April and May 2023 have been a period with significant news flow for investors. We have seen company quarterlies, half-year results, investors days, trading updates, the annual Macquarie Australia conference and economic surveys – all of which have highlighted themes with real implications for both the Australian equity market, and our Value Equity portfolio positioning1. The outlook remains strong for the Value style, but it is as important than ever for investors to be discerning in their stock picking.

Inflation rages on and Australian consumer confidence points to contractionary conditions.

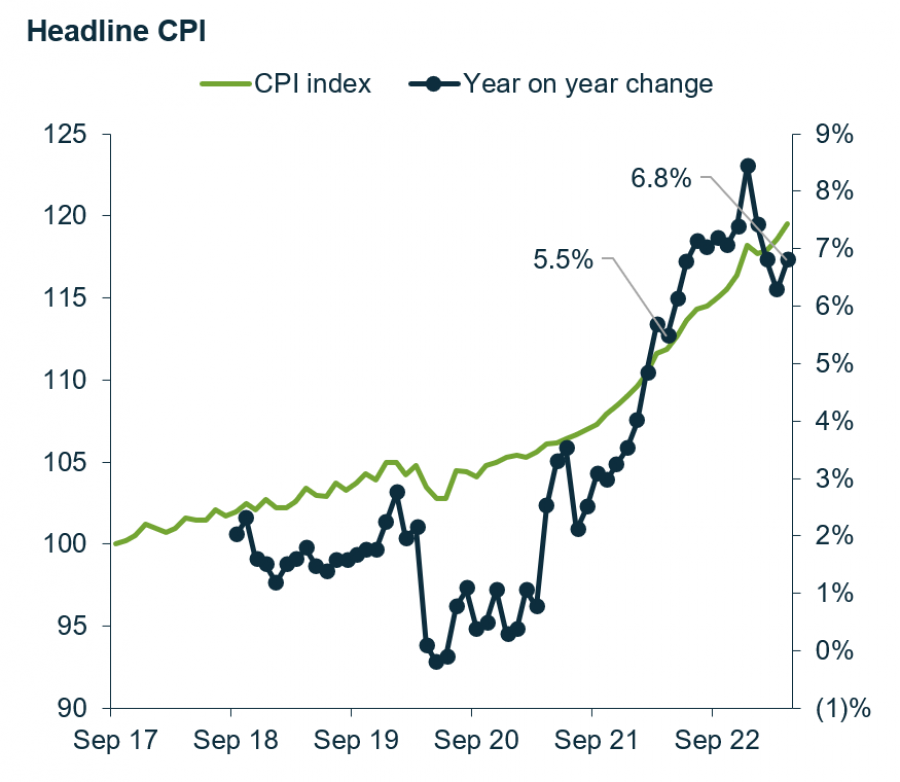

First and foremost, in the news flow, Australia’s headline CPI print for April was higher than expected at +6.8% p.a2 We believe this result is concerning for two reasons.

- This 6.8% is compounding on the high 5.5% p.a. inflation read from a year ago – despite starting from an already high level, inflation remains elevated.

- The month-on-month trend is not showing signs of any slowing.

