Welcome to the second edition of STEWARDSHIP MATTERS – our regular publication where our investment teams in Edinburgh, Singapore and Melbourne share their sectoral and regional Stewardship and ESG insights, updates on the ongoing development of our ESG toolkit, and outcomes of the extensive active ownership activities that we are undertaking on behalf of clients.

This edition provides a review of Stewardship and ESG activity over the second half of 2020, and specifically focuses on a key topic of interest highlighted by our clients - how we are working towards mapping corporate activities and portfolios against the targets of the UN Sustainable Development Goals (UN SDGs).

Key Highlights

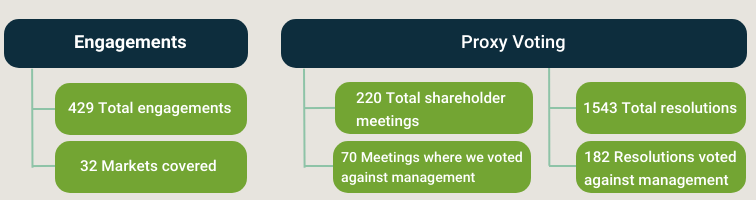

- Despite the physical barriers imposed by the global lockdowns, our investment teams have continued to participate in extensive engagement and voting activities in the second half of 2020, many of which have had an SDG focus.

- Our ongoing work on SDG mapping has provided us with a useful lens through which to analyse sustainability, and we provide detail on some of the SDG initiatives developed in our effort to achieve best-in-class ESG outcomes at the companies we invest in.

- Using the SDGs as a lens, our investment teams also explore the potential risks and opportunities for our investee companies arising from themes such as human rights, cyber security, the rising middle class, fiduciary responsibility and sustainability disclosures.

- Finally, we touch on the key themes coming out of Australia’s COVID-impacted proxy season, the US inauguration and the new EU Sustainable Finance Disclosure Regulation (SFDR).

Looking forward, the start of 2021 is likely to see some significant changes in the ESG landscape, and if anything, bring it even more into mainstream focus. Within this backdrop, and reflecting the increasing focus on the SDGs by our clients, our work in SDG mapping will continue to evolve. In particular we are working on how we can regularly report on the extent to which companies and portfolios overall are aligned to the goals. We look forward to working closely with clients in this space.

Our investment teams have been looking carefully at how we map products and services of the companies we invest in against the SDGS.

Regulatory information and risk warnings

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered arecommendation to purchase or sell any particular strategy/fund/security. It should not be assumed that any of thesecurity transactions discussed here were or will prove to beprofitable.

The analysis of Environmental, Social and Governance (ESG)factors forms an important part of the investment processand helps inform investment decisions. The strategy/ies donot necessarily target particular sustainability outcomes.