Content navigation

Originally written on 6 April.

Having slapped a blanket tariff on all countries of 10%, reciprocal tariffs on all trading nations where the US has a trade deficit (ranging from 11% to 50%), and a 25% tariff on autos imports. This policy initiative, if it does not get reversed, will trigger a higher likelihood of recession in the US and Europe, as well as what we would qualify as a recessionary environment in China and the Rest of Asia.

The revision to our outlook is based on the announced tariffs being implemented; we are conscious that this scenario could evolve, as the situation develops, with both risk of downside if we have further escalation and retaliation, and risk of upside if the policy announcements get reversed.*

Macroeconomics

Our macroeconomic outlook for 2025 across regions was downgraded significantly, due to an increased probability of recession. This could be the case for both the US and Europe, with a potential sharp slowdown for the Chinese economy. Whilst our forecasts are not for a recession in the technical sense of the term, we believe that there is a high likelihood of a sharp slowdown across all large economies, which will feel recessionary per se.

Inflation

Inflation is likely to increase further in the US in the near term, as tariffs get passed through to the end customers, as it typically does, but also across many other regions, as there is a likelihood of retaliatory tariffs being imposed by Europe and China in particular (in fact, China has now announced its retaliatory tariffs initiative). Stagflation therefore becomes a more plausible scenario across many key regions in the nearer-term, in our view.

Monetary policies

Central banks are likely to turn more dovish in a backdrop of deteriorating economic growth, although the inflationary pressures could limit somewhat their ability to respond more forcefully with rate cuts.

-

The revision to our outlook is based on the announced tariffs being implemented; we are conscious that this scenario could evolve, as the situation develops, with both risk of downside if we have further escalation and retaliation, and risk of upside if the policy announcements get reversed.*

Earnings risk

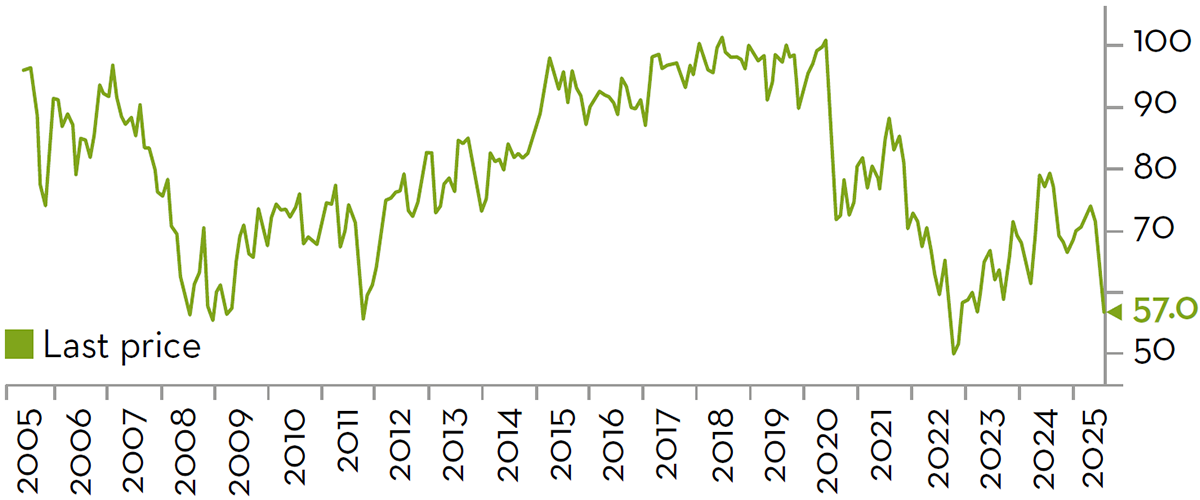

As a result of the higher risk of stagflation, we see significant downside earnings risk for cyclical sectors, and those caught into the tariffs crossfire. Whilst share prices have adjusted rapidly, there could be further downside risk as profit warnings start coming through. We believe this will happen rapidly in the consumer names, given that consumers can be quick to retrench. Consumer sentiment surveys have already been deteriorating, and are close to the Global Financial Crisis 2008- 09 levels, with the risk of further degradation in sentiment (see charts below).

Corporates are likely to look at reducing costs and capex where possible, which will further amplify some of the downside risk to macroeconomic momentum, notably if employment trends deteriorate (which is likely in our view), leading to a further increase in the cautious consumption trends. Business sentiment surveys have already been deteriorating prior to the tariffs announcement, and could deteriorate further with the next reading, as can be seen in the chart below right.

US consumer sentiment

Business sentiment deteriorating in the US prior to tariffs announcement

Source: Bloomberg as at 6 April 2025.

Earnings downside risk has increased across regions, but most notably in the US, given the largest near-term reduction in the growth forecast. Consensus currently stands at 11% for the US (down from 15% at the end of last year) – we are now forecasting 7% on a top-down basis (down from 11% previously).