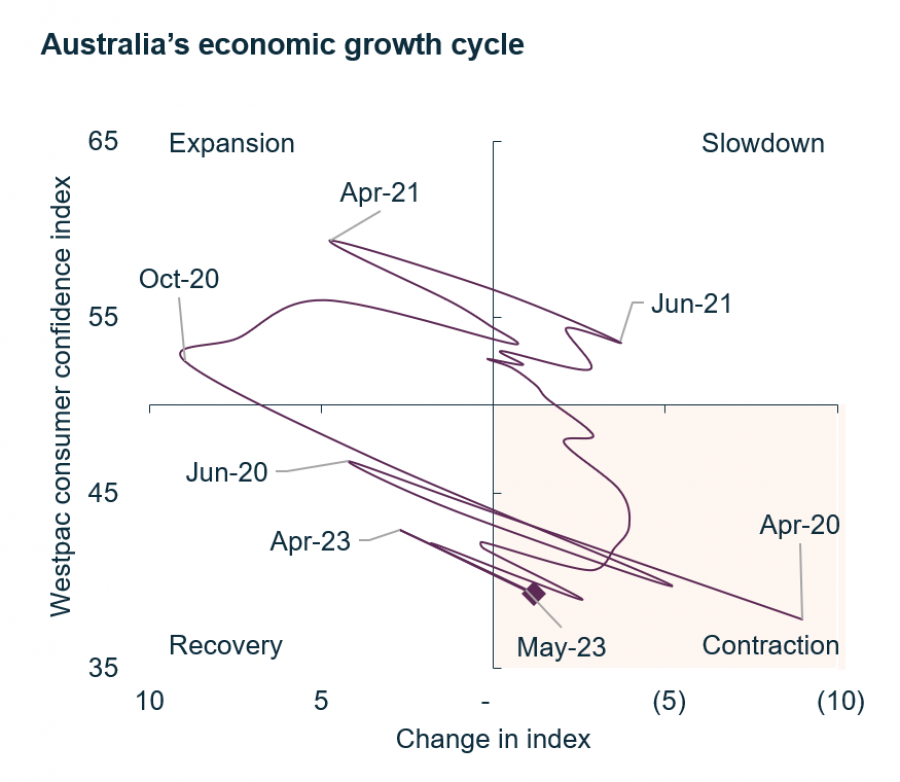

Australian consumer confidence indicators have also plummeted to new lows on the back of a rising cost of living and ongoing interest rate hike concerns3. Stocks such as Lovisa Holdings, Super Retail Group and Premier Investments are examples of those that fell in May on these cycle concerns

We are typically underweighting the Consumer Discretionary sector in our Value portfolio. We see current sales levels normalising lower as the above-trend growth through Covid reverses and more challenged household budgets compound the downturn. We heard a good example of this budget crunch from Wesfarmers, who were highlighting evidence of consumer spending slowing and ‘trading down’ at their strategy day this month.

In contrast to falling consumer goods sales, tourism stocks such as Flight Centre Travel Group have seen earnings upgrades. Covid reopening is still providing a tail wind as the travel market transitions from a price recovery to a volume recovery.

-

As the world continues to normalise to higher rates and long-term inflation expectations, the market thematic continues to play towards an ongoing attractive environment for the Value style.

Inflation impacting growth and volumes

The Covid-impacted supply chain and government stimulus-induced high inflationary environment has made for strong positive nominal GDP numbers in Australia. However, the impact of inflation on growth and volumes is far more concerning.

Economists tend to focus on Real GDP per Capita whereas Equity investors often focus on Nominal Sales growth. Amcor recently provided a trading update that showed negative packaging volume growth that resulted in earnings downgrades and share price falls. This result was a good demonstration of how weak volumes really matter to company profits.

We are concerned more broadly for the outlook for company profits in a world of negative real GDP per capita growth4.

Wage growth and inflation puts pressure on companies

The recent decision by the Fair Work Commission to raise all Modern Award Wages by 5.75% has added to the existing inflationary pressures.

We have discussed the implications of a potential high award outcome with companies such as Woolworths over the recent months, and it is clear that companies have been preparing for this possibility for some time. Woolworths for example has been working on automation projects that can lead to productivity offsets for the FY24 year to control overall wage growth at a group level.

We do own several reflation beneficiaries in our portfolios but we are avoiding rate sensitive names such as those with high debt levels, given potential funding stress after rate rises and the potential for debt markets to tighten in a slowing economy.

The rise of AI

Tech stocks have been particularly strong this year in the US on the back of growing interest in Artificial Intelligence (AI), especially Nvidia. This has played out in Australia with very strong performance for the market’s few tech stocks such as Megaport post an upgrade on cost out, Xero through a focus on profit, and WiseTech Global.

With each of these stocks currently trading at extreme valuations (PE >70x)5, we can find alternatives to tech stocks that offer superior valuation upside potential for our Value portfolios.

