Back in the 80s, an American fast food chain made the memorable slogan, “Where’s the beef?” to imply that its competitors were not providing enough substance – in this case - beef! In this update on the Emerging Markets (EM) we take some time to lay out why we believe EM is a compelling asset class story. The question we get most often is “what’s the catalyst that’s going to drive EM forward?”

In this case, we’d like to use this easy to remember analogy and highlight “the beef” for the asset class-earnings growth. As fundamental, stock-driven investors, this is a core lens through which we look at investments in our fund.

What’s also interesting about EM earnings is how critical it is for driving asset class performance throughout longer-term cycles. When we look at EM’s performance versus Developed Markets (DM) over the long term, we see that relative earnings growth is a major driver of EM’s outperformance.

For example, the 35-year earnings per share (EPS) compound annual growth rate CAGR for the US has been 6.4%1. What we’ve observed historically is that during strong outperformance periods for EM equities, the earnings growth is double-digit (strong on both an absolute and relative basis).

Fortunately, we are right at a key turning point and the case for EM earnings outpacing DM is strong. It’s driven by higher growth rates (GDP) and less margin pressure as inflationary forces abate. Furthermore, for technology companies in EM, it’s also supported by strong market positioning and structural growth drivers such as artificial intelligence (AI).

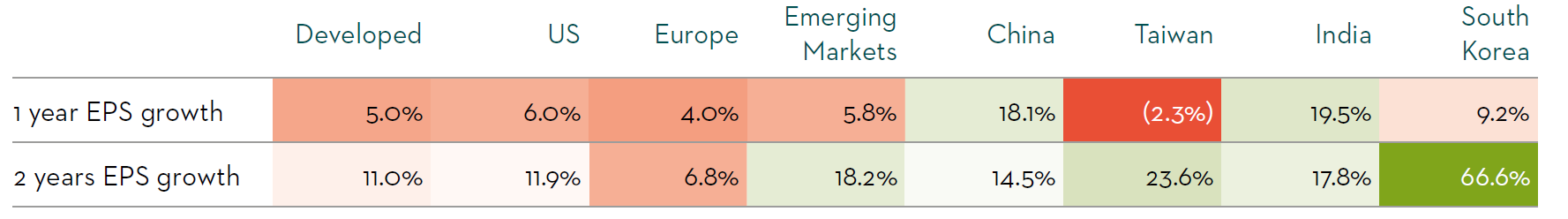

As shown In Figure 1, emerging markets are expected to deliver higher earnings growth (relative to DM) over the next 12 months and 24 months. In particular, the major EM constituents – China, India, South Korea, and Taiwan are set to deliver explosive earnings growth over the next 2 years.

Figure 1: Forecast earnings growth across regions

Source: FactSet as at 15 June 2023, using MSCI country indexes.

What’s also interesting about EM earnings is how critical it is for driving asset class performance throughout longer-term cycles...

Divergence between earnings and share prices in China

Recently we have observed strong earnings delivery from two key areas in the Chinese stock market: 1) Chinese digital economy stocks and 2) Chinese financials – namely insurance companies.

