Content navigation

Four reasons for perseverance in Emerging Markets (EM)

We are at the beginning of a more favourable monetary policy backdrop

- Key EM economies are expected to cut rates in the next two years: China, India, Indonesia, Korea, Taiwan, Brazil, Mexico, and South Africa. Together they represent 86% of the index.1

Chinese share prices will revert back to fundamentals and there is a significant valuation opportunity

- Despite delivering solid earnings growth, Chinese stocks derated in 2023, creating a dislocation between fundamentals and valuation. We delve into the opportunity it presents in more detail in pages 3-5.

India will help drive forward the earnings growth and performance of EM

- India’s weight in the MSCI EM Index has almost doubled.2

- India has a performance gap vs. EM of almost 90 percentage points and 33 percentage points against the S&P 500.3

- MSCI India delivered 69% earnings-per-share (EPS) growth vs. 35% for the S&P 500.4

In the past four years:

EM technology will go from strength to strength: Information technology (IT) represents 22% of the index and 32% of our strategy5

- IT has been the best performing sector in EM over the long term.6

- EM technology stocks are expected to deliver earnings growth of more than triple the US (almost 60% vs. 17% in the next two years), whilst trading at a 40% discount to US technology.7

- MSCI India delivered 69% earnings-per-share (EPS) growth vs. 35% for the S&P 500.4

Four reasons for perseverance in Emerging Markets (EM)

We are at the beginning of a more favourable monetary policy backdrop

- Key EM economies are expected to cut rates in the next two years: China, India, Indonesia, Korea, Taiwan, Brazil, Mexico, and South Africa. Together they represent 86% of the index.1

Chinese share prices will revert back to fundamentals and there is a significant valuation opportunity

- Despite delivering solid earnings growth, Chinese stocks derated in 2023, creating a dislocation between fundamentals and valuation. We delve into the opportunity it presents in more detail in pages 3-5.

India will help drive forward the earnings growth and performance of EM

- India’s weight in the MSCI EM Index has almost doubled.2

- India has a performance gap vs. EM of almost 90 percentage points and 33 percentage points against the S&P 500.3

- MSCI India delivered 69% earnings-per-share (EPS) growth vs. 35% for the S&P 500.4

In the past four years:

EM technology will go from strength to strength: Information technology (IT) represents 22% of the index and 32% of our strategy5

- IT has been the best performing sector in EM over the long term.6

- EM technology stocks are expected to deliver earnings growth of more than triple the US (almost 60% vs. 17% in the next two years), whilst trading at a 40% discount to US technology.7

- MSCI India delivered 69% earnings-per-share (EPS) growth vs. 35% for the S&P 500.4

-

The problem is not fundamentals. The problem is valuation.

-

The problem is not fundamentals. The problem is valuation.

Challenges in 2023 have created opportunities for 2024 and beyond

Style headwinds impacted performance with the strongest outperformance of value vs. growth in a quarter of a century.8

