Net Zero: Investing to create impact

Capital markets and investors have a significant role to play in helping achieve ‘net zero’. However, there is a common misconception that without raising direct equity capital, the ability for secondary markets to create ‘impact’ in support of net zero is limited.

We strongly disagree with this assumption and see three key ways in which investors can support net zero ambitions. Specifically, we believe active equity investors can create impact in their role as engaged public market participants through:

- Directing capital to finance and reward businesses which are creating solutions to the climate crisis.

- Using active engagement to push for, assess and ultimately price the presence and credibility of net zero emissions reductions targets.

- Policy engagement, education and broadening the adoption of key tools and frameworks to aid pursuit of climate targets.

Achieving this transformation will require a significant increase in low-carbon investment. At the global level, the Intergovernmental Panel on Climate Change (IPCC) estimates an immediate investment requirement of US$2.4 trillion per year in the energy system until 2035.1

We believe the only way of generating this kind of capital commitment requires leveraging the full power of markets in support of achieving the goal of net zero. This will involve both the redirection and growth of capex in support of transitioning business, the growth of new businesses and funding new green infrastructure projects

This article which is the third in our series on net zero in the run up to COP 26 will focus on how we as active, engaged, long-term investors facilitate this change through our investment activities and the role of the wider equity market in creating incentives for innovative climate solutions.

At Martin Currie we adopt a Carbon Value at Risk approach across portfolios to track the exposure of our investee companies to a changing carbon landscape.

1. Directing capital to finance and reward businesses which are creating solutions to the climate crisis

The role of public equity markets in helping solve key sustainability challenges is not lost on politicians and regulators.

Governments' climate commitments are creating wider opportunities for market participation thereby leveraging a more significant pool of capital and incentives that can reward genuine solutions to the climate crisis. This was acknowledged by the European Central Bank which concluded that ‘equity investors, who tend to have a longer investment horizon and a greater appetite for high-risk high-return projects might be better placed to finance environmentally sustainable innovation than banks,’ adding that, ‘deep and liquid capital markets could help mobilise the funds needed to finance the transition to a low-carbon economy.’2 The mobilisation of private capital towards sustainable investment was also a centrepiece of the EU Sustainable Finance Action Plan which aims to ‘reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth.’3

We agree with the potential positive impact that equity market participants can have with regard to key objectives such as net zero. As we have previously highlighted, efforts to limit climate change and the transition to a lower-carbon economy also present a range of opportunities for investors.4 However, we have also emphasised that investor involvement should be authentic and well-thought-out to avoid capital being deployed in areas where the perception of positive change is high, but actual sustainable outcomes are low – the so-called ‘greenwashing’ effect

As long-term, high-conviction equity investors we believe an effective way to do this is by channelling our clients’ capital towards businesses that are creating solutions. For instance, to solve challenges such as net zero or to support other sustainable development frameworks such as the UN Sustainable Development Goals. Specifically, we look at how companies can contribute rather than simply align to these goals. In our view they can best do this through the products and services they create rather than simply just aligning through their behaviour (although we will come to the importance of that later).

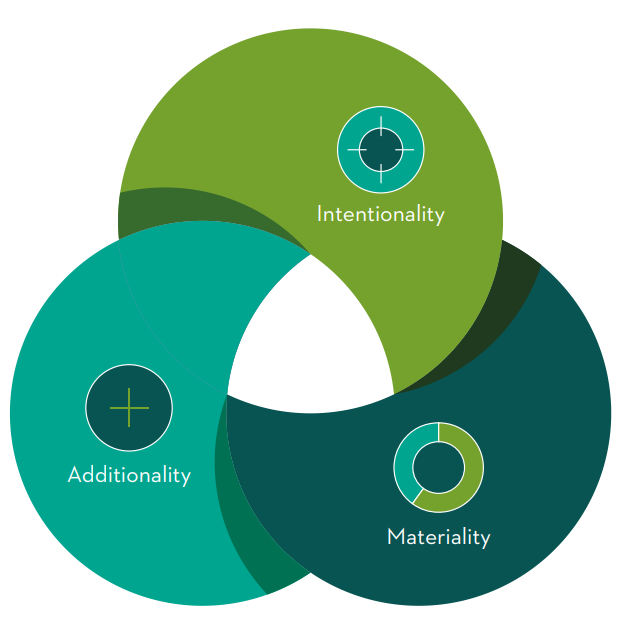

This therefore implies an important distinction when assessing impact. We believe that the most impactful investments should have evidence of:

- Intentionality: that the specific intent of the business, product or service is to help solve a challenge, in this case a specific intention to help achieve net zero.

