Key Takeaways:

- Historic valuation spreads are flashing opportunity signals: The gap between cheap and expensive stocks has reached levels only seen at major market turning points—each time setting the stage for Value investors to benefit.

- Today's Value stocks should offer a safety net: Unlike previous Value rallies, today's opportunities are concentrated in lower-risk companies—giving both upside potential AND protection against market chaos.

- Market euphoria is masking fundamentals: As sentiment-driven rallies push the Australia market to record highs, a reconnection with reality is inevitable—and often painful for those caught unprepared.

- The clock is ticking: These extreme valuation disparities typically resolve within 18 months—meaning this opportunity won't wait around.

- Multiple ways to capitalise: Whether you prefer high conviction plays or a more balanced approach, there are strategies to capture the Value premium while managing risk and prioritising fundamental valuation.

Shifting Gears: Are You in the Right Lane?

Time and again, after being left in the rearview mirror, Value has staged powerful comebacks. Value style investing has been in the doldrums for some time, but change is afoot.

The widening disconnect between price and earnings forecasts—along with the growing chasm between the market's most expensive and cheapest stocks—suggests we're approaching a moment of reckoning that could significantly reward Value-oriented investors. For us, the question isn’t if Value will outperform but when—and based on our history of managing Australian Value Equity portfolios, when it does, the acceleration is fast and powerful.

The Value Gap: Bigger Than We've Seen in Decades

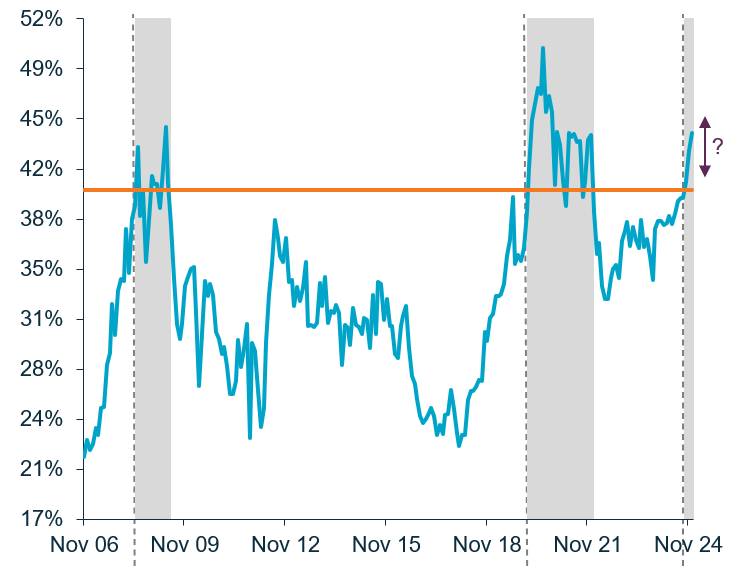

Drawing on over 20 years of fundamental company valuations, our team has a unique lens into just how extreme today's opportunity has become. We measure this by tracking the valuation spread between our Value Equity portfolio holdings and the broader S&P/ASX 2001.

The data is striking: today's valuation spread has surpassed 40%—a level we've only seen three times in the past two decades. Each previous instance—following the Tech Bubble, during the Global Financial Crisis, and after the COVID-19 crash—marked the beginning of extraordinary outperformance for Value investors.

MCA Valuation Spread:

Safety First: The Unusual Protection Play in Today's Value Stocks

Typically, Value rallies come with higher risk profiles. What makes today's setup unique? The Value opportunity is concentrated in lower-risk, low-beta stocks—essentially giving investors both upside potential and downside mitigation.

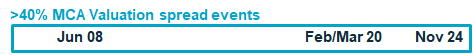

The current conditions closely mirror what we saw in early 2000, when the MSCI Australian Value Index, after years of lagging performance, suddenly surged ahead and delivered market-beating returns for several years running2. Over the months that followed, the premium of the Value style in Australia was uniquely valuable. In the face of deep US and World market drawdowns, Australian Value investors were able to realise positive absolute returns.