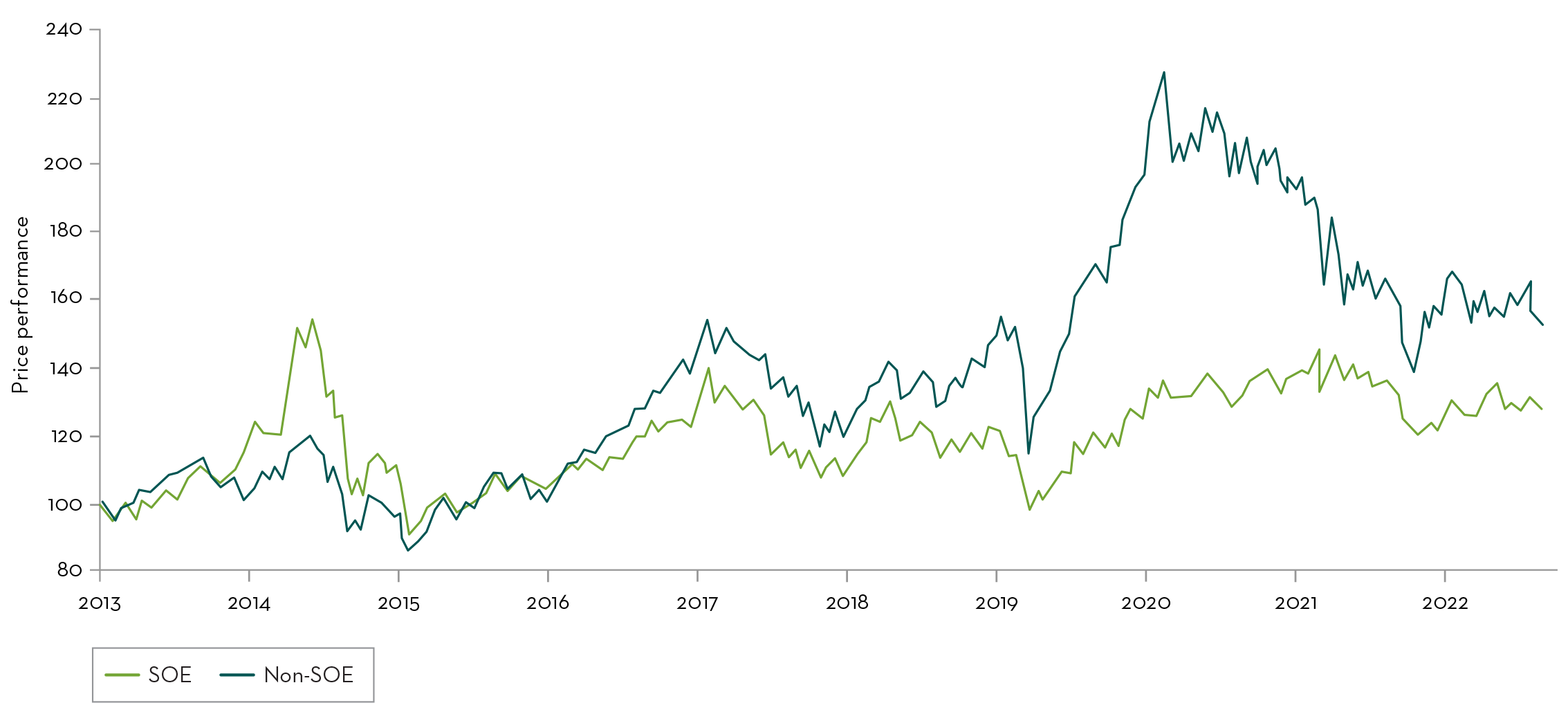

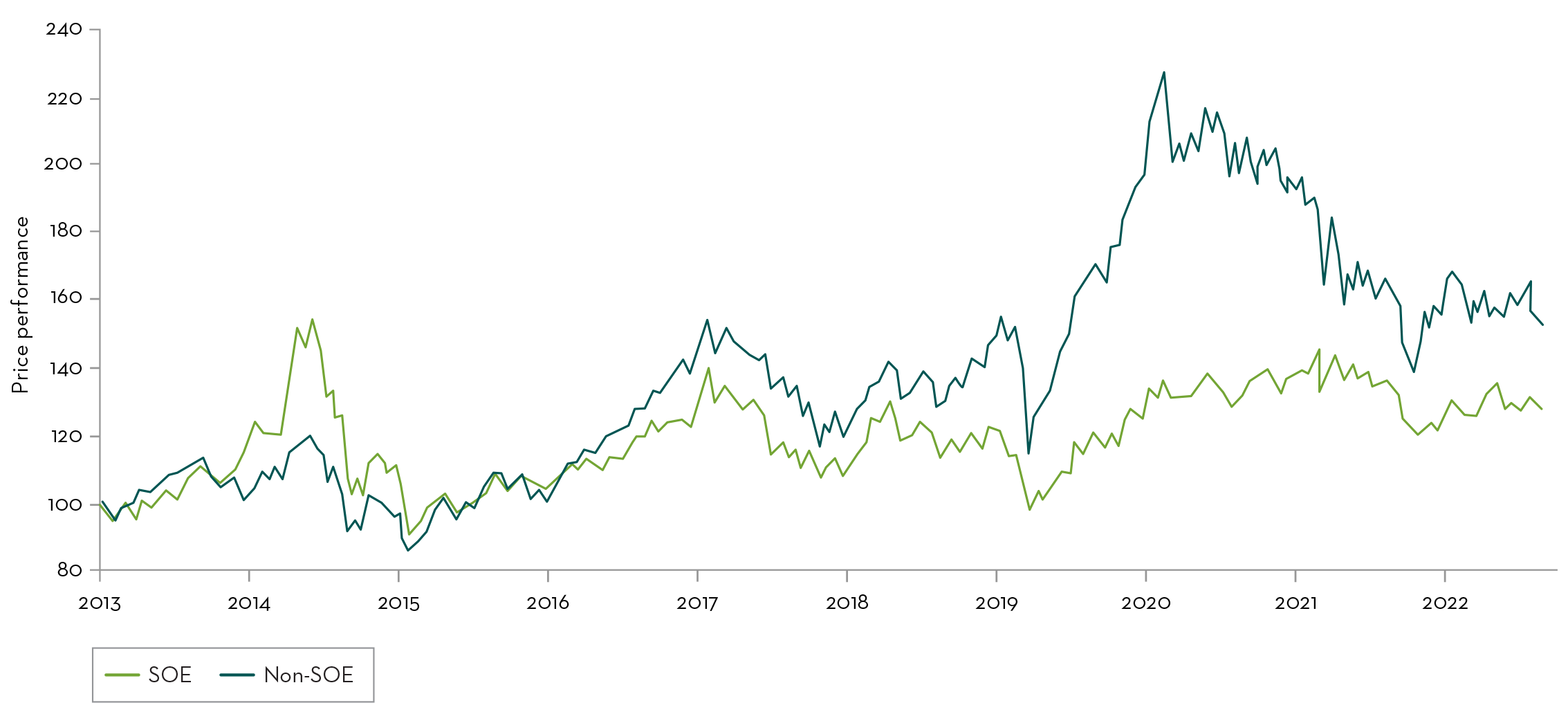

- In particular, quality growth was challenged in China where, amidst broadly falling markets, state-owned/value stocks outperformed private/quality growth stocks. With a more accommodative central bank environment globally, we expect the market to reward quality growth companies once again

Technology was the most significant contributor to the portfolio’s performance in 2023.9

- Our overweight to the sector and stock selection supported performance, particularly semiconductors, hardware, and IT services. Even following from a strong 2023, we expect a continuation of strength in the sector, given the earnings growth outlook and valuation discount relative to US technology.