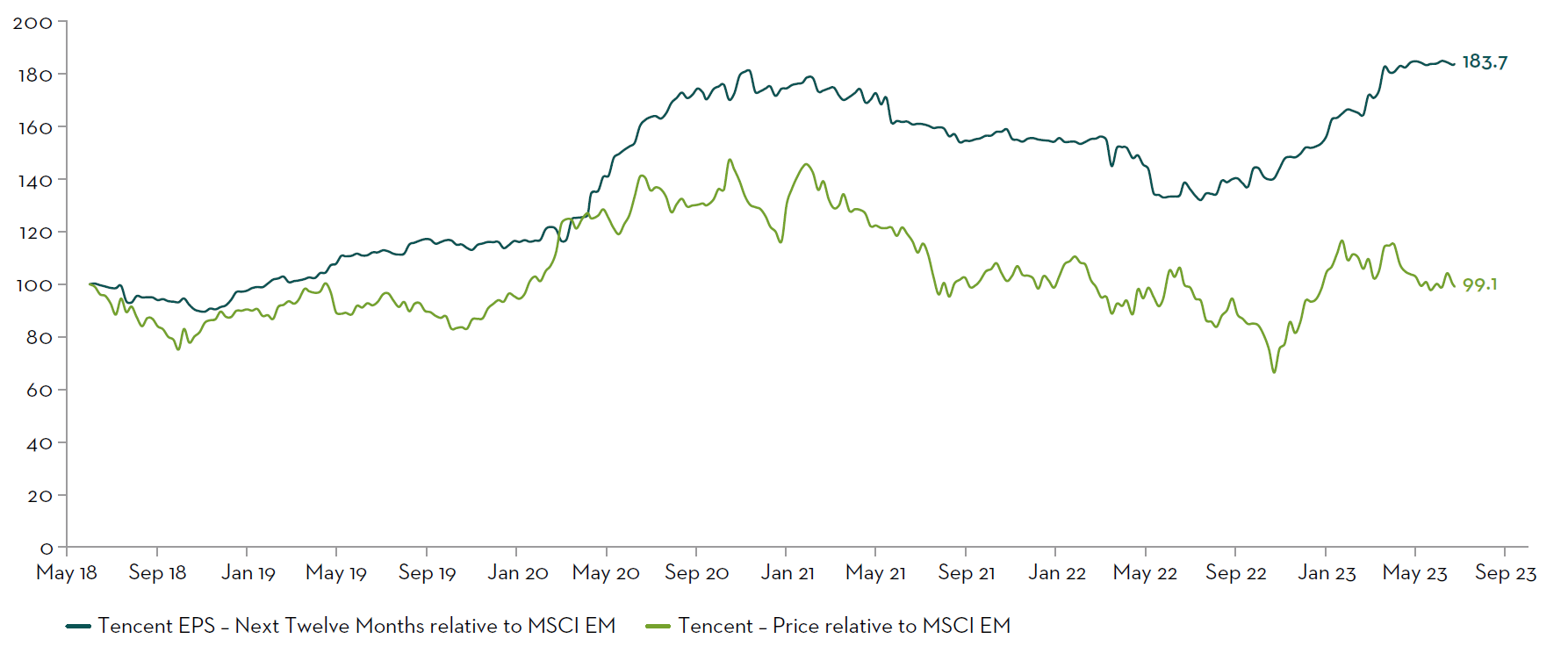

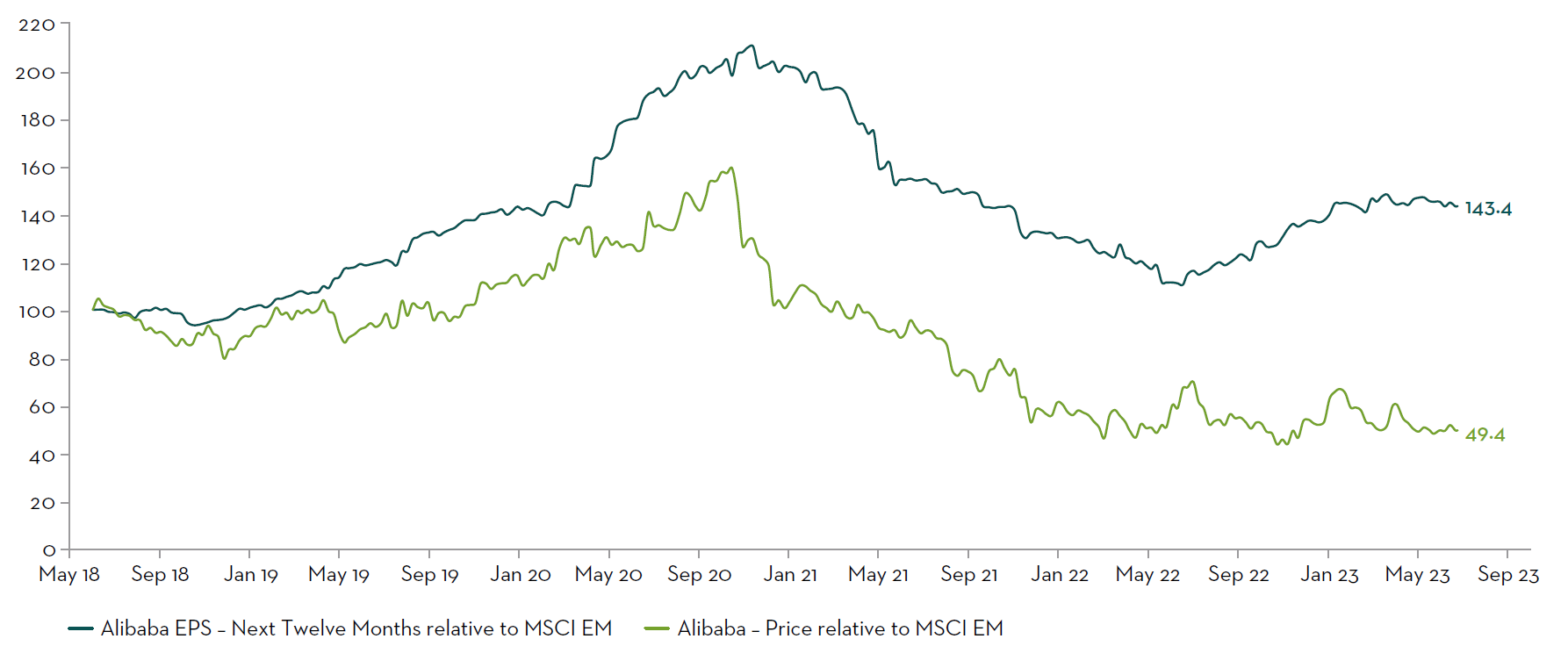

Below we highlight the positive divergence between fundamental earnings delivery (relative to MSCI EM) and the stock performance (relative to MSCI EM) using the two largest benchmark holdings in the MSCI Emerging Markets Index (Tencent and Alibaba). When we see such a divergence between share prices and stock earnings, we view this as an opportunity for fundamental, bottom-up investors. We have increasing confidence in the profitability of these quality growth companies in EM.