- Materiality: if a significant portion of current or future profits from the investment case is meaningfully associated with solving challenges such as net zero.

- Additionality: that the solution created is differentiated and impactful enough to make a significant difference in reaching net zero.

The prospect of making a strong return should drive capital flows to the most effective solutions. Companies creating innovative and impactful sustainability solutions should be in a position to grow strongly into large addressable markets and, as such, should be rewarded with a cost of capital advantage. The market should also have the capacity to reward those making significant changes to their business in support of the green transition. This will help create and sustain a virtuous flow of capital towards businesses that are creating solutions to net zero. It is our contention that private markets can have positive societal impacts through creating incentives for increased innovation and allowing for more rapid scaling of solutions.

2. Using active engagement to push for, assess and ultimately price the presence and credibility of Net Zero

A second key area of impact for investors to actively contribute to net zero is by creating incentives for companies to adopt credible net zero targets.

This can be through supporting those companies which have proactively created credible transition plans as well as helping companies adopt best practice in moving to specific, scientific and timebound net zero targets. This is what we would refer to as alignment with net zero goals through their behaviour and their operations. As such, all companies can help support net zero ambitions and investors can assist in accelerating decarbonisation through active engagement and ensuring company goals are credibly aligned to net zero.

In our own case we hold ourselves to a standard on engagement based on outcomes rather than just dialogue. We believe that this kind of approach – where we can see the status of every engagement in terms of its stage of completion at investee companies – gives us a strong insight into how effective investors can be at facilitating and accelerating adoption of credible net zero targets.

There is a real challenge currently in the sizeable disconnect between ambition and action on net zero. To be clear, this is not just a challenge facing corporates, but also one facing governments who now have the task of translating long-dated targets into specific action plans. However, a recent study from sustainability consultants South Pole found that although net zero commitments had doubled over the last year, just 11% of organisations have set a scientific-based target in support of these.5

As we made clear in our previous article in this series Net Zero: From Policy to Action6, there needs to be a sense of urgency in translating high-level commitments into more specific targets. A key part of how investors can do this is through active engagement around the adoption, measurement and tracking of key climate-related pledges, and by voting in support of these ambitions, such as supporting proposals that increase transparency. Ultimately, it may involve voting against management when we believe companies are not effectively addressing their climate risks.

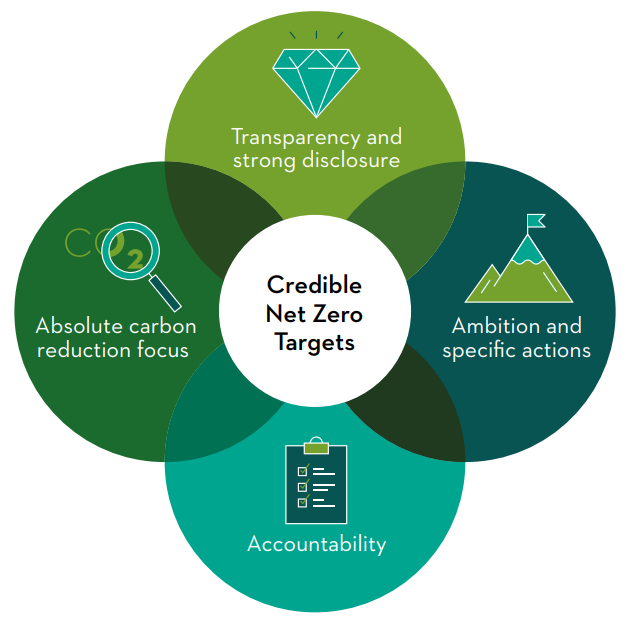

Our experience suggests that a two-way conversation between investors and industry is the most effective means of sharing best practice. There are four key aspects we look for and advocate to our investee companies:

- Transparency and strong disclosure: any future targets should be predicated on having a clear view of the current carbon intensity of a business. We expect businesses to provide as much information as possible to investors around their carbon footprint not just as it pertains to their own operations, but also their supply chains and the ultimate carbon footprint of their end products. We also expect them to provide consistent data, structure and frameworks to track their progress to their net zero ambitions alongside transparency on their direct and indirect lobbying activity and the extent to which this is aligned with net zero.

- Ambition and specific actions: we recognise that different industries have different pathways towards net zero. This will look different by industry in terms of the starting point, scale of action and technology challenges. However, we expect that companies try and put themselves on a pathway to net zero that is credible within their own industry, is consistent with net zero by 2050 and with short and medium-term targets for their scope 1 (direct), scope 2 (indirect – typically electricity consumed by a business) and, where relevant, scope 3 (other indirect or end product) emissions7 . Bodies such as the Transition Pathway Initiative (TPI) – a global asset-owner led initiative – provide invaluable information in assessing the current status of companies and industries in aligning to climate goals. Specific targets are an integral part of this. Without them high-level policy goals lack credibility and structure. There is still much work to be done in this area with the TPI highlighting that 86% of publicly listed industrials are failing to align with a pathway to 2°C or below.8 Targets should also have a linkage to the investment decisions of a business in terms of how they are changing both their capital investment and operational expense assumptions in response to their targets.

- Accountability: key executives and the board should have the ultimate responsibility for shaping and delivering on climate targets. There should be encouragement to have remuneration linked to climate targets. In high-risk industries it may also be important to give shareholders a ‘say on climate’ at the AGM. However, this should never relieve ultimate responsibility for delivering on climate targets away from the board. Companies should also be cognisant of the imperative of aligning to a ‘Just Transition’9 as they navigate their journey to net zero.

- Absolute carbon reduction focus: we must be clear that the ultimate goal is reaching net zero. While in the short term especially there may be merit in having relative measures of carbon intensity for a business, any plan must show a path to lowering overall absolute emissions to be credible with longer-term net zero ambitions. In a similar way, the structure of how companies reach their reduction targets is also important. Carbon offsets and credits should form a limited and decreasing part of company’s climate pledges. The focus should be on real operational change rather than how to offset it. Ultimately, as carbon prices rise over time, companies who choose to use offsets longer term may find these schemes to be uneconomic and will have to accelerate their own plans to decarbonise more aggressively at a later date. Since the intention of net zero is to avoid a damaging extreme policy response, collectively we encourage companies to avoid this approach.

We believe companies which are strong in these areas provide reassurance to their investors that they are effectively managing climate-related risks. As such, they are likely to be rewarded with a lower cost of capital10. The importance of net zero in this sense is only likely to grow as the regulatory landscape continues to shift, carbon pricing becomes more widespread and consumers continue to exhibit strong preferences for brands and businesses that are managed sustainably11. A study by Schroeder's hypothesised that at a US$100 carbon price up to fifth of corporate profits could be at risk12. Accordingly, at Martin Currie we adopt a Carbon Value at Risk approach across portfolios to track the exposure of our investee companies to a changing carbon landscape.

As a signatory to TCFD, Martin Currie believes that it is important to become part of the solution for driving wider adoption of climate disclosure.

Collaborative engagement

Engagement can also be even more effective on key issues when done in a collaborative form. While we believe that our own focus on outcome-oriented engagement is powerful in driving change, there are also instances where our voice can be augmented as part of a wider investor community.

For example, Climate Action 100+ (CA100+, launched in December 2017) is an investor-led initiative coordinated by five regional investor networks whose purpose is to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change. Investor engagement through the initiative has secured a number of ground-breaking commitments from focus companies – often in hard-to-abate industries.