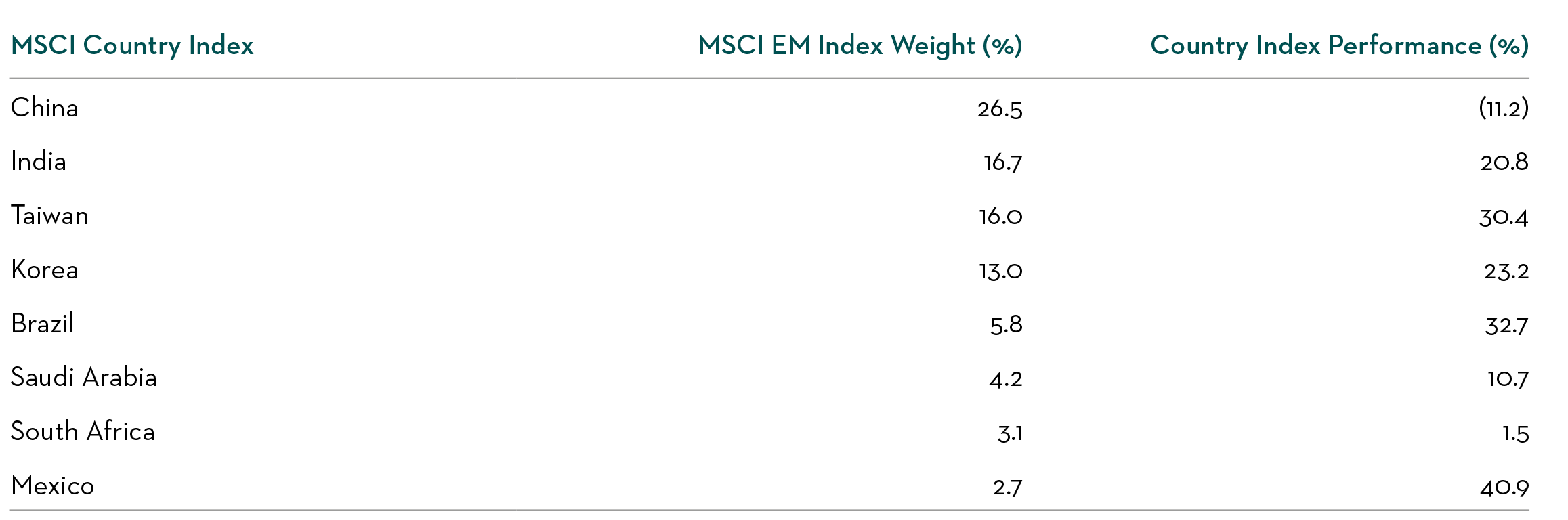

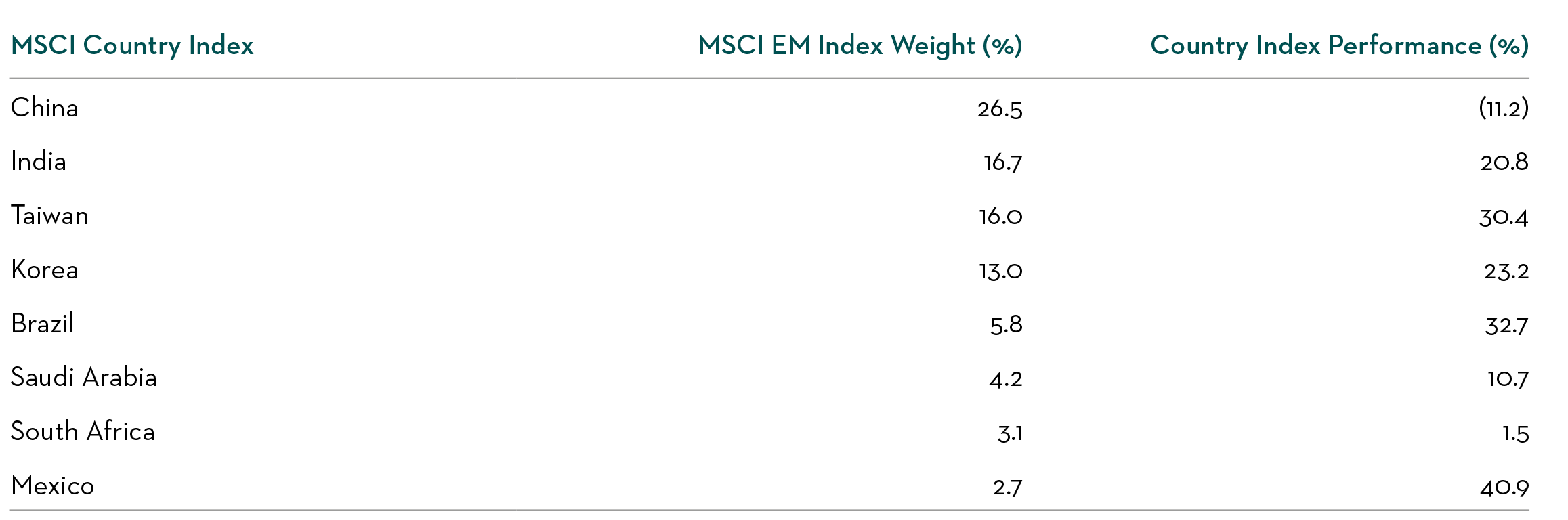

EM is a heterogenous asset class which captures a wide range of opportunities. In 2023, key emerging market countries posted positive returns with the exception of China. While China challenged our traditional EM model, our EM ex. China portfolio had strong relative returns for the year.