Tencent, Diverging EPS and Price Relative to Index

Source: FactSet as at 26 June 2023.

Alibaba, Diverging EPS and Price Relative to Index

Source: FactSet as at 26 June 2023.

Where’s the Growth? EM GDP vs DM GDP

Figure 2: Forecast real GDP growth across regions

Source: IMF as at June 2023.

While acknowledging the difficulty of predicting growth in 2023, the International Monetary Fund (IMF) has just published its forecasts for DM EM. The IMF expects that EM will outgrow the advanced economies, forecasting 4.0% GDP growth for EM and 1.2% for DM. Global growth is estimated at just under 3.0% for 2023. Within that, China and India are expected to be key drivers of this, contributing to approximately 50% of that growth projection.

Where’s the Valuation? EM Valuation vs DM Valuation

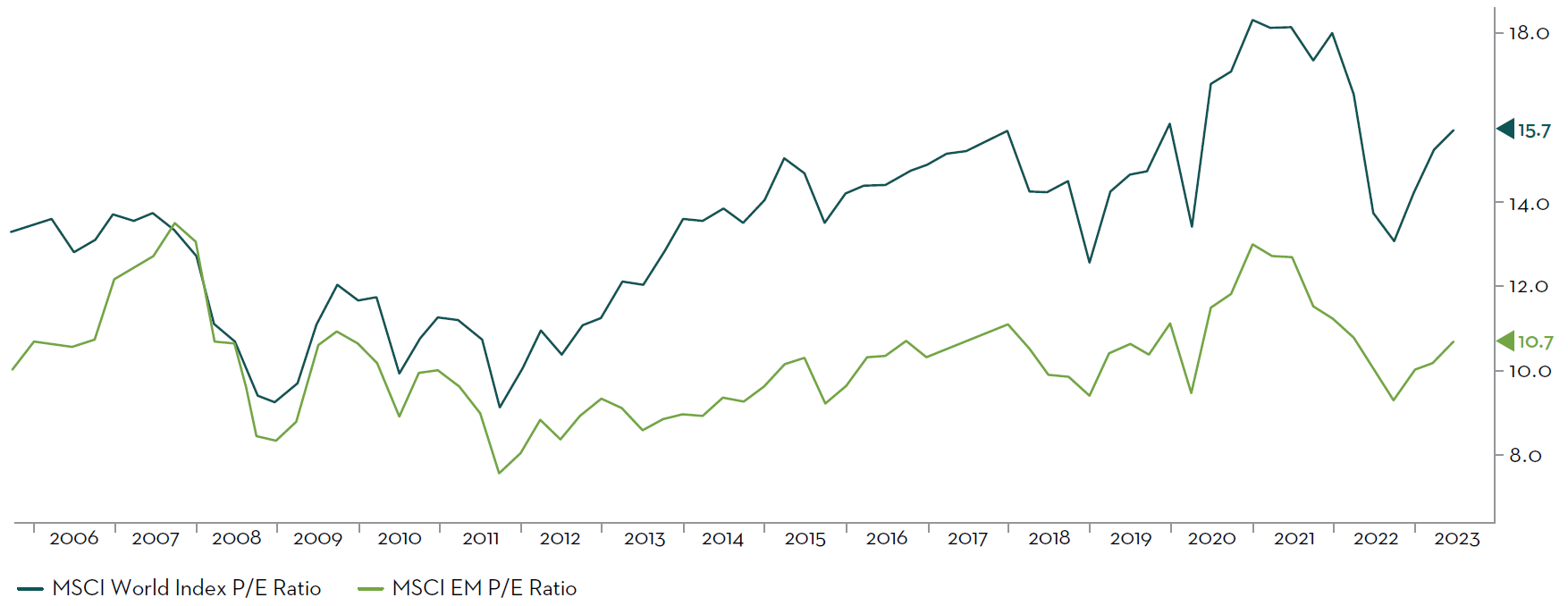

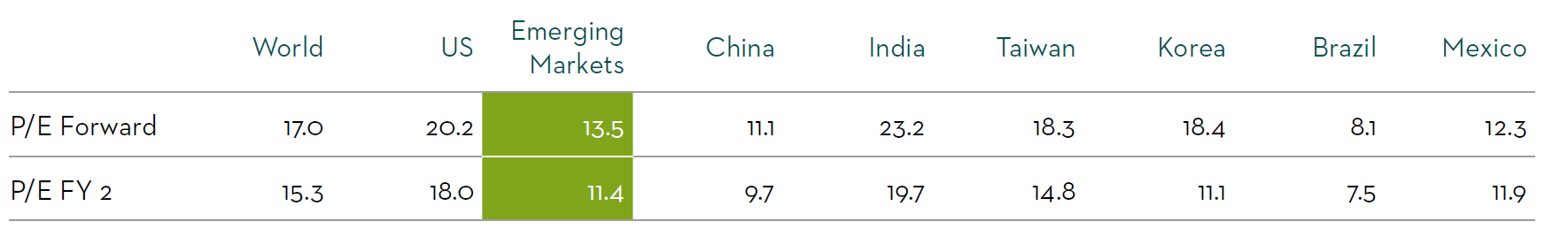

MSCI EM Index and MSCI World PE

Source: Bloomberg as at 15 June 2023.

Given this combination of GDP/macro growth and earnings growth, EM offers a once in a generation opportunity in terms of a reasonable absolute and relative valuation. The asset class is trading at a 35% discount to MSCI World. Using a medium-term outlook, MSCI EM is trading at 10x P/E versus MSCI World at 15x.

Figure 3: Forecast price-to-earnings ratios across regions

Source: Factset as at 15 June 2023, using MSCI country indexes.

Under the radar at the country level, we see that valuations within the EM complex are also very compelling. Most notably, China and Brazil are trading at single digit price-to-earnings (P/E) ranges over the next 2 years.

So, where’s the beef?

The beef may have been in DM over the past decade, but that does not mean it will continue and the current backdrop in EM looks exciting! With superior GDP growth expectations, trading at discounted valuations, and the expectations for stronger earnings growth going forward, its clear the beef is now in EM.

Important Information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund/security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

For professional investors in Canada.

This material is intended for residents in, or incorporated in, Canada and are a Permitted Client for the purposes of MI 31-103. The information on this section of the website is not intended for use by any other person, including members of the public.

Martin Currie Inc, incorporated in New York with its registered office at 280 Park Avenue, New York, NY 10017 and having a UK branch registered in Scotland (no SF000300), Head office, 5 Morrison Street, 2nd floor, Edinburgh, EH3 8BH, Tel: +44 (0) 131 229 5252 Fax: +44 (0) 131 222 2532 www.martincurrie.com, operates under the International Adviser Exemption with the Ontario Securities Commission (‘OSC’) and is therefore currently not required to be registered as a portfolio manager for the purposes of MI 31-103. Martin Currie Inc. is also authorised by the UK Financial Conduct Authority.