After signing up to CA100+ in 2020, Martin Currie has led an engagement with an Indian cement company focused on very specific objectives. This built upon the existing engagement we had been carrying out privately with the company prior to joining CA100+, but was more effectively supported by being part of a wider investor network.

Our goals as part of the collective engagement follow a similar structure to our private engagements. Specifically, in terms of focusing on accountability, specific targets, transparency and absolute carbon reduction:

- Implement a strong governance framework which clearly articulates the board’s accountability and oversight of climate change risks and opportunities.

- Take action to reduce greenhouse gas emissions across the value chain, consistent with the Paris Agreement’s goal of limiting global average temperature increase to well below 2°C above preindustrial levels.

- Provide enhanced corporate disclosure in line with the final recommendations of the Task Force on Climaterelated Financial Disclosures (TCFD) and, when applicable, sector-specific Global Investor Coalition on Climate Change policies to enable investors to assess the robustness of business plans against a range of climate scenarios, including well below 2°C, and improve investment decision-making.

By being strong advocates for effective and specific climate-related measures investors can help ensure that the companies they invest in have supportive shareholders that can provide support to them in their net zero ambitions, while holding them accountable for delivery of these key initiatives. This is another key impact vector for investors where we can help provide the impetus for setting climate targets, and support, challenge & oversight for companies in terms of managing their climate related commitments. There are, however, other ways in which we as investors can collectively aid the ability of firms to meet climate targets.

3. Policy engagement, education and broadening the adoption of key tools and frameworks to aid pursuit of climate targets

As active and engaged stewards of our clients’ capital we also believe that we have an obligation to support key initiatives such as the Principles for Responsible Investment (PRI), TCFD and those promoted through industry bodies.

By doing so we can influence policy direction encouraging the protection of the environment and enable an efficient transition using the power of capital markets in directing capital, pricing climate risk and encouraging best practice. As an example of our actions in this area we are signatories to the Global Investor Statement to Government on Climate Change which urges governments to step up ambition on climate and enact strong policies to achieve the goals of the Paris Agreement.

The investment management industry is a global force, which – through its actions as long-term stewards of its clients’ assets – is on a journey to support delivery of the Paris Agreement goals.13 That said, studies such as those by Influence Map have shown that the industry’s policy actions remain limited at present14 and as such we should continue to lobby for and support strong policy actions in relation to climate finance. The EU Action Plan on Sustainable Finance is a good example of the increasing ambition and scope of policy – something investors can be support and engaged with in terms of continuing to advance the policy debate.

One other way that investors can help back the achievement of climate targets is to institutionalise and help support the adoption of key tools and frameworks around climate change as they relate to corporates. These frameworks have the dual benefit of providing industry specific frameworks for managing climate risks and providing greater insight to investors to aid more effective market pricing of climate-related risks and opportunities. They also aid corporates by providing structured tools to help them with the management of their own climate-related goals.

As adoption of these frameworks expands to a greater number of companies and investors, the utility for all involved increases creating a positive feedback loop around more, higher-quality climate-related data to compare performance within industries and to help facilitate accelerated use of best practice across industries.

Frameworks such as TCFD have validated the necessity and momentum behind the rise of ‘decision-useful information’ frameworks. These have been developed to be industry specific, quantitative in nature, comparable and relevant to the companies concerned and cover disclosure on the governance, strategy, risk management and metrics & targets associated with climate change for a given business.

As a signatory to TCFD, Martin Currie believes that it is important to become part of the solution for driving wider adoption of climate disclosure and to play our part in helping educate and share best practice with our investee companies. Specifically, about how reporting under TCFD could benefit their own business and provide them with an established framework to align to and report on. Critical mass in adopting key frameworks helps companies by simplifying their reporting demands from investors and the outside world and they can do it with greater precision and relevance.