- We have high conviction in India and Korea in particular. India should benefit from the expanding middle class and increased in infrastructure, while Korea is home to some of the most cutting-edge technology companies in the world.

Table 1. MSCI Country Index Performance of Largest EM Countries in 202310

Challenges in 2023 have created opportunities for 2024 and beyond

Style headwinds impacted performance with the strongest outperformance of value vs. growth in a quarter of a century.8

- In particular, quality growth was challenged in China where, amidst broadly falling markets, state-owned/value stocks outperformed private/quality growth stocks. With a more accommodative central bank environment globally, we expect the market to reward quality growth companies once again

Technology was the most significant contributor to the portfolio’s performance in 2023.9

- Our overweight to the sector and stock selection supported performance, particularly semiconductors, hardware, and IT services. Even following from a strong 2023, we expect a continuation of strength in the sector, given the earnings growth outlook and valuation discount relative to US technology.

EM is a heterogenous asset class which captures a wide range of opportunities. In 2023, key emerging market countries posted positive returns with the exception of China. While China challenged our traditional EM model, our EM ex. China portfolio had strong relative returns for the year.

- We have high conviction in India and Korea in particular. India should benefit from the expanding middle class and increased in infrastructure, while Korea is home to some of the most cutting-edge technology companies in the world.

Table 1. MSCI Country Index Performance of Largest EM Countries in 202310

Given the challenging environment, what is our team’s view on China?

It is important to set the scene in China. The economy is delivering growth, but the pace of growth has disappointed. Slowerthan-expected growth is the result of property sector woes, which are dragging fixed asset investment and dampening consumer confidence and activity as Chinese citizens feel the negative wealth effect of falling property values.

The Martin Currie EM strategy is heavily skewed towards quality growth, privately-owned enterprises compared to the MSCI index. Roughly a third of publicly traded Chinese stocks are state-owned enterprises (SOEs), which have been supported by the Chinese government and are not widely held by foreign investors. As a result, quality growth companies have fallen more than their SOE peers, despite delivering solid fundamental operations (i.e., earnings growth). Essentially, the selloff is due to weak sentiment and high quality growth companies have borne the brunt of the selling pressure.

Chart 1. Performance of SOEs and non-SOEs in China

Source: J.P. Morgan research (Refiniv Eikon Datastream, Bloomberg, J.P. Morgan, 29 November 2023).

Given the challenging environment, what is our team’s view on China?

It is important to set the scene in China. The economy is delivering growth, but the pace of growth has disappointed. Slowerthan-expected growth is the result of property sector woes, which are dragging fixed asset investment and dampening consumer confidence and activity as Chinese citizens feel the negative wealth effect of falling property values.

The Martin Currie EM strategy is heavily skewed towards quality growth, privately-owned enterprises compared to the MSCI index. Roughly a third of publicly traded Chinese stocks are state-owned enterprises (SOEs), which have been supported by the Chinese government and are not widely held by foreign investors. As a result, quality growth companies have fallen more than their SOE peers, despite delivering solid fundamental operations (i.e., earnings growth). Essentially, the selloff is due to weak sentiment and high quality growth companies have borne the brunt of the selling pressure.

Chart 1. Performance of SOEs and non-SOEs in China

Source: J.P. Morgan research (Refiniv Eikon Datastream, Bloomberg, J.P. Morgan, 29 November 2023).

What are we seeing from our Chinese holdings? Where do we stand today?

The problem is not fundamentals.

The deeply negative sentiment that surrounds China has resulted in a significant fall in share prices. Yet, we continue to see stable to strong fundamentals in our Chinese holdings. There is a dramatic divergence between the solid fundamentals of the businesses we own (i.e. sound operational delivery) and the extremely weak share prices we have seen of late.