For the avoidance of doubt, nothing excludes, limits or restricts our obligations to you under the UK Financial Services and Market Act 2000, National Instruments or any other applicable law or regulation.

The opinions and views in this website do not take into account your individual circumstances, objectives, or needs and are not intended to be recommendations of particular financial instruments or strategies to you.

This website does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. You should consult with your professional advisers before undertaking any investment activity. The information provided on this website should not be treated as advice or a recommendation to buy or sell any particular security or other investment. The information on this website has not been reviewed by any competent regulatory authority.

For wholesale investors in Australia:

This material is provided on the basis that you are a wholesale client within the definition of ASIC Class Order 03/1099. MCIM is authorised and regulated by the FCA under UK laws, which differ from Australian laws.

For professional investors:

In the People’s Republic of China:

This document does not constitute a public offer of the strategy, whether by sale or subscription, in the People’s Republic of China (the “PRC”). These strategies are not being offered or sold directly or indirectly in the PRC to or for the benefit of, legal or natural persons of the PRC.

Further, no legal or natural persons of the PRC may directly or indirectly purchase any of the strategy or any beneficial interest therein without obtaining all prior PRC’s governmental approvals that are required, whether statutorily or otherwise. Persons who come into possession of this document are required by the issuer and its representatives to observe these restrictions.

In Hong Kong:

The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

In South Korea:

This document is for information purposes only. It is prepared and presented to provide an introduction to the business of MCIM and its related companies (collectively known as ‘Martin Currie’). This document does not constitute an offer to sell or a solicitation of any offer to invest in any security, fund or other vehicle managed or advised by Martin Currie.

None of the security(ies), fund(s) or vehicle(s) managed by or advised by Martin Currie are registered in South Korea under the Financial Investment Services and Capital Markets Act of Korea and accordingly, none of these instruments nor any interest therein may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in South Korea or to any resident of South Korea except pursuant to applicable laws and regulations of South Korea.

Martin Currie is not registered with or regulated by any regulatory authorities in South Korea.