For Europe, consensus is at 15% (up from 8% at the end of last year) and we are now at 8% (up from 6%), supported in particular by fiscal measures in Germany, albeit offset by the downside risk to growth. At the global level, consensus sits at 12% earnings growth, with our own estimate now at 7%, from 10% previously1.

Retaliation and potential trade war escalation

With China already responding with 34% retaliatory tariffs on US imports, there is a risk of escalation to the trade tensions, with potentially Europe also joining in. The risk of an escalating trade war across key regions, and therefore the likely increased trade frictions, will have negative implications both in terms of economic activity and in terms of inflationary pressures. This will be an important focal point for markets.*

Macroeconomic picture likely to deteriorate, potentially heading into stagflation

On the macroeconomic side, the higher and broader than expected tariffs and increased retaliation risk is leading to deteriorating growth prospects. For the US, an economy that was forecast to grow at 1.9% in 2025 (vs our initial forecast of 2.1-2.4%), we believe that tariffs could drive the gross domestic product (GDP) growth down to a range of 0-0.8% in the near term.

For Europe, which was forecast to grow its GDP at 1.3% in 2025, we believe that tariffs could bring that growth down to 0-0.5% as well. Similarly, the UK, which was forecast to grow at 1% this year, is likely to have to be revised down to circa 0%.

For China, the GDP growth target for 2025 is 5%, versus current economist forecasts of 4.5%, and our initial forecast range of 4-5%. We believe that the tariff announcements and escalation of retaliatory tariffs could lead to a sharp reduction in GDP growth, potentially in the range of 1-2% points, bringing their GDP growth this year to 2.5-3.5%. This is prior to any counter-cyclical policy announcements, which the Chinese authorities could unveil to offset the risk of slow down.

Monetary policies likely to turn more dovish

A deteriorating growth outlook is likely to make monetary policies more dovish, although there will be an element of constraint from the potential shorter-term flare up in inflation resulting from increased tariffs. Expectations are shifting for more rate cuts this year since the tariff announcements. The US Federal Reserve is now forecast to cut rates by c.100bps, or four rate cuts by the end of 2025 versus three rate cuts prior to the announcement. The European Central Bank is now forecast to cut rates by c.80bps or 3-4 rate cuts by year end, versus 2-3 rate cuts prior.

Sectors most at risk – not just the first degree hit from tariffs, but a second degree hit from the sharp economic slowdown into stagflation

- Sectors/companies with a mismatch of sales and production bases, and that lack the pricing power to pass on the increased costs from higher tariffs

- Cyclicals, notably consumer exposed names most at risk

- Advertising exposed names, as advertising is more cyclically sensitive – and cuts happen sooner

- Capex exposed names could see a slowdown, although these decisions will be slower for the longer investment cycle

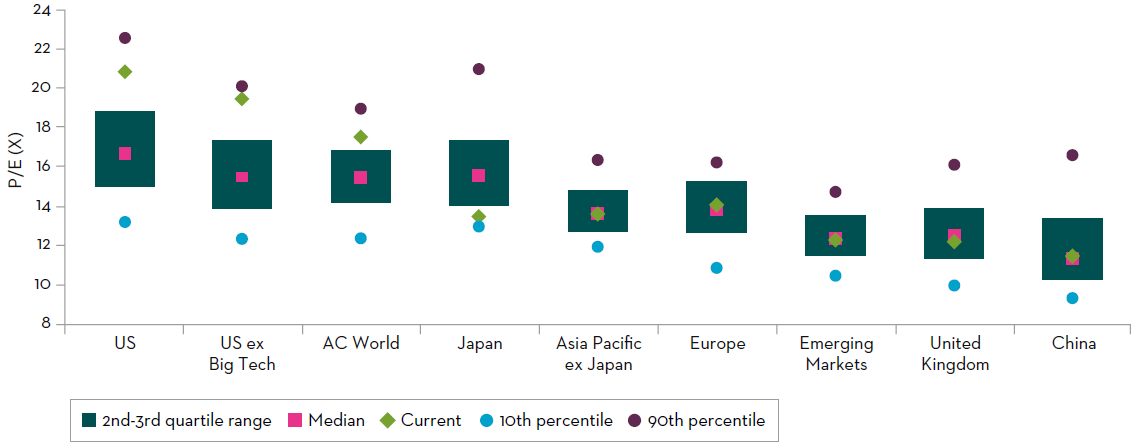

Valuations are adjusting, but there could be more downside risk

With the sharp reaction in equity prices, valuations are adjusting rapidly, although a major area of uncertainty will remain the magnitude of the earnings downgrades risk, which itself depends on speed of the macroeconomic deterioration.