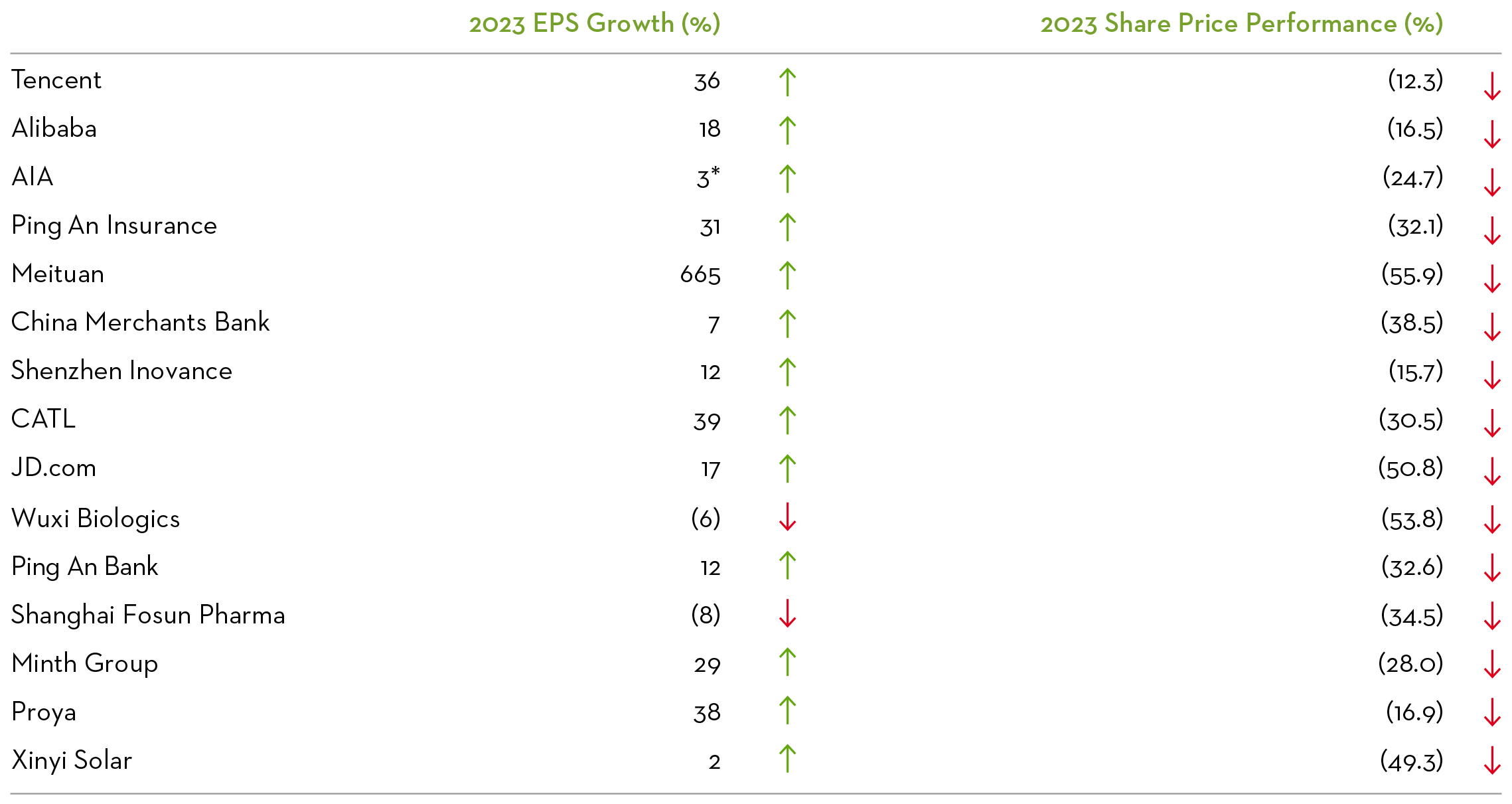

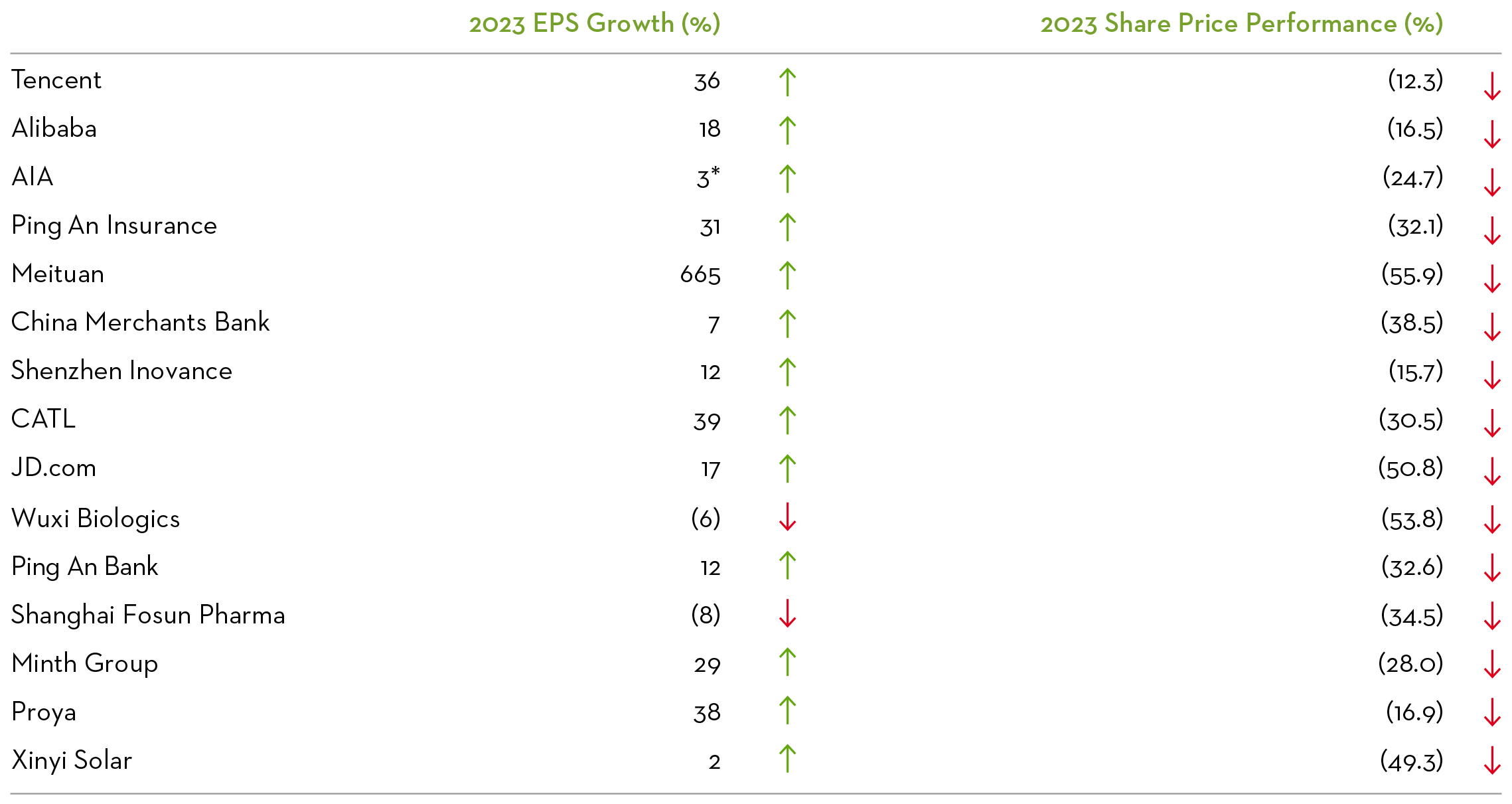

Table 2. Earnings growth and share price performance of Martin Currie EM strategy Chinese holdings in 2023

Source: Bloomberg and FactSet, as at December 2023. EPS = Earnings per Share, based on FY2023 estimates. Companies shown in order of active weight in our strategy portfolio. *Extraordinary items excluded from calculation.