Cumulative return before and after March 2000

Today, we see a similar opportunity. We're particularly excited about the quality and diversification of undervalued Australian stocks available today. In our active portfolios, we're overweight what we believe are attractively valued quality businesses including Medibank Private, ANZ Banking Group, QBE Insurance, Aurizon, Flight Centre, and AGL Energy, while maintaining underweight positions in fully valued names like CBA and CSL.

The Sentiment Shift: Why Fundamentals Are About to Matter Again

Markets have been riding high on a wave of optimism and momentum, with prices seemingly detached from underlying business fundamentals.

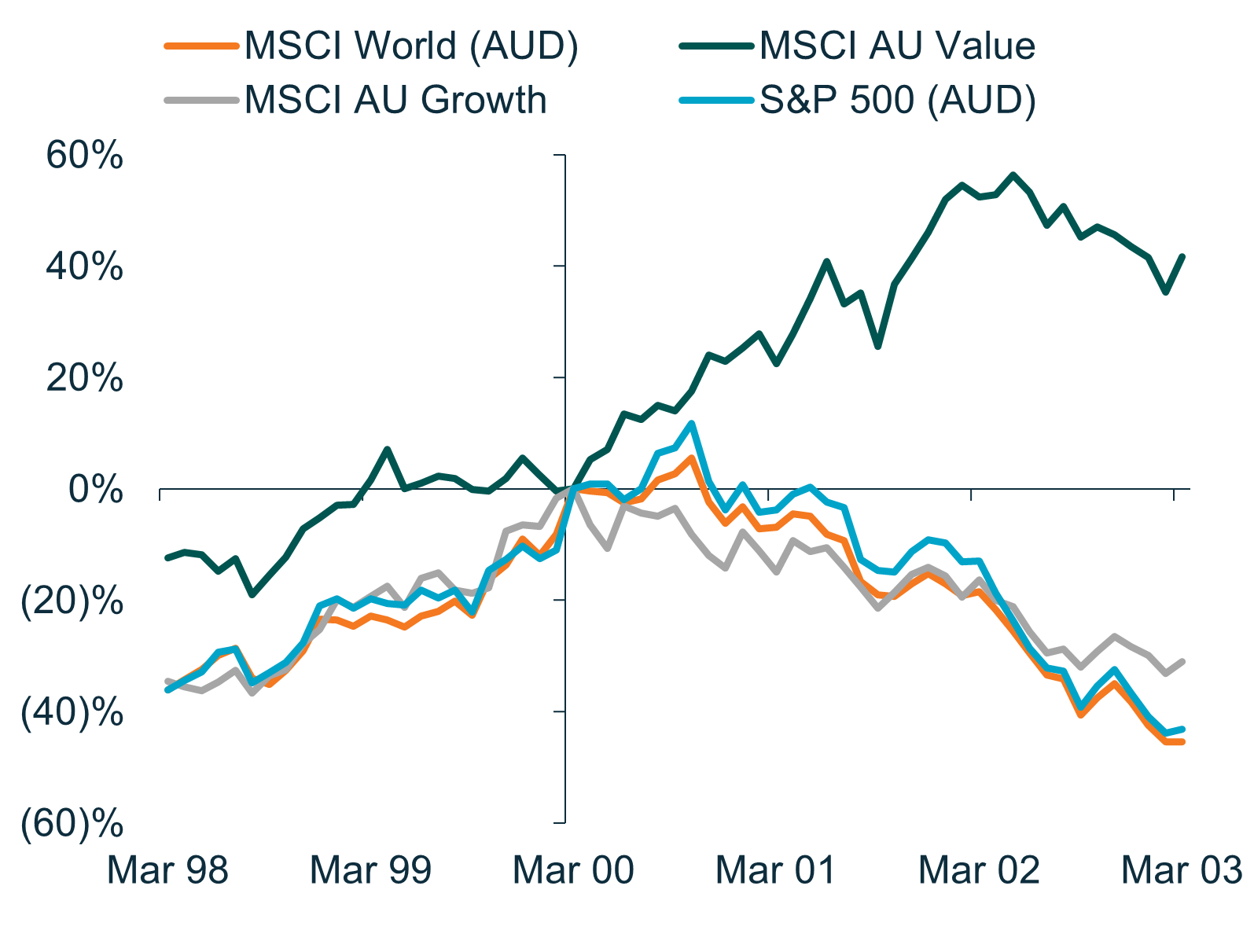

An example of this can be seen in the stocks shown in the table3. We have concealed the identities of these two Australian listed stocks, but they both trade in the same sector and operate in the same geographic regions targeting primarily the mass middle market of Australian households. They are both established leaders in their respective segment.