Concentration in winners likely to unwind

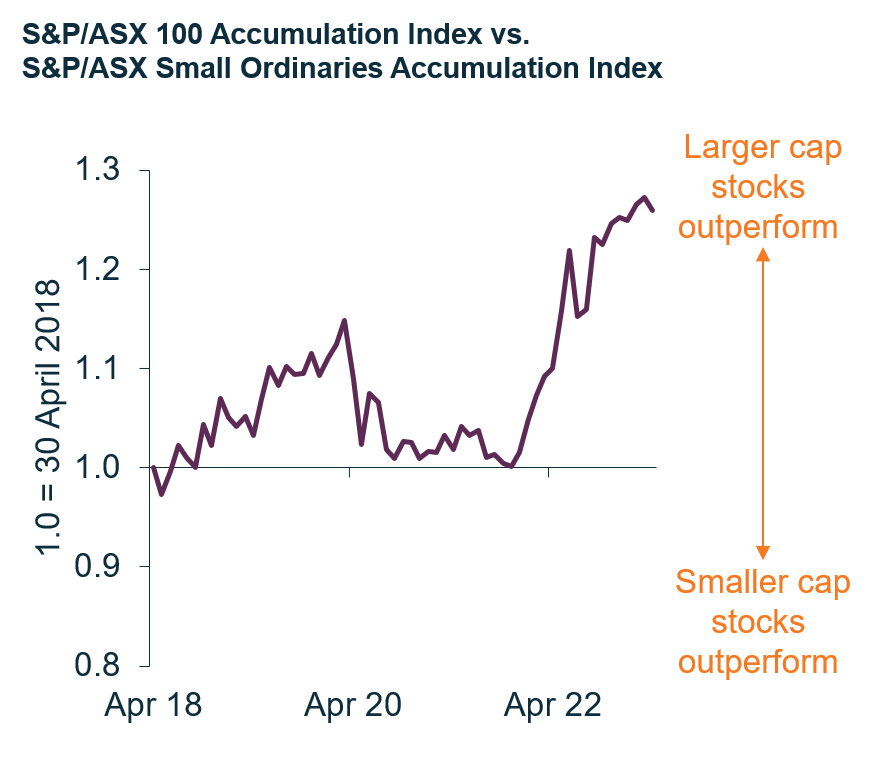

Concentrated index performance has also been a negative theme for active manager performance this year, both in Australia and the US6.

- In the US, just 7 stocks in the S&P 500 are up 70% year to date, while the other 493 stocks in index are up only 0.1%.

- In Australia, this has been evident via the 30% outperformance of the S&P/ASX 100 vs the Small Ordinaries index.

At the annual Macquarie Australia Conference in early May, it was evident how fund managers are now searching for value outside of large cap names by the high attendance at small company presentations.

The outperformance of large cap stocks versus small caps is already at peak levels, and as this inevitably unwinds, we see opportunities for active managers. As our Value portfolios are best ideas/high conviction, we have always had a natural bias away from the largest securities.

Energy transition themes playing out

Finally, the energy transition is an important ongoing theme for our Value portfolios, news flow has been positive for several of our key overweight holdings in May.

Worley is one of our long-term overweight stocks, and it was finally moved from being classified in the GICS Energy sector to the Industrials sector under Construction & Engineering. This appeared to draw in new investors, and its investor day highlighted the growth and significance of Sustainability and energy transition revenues.

Additionally, AGL Energy was strong as the Australian Energy Regulator passed higher Retail electricity prices for Victoria that will see a material uplift in their EPS in FY24, the forward curve increase following the Liddell closure in April, and the Australian Energy Market Operator recently highlighting expected tightness in market through 2025.

Aurizon also highlighted at the Macquarie conference its key attributes of inflation protection, weather related volume recovery and its moves into ‘new economy’ commodities that support the energy transition. Aurizon’s regulated rate of return will be set during June 2023 which will lead to higher regulated returns over the next regulatory period.

The implications from these themes: Defensive positioning for Value portfolios

As the world continues to normalise to higher rates and long-term inflation expectations, the market thematic continues to play towards an ongoing attractive environment for the Value style.

Growth stocks are expensive, and Value stocks are still far cheaper today relative to history. As these extremes will inevitably unwind, the Valuation starting point for excess returns to Value investing is strong for the next decade.

However, it is more important than ever for investors to be discerning in their stock picking, focussing on companies that can maintain earnings in this environment yet not be exposed to expensive stocks with valuation risk.