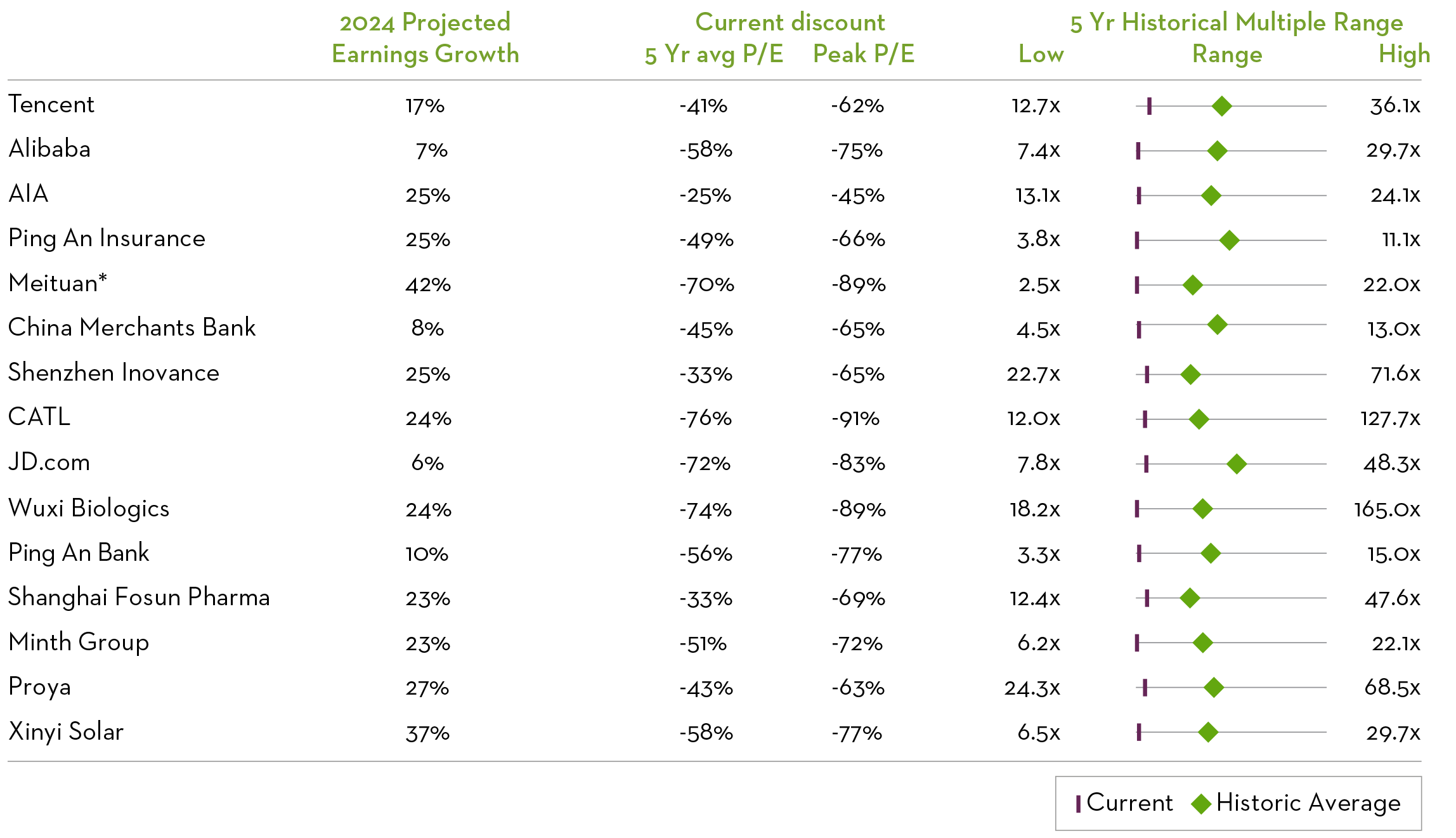

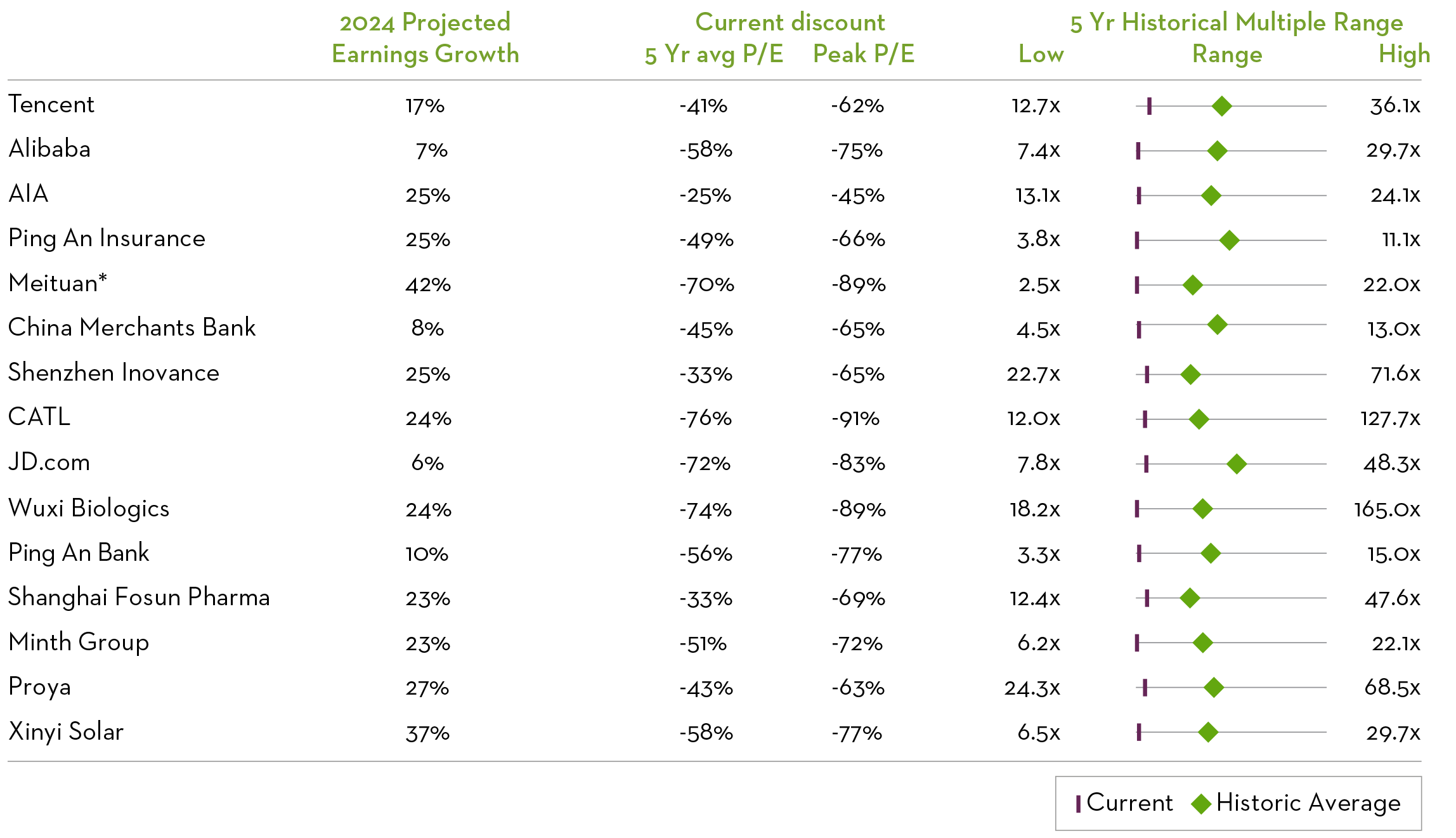

The problem is valuation.

The price that the market is willing to pay for Chinese businesses has significantly derated as shown by these valuation bands for our portfolio. This valuation situation in China is extremely stark. The only parallel we can find in modern history is the global financial crisis – when the situation was dramatically worse. Although China faces confidence issues, we believe the negativity has gone too far. We expect share prices to follow fundamentals again as investors recognise the historic upside opportunity.

Table 3. Projected earnings growth and valuation analysis for Martin Currie EM strategy Chinese holdings

Source: Bloomberg, January 2024. *Meituan shows the P/B multiple instead of P/E due to data availability. Companies shown in order of active weight in our strategy portfolio.

What are we seeing from our Chinese holdings? Where do we stand today?

The problem is not fundamentals.

The deeply negative sentiment that surrounds China has resulted in a significant fall in share prices. Yet, we continue to see stable to strong fundamentals in our Chinese holdings. There is a dramatic divergence between the solid fundamentals of the businesses we own (i.e. sound operational delivery) and the extremely weak share prices we have seen of late.

Table 2. Earnings growth and share price performance of Martin Currie EM strategy Chinese holdings in 2023

Source: Bloomberg and FactSet, as at December 2023. EPS = Earnings per Share, based on FY2023 estimates. Companies shown in order of active weight in our strategy portfolio. *Extraordinary items excluded from calculation.

The problem is valuation.

The price that the market is willing to pay for Chinese businesses has significantly derated as shown by these valuation bands for our portfolio. This valuation situation in China is extremely stark. The only parallel we can find in modern history is the global financial crisis – when the situation was dramatically worse. Although China faces confidence issues, we believe the negativity has gone too far. We expect share prices to follow fundamentals again as investors recognise the historic upside opportunity.

Table 3. Projected earnings growth and valuation analysis for Martin Currie EM strategy Chinese holdings

Source: Bloomberg, January 2024. *Meituan shows the P/B multiple instead of P/E due to data availability. Companies shown in order of active weight in our strategy portfolio.

Summary

In summary, EM continues to be an exciting area for opportunity, especially for quality growth investing. While we’ve experienced the largest rotation from growth to value in the past 25 years, we believe that investing in world class businesses positioned to take advantage of strong secular growth opportunities across emerging markets will be the long-term winners.

Perhaps the biggest opportunity from a valuation perspective might be Chinese quality and growth companies, where they are trading at steep discounts, especially in our portfolio. The current valuation multiples of the Chinese companies held in our strategy portfolio are at a c.50-70% discount to 5-year averages.

This presents a significant valuation opportunity for businesses with positive earnings outlooks and that have delivered strong operational performance. We are confident that the dislocation between fundamentals and valuation cannot last indefinitely and that there will be a shift in sentiment towards Chinese companies in 2024. This shift will be a significant turning for Chinese equity markets and, given the allocation of China within EM, will be a key positive for the asset class more broadly.

While the China opportunity is compelling, there continue to be exciting companies in EM outside of China. There were several countries that outperformed the US market last year and India, in particular, has outperformed the US over the past four years. We believe it is in a great position to continue delivering earnings growth and driving EM returns.

Finally, technology has been the big winner in emerging markets over the past decade and will continue over the long term, given the ability for EM IT companies to innovate and stay on the front foot of technological advancement. The opportunity is especially apparent from the valuation discount and earnings expectations relative to US technology companies.

Summary

In summary, EM continues to be an exciting area for opportunity, especially for quality growth investing. While we’ve experienced the largest rotation from growth to value in the past 25 years, we believe that investing in world class businesses positioned to take advantage of strong secular growth opportunities across emerging markets will be the long-term winners.

Perhaps the biggest opportunity from a valuation perspective might be Chinese quality and growth companies, where they are trading at steep discounts, especially in our portfolio. The current valuation multiples of the Chinese companies held in our strategy portfolio are at a c.50-70% discount to 5-year averages.

This presents a significant valuation opportunity for businesses with positive earnings outlooks and that have delivered strong operational performance. We are confident that the dislocation between fundamentals and valuation cannot last indefinitely and that there will be a shift in sentiment towards Chinese companies in 2024. This shift will be a significant turning for Chinese equity markets and, given the allocation of China within EM, will be a key positive for the asset class more broadly.

While the China opportunity is compelling, there continue to be exciting companies in EM outside of China. There were several countries that outperformed the US market last year and India, in particular, has outperformed the US over the past four years. We believe it is in a great position to continue delivering earnings growth and driving EM returns.

Finally, technology has been the big winner in emerging markets over the past decade and will continue over the long term, given the ability for EM IT companies to innovate and stay on the front foot of technological advancement. The opportunity is especially apparent from the valuation discount and earnings expectations relative to US technology companies.

Sources

1Source: Martin Currie and MSCI, as at 31 December 2023.

2Source: FactSet. From 8.6% in December 2019 to 16.7% in December 2023.

3Source: FactSet, from 31 December 2019 to 31 December 2023 MSCI India net total return was 80% versus 47% for the S&P 500 and -8% for MSCI Emerging Markets.

4Source: FactSet, from 31 December 2019 to 31 December 2023. 2023 EPS based on consensus earnings estimates.

5Source: Martin Currie and MSCI, as at 31 December 2023.

6Source: FactSet, from 31 December 2014 to 31 December 2023. Over this period the MSCI EM IT sector generated a return of 256%.

7Source: FactSet, 19 January 2024. Valuation of 17x NTM P/E for EM vs. 28x NTM P/E for the US.

8Source: Morningstar, as at 31 December 2023.

9Source: Martin Currie and MSCI, as at 31 December 2023. Data presented is for the Martin Currie Global Emerging Markets representative account. MSCI Emerging Markets Index used as benchmark.

10Source: Martin Currie and MSCI, 31 December 2023. Index weight as at the end of the period, shows countries with an index weighting of >2%.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document.

Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

The analysis of Environmental, Social and Governance (ESG) factors forms an important part of the investment process and helps inform investment decisions. The strategy/ies do not necessarily target particular sustainability outcomes.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client. MCIM has entered an Intermediary arrangement with Franklin Templeton Australia Limited (ABN 76 004 835 849) (AFSL No. 240827) (FTAL) to facilitate the provision of financial services by MCIM to wholesale investors in Australia. Franklin Templeton Australia Limited is part of Franklin Resources, Inc., and holds an Australian Financial Services Licence (AFSL No. AFSL240827) issued pursuant to the Corporations Act 2001.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.