On current metrics, Stock A offered a better return on equity, dividend yield and EPS growth than Stock B. Whilst there is more to the assessment of both company’s prospects than merely a simple comparison of the numbers, the market has rewarded Stock B with a significant premium.

History reminds us that periods of market euphoria inevitably give way to reality checks—and those transitions can happen with startling speed. The key challenge for investors is identifying when this will shift—forcing the market to refocus on the fundamentals, valuation and earnings.

Why Act Now? The Opportunity Won't Last Forever

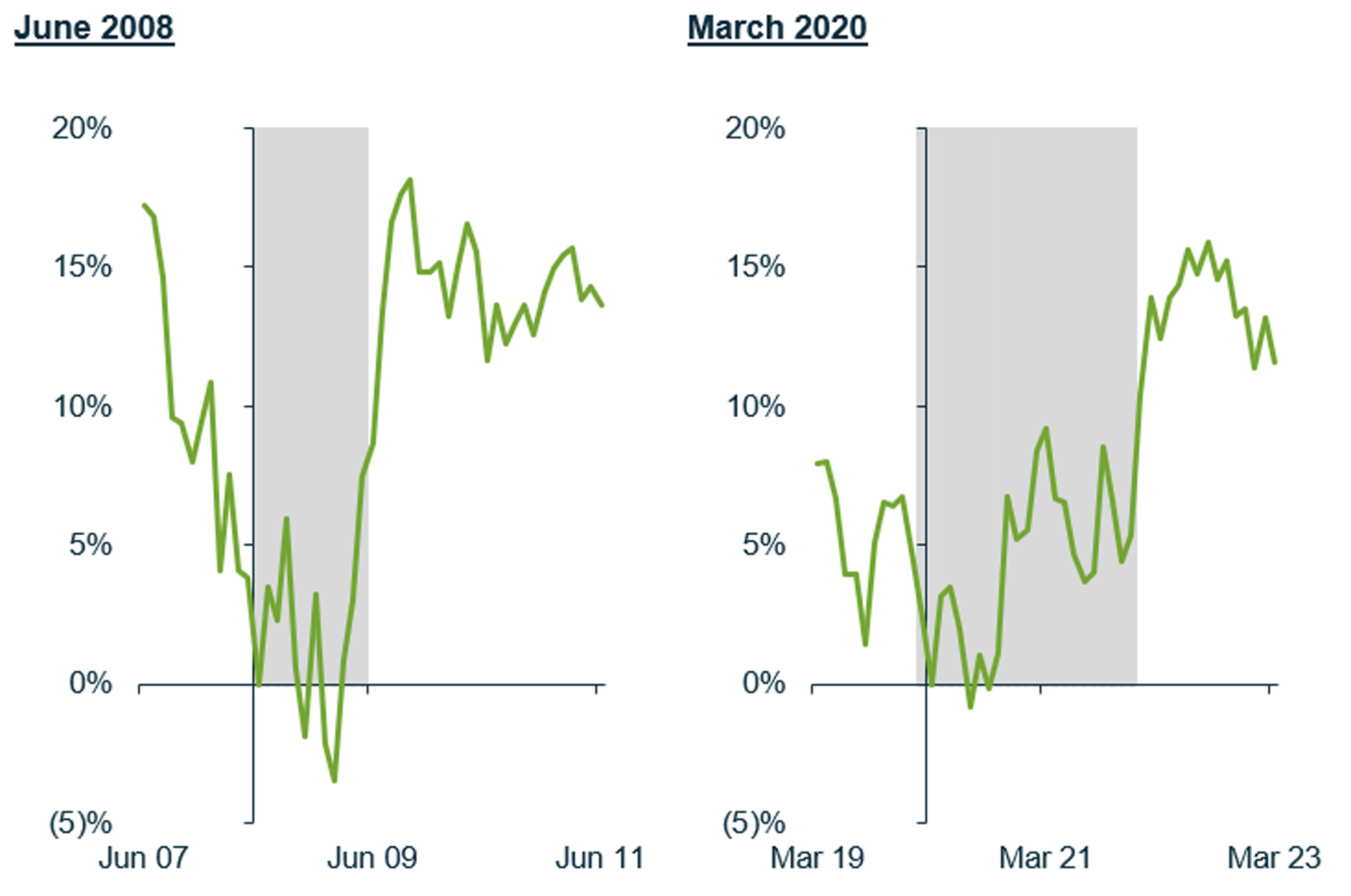

Valuation disconnects of this magnitude rarely persist beyond 18 months, as can be seen in the experience of our Value Equity portfolio4. For investors who recognise what's happening, we believe that the time to reassess Value exposure is now—before the market catches up. In fact, February returns for our Australia Value Equity strategy portfolios already show early signs that Value is truly ‘back’

Like all market opportunities, this one comes with its own set of considerations. Value investing requires patience and conviction. The largest returns often come after periods of maximum pain, making it psychologically challenging to maintain positions against prevailing market sentiment.

Cumulative alpha for MCA Equity Value before and after

each >40% MCA Valuation Spread event

However, for investors willing to look beyond short-term market noise and focus on fundamental business valuations, the potential rewards appear substantial. Whether through high-active share approaches that maximise alpha potential or through style-neutral, risk-controlled strategies that prioritise fundamental valuation while managing broader risk factors, the Value opportunity appears robust enough to benefit multiple implementation approaches.

Multiple ways to capitalise

Given the size of the Value opportunity, we believe that all investors can benefit, even those facing strict performance and risk benchmarks. Our team are available to discuss how best to position for the opportunity through either:

- Research-driven contrarian stock picks that target undervalued companies with strong fundamentals (MCA Value Equity strategy),

- A risk-managed strategy combining fundamental analysis with quantitative techniques to capture value opportunities while minimising sector and style risks (MCA Active Insights strategy), or

- A flexible portfolio that shifts between value and style-neutral positions based on market cycles to optimise returns (MCA Dynamic Value strategy).