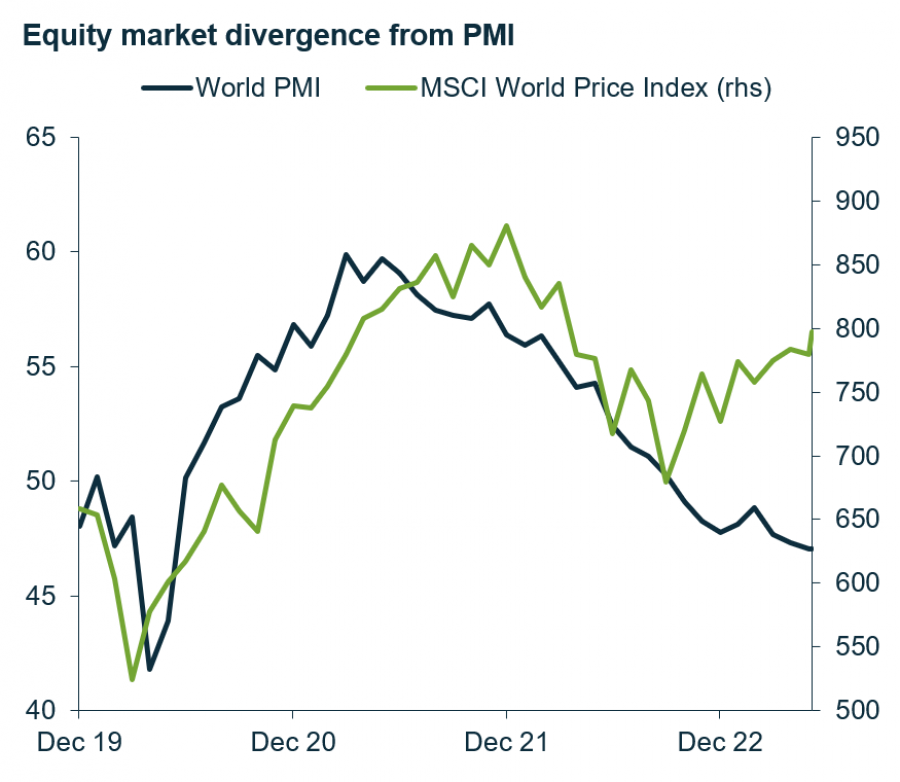

We remain concerned about market complacency on the slowing real economy. Economic growth, as represented by PMI surveys, continues to slow yet equity markets have rebounded since October 20227. This is implying little margin of safety in broad market pricing.

As such we are now much more defensive in our positioning (as seen by a portfolio beta of close to 1.00)8, avoiding those discretionary sectors that will be impacted by an ongoing contraction in household budgets and targeting companies with strong balance sheets and robust cash flows.

Positioned for the Value opportunity

-

The Martin Currie Australia Value Equity strategy provide investors with a diversified exposure to our highest conviction stock ideas with Valuation potential, while balancing risks through our focus on Quality & Direction analysis. Click here to find out more about the Martin Currie Australia Value Equity strategy.

Click to display all sources >>

Past performance is not a guide to future returns.

1 Source: Martin Currie Australia, as of 31 May 2023. All holdings are based on a representative account vs. S&P/ASX 200.

2 Source: ABS; as of 30 April 2023. Monthly Consumer Price Index Indicator. 6484.0 Monthly Consumer Price Index indicator. Available from https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/monthly-consumer-price-index-indicator/latest-release

3 Source: FactSet, Westpac; as of 31 May 2023

4 Source: FactSet; as of 31 May 2023

5 Source: FactSet, as of 31 May 2023

6 Source: FactSet, as of 31 May 2023

7 Source: FactSet; as of 31 May 2023

8 Source: Martin Currie Australia, as of 31 May 2023. Based on a representative account vs. S&P/ASX 200.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings - Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- The strategy may invest in derivatives (index futures) to obtain, increase or reduce exposure to underlying assets. The use of derivatives may restrict potential gains and may result in greater fluctuations of returns for the portfolio. Certain types of derivatives may become difficult to purchase or sell in such market conditions