On a Price-to-Earnings (P/E) 12 months forward basis, valuations are not supportive yet in the US, whilst Europe remains more attractive on a relative basis to the US.

Forward P/E across regions

Source: FactSet and Martin Currie as at 4 April 2025.

China equities are more supportive on valuation, and arguably have more levers to pull in terms of policy measures to prop up its economy. Whilst there could be a temptation to look for opportunities to buy into the sell-off, we would want to see either a shift in policy intentions (economic policies, monetary policies, trade policies), and/or more certainty around the US policies vis-a-vis its trading partners. Although central bank action could be a catalyst for markets, it is unlikely they will act too aggressively too soon, as there will be the need to assess both the probability of slow down and the reality of a spillover from higher tariffs into higher inflation.

There is also the need to estimate a floor to the earnings level for the market, notably for the more cyclical areas of the market. In the meantime, the market will likely be assessing potential earnings downside risk from here, with the increased risk of profit warnings, should the slowdown be sharp.

Retaliation and risk of recession

The market is now worried about further tariff increases, notably retaliation from countries and increased recession risk. Tariffs are now announced, with risk of further increases, as retaliation by other countries is potentially likely (certainly China has now announced the steps it will take, and Europe could do so soon), which then increases the risk of recession both in the US, China and Europe, and therefore globally.

Stick to companies with pricing power, resilient business models and solid balance sheets, and exposure to structural growth opportunities

In such an uncertain environment, we continue to focus on companies that have pricing power, to manage the increased tariffs and ensuing inflationary flare up, as well as companies with resilient business models generally, even for those who are in a cyclical end-market - these are companies that are able to typically more than cover their cost of capital in our view. We also continue to focus on companies with solid balance sheets, and that have exposure to structural growth opportunities, as these are companies that are more able to generate their own weather.

Sources

1Source: FactSet as at 4 April 2025.

*Since we wrote the article, China tariffs have been further increased to 145%, with China tariffs on US goods at 125% now, and Trump's administration has paused reciprocal tariffs on other nations for 90 days.

Important information

This information is issued and approved by Martin Currie Investment Management Limited (‘MCIM’), authorised and regulated by the Financial Conduct Authority. It does not constitute investment advice. Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The information contained in this document has been compiled with considerable care to ensure its accuracy. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this document for its own use. It is provided to you only incidentally and any opinions expressed are subject to change without notice.

This document may not be distributed to third parties. It is confidential and intended only for the recipient. The recipient may not photocopy, transmit or otherwise share this [document], or any part of it, with any other person without the express written permission of Martin Currie Investment Management Limited.

This document is intended only for a wholesale, institutional or otherwise professional audience. Martin Currie Investment Management Limited does not intend for this document to be issued to any other audience and it should not be made available to any person who does not meet this criteria. Martin Currie accepts no responsibility for dissemination of this document to a person who does not fit this criteria.

The document does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned.

Past performance is not a guide to future returns.

The distribution of specific products is restricted in certain jurisdictions, investors should be aware of these restrictions before requesting further specific information.

The views expressed are opinions of the portfolio managers as of the date of this document and are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Please note the information within this report has been produced internally using unaudited data and has not been independently verified. Whilst every effort has been made to ensure its accuracy, no guarantee can be given.

Some of the information provided in this document has been compiled using data from a representative account. This account has been chosen on the basis it is an existing account managed by Martin Currie, within the strategy referred to in this document. Representative accounts for each strategy have been chosen on the basis that they are the longest running account for the strategy. This data has been provided as an illustration only, the figures should not be relied upon as an indication of future performance. The data provided for this account may be different to other accounts following the same strategy. The information should not be considered as comprehensive and additional information and disclosure should be sought.

The information provided should not be considered a recommendation to purchase or sell any particular strategy/ fund / security. It should not be assumed that any of the securities discussed here were or will prove to be profitable.

It is not known whether the stocks mentioned will feature in any future portfolios managed by Martin Currie. Any stock examples will represent a small part of a portfolio and are used purely to demonstrate our investment style.

Risk warnings – Investors should also be aware of the following risk factors which may be applicable to the strategy shown in this document.

- Investing in foreign markets introduces a risk where adverse movements in currency exchange rates could result in a decrease in the value of your investment.

- This strategy may hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the strategy’s value than if it held a larger number of investments.

- Smaller companies may be riskier and their shares may be less liquid than larger companies, meaning that their share price may be more volatile.

- Emerging markets or less developed countries may face more political, economic or structural challenges than developed countries. Accordingly, investment in emerging markets is generally characterised by higher levels of risk than investment in fully developed markets.

- The strategy may invest in derivatives Index futures and FX forwards to obtain, increase or reduce exposure to underlying assets. The use of derivatives may result in greater fluctuations of returns due to the value of the derivative not moving in line with the underlying asset. Certain types of derivatives can be difficult to purchase or sell in certain market conditions.