As Warren Buffett famously observed, "Price is what you pay; value is what you get." In today's market, the gap between those two concepts has rarely been wider—and history suggests that gap won't persist indefinitely.

The question for investors isn't whether valuation will matter again, but whether they'll be positioned to benefit when it does.

-

Value style investing has been in the doldrums for some time, but the tide appears to be turning.

Sources

Past performance is not a guide to future returns.

1 Source: MCA, FactSet; as of 31 December 2024. Data shown for a representative MCA Value Equity account vs. S&P/ASX 200 (log)

2 Source: MCA, FactSet; as of 31 December 2024. Returns shown in A$ gross of management fee.

3 Source: MCA, FactSet; as of 31 December 2024.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

*Expected next 12 Months (NTM) data is calculated using the weighted average of broker consensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed and may differ materially from the figures mentioned. The figures may also be affected by inaccurate assumptions or by known or unknown risks and uncertainties. In respect of the broker consensus data the number of brokers included for each individual stock will vary depending on active coverage of that stock by a broker at any point in time. A median of brokers is typically utilised. All estimates avoid stale forecasts which are removed after a certain number of days.

4 Source: MCA, FactSet; as of 31 December 2024.

Data shown for a representative MCA Value Equity account.

Returns shown in A$ gross of management fee. Index: S&P/ASX 200

Important information

This publication is issued for information purposes only and does not constitute investment or financial product advice. It expresses no views as to the suitability of the services or other matters described in this document as to the individual circumstances, objectives, financial situation, or needs of any recipient. You should assess whether the information is appropriate for you and consider obtaining independent taxation, legal, financial or other professional advice before making an investment decision.

Neither MCA, Franklin Templeton Australia, nor any other company within the Franklin Templeton group guarantees the performance of any Fund, nor do they provide any guarantee in respect of the repayment of your capital.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, or a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by MCA, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy / fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable. It is not known whether the stocks mentioned will feature in any future portfolios managed by MCA. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions.