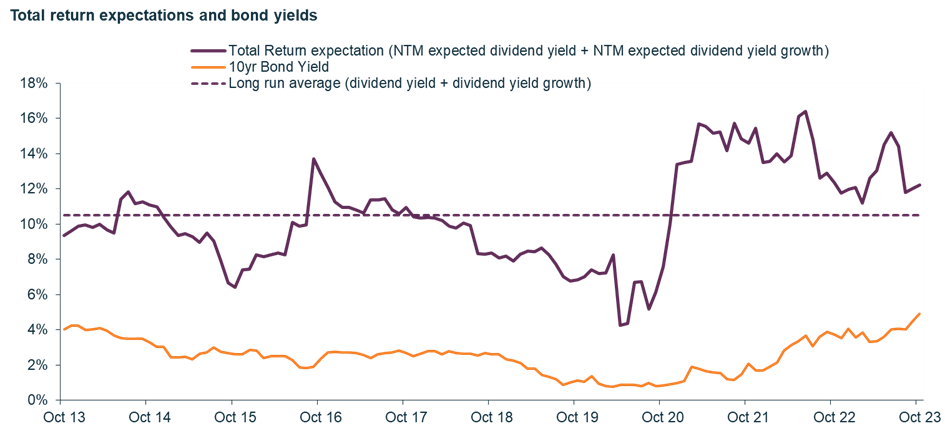

We can calculate a rough estimate of the expected total return opportunity using the rule of thumb calculation of total return = yield + dividend yield growth. This is similar to the bond concept of a “yield-to-maturity”.

For further perspective, on a forward-looking basis the expected total return for our Martin Currie Australia Real Income strategy currently sits above its long-run average over the past decade.

Past performance is not a guide to future returns. Source: Martin Currie Australia, FactSet; as of 31 October 2023.*

Investing in the megatrends to navigate any rough waters ahead

As we navigate an evolving economic landscape, the defensive qualities of Real Assets become particularly valuable.

In the face of uncertainties, Real Assets may provide an equity ‘anchor’, diversifying portfolios from the volatility that often accompanies stocks with more uncertain earnings streams. This is because Real Assets are typically less exposed to the economic cycle given their ‘everyday needs’ nature, and they have demand growth drivers that are more external to short term economic and market levers.

When seeking out the most promising listed Real Asset investment opportunities, our focus is on the impact of three key megatrends on demand growth:

- Population growth: We invest in markets (such as Australia) where population growth is driving greater demand for Real Assets - more customers everyday helps underpin pricing power.

- Energy transition: This ongoing theme furthers bolsters demand to build out renewables, firming capacity and grids to facilitate greater electrification.

- Data growth: Explosive growth in data needs is also driving demand for Real Asset services, this includes everything from telco towers, fibre networks to data centres.

A strong setup for long-term total return

In conclusion, we see Real Assets re-emerging as a compelling investment choice, offering attractive yields relative to the wider equity market, and the potential for income growth with some insulation against inflation. The current environment of high real interest rates sets a favourable stage for the total return of Real Assets, especially considering that even a minor downward adjustment in long-term inflation expectations can enhance their valuation outlook. This, combined with the ongoing megatrends driving consistent demand, paints a promising and robust outlook for Real Assets.REAL ASSETS: Investing to Improve Lives

-

Find out more about the Martin Currie Australia Real Assets platform.

REAL ASSETS: Investing to Improve Lives

-

Find out more about the Martin Currie Australia Real Assets platform.

Sources

Source: Martin Currie Australia, FactSet; as of 31 October 2023.

Data calculated for a representative Martin Currie Australia Real Income account. Expected next 12 Months (NTM) Income is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Income strategy charges are deducted from capital. Because of this, the level of income may be higher but the growth potential of the capital value of the investment may be reduced.

For wholesale investors in Australia: Any distribution of this material in Australia is by Martin Currie Australia (‘MCA’). Martin Currie Australia is a division of Franklin Templeton Australia Limited (ABN 76 004 835 849). Franklin Templeton Australia Limited is a wholly owned subsidiary of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. 240827) issued pursuant to the Corporations Act 2001.