We use information from TCFD disclosures alongside other investor tools such as the Paris Agreement Capital Transition Assessment (PACTA), the Transition Pathway Initiative (TPI) as tools to help our analysis. Elsewhere in the industry, there is also fast emerging support for initiatives such as the Paris Aligned Investment Initiative (PAII) and the Asset Manager Net Zero Alliance in promoting widespread investment industry adoption of net zero targets, which will increasingly form part of an industry response in creating transparency.

Conclusion

In conclusion, we feel there are a number of key ways in which investors can support society's net zero ambitions.

Specifically, by directing capital to reward solutions to the climate crisis, by using active engagement to encourage emissions reductions targets and by influencing the adoption of best practice.

As investors we do this as part of our underlying purpose of ‘investing to improve lives’ and because we continue to believe that there will be compelling investment opportunities for those investing with a long-term sustainability perspective as the rate of change continues to accelerate in the fight against climate change.

As we go forward, we as a business are holding ourselves accountable to these same standards. In the run up to COP26, we are examining our own actions in this area with the ambition to show leadership in how we align to net zero by: managing our own carbon footprint; monitoring how our portfolios can contribute to Paris-aligned targets and holding ourselves to the highest standards of transparency in reporting alongside these goals. Watch this space.

Click to display all sources >>

1Source: Intergovernmental Panel on Climate Change (IPCC) ‘Global Warming of 1.5°C: Summary for Policymakers’ (2018) and International Energy Agency (IEA) ‘World Energy Investment 2019’ (2019).

2Source: https://www.ecb.europa.eu/press/inter/date/2020/html/ecb.in200303~8296db2801.en.html

3Source: https://ec.europa.eu/transparency/regdoc/rep/1/2018/EN/COM-2018-97-F1-EN-MAIN-PART-1.PDF p.2

4Source: https://www.martincurrie.com/__data/assets/pdf_file/0030/9885/LTII-ClimateChangeOpportunities-v2.pdf

5Source: COVID-19 is making organisations ‘Net Zero Ready’ – but few have set concrete milestones – a South Pole report – News

6Source: https://www.martincurrie.com/uk/insights/long-term-investment-institute/investment-institute-insights/net-zero-from-policy-to-action

7Scope 1 - All Direct Emissions from the activities of an organisation or under their control. Including fuel combustion on site such as gas boilers, fleet vehicles and air-conditioning leaks.

Scope 2 – Indirect Emissions from electricity purchased and used by the organisation. Emissions are created during the production of the energy and eventually used by the organisation. Provisional UK greenhouse gas emissions national statistics 2019.

Scope 3 – All Other Indirect Emissions from activities of the organisation, occuring from sources that they do not own or control. These are usually the greatest share of the carbon footprint, covering emissions associated with business travel, procurement, waste and water. (Source: https://compareyourfootprint.com/difference-scope-1-2-3-emissions/)

8Source: https://www.transitionpathwayinitiative.org/publications/75.pdf?type=Publication

9Source: Just-Transition-Centre-report-just-transition.pdf (oecd.org)

10Source: https://www.msci.com/www/blog-posts/esg-and-the-cost-of-capital/01726513589

11Source: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/nef-spotlight-the-path-forward-for-retails-sustainable-future

12https://www.schroders.com/hu/insights/economics/a-fifth-of-company-profits-at-risk-from-rising-carbon-prices/

13Source: IA Position Paper Climate Change November 2020.

14Source: influencemap.org Asset Managers and Climate Change 2021. https://influencemap.org/report/Asset-Managers-and-Climate-Change-cf90d26dc312ebe02e97d2ff6079ed87

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’). It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. But no representation or warranty, express or implied, is made to its accuracy or completeness.

This document is intended for the recipient only and may not be distributed to third parties. The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally, and any opinions expressed are subject to change without notice. The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

The analysis of Environmental, Social and Governance (ESG) factors form an important part of the investment process and helps inform investment decisions. Strategies do not necessarily target particular sustainability outcomes.

The TCFD logo shown on this page is that of the respective owner and is used for descriptive and illustrative purposes only. The company trademark shown is not in any way associated, or to be deemed to be associated with Martin Currie or